Village Roadshow Sale Finalized: Alcon Secures $417.5 Million Stalking Horse Bid

Table of Contents

Understanding the Alcon Entertainment Acquisition

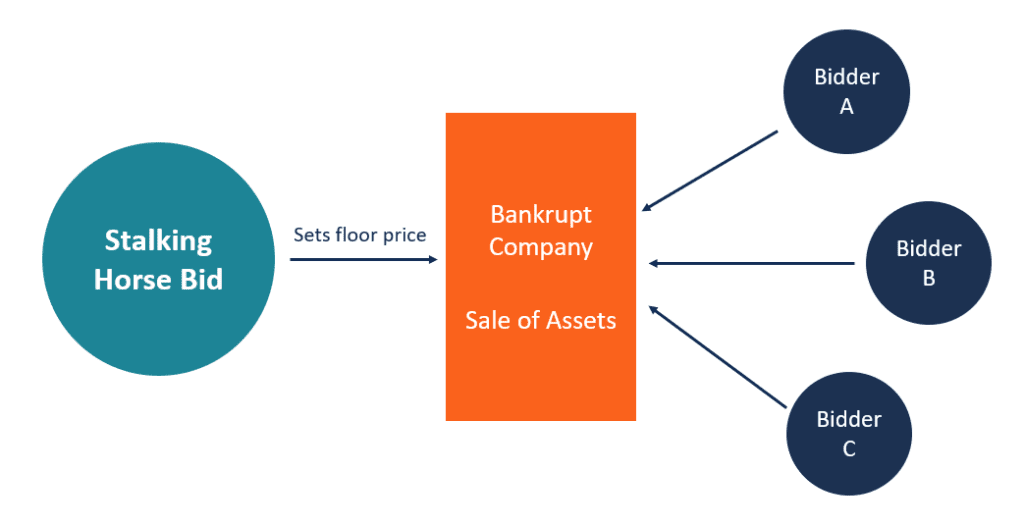

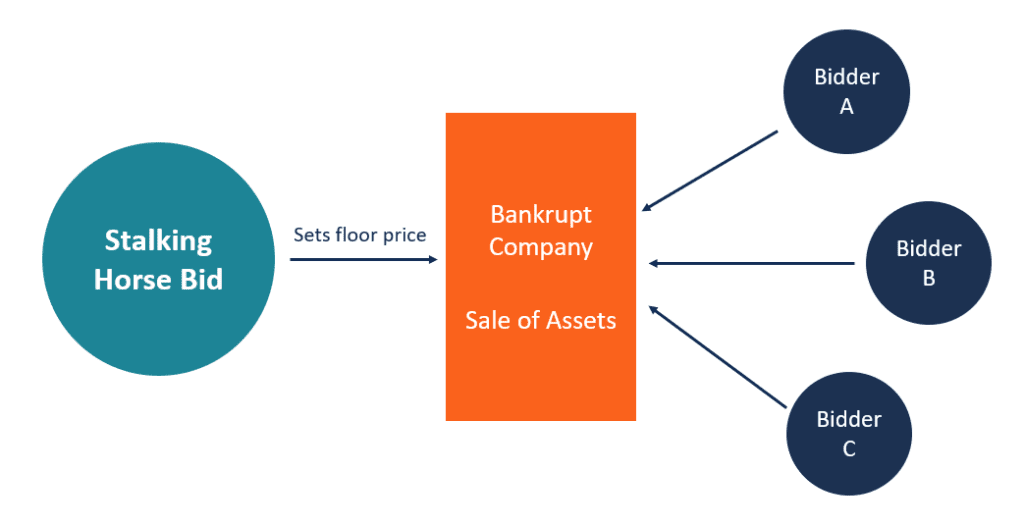

A "stalking horse bid" is an initial bid in an auction process designed to attract further bids. It sets a baseline price and encourages other potential buyers to participate. In this case, Alcon's $417.5 million bid served as the starting point, potentially leading to a higher final price, though it ultimately secured the deal.

-

Alcon Entertainment: Founded in 1997 by Broderick Johnson and Andrew Kosove, Alcon Entertainment is a well-established film production and finance company known for films like Blade Runner 2049 and The Blind Side. Their history demonstrates a strong track record in developing and distributing successful films, making them a suitable buyer for Village Roadshow's assets.

-

Village Roadshow's Assets: Village Roadshow's assets include a vast library of films, valuable intellectual property, and established distribution networks. For Alcon, these assets represent a significant expansion of their portfolio, providing access to established franchises and a wider audience.

-

Competitive Bidding: While Alcon's stalking horse bid initiated the process, the specifics of any further competitive bidding remain undisclosed. The success of Alcon's bid suggests its offer was compelling enough to either deter other bidders or secure the deal outright.

-

Strategic Advantages for Alcon: This acquisition offers several strategic advantages for Alcon. Access to Village Roadshow's established distribution channels, film library, and production infrastructure allows for significant economies of scale and expansion into new markets. This vertical integration strengthens Alcon's position in the industry.

Financial Details and Implications of the $417.5 Million Deal

The $417.5 million figure represents a substantial investment for Alcon. Whether it's a "fair" price depends on various valuation models applied to Village Roadshow's assets and future earning potential. However, the deal suggests confidence in the profitability of Village Roadshow's holdings.

-

Payment Structure: The exact payment structure – whether it's solely cash, a combination of cash and stock, or other arrangements – remains confidential. This detail would significantly impact Alcon's immediate financial position and future cash flow.

-

Valuation of Village Roadshow's Assets: Valuing Village Roadshow's assets requires considering factors like the library's revenue-generating potential, the value of its intellectual property rights, and the strength of its distribution networks. Independent analysts will likely scrutinize the deal to determine if the price accurately reflects these assets' worth.

-

Return on Investment for Alcon: Alcon's projected return on investment hinges on successful integration of Village Roadshow's assets, strategic exploitation of its library, and the continued success of future film productions. Synergies between the two companies are crucial to maximizing profitability.

-

Impact on Alcon's Financial Standing: The acquisition will undoubtedly impact Alcon's financial statements. Debt financing, if used, will affect leverage ratios, while the acquisition’s success will influence overall profitability and market capitalization.

Impact on the Film and Entertainment Industry

This acquisition has significant implications for the film and entertainment industry.

-

Film Production and Distribution: The merger could lead to increased efficiency in film production and distribution due to synergies in operations. This might result in cost savings and potentially lower prices for consumers.

-

Industry Consolidation: The deal further exemplifies a trend towards consolidation in the entertainment industry, with larger companies acquiring smaller ones to gain scale and market share.

-

Consequences for Consumers: While potential cost savings might benefit consumers, the impact on film diversity and the range of content available remains uncertain. Increased industry consolidation could lead to less independent filmmaking.

-

Changes to Village Roadshow's Projects: The future of Village Roadshow’s existing projects and future plans under Alcon's ownership is yet to be determined. Alcon may decide to continue certain projects, shelve others, or re-imagine them entirely.

Future Outlook for Alcon and Village Roadshow

The future of both companies post-acquisition is filled with both opportunities and challenges.

-

Alcon's Plans: Alcon's plans likely involve leveraging Village Roadshow's library for remakes, sequels, and spin-offs, potentially exploring streaming opportunities and international markets. Integration of production and distribution networks will be a key focus.

-

Synergies: Synergies are expected in areas like film production, marketing, and distribution. Combining resources should streamline operations and potentially reduce costs.

-

Job Losses/Restructuring: The integration process might unfortunately involve job losses or restructuring as redundancies are identified and eliminated. The extent of any restructuring remains to be seen.

-

Challenges for Alcon: Integrating two organizations of different sizes and cultures presents challenges. Successfully managing this integration process and maximizing synergies is crucial for the long-term success of the acquisition.

Conclusion

The Alcon Entertainment acquisition of Village Roadshow, finalized with a significant $417.5 million stalking horse bid, represents a pivotal moment in the entertainment industry. This deal reshapes the competitive landscape, offering substantial strategic advantages for Alcon while also raising questions about the future of film production and distribution. The details of the financial arrangement and the integration process will be key to observing the long-term impact of this major acquisition.

Call to Action: Stay informed about the ongoing developments in this major entertainment industry transaction. Follow our updates for further analysis of the Village Roadshow sale and its broader implications. Learn more about the evolving landscape of film studio acquisitions and the strategies employed by industry giants like Alcon.

Featured Posts

-

The Countrys Rising Business Stars A Comprehensive Guide

Apr 24, 2025

The Countrys Rising Business Stars A Comprehensive Guide

Apr 24, 2025 -

New Instagram App Challenges Tik Toks Video Editing Dominance

Apr 24, 2025

New Instagram App Challenges Tik Toks Video Editing Dominance

Apr 24, 2025 -

Canadas Fiscal Future A Vision For Responsible Spending

Apr 24, 2025

Canadas Fiscal Future A Vision For Responsible Spending

Apr 24, 2025 -

The Truth About Chalet Girls Serving Europes Wealthy Skiers

Apr 24, 2025

The Truth About Chalet Girls Serving Europes Wealthy Skiers

Apr 24, 2025 -

La Palisades Fire A List Of Celebrities Affected By Home Losses

Apr 24, 2025

La Palisades Fire A List Of Celebrities Affected By Home Losses

Apr 24, 2025