Canada Election: Conservatives Pledge Tax Cuts, Deficit Shrinkage

Table of Contents

Detailed Analysis of Proposed Tax Cuts

The Conservative Party's platform centers around significant tax relief for Canadians. Their proposed cuts target various aspects of the current tax system:

Specific Tax Cut Proposals:

-

Individual Income Tax Brackets: The Conservatives propose a reduction in individual income tax rates across multiple brackets. Exact percentage changes are still being debated, but preliminary proposals suggest lowering the rates for middle- and upper-income earners. This aims to increase disposable income and stimulate consumer spending. The specific income thresholds for each bracket and the corresponding percentage changes will be crucial to understanding the true impact of this proposal.

-

Corporate Tax Rates: A reduction in corporate tax rates is also a key element of the plan. The proposed reduction is intended to boost business investment, job creation, and overall economic growth. The party believes that a more competitive corporate tax environment will attract foreign investment and create a more robust Canadian economy. Specific details regarding the magnitude of the rate cut and its implementation timeline remain to be clarified.

-

GST/HST Reductions: The Conservatives may also explore options to reduce the Goods and Services Tax (GST) or Harmonized Sales Tax (HST), further alleviating the tax burden on Canadian consumers. The impact of this type of cut would be broadly felt across the population, influencing purchasing power and potentially impacting inflation rates. However, the feasibility of such cuts given the current deficit needs careful consideration.

The estimated cost of these tax cuts is substantial and forms a significant part of the ongoing fiscal debate. These proposals are targeted at stimulating the economy, but critics argue the impact might disproportionately benefit higher-income earners. The distribution of the tax relief across different income levels remains a critical aspect of the analysis.

Conservative Plan for Deficit Reduction

The Conservative Party's commitment to tax cuts is interwoven with a plan for significant deficit reduction. Their proposed methods focus on several key areas:

Mechanisms for Deficit Reduction:

-

Targeted Spending Cuts: The Conservatives propose to identify and eliminate wasteful government spending. Specific areas for potential cuts have not yet been fully detailed, leaving room for public debate and speculation. However, they suggest greater scrutiny on government programs and a focus on improving efficiency across all levels of government.

-

Increased Government Efficiency: Streamlining bureaucratic processes and eliminating redundancies are central to their deficit reduction strategy. The party argues that improving efficiency can generate significant savings without necessarily impacting the delivery of essential public services. The specific measures to achieve this increased efficiency are key to assessing the feasibility of their plan.

-

Economic Growth Strategies: The Conservatives believe that their proposed tax cuts and business-friendly policies will lead to robust economic growth. They project that this increased economic activity will naturally expand the tax base and contribute to deficit reduction. The strength of the connection between these tax cuts, economic growth, and deficit reduction will be a significant determinant of the plan's ultimate success.

The projected timeline for deficit reduction remains a subject of debate. The party's projections need to be carefully examined, considering potential risks and uncertainties in economic forecasting. Any significant changes in government programs or social services alongside spending cuts also require scrutiny.

Economic Impact and Analysis

The Conservative party's plan carries both potential positive and negative economic consequences.

Potential Positive Impacts:

- Stimulated Economic Growth: Tax cuts, particularly for businesses, could encourage increased investment and job creation. This could lead to a more dynamic and competitive Canadian economy.

- Increased Employment: A stronger economy, driven by increased investment and consumer spending, could create new job opportunities, reducing unemployment rates.

- Attracting Foreign Investment: A more business-friendly tax environment might attract foreign investment, injecting capital into the Canadian economy.

Potential Negative Impacts:

- Increased Inequality: Critics argue that the proposed tax cuts might disproportionately benefit higher-income earners, potentially widening the income gap.

- Reduced Government Services: Achieving significant deficit reduction might require cuts to essential government programs and services, leading to potential negative social consequences.

- Slower-Than-Projected Deficit Reduction: Unforeseen economic events or inaccurate economic forecasts could result in a slower pace of deficit reduction than projected.

Economic experts have offered varying opinions on the Conservatives' proposals. A comprehensive analysis requires careful consideration of these diverse perspectives and the use of relevant economic data and models.

Public Opinion and Political Landscape

Public reaction to the Conservative tax cut and deficit reduction plan is mixed. Opinion polls show varying levels of support, depending on the specific proposals and the demographics surveyed. The political landscape further complicates the issue; other political parties offer alternative fiscal policies, creating a multifaceted electoral debate. Analyzing election polls and understanding the diverse range of opinions is critical to comprehending the political climate surrounding these proposals.

Conclusion: Canada Election 2024: Weighing the Conservative Promise of Tax Cuts and Deficit Shrinkage

The Conservative Party's promise of significant tax cuts and deficit reduction is a central theme of the 2024 Canadian election. This article has analyzed their proposed tax cuts, their deficit reduction strategy, and the potential economic and political implications. While the plan aims to stimulate economic growth and create jobs, concerns remain about the potential for increased inequality and reduced government services. The feasibility of their projections and the potential impact on various segments of the Canadian population require careful consideration. We encourage you to conduct thorough research, engage in informed political discourse, and cast your vote based on a comprehensive understanding of the different parties’ plans regarding Canada election tax cuts and deficit reduction. Understanding the nuances of these plans is critical for informed voting and shaping the future of Canada's economic landscape.

Featured Posts

-

Governor Newsoms Call To Action Addressing High California Gas Prices Through Collaboration

Apr 24, 2025

Governor Newsoms Call To Action Addressing High California Gas Prices Through Collaboration

Apr 24, 2025 -

Office365 Security Failure Leads To Multi Million Dollar Theft

Apr 24, 2025

Office365 Security Failure Leads To Multi Million Dollar Theft

Apr 24, 2025 -

Mark Zuckerberg And The Trump Era A New Phase For Meta

Apr 24, 2025

Mark Zuckerberg And The Trump Era A New Phase For Meta

Apr 24, 2025 -

Crude Oil Price Analysis April 23 Market Overview

Apr 24, 2025

Crude Oil Price Analysis April 23 Market Overview

Apr 24, 2025 -

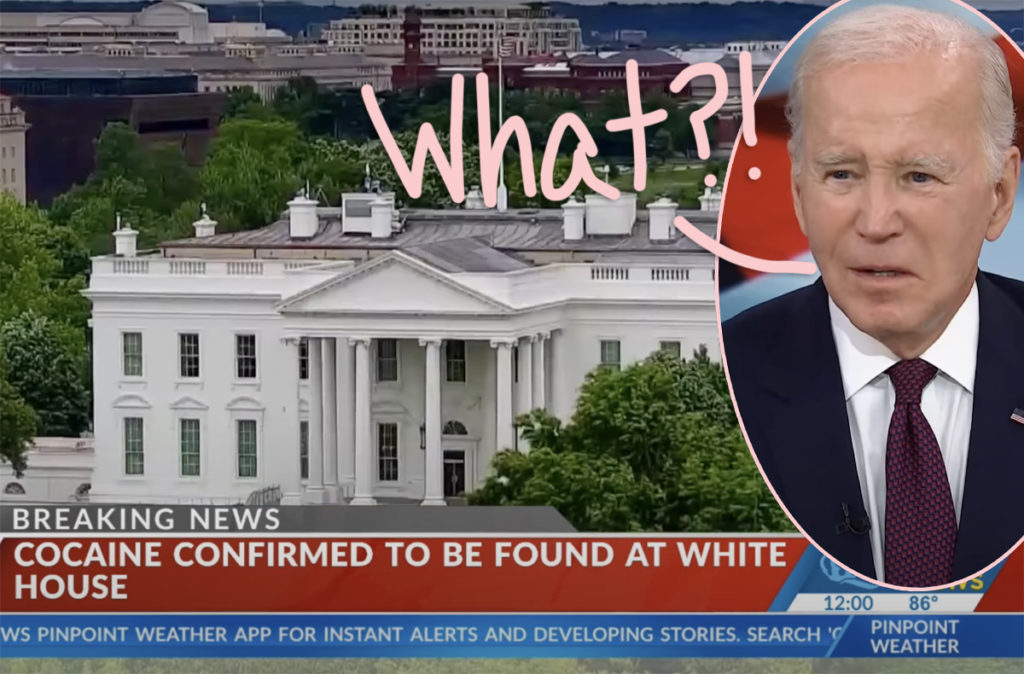

White House Cocaine Found Secret Service Concludes Investigation

Apr 24, 2025

White House Cocaine Found Secret Service Concludes Investigation

Apr 24, 2025