Credit Card Industry Faces Headwinds Amidst Reduced Consumer Spending

Table of Contents

Decreased Consumer Spending and its Impact on Credit Card Usage

Reduced consumer spending is directly impacting credit card transactions. As consumers tighten their belts, the volume of credit card purchases is declining, creating a ripple effect throughout the industry. Key factors contributing to this decline include:

- Decline in retail sales and overall consumer spending: Data from the Bureau of Economic Analysis shows a clear correlation between decreases in retail sales and a subsequent drop in credit card transactions. This signifies a broad-based reduction in purchasing power.

- Consumers prioritizing essential expenses: With inflation driving up the cost of essential goods and services like groceries, housing, and utilities, consumers are prioritizing these necessities, leaving less room for discretionary spending on credit.

- Reduced credit card purchase volume and average transaction value: Year-over-year comparisons reveal a significant decrease in the total value of credit card transactions, indicating that consumers are buying less and spending less per purchase. This trend is observable across various retail sectors.

- Shifting consumer spending habits: Consumers are actively seeking ways to reduce their reliance on credit cards, opting for cash, debit cards, or delaying purchases altogether.

The correlation between economic indicators and credit card usage is undeniable. High inflation rates, coupled with rising unemployment, directly contribute to decreased consumer confidence and, consequently, less reliance on credit. This dynamic creates a vicious cycle where reduced spending further impacts economic growth.

Rising Interest Rates and Increased Credit Card Debt

The Federal Reserve's recent interest rate hikes have significantly impacted the credit card industry. Higher interest rates translate to increased borrowing costs for consumers, making it more challenging to manage existing credit card debt. This leads to several detrimental consequences:

- Higher interest rates increase the cost of borrowing: The interest charged on outstanding credit card balances is directly linked to the prevailing interest rate environment. Increases in this rate dramatically raise the cost of carrying debt.

- Struggle to make minimum payments: As interest charges accumulate, many consumers find it increasingly difficult to meet even their minimum monthly payments. This snowball effect leads to a rapid increase in overall debt.

- Increased debt burdens and higher default rates: The inability to make timely payments results in escalating debt burdens and, ultimately, higher default rates. This puts a significant strain on consumers' financial stability.

- Mitigating strategies for credit card companies: Credit card companies are exploring various strategies to mitigate these risks, including more stringent credit checks, offering debt consolidation programs, and adjusting interest rates based on consumer credit scores.

Data shows a worrying upward trend in credit card delinquency rates and bankruptcies, demonstrating the severe financial hardship faced by many consumers struggling with rising interest rates and mounting debt.

Weakening Consumer Confidence and its Effect on Credit Card Applications

Decreased consumer confidence significantly impacts credit card applications and approval rates. Uncertainty about the future economic outlook discourages consumers from taking on new debt. This is reflected in:

- Less willingness to take on new debt: Economic uncertainty makes consumers hesitant to commit to new financial obligations, regardless of the perceived benefits.

- Fewer credit card applications and lower approval rates: Credit card companies see a marked decline in applications, and approval rates become more stringent due to heightened risk assessment.

- Correlation between consumer sentiment and credit card applications: Consumer sentiment surveys consistently show a strong negative correlation between declining confidence and credit card application rates.

- Impact on credit card companies' risk assessment: Economic uncertainty compels credit card companies to implement stricter lending criteria, impacting their ability to acquire new customers.

The Consumer Confidence Index provides a reliable measure of consumer sentiment, directly reflecting the impact of economic uncertainty on the willingness to use credit.

The Impact on Credit Card Companies' Profitability

Reduced transaction volume, increased default rates, and a decline in new customer acquisition directly impact the profitability of credit card companies. This impact manifests in several ways:

- Reduced revenue and net income: Lower transaction volumes and higher default rates translate to reduced revenue and lower net income for credit card issuers.

- Potential decrease in shareholder value and stock prices: Reduced profitability inevitably leads to a decrease in shareholder value and a subsequent decline in stock prices for publicly traded credit card companies.

- Financial performance of major credit card companies: Analysis of financial statements from major credit card companies reveals a clear trend of declining profitability, reinforcing the impact of reduced consumer spending.

The financial performance of major credit card issuers demonstrates the tangible consequences of the current economic climate on the industry's bottom line.

Conclusion

The credit card industry is facing a challenging period characterized by reduced consumer spending, rising interest rates, and decreased consumer confidence. These intertwined factors are impacting credit card usage, fueling increased debt burdens, and significantly affecting the profitability of credit card companies. The future outlook for the industry is closely tied to economic recovery and shifts in consumer spending behaviors. Understanding these dynamics is crucial for navigating the evolving landscape of personal finance. Stay informed about changes in consumer spending and interest rates to effectively manage your financial well-being and make sound financial decisions within the context of the changing credit card industry. Further research into the intricacies of this economic interplay is strongly encouraged.

Featured Posts

-

Pope Francis Signet Ring Its Fate After His Death And The Significance Of The Papal Seal

Apr 24, 2025

Pope Francis Signet Ring Its Fate After His Death And The Significance Of The Papal Seal

Apr 24, 2025 -

Optimism On Trade Talks Spurs Chinese Stock Rally In Hong Kong

Apr 24, 2025

Optimism On Trade Talks Spurs Chinese Stock Rally In Hong Kong

Apr 24, 2025 -

Steffy Blames Bill Calls Finn The Bold And The Beautiful April 9 Recap

Apr 24, 2025

Steffy Blames Bill Calls Finn The Bold And The Beautiful April 9 Recap

Apr 24, 2025 -

The Zuckerberg Trump Dynamic Implications For Tech And Politics

Apr 24, 2025

The Zuckerberg Trump Dynamic Implications For Tech And Politics

Apr 24, 2025 -

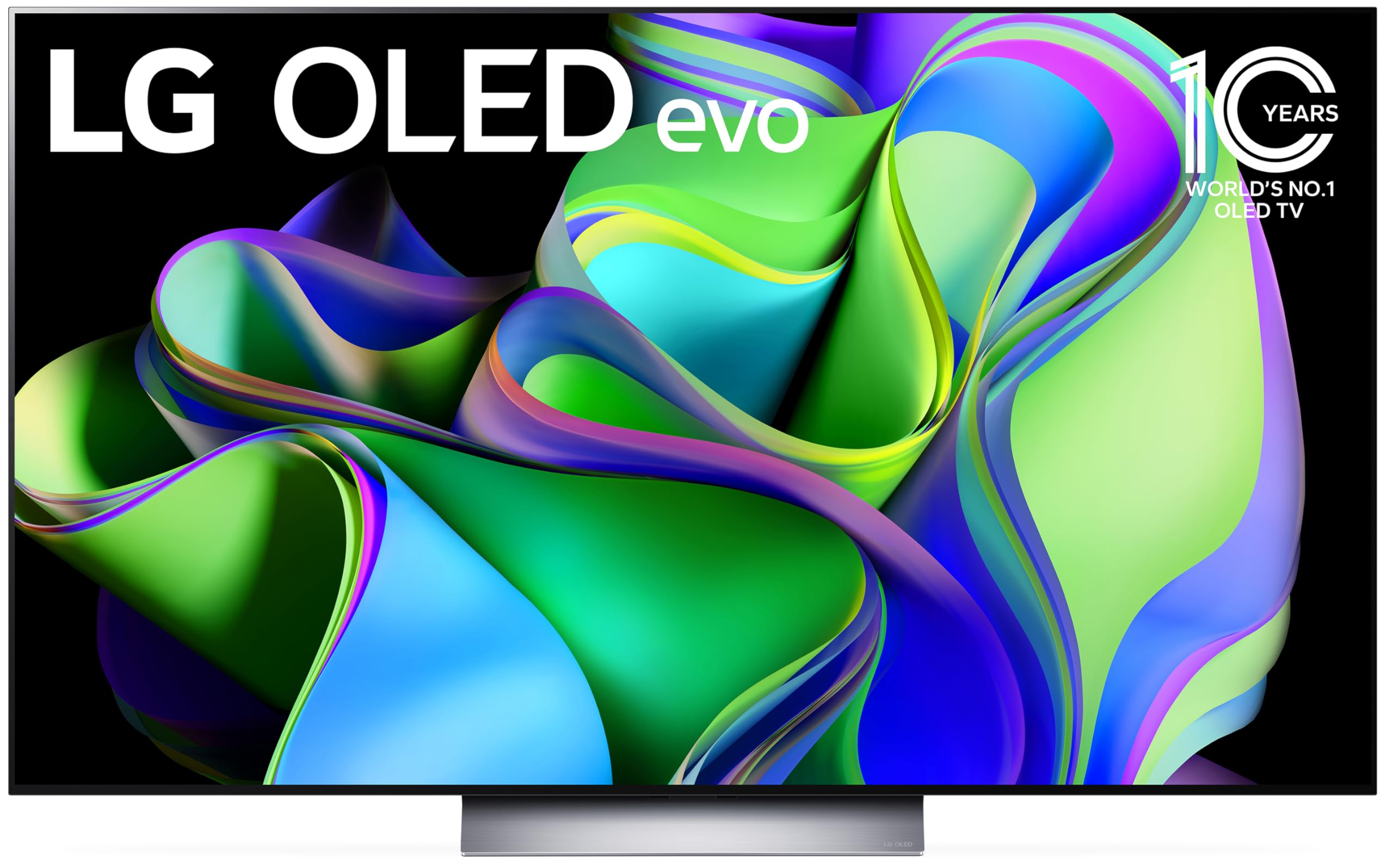

My 77 Inch Lg C3 Oled Tv A Detailed Review

Apr 24, 2025

My 77 Inch Lg C3 Oled Tv A Detailed Review

Apr 24, 2025