Canada's Fiscal Future: A Vision For Responsible Spending

Table of Contents

The Current State of Canada's Finances

Understanding Canada's current fiscal situation is crucial for charting a path towards responsible spending. Canada, like many developed nations, faces a complex interplay of debt, deficits, and competing spending priorities. Analyzing recent budget trends reveals fluctuating levels of government spending and revenue, impacting economic growth and stability.

-

Analysis of recent budget trends and their impact on the economy: Recent budgets have shown a trend of increasing spending on social programs and infrastructure, while revenue generation has faced challenges due to economic fluctuations and global uncertainties. This has led to concerns about the sustainability of the current fiscal path and its potential long-term impact on Canadian debt.

-

Discussion of current government spending allocations across key sectors (healthcare, education, infrastructure): A significant portion of government spending is allocated to healthcare, education, and infrastructure. While these are essential sectors, careful consideration is needed to ensure efficient allocation of resources and maximize the return on investment for taxpayers. There's ongoing debate about the optimal balance between these sectors and other pressing needs.

-

Highlighting existing fiscal challenges and potential risks: Canada's aging population and rising healthcare costs present significant fiscal challenges. Furthermore, global economic uncertainty and potential future economic downturns pose risks to revenue projections and the ability to manage existing debt levels. Careful fiscal planning is crucial to mitigate these risks.

-

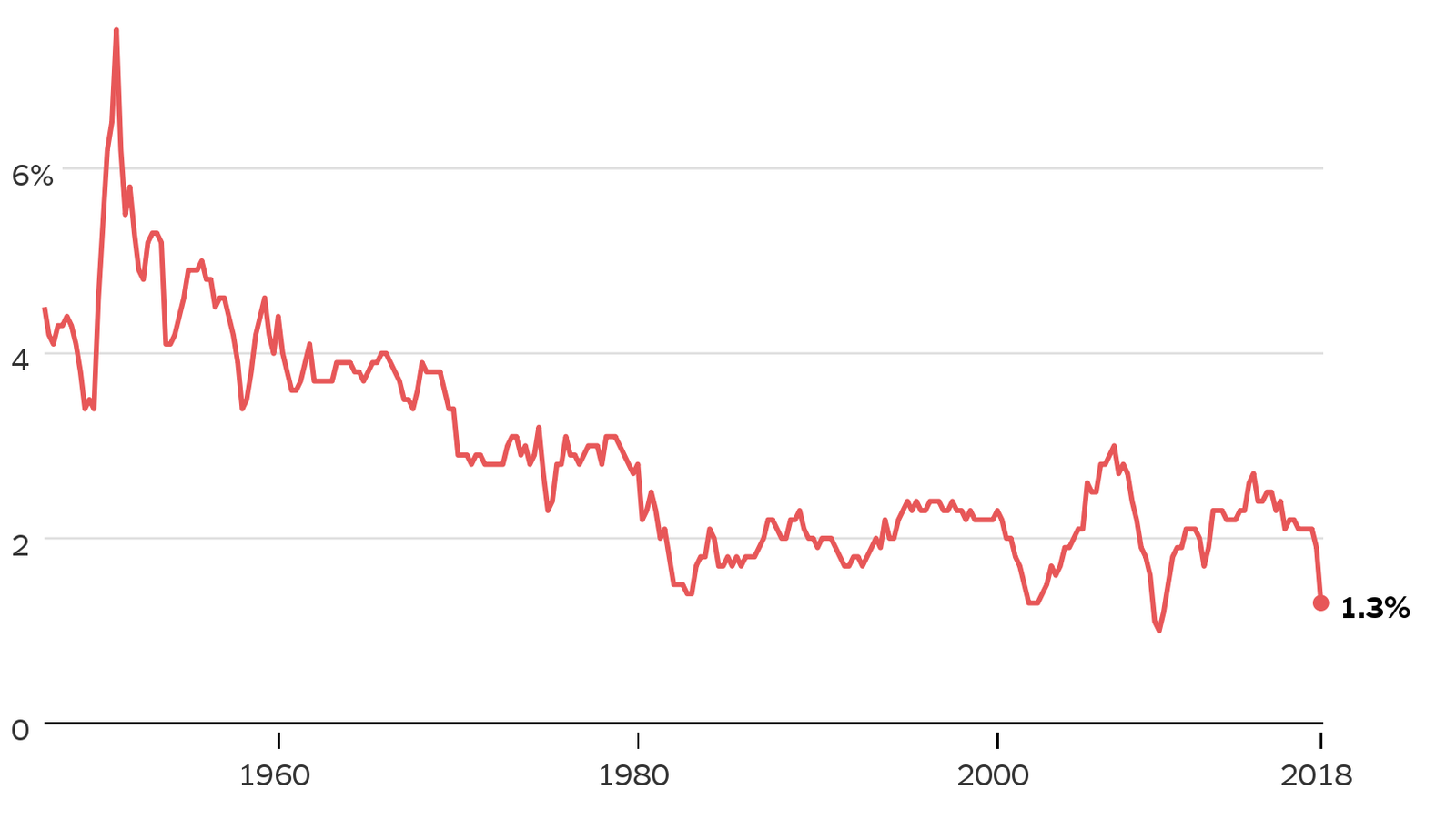

Comparison to other developed nations' fiscal standings: Comparing Canada's fiscal situation to other OECD countries provides valuable context. While Canada's debt-to-GDP ratio is relatively manageable compared to some European nations, continuous monitoring and proactive fiscal management are essential to maintain its stability. Benchmarking against other developed nations informs best practices and identifies areas for improvement in Canadian fiscal policy.

Strategies for Responsible Fiscal Management

Improving Canada's fiscal health requires a multi-pronged approach focused on responsible fiscal management. This involves both enhancing revenue generation and implementing strategies for more efficient spending.

-

Prioritizing government spending: A critical aspect of responsible spending is identifying core government programs and eliminating redundancies or inefficiencies. This requires a rigorous assessment of the value and impact of each program, ensuring that resources are allocated to those with the highest societal return.

-

Enhancing revenue generation: Exploring tax reforms that are both equitable and efficient is crucial. This includes assessing the current tax system for potential areas of improvement and evaluating the impact of different tax policies on economic growth. Stimulating economic growth through targeted investments and policies also plays a key role in boosting government revenue.

-

Improving efficiency in government operations: Streamlining bureaucratic processes and reducing administrative costs are crucial for fiscal responsibility. This can involve leveraging technology, improving inter-departmental collaboration, and implementing modern management practices.

-

Investing in long-term economic growth: Investing in infrastructure, education, and innovation are crucial for long-term economic prosperity and enhanced government revenue. Strategic investments in these areas can stimulate economic growth, create jobs, and contribute to a more robust and resilient economy.

The Role of Technological Advancement in Fiscal Sustainability

Technology offers significant potential for improving government efficiency and reducing costs, contributing to fiscal sustainability.

-

Utilizing data analytics for better resource allocation and program evaluation: Data analytics can provide valuable insights into program effectiveness and help optimize resource allocation. By analyzing data, governments can identify areas for improvement and make data-driven decisions that enhance efficiency and effectiveness.

-

Implementing digital government services to improve access and reduce administrative burdens: Digital government services can make government more accessible and reduce administrative burdens. This can involve shifting services online, improving online portals, and simplifying processes for citizens.

-

Leveraging technology to combat fraud and improve transparency: Technology can play a crucial role in detecting and preventing fraud, promoting accountability, and enhancing transparency in government operations.

-

Investing in digital infrastructure to support economic growth and innovation: Investing in Canada's digital infrastructure is crucial for fostering economic growth and innovation. This includes enhancing broadband access across the country and supporting the development of digital technologies.

Engaging Citizens in Fiscal Responsibility

Public understanding and engagement are essential for informed fiscal decision-making.

-

Promoting financial literacy among Canadians: Improving financial literacy among Canadians will empower citizens to make informed decisions about their personal finances and contribute to a more fiscally responsible society.

-

Increasing transparency and accessibility of government financial information: Open and accessible government financial information fosters public trust and enables citizens to hold their government accountable for its fiscal decisions.

-

Encouraging public discourse and debate on fiscal policy: Open public discussion and debate on fiscal policy allow for a wider range of perspectives to be considered and contribute to better decision-making.

-

Fostering a culture of responsible spending at both individual and governmental levels: Cultivating a culture of responsible spending at all levels of society is crucial for long-term fiscal health.

Conclusion

Achieving a sustainable fiscal future for Canada requires a multi-faceted approach encompassing responsible spending, strategic investment, technological innovation, and meaningful public engagement. By embracing these key strategies, we can build a stronger, more prosperous nation for generations to come. Let's work together to build a future based on responsible spending and sound fiscal management for Canada.

Featured Posts

-

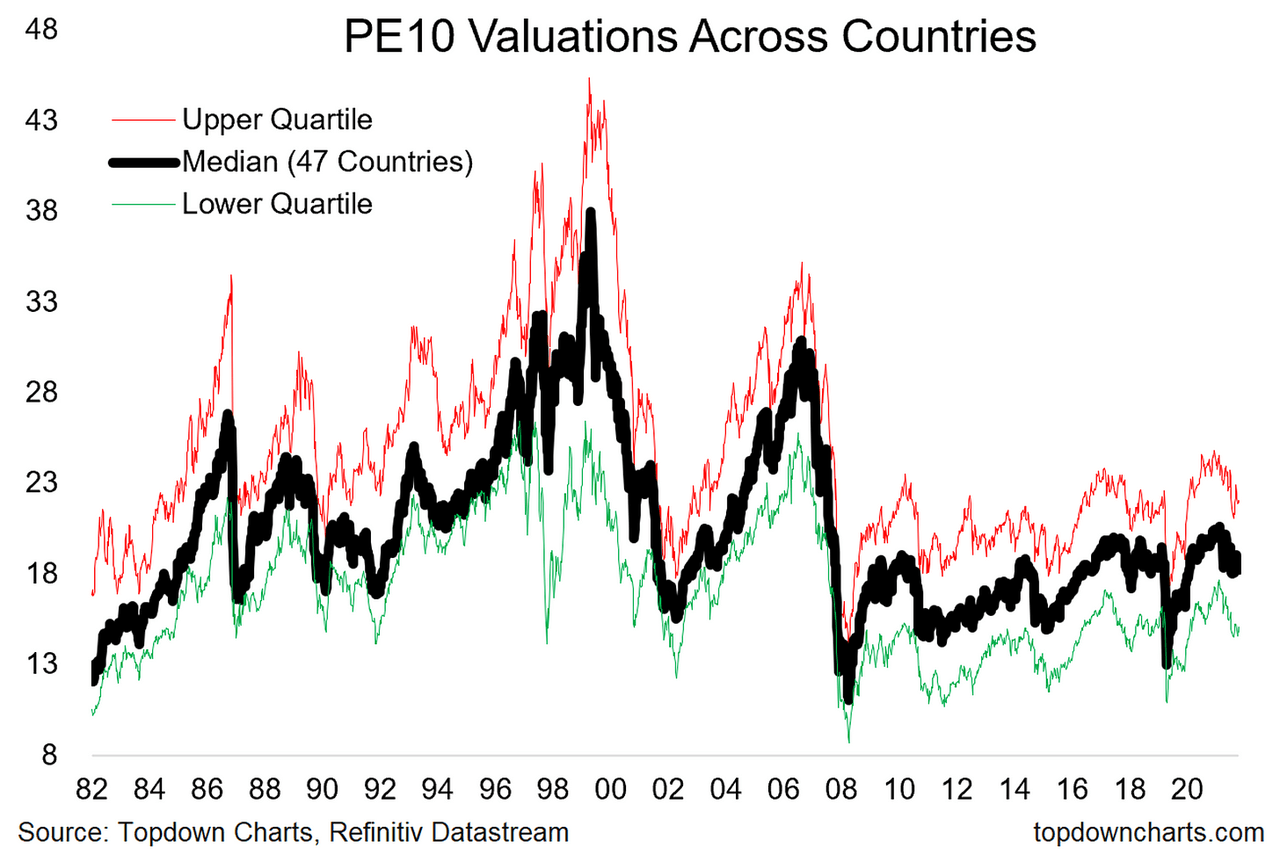

Bof As Take Why Stretched Stock Market Valuations Shouldnt Worry Investors

Apr 24, 2025

Bof As Take Why Stretched Stock Market Valuations Shouldnt Worry Investors

Apr 24, 2025 -

77 Inch Lg C3 Oled Why Its My Favorite Tv

Apr 24, 2025

77 Inch Lg C3 Oled Why Its My Favorite Tv

Apr 24, 2025 -

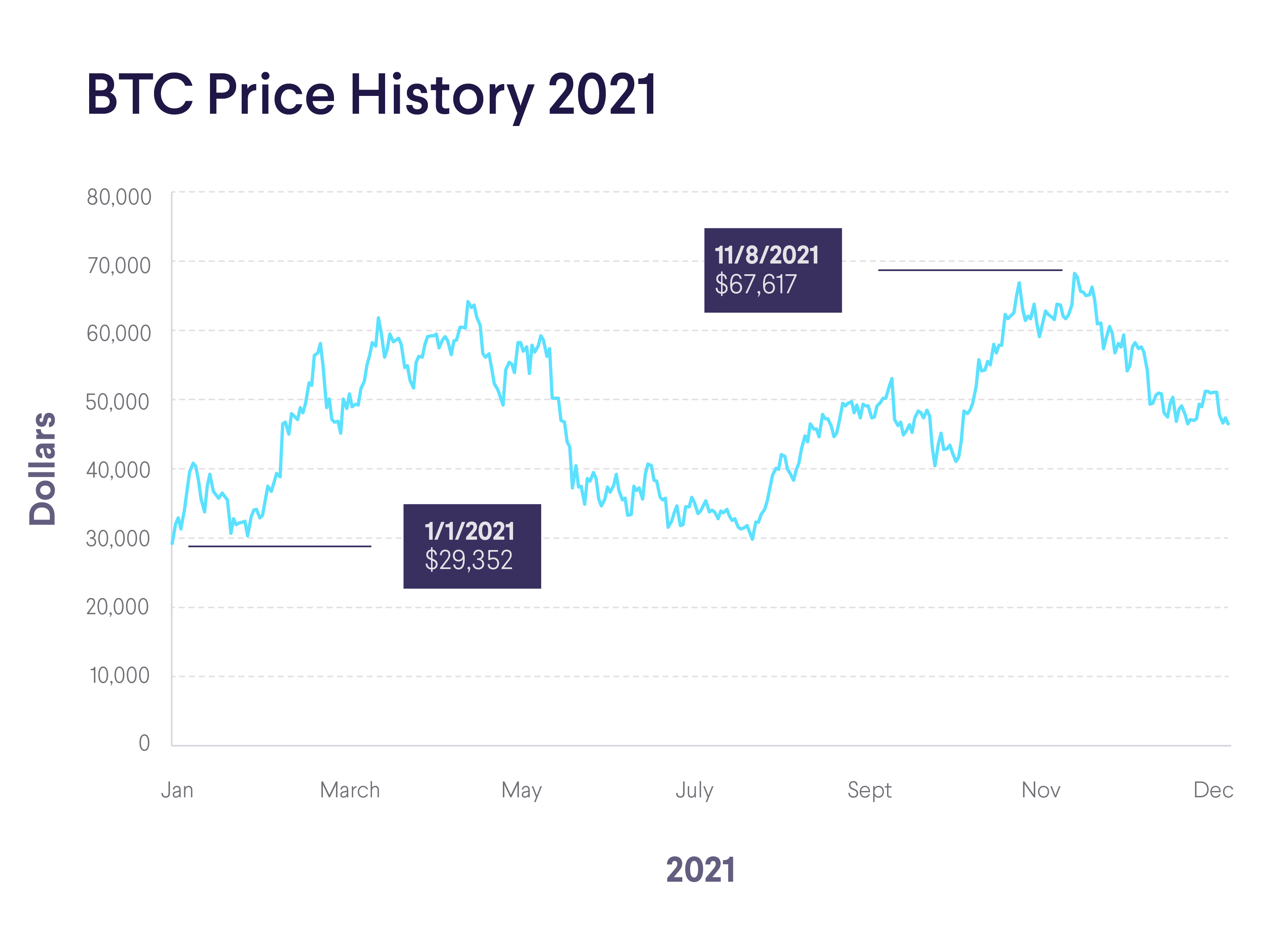

Bitcoin Price Surge Trumps Actions And Fed Policy Impact

Apr 24, 2025

Bitcoin Price Surge Trumps Actions And Fed Policy Impact

Apr 24, 2025 -

Increased Rent In La After Fires Is Price Gouging To Blame

Apr 24, 2025

Increased Rent In La After Fires Is Price Gouging To Blame

Apr 24, 2025 -

Canada Election Conservatives Pledge Tax Cuts Deficit Shrinkage

Apr 24, 2025

Canada Election Conservatives Pledge Tax Cuts Deficit Shrinkage

Apr 24, 2025