Stock Market Valuations: BofA Explains Why Investors Shouldn't Worry

Table of Contents

BofA's Rationale: Why Current Valuations Aren't Overblown

BofA's market view counters the narrative of excessively high valuations. Their analysis doesn't rely solely on a single valuation metric like the widely-used price-to-earnings ratio (P/E). Instead, they employ a more comprehensive approach, incorporating several key aspects of stock market analysis.

-

A Multifaceted Approach: BofA's analysis uses a combination of absolute and relative valuation methods. This includes considering the price-to-earnings ratio (P/E), the price-to-book ratio (P/B), and the discounted cash flow (DCF) model. A holistic view like this provides a more nuanced understanding than relying on any single metric.

-

Contextual Adjustments: They meticulously adjust for crucial macroeconomic factors like prevailing interest rates and inflation. This ensures that valuations aren't misinterpreted due to external economic influences. Understanding how these factors affect valuation is crucial for a well-informed investment strategy.

-

Growth-Oriented Perspective: Their research suggests that current valuations are, to a large extent, justified by robust corporate earnings and positive future growth prospects. This is especially relevant for understanding the valuation of growth stocks.

The Impact of Low Interest Rates on Stock Market Valuations

Low interest rates play a significant role in influencing stock market valuations. This is because lower rates decrease the opportunity cost of investing in equities compared to bonds.

-

Present Value Enhancement: Low interest rates effectively increase the present value of future earnings. This is because the discount rate used in DCF analyses is lower, making future cash flows appear more valuable today.

-

Increased Investor Appeal: This increased present value makes companies appear more attractive to investors, ultimately pushing up stock prices. This is especially important for investors considering a long-term investment strategy.

-

BofA's Integrated Analysis: BofA's analysis explicitly incorporates the impact of low interest rates on their valuation models, providing a more complete picture than analyses that ignore this crucial factor. The interplay between bond yields and equity valuations is a critical consideration in their market outlook.

Addressing the Concerns: Growth Expectations and Market Sentiment

While acknowledging investor concerns regarding market sentiment and the potential for a market correction, BofA's analysis offers mitigating factors.

-

Incorporating Corrections: BofA's models likely account for potential market corrections, acknowledging the inherent volatility of the market. This shows a pragmatic understanding of investor psychology.

-

Sector-Specific Growth: They might point to strong earnings growth in specific sectors as a counterbalance to general concerns. This nuanced view recognizes that not all sectors experience the same growth trajectory, thus impacting valuation differently. The distinction between growth stocks and value stocks is important here.

-

Beyond Sentiment: BofA emphasizes that while market sentiment can be highly volatile, fundamental analysis offers a more stable and reliable view of long-term stock market valuations.

Long-Term Investment Strategy: A Balanced Approach

Navigating market fluctuations requires a long-term perspective and a well-diversified portfolio strategy.

-

Diversification's Importance: Diversification across different asset classes (stocks, bonds, real estate, etc.) is crucial for mitigating risk and smoothing returns over time. This is a cornerstone of effective risk management.

-

Long-Term Vision: A long-term investment strategy significantly reduces the impact of short-term market volatility. The focus shifts from daily fluctuations to achieving long-term financial goals.

-

Portfolio Rebalancing: Regular portfolio rebalancing, adjusting asset allocation to maintain target proportions, is an essential component of long-term investment success. This ensures that your investment remains aligned with your risk tolerance and goals.

Conclusion

BofA's analysis suggests that while stock market valuations might appear high, several factors, including low interest rates and strong corporate earnings, mitigate these concerns. Their comprehensive approach, incorporating multiple valuation metrics and macroeconomic factors, offers a reassuring perspective. However, investors should remember that this is just one perspective. Understanding stock market valuations requires thorough due diligence. Don't let fear of high valuations prevent you from making informed decisions about your investment strategy. Conduct your own research, consider your individual risk tolerance, and build a diversified portfolio suitable for your long-term financial objectives. Remember, a well-informed approach to stock market valuations can lead to successful long-term investment growth.

Featured Posts

-

Hopes New Home Liams Crisis A Bold And The Beautiful Recap For April 3rd

Apr 24, 2025

Hopes New Home Liams Crisis A Bold And The Beautiful Recap For April 3rd

Apr 24, 2025 -

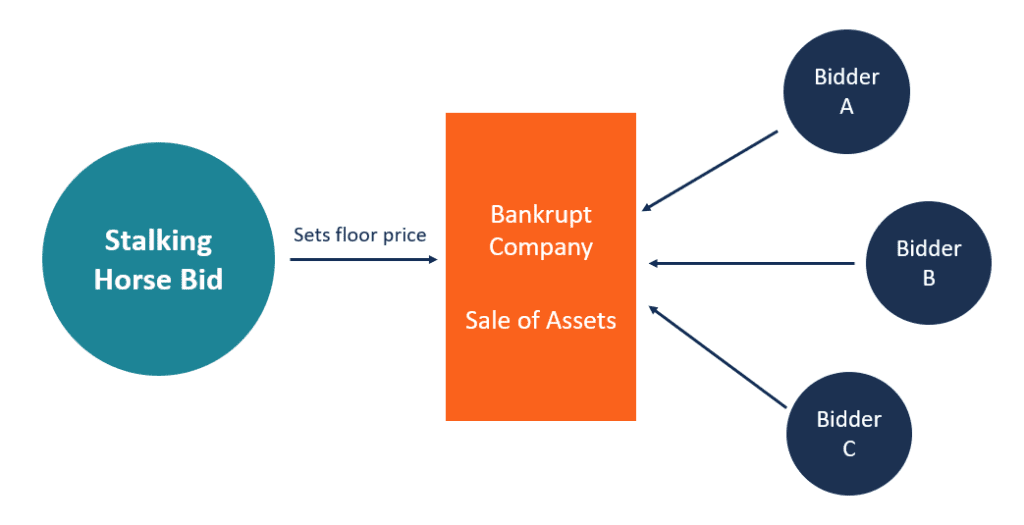

Village Roadshow Sale Finalized Alcon Secures 417 5 Million Stalking Horse Bid

Apr 24, 2025

Village Roadshow Sale Finalized Alcon Secures 417 5 Million Stalking Horse Bid

Apr 24, 2025 -

Credit Card Industry Faces Headwinds Amidst Reduced Consumer Spending

Apr 24, 2025

Credit Card Industry Faces Headwinds Amidst Reduced Consumer Spending

Apr 24, 2025 -

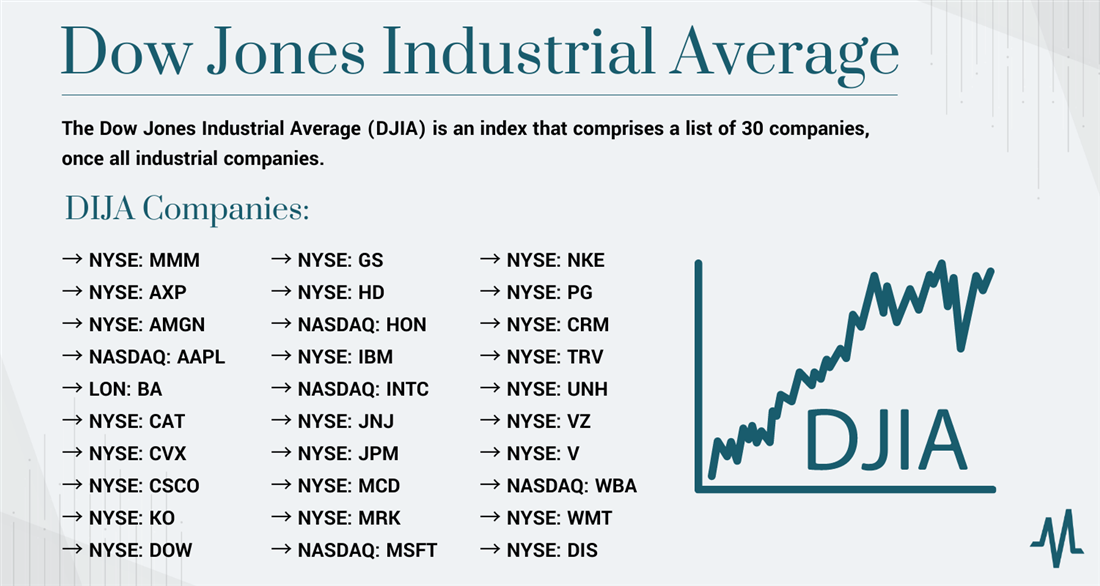

Tracking The Stock Market Dow S And P 500 And Nasdaq On April 23rd

Apr 24, 2025

Tracking The Stock Market Dow S And P 500 And Nasdaq On April 23rd

Apr 24, 2025 -

Q1 2024 Teslas Financial Performance And The Musk Effect

Apr 24, 2025

Q1 2024 Teslas Financial Performance And The Musk Effect

Apr 24, 2025