Bitcoin Price Surge: Trump's Actions And Fed Policy Impact

Table of Contents

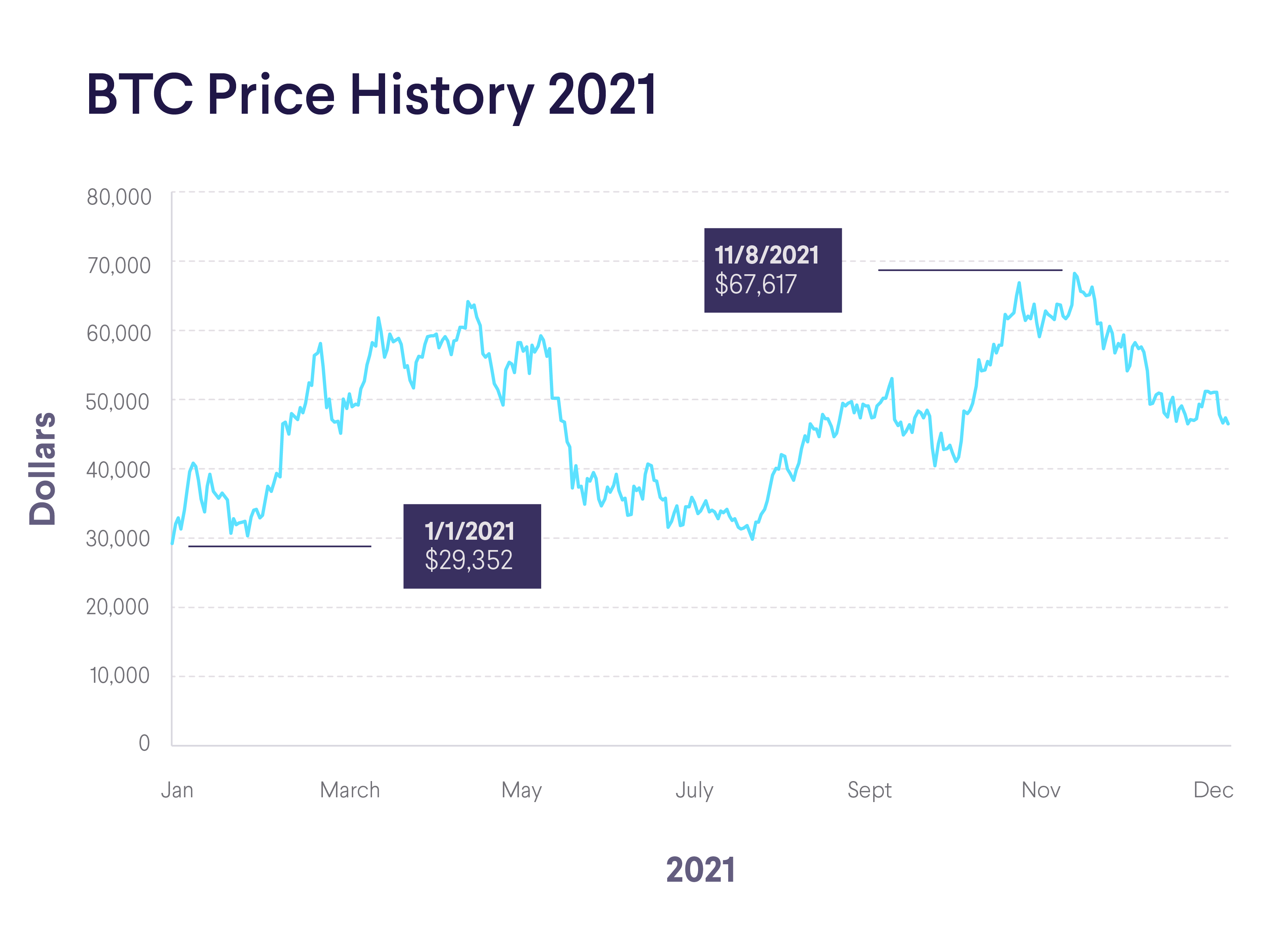

Trump's Economic Policies and Bitcoin's Price

Trump's economic policies significantly influenced the crypto market, creating both opportunities and challenges for Bitcoin. Understanding this impact is key to analyzing the Bitcoin price surge during this period.

Fiscal Stimulus and Inflation

Trump's fiscal policies, characterized by significant tax cuts and increased government spending, injected substantial liquidity into the US economy. This massive fiscal stimulus, while aiming to boost economic growth, also fueled concerns about inflation.

- Increased money supply leading to devaluation of the dollar: The increased money supply diluted the value of the US dollar, making investors seek alternative stores of value.

- Bitcoin's appeal as a store of value during inflationary periods: Bitcoin, with its fixed supply of 21 million coins, gained appeal as a hedge against inflation. Investors saw it as a potential safeguard against a weakening dollar.

- Correlation between inflation rates and Bitcoin price fluctuations: Studies have shown a positive correlation between rising inflation and Bitcoin price increases, suggesting that investors actively use Bitcoin to protect their purchasing power during inflationary periods. This correlation is a significant factor contributing to the Bitcoin price surge.

Trade Wars and Geopolitical Uncertainty

Trump's trade policies, including the imposition of tariffs on various goods, created significant geopolitical uncertainty. This instability impacted global markets, pushing investors towards perceived safe-haven assets.

- Increased market volatility during trade disputes: The uncertainty surrounding trade negotiations often resulted in increased market volatility, prompting investors to seek assets considered less susceptible to these fluctuations.

- Bitcoin's perceived safe-haven status during times of political instability: Bitcoin, often described as "digital gold," gained traction as investors sought refuge from the uncertainty generated by trade wars and geopolitical tensions.

- Examples of Bitcoin price movements correlated with specific trade events: Several studies have shown a correlation between escalating trade tensions and subsequent increases in Bitcoin's price, indicating a clear flight-to-safety phenomenon. For example, specific instances of tariff announcements often preceded noticeable Bitcoin price surges.

The Federal Reserve's Role and Bitcoin's Trajectory

The Federal Reserve's monetary policy decisions played a crucial role in shaping the environment for Bitcoin's price. Understanding the Fed's actions is vital to comprehending the Bitcoin price surge.

Interest Rate Hikes and Bitcoin's Value

The Federal Reserve's interest rate hikes, aimed at controlling inflation, had a direct impact on the US dollar's value and, consequently, Bitcoin's price.

- Impact of higher interest rates on the US dollar: Higher interest rates generally strengthen the US dollar, making it more attractive to investors seeking returns.

- Inverse relationship between the dollar and Bitcoin price: Often, a strengthening dollar leads to a decrease in Bitcoin's price, as investors shift their capital towards the higher-yielding dollar-denominated assets. Conversely, periods of low interest rates or quantitative easing can fuel a Bitcoin price surge.

- How interest rate expectations affect Bitcoin investment decisions: Investor expectations surrounding future interest rate adjustments significantly impact Bitcoin investment decisions. Anticipations of further rate hikes can trigger sell-offs, while expectations of easing can fuel a Bitcoin price surge.

Quantitative Easing and Bitcoin Adoption

Periods of quantitative easing (QE) implemented by the Fed to stimulate the economy indirectly influenced Bitcoin's price and adoption.

- QE's effect on the money supply and potential for inflation: QE increases the money supply, potentially leading to inflation. This inflationary pressure can drive investors towards alternative assets, including Bitcoin.

- Increased interest in alternative assets, including Bitcoin: The low-interest-rate environment created by QE made traditional investments less attractive, pushing investors towards higher-risk, higher-reward assets like Bitcoin.

- The role of QE in driving broader crypto market adoption: The increased liquidity generated by QE contributed to broader crypto market adoption, boosting investor interest and contributing to a Bitcoin price surge.

Conclusion

The Bitcoin price surge is not an isolated event. It's a complex outcome influenced by a confluence of factors, including significant shifts in US economic and monetary policy under the Trump administration and the subsequent actions of the Federal Reserve. Fiscal stimulus, trade wars, interest rate adjustments, and quantitative easing all contributed to shaping Bitcoin’s price trajectory. Understanding the interplay between macroeconomic policies and Bitcoin's price movements is crucial for navigating the cryptocurrency market. Stay informed about future developments in monetary policy and geopolitical events to make well-informed decisions regarding your Bitcoin investments. Further research into Bitcoin price surge patterns and their correlation to global events can help you become a more successful investor.

Featured Posts

-

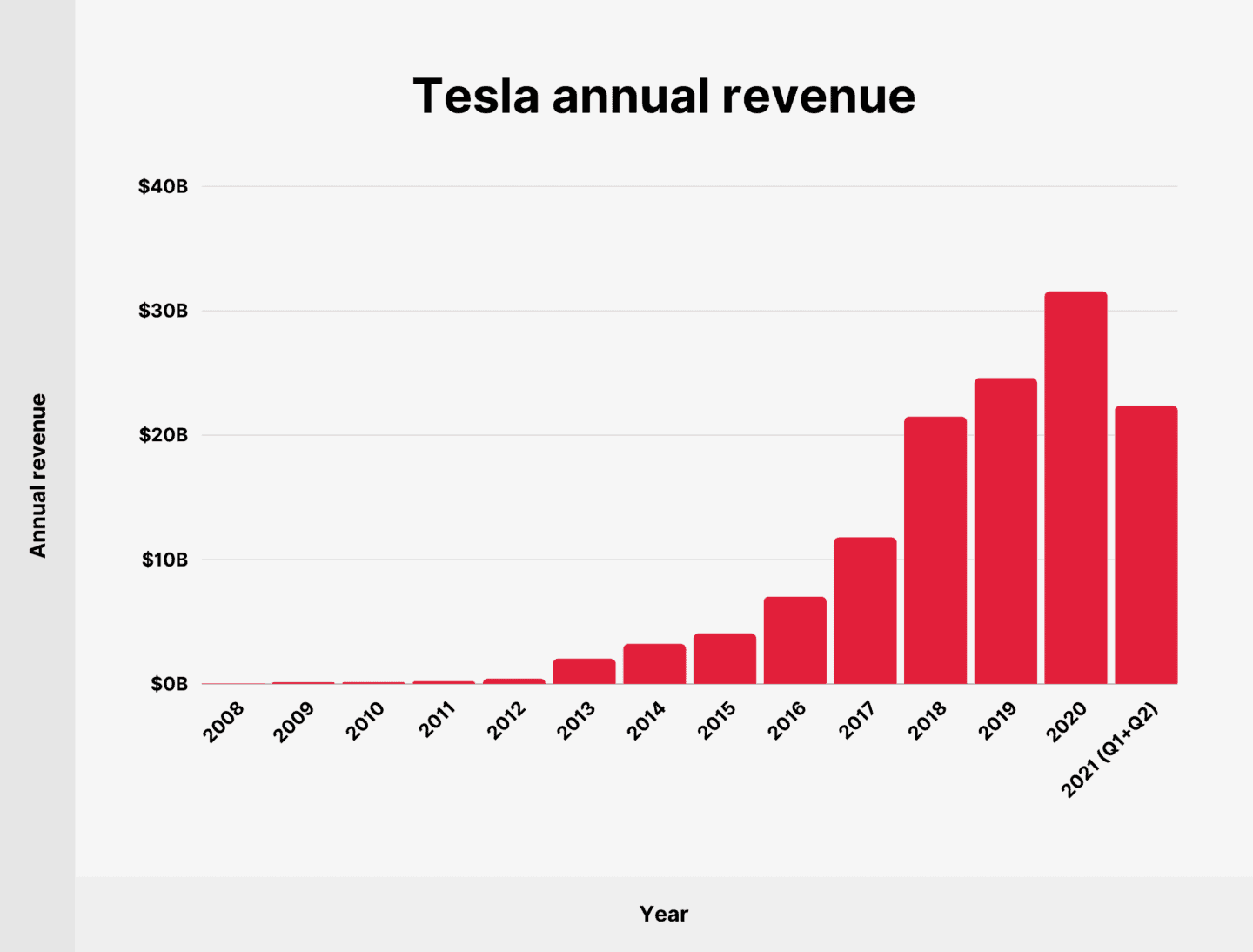

Tesla Earnings Disappoint 71 Net Income Decline In First Quarter

Apr 24, 2025

Tesla Earnings Disappoint 71 Net Income Decline In First Quarter

Apr 24, 2025 -

Teslas Q1 Profit Fall A Detailed Look At The Contributing Factors

Apr 24, 2025

Teslas Q1 Profit Fall A Detailed Look At The Contributing Factors

Apr 24, 2025 -

Understanding Stock Market Valuations Bof As View On Investor Concerns

Apr 24, 2025

Understanding Stock Market Valuations Bof As View On Investor Concerns

Apr 24, 2025 -

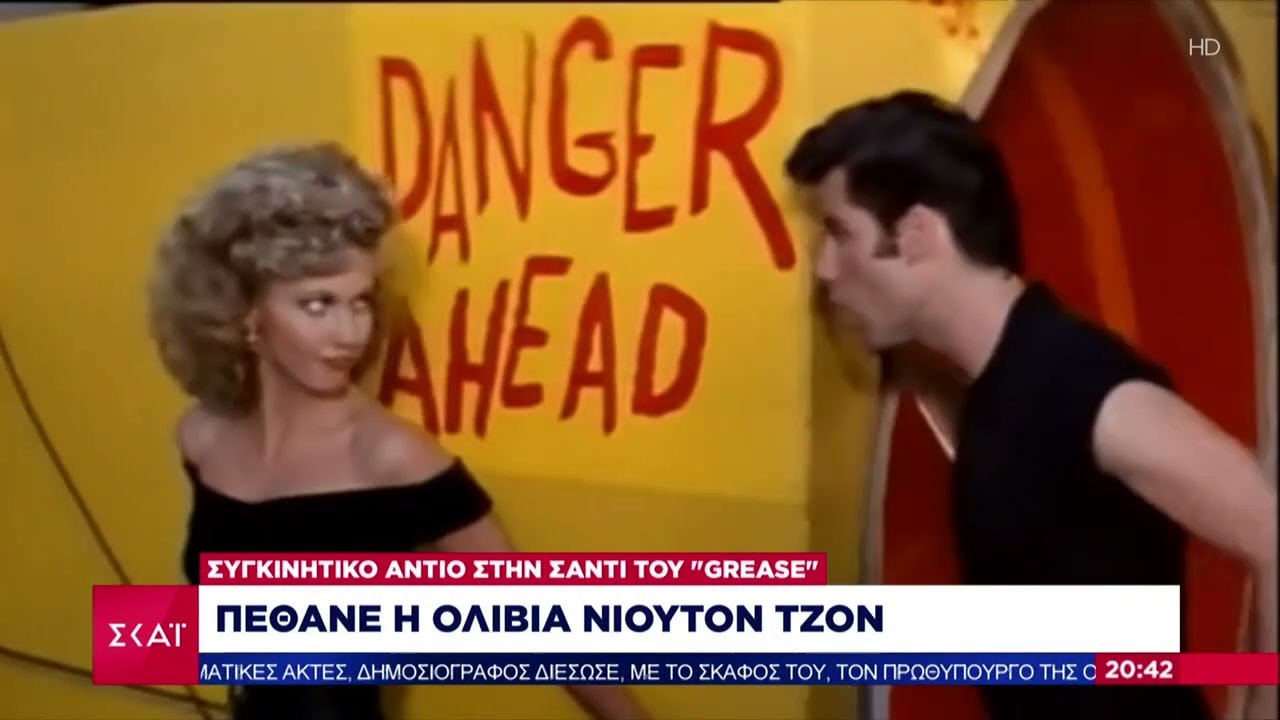

Tzon Travolta Ena Sygkinitiko Antio Ston Tzin Xakman

Apr 24, 2025

Tzon Travolta Ena Sygkinitiko Antio Ston Tzin Xakman

Apr 24, 2025 -

Apr 24, 2025

Apr 24, 2025