BofA's Take: Why Stretched Stock Market Valuations Shouldn't Worry Investors

Table of Contents

Despite the S&P 500 hitting record highs and some analysts expressing concerns about high valuations, a recent report from Bank of America (BofA) suggests investors shouldn't panic. While current stock market valuations might appear stretched compared to historical averages, BofA argues that underlying economic factors and robust long-term growth prospects mitigate the risks associated with these seemingly high valuations. This article will delve into BofA's analysis, exploring why their perspective on stretched stock market valuations offers a compelling case for maintaining a long-term investment strategy.

2. Main Points:

2.1. The Importance of Context: Understanding Current Economic Fundamentals

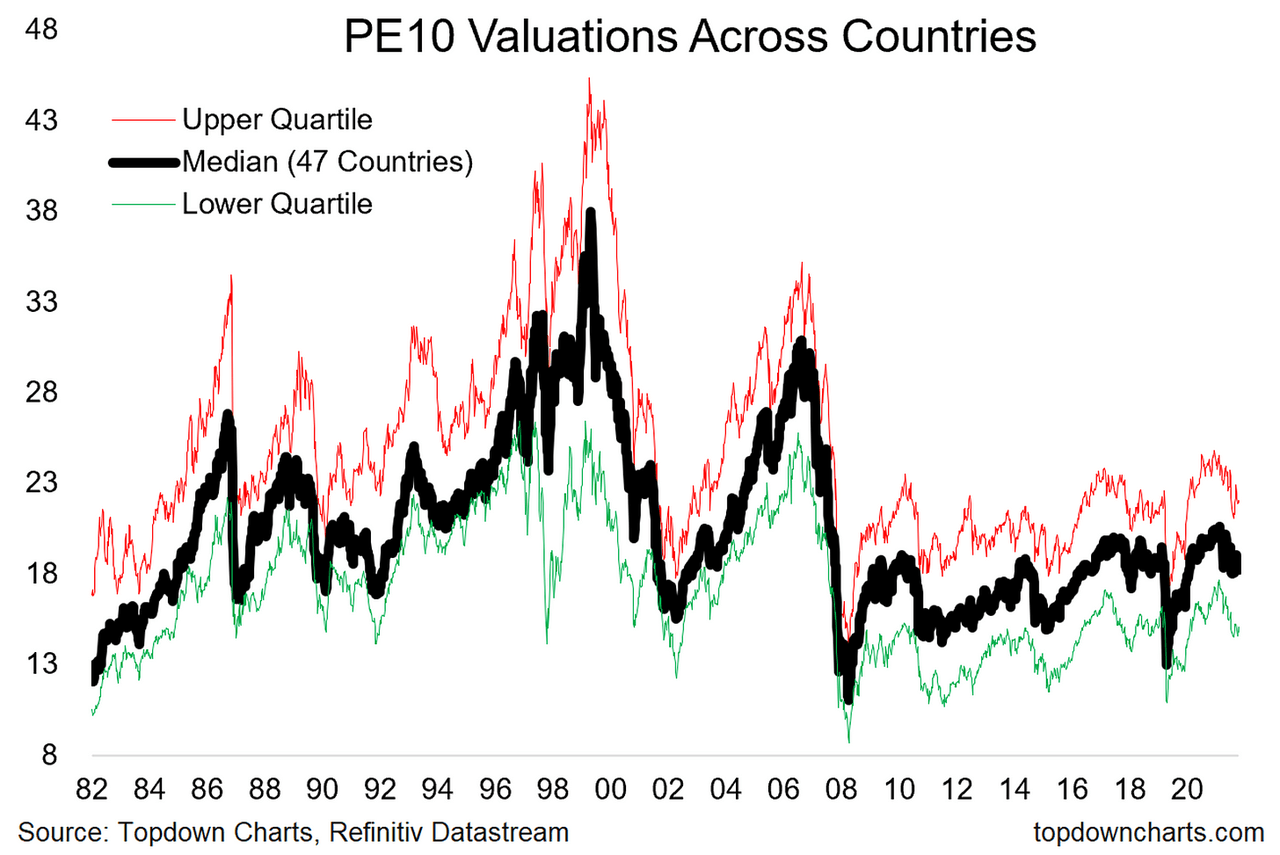

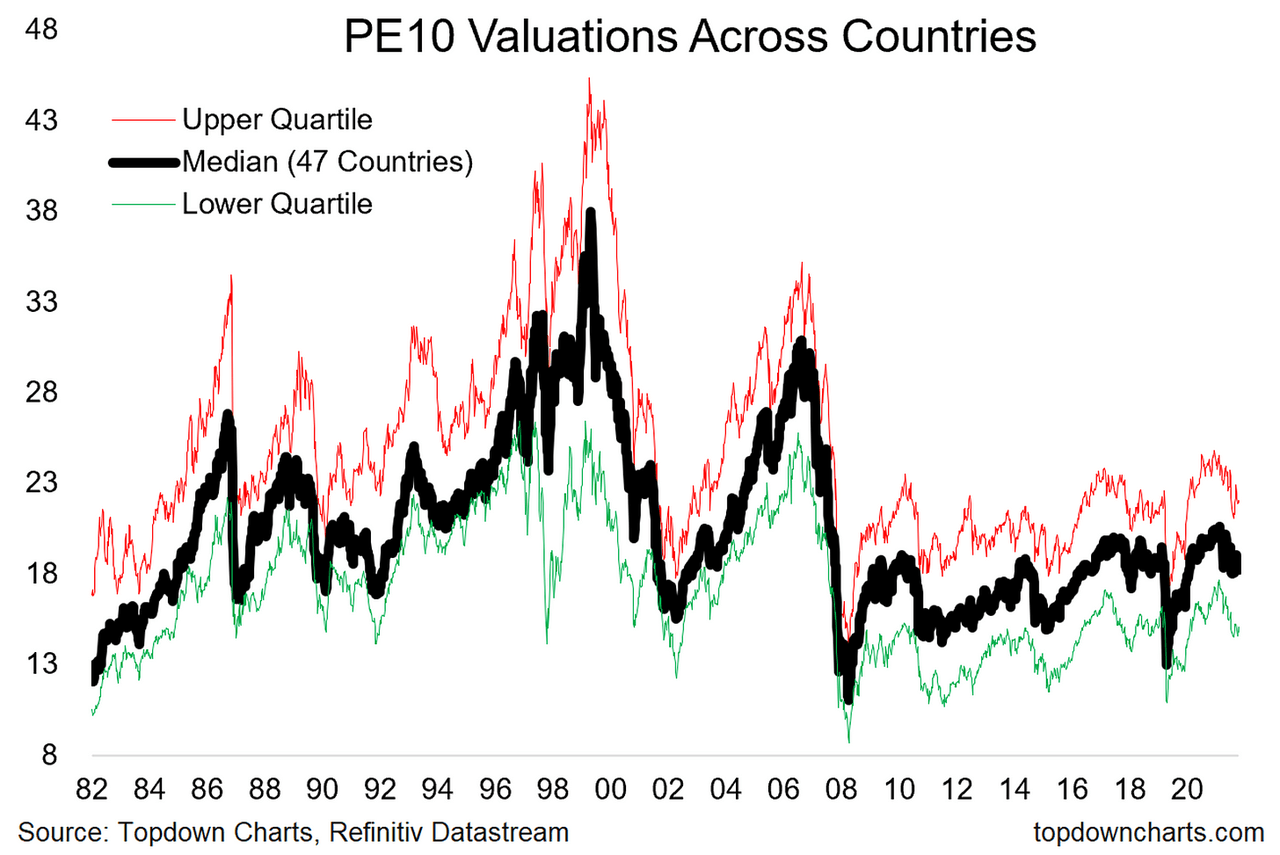

To accurately assess the significance of stretched stock market valuations, it's crucial to consider the broader economic context. Simply looking at price-to-earnings ratios (P/E ratios) in isolation can be misleading. A holistic view incorporating key economic indicators provides a more nuanced understanding.

H3: Strong Corporate Earnings and Revenue Growth: Robust corporate earnings and revenue growth significantly impact stock prices, even in the face of high valuations. Many companies have demonstrated impressive resilience and adaptability, leading to sustained profitability.

- Examples of strong performing sectors: Technology, healthcare, and consumer staples have consistently shown strong earnings growth.

- Statistics supporting earnings growth: The Q[insert Quarter]-2024 earnings season showed an X% increase in earnings per share (EPS) for S&P 500 companies (replace X with actual data).

- Projections for future growth: Analysts predict continued earnings growth in [insert year], driven by factors such as [insert relevant factors, e.g., increased consumer spending, technological innovation].

H3: Low Interest Rates and Monetary Policy: The prevailing low-interest-rate environment plays a crucial role in supporting higher valuations. Low borrowing costs encourage companies to invest and expand, while also making equities more attractive compared to fixed-income investments.

- Current interest rate environment: Interest rates remain relatively low compared to historical levels.

- Potential for future rate changes: While future rate hikes are possible, the pace is expected to be gradual.

- Impact on investor decisions: Low rates incentivize investors to seek higher returns in the stock market.

H3: Inflation and its Impact on Valuation Metrics: Inflation can influence valuation metrics like P/E ratios. While higher inflation might initially push valuations higher, the impact on real returns needs to be carefully considered.

- Current inflation rates: Current inflation is [insert current inflation data], impacting valuation metrics.

- Impact on P/E ratios: Inflation can inflate earnings, leading to higher P/E ratios, but this doesn't necessarily reflect an overvalued market.

- Analysis of real versus nominal returns: Investors should focus on real returns (adjusted for inflation) to get a clearer picture of investment performance.

2.2. Long-Term Growth Prospects and Technological Innovation

BofA's positive outlook on stretched stock market valuations is partly fueled by their assessment of long-term growth prospects.

H3: Technological Advancements and Disruptive Innovation: The rapid pace of technological advancements fuels economic growth and justifies higher valuations. Disruptive innovations continually create new markets and opportunities.

- Examples of disruptive technologies: Artificial intelligence (AI), renewable energy, and biotechnology are driving significant growth.

- Their potential impact on various sectors: These technologies are transforming various sectors, boosting productivity and efficiency.

- Long-term growth forecasts: These innovations contribute to long-term economic growth projections of [insert data, e.g., X% annual growth].

H3: Global Economic Growth and Emerging Markets: Global economic growth, particularly in emerging markets, contributes to higher stock valuations. These markets represent significant growth opportunities.

- Growth projections for emerging markets: Emerging markets are projected to grow at [insert data] in the coming years.

- Global economic outlook: The global economic outlook remains relatively positive, despite geopolitical uncertainties.

- Potential risks and opportunities: While risks exist, the potential rewards from global growth outweigh the concerns.

2.3. BofA's Specific Arguments and Supporting Data:

BofA's assessment of stretched stock market valuations is rooted in rigorous analysis.

H3: BofA's Valuation Models and Analysis: BofA employs sophisticated valuation models, considering factors beyond simple P/E ratios. Their analysis suggests that while valuations are high, they are not historically unprecedented, especially when considering the factors outlined above. [Insert specific data points and charts if available from BofA's report].

- Key findings from BofA’s report: [Summarize BofA's key findings]

- Comparison to historical valuations: [Compare current valuations to historical averages]

- Explanation of their models: [Briefly explain the methodology used by BofA].

H3: Addressing Counterarguments: It's important to acknowledge potential counterarguments. Some might argue that a market correction is inevitable given current valuations. BofA acknowledges this risk but suggests that the underlying fundamentals support a continued, albeit potentially volatile, upward trajectory.

- Potential risks: Market corrections are always possible.

- BofA's assessment of these risks: BofA’s analysis suggests these risks are manageable within a diversified portfolio.

- Mitigating factors: Strong earnings growth and low interest rates help to mitigate the risk of a significant correction.

3. Conclusion: Navigating Stretched Stock Market Valuations with Confidence

BofA's analysis suggests that while current stock market valuations might appear stretched, a comprehensive assessment of economic fundamentals and long-term growth prospects paints a more optimistic picture. Strong corporate earnings, low interest rates, technological innovation, and global growth all contribute to a positive outlook. While market corrections are always a possibility, maintaining a long-term investment perspective is crucial. Don't let short-term market fluctuations derail your long-term investment strategy. Remember to consider BofA's insights when assessing your portfolio and always consult with a financial advisor to develop a personalized investment strategy that aligns with your individual risk tolerance and long-term financial goals. Don't let concerns about stretched stock market valuations prevent you from achieving your financial objectives. Contact a financial advisor today to discuss your options.

Featured Posts

-

The China Factor Analyzing Bmw And Porsches Market Struggles

Apr 24, 2025

The China Factor Analyzing Bmw And Porsches Market Struggles

Apr 24, 2025 -

Los Angeles Wildfires The Dark Side Of Speculative Gambling

Apr 24, 2025

Los Angeles Wildfires The Dark Side Of Speculative Gambling

Apr 24, 2025 -

Faa Investigates Las Vegas Airport Collision Risks

Apr 24, 2025

Faa Investigates Las Vegas Airport Collision Risks

Apr 24, 2025 -

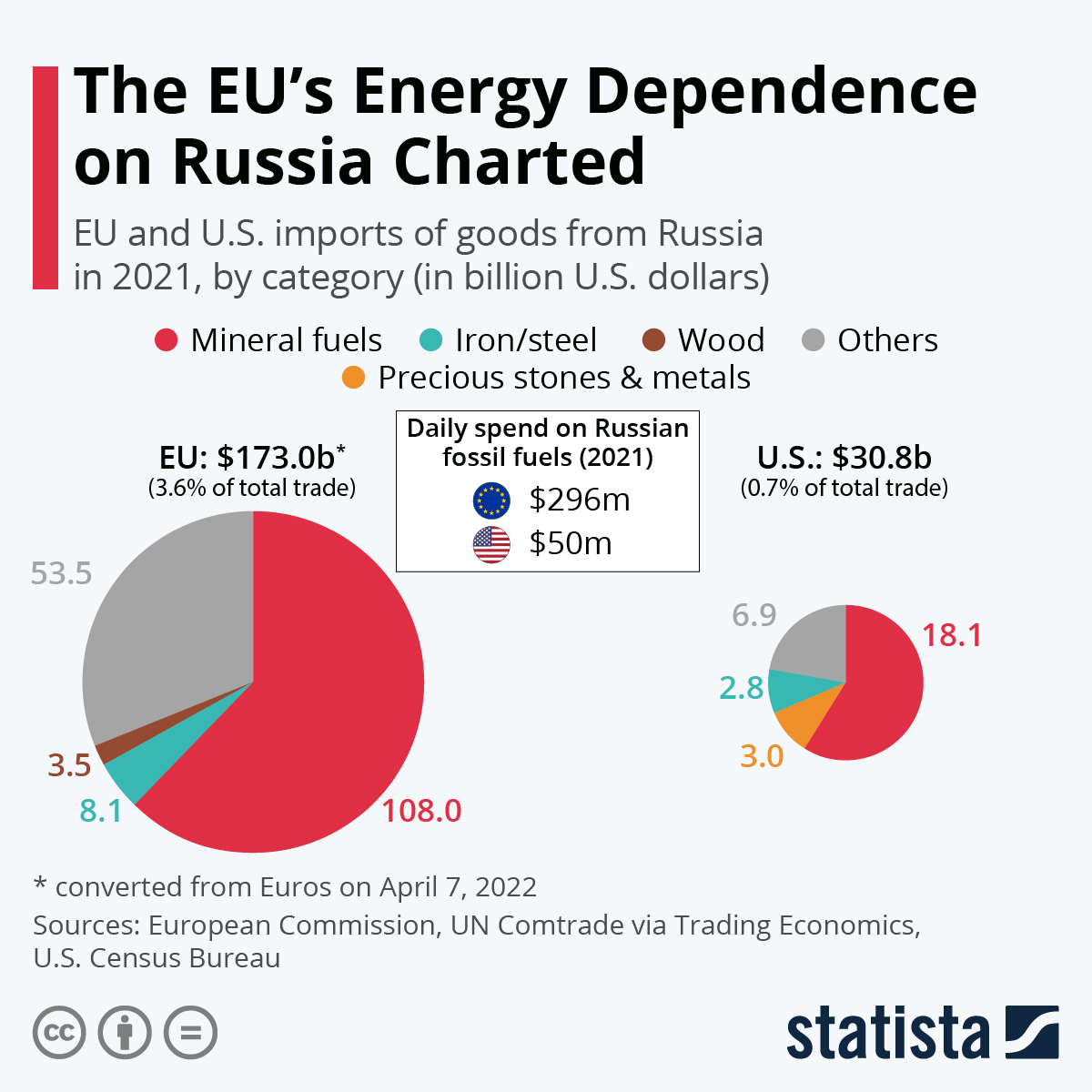

Eus Strategy To Eliminate Russian Gas Focus On The Spot Market

Apr 24, 2025

Eus Strategy To Eliminate Russian Gas Focus On The Spot Market

Apr 24, 2025 -

T Mobile Data Breach 16 Million Penalty For Security Failures

Apr 24, 2025

T Mobile Data Breach 16 Million Penalty For Security Failures

Apr 24, 2025