EU's Strategy To Eliminate Russian Gas: Focus On The Spot Market

Table of Contents

The Limitations of Long-Term Contracts with Russia

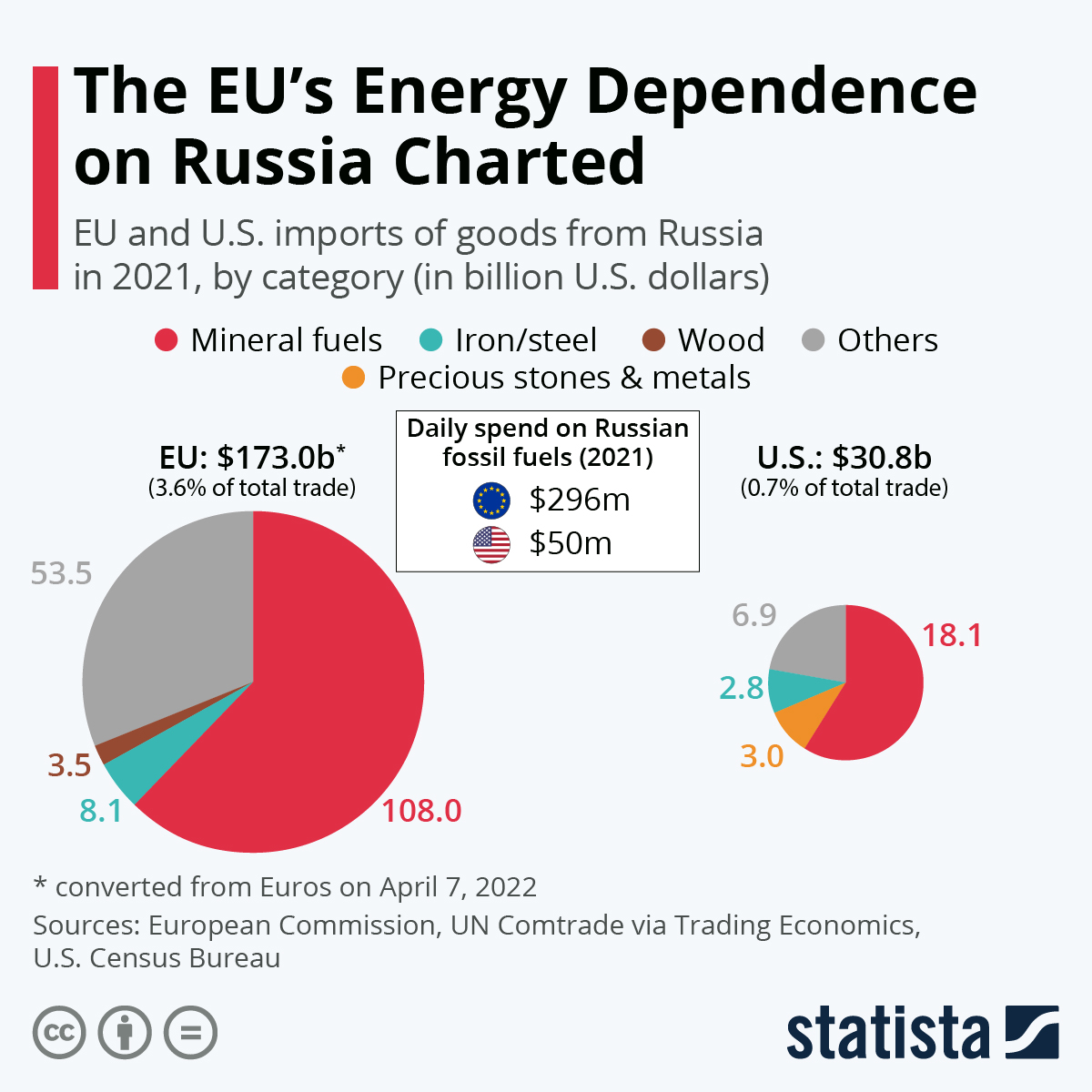

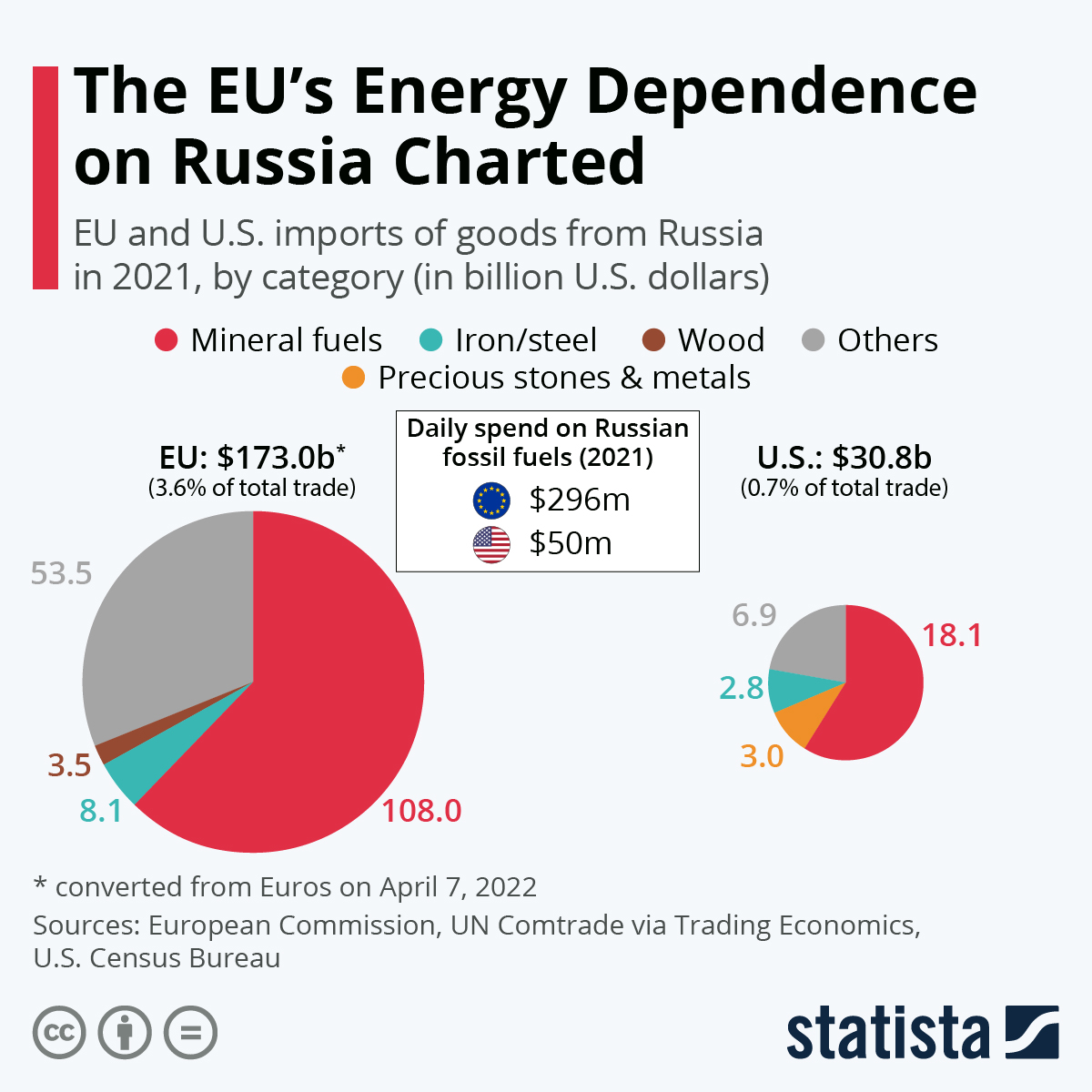

Historically, the EU relied heavily on long-term contracts with Russia for natural gas supply. This approach, while seemingly providing stability, has proven incredibly vulnerable in the face of geopolitical tensions. These contracts, often spanning years, locked the EU into arrangements that proved detrimental when Russia weaponized its energy exports.

- High prices locked in for extended periods: Long-term contracts often meant paying prices that were significantly higher than those available on the open market, especially as global prices fluctuated.

- Limited flexibility to adjust supply in response to geopolitical events: The inflexible nature of these contracts left the EU with little recourse when Russia curtailed gas supplies, creating energy crises.

- Dependence on a single supplier (Russia): This over-reliance created a significant vulnerability, making the EU susceptible to supply disruptions and political manipulation.

- Vulnerability to supply disruptions and price manipulation: Russia's ability to control the flow of gas through these contracts enabled it to exert considerable political pressure on EU member states.

The Spot Market: A Dynamic Alternative

The spot market for natural gas offers a dynamic alternative to the rigid long-term contracts. This market, characterized by shorter-term trading and diverse suppliers, provides the EU with much-needed flexibility and resilience.

- Access to diverse gas suppliers globally: The spot market allows the EU to source gas from a wider range of countries, reducing dependence on any single nation. This diversification is a key element of the EU's strategy to eliminate Russian gas.

- Shorter-term contracts provide greater price flexibility: Shorter-term agreements allow the EU to adapt to fluctuating market prices, potentially avoiding the high costs associated with long-term contracts.

- Ability to respond quickly to supply shocks and demand fluctuations: The spot market's agility allows the EU to swiftly adjust its gas purchases to meet unexpected changes in supply or demand.

- Increased negotiating power for EU member states: A diversified sourcing strategy, facilitated by the spot market, empowers individual EU members to negotiate better terms with suppliers.

- Incentivizes diversification of energy sources: The flexibility of the spot market encourages the EU to explore and invest in alternative energy sources, reducing reliance on natural gas altogether.

LNG Imports: A Cornerstone of the Spot Market Strategy

Liquefied natural gas (LNG) imports are pivotal to the EU's spot market strategy. The significant investment in expanding LNG terminal capacity across the EU is directly impacting the market's dynamics.

- Increased LNG import infrastructure across the EU: New terminals and pipelines are providing access to global LNG supplies, a key component of the EU’s strategy to eliminate Russian gas reliance.

- Greater competition among LNG suppliers: Increased import capacity fosters competition among LNG suppliers, potentially leading to more favorable pricing for the EU.

- Reduced reliance on pipeline gas from Russia: LNG imports directly contribute to reducing the EU's dependence on Russian pipeline gas.

- Challenges of securing sufficient LNG supplies in peak demand seasons: Competition for LNG globally presents challenges, especially during periods of high demand, underscoring the need for continued diversification.

Challenges and Risks of the Spot Market Approach

While the spot market offers considerable advantages, it's not without its challenges and risks. Reliance on this dynamic market requires careful planning and risk management.

- Price volatility and potential for price spikes: Spot market prices are inherently volatile, exposing the EU to the risk of price spikes during periods of high demand or supply disruptions.

- Increased competition for limited LNG supplies: Global competition for LNG creates a challenge, potentially driving up prices and limiting supply for the EU.

- Need for robust infrastructure to handle fluctuating volumes: The EU needs robust infrastructure to manage the fluctuating volumes of gas associated with spot market transactions.

- Concerns about security of supply during periods of high demand: The competitive nature of the spot market raises concerns about securing sufficient supplies during periods of peak demand.

Diversification of Energy Sources Beyond Gas

The EU's strategy to eliminate Russian gas necessitates a broader energy transition. Relying solely on the spot market for natural gas isn't a sustainable long-term solution.

- Investing in renewable energy sources (wind, solar, etc.): Massive investments in renewable energy sources are crucial for long-term energy security and independence.

- Improving energy efficiency measures across the EU: Reducing energy consumption through efficiency improvements is essential for lowering demand and reducing reliance on gas imports.

- Developing smart grids to optimize energy distribution: Modernizing energy grids is key to efficiently managing the fluctuating supply from renewable and spot market sources.

- Exploring alternative energy sources like hydrogen: Investing in research and development of alternative energy carriers like hydrogen is crucial for a truly diversified energy future.

Conclusion

The EU's strategy to eliminate Russian gas relies heavily on a transition towards a more flexible and diverse energy system, with the spot market playing a pivotal role. While the spot market offers flexibility and diverse sourcing, it also presents challenges like price volatility and competition. Success hinges on building sufficient LNG import capacity, improving energy efficiency, and transitioning to renewable energy sources. The EU's journey towards energy independence requires a sustained commitment to diversifying energy supplies and addressing the opportunities and challenges presented by the spot market. Learn more about the EU's plan to eliminate its dependence on Russian gas and contribute to a secure energy future. Understanding the intricacies of the EU's strategy to eliminate Russian gas is crucial for navigating this pivotal moment in European energy policy.

Featured Posts

-

16 Million Fine For T Mobile Details Of Three Years Of Data Breaches

Apr 24, 2025

16 Million Fine For T Mobile Details Of Three Years Of Data Breaches

Apr 24, 2025 -

Instagram Launches Video Editor To Rival Tik Tok

Apr 24, 2025

Instagram Launches Video Editor To Rival Tik Tok

Apr 24, 2025 -

Is The 77 Inch Lg C3 Oled Tv Worth It My Experience

Apr 24, 2025

Is The 77 Inch Lg C3 Oled Tv Worth It My Experience

Apr 24, 2025 -

Chat Gpts Developer Open Ai Faces Ftc Investigation

Apr 24, 2025

Chat Gpts Developer Open Ai Faces Ftc Investigation

Apr 24, 2025 -

Canadian Dollar Plunges Despite Us Dollar Gains

Apr 24, 2025

Canadian Dollar Plunges Despite Us Dollar Gains

Apr 24, 2025