Tesla's Q1 Profit Fall: A Detailed Look At The Contributing Factors

Table of Contents

Price Cuts and Their Impact on Profit Margins

Tesla's aggressive price cuts during Q1 2024 were a major contributor to the decline in profit margins. While the rationale behind these cuts – primarily aiming for increased market share and a competitive response to emerging rivals – is understandable, the immediate impact on profitability was substantial. The company prioritized volume over margin, a strategy that, while potentially beneficial in the long run, significantly impacted short-term earnings.

- Percentage decrease in vehicle prices: Tesla implemented price reductions averaging around 10-20% across its model range, varying by region and model.

- Estimated impact on unit sales: While exact figures remain proprietary, analysts suggest a considerable boost in unit sales, though not sufficient to entirely offset the reduced profit per vehicle.

- Comparison to competitor pricing strategies: Unlike some competitors who maintain premium pricing, Tesla's strategy signaled a shift toward broader market penetration, directly influencing the Tesla stock price in the short term.

Increased Competition in the EV Market

The electric vehicle market is no longer Tesla's sole domain. A wave of new entrants and established automakers aggressively expanding their EV offerings has intensified competition, placing significant pressure on Tesla's pricing and market share. This increased competition is a critical factor in understanding the Tesla Q1 earnings report.

- Key competitors and their market strategies: Companies like BYD, Volkswagen, and Ford are rapidly scaling up their EV production, offering competitive pricing and features.

- New EV model launches and their impact: The launch of numerous new EV models has increased consumer choice, intensifying the pressure on Tesla to maintain its competitive edge.

- Market share analysis comparing Tesla to competitors: While Tesla retains a significant market share, the data indicates a slowing growth rate compared to previous quarters, highlighting the growing competitive landscape.

Rising Production Costs and Supply Chain Disruptions

Escalating raw material costs, particularly for batteries and crucial semiconductor components, significantly impacted Tesla's profitability during Q1. Furthermore, persistent supply chain disruptions and logistical challenges added to the strain on production efficiency.

- Percentage increase in key raw material costs: Reports indicate double-digit percentage increases in the cost of lithium, nickel, and other battery materials, directly impacting production costs.

- Examples of supply chain disruptions: Ongoing semiconductor shortages and logistical bottlenecks in transportation and shipping further constrained Tesla's production capabilities.

- Impact on production volume and delivery timelines: These factors combined to result in lower-than-projected production volumes and extended delivery times for some models.

Increased Investment in Research and Development & Expansion

Tesla's commitment to ongoing innovation and expansion requires substantial investments in research and development (R&D) and new factory construction. These expenditures, while crucial for long-term growth and technological leadership, negatively impact short-term profitability.

- Breakdown of R&D spending: Tesla continues to invest heavily in autonomous driving technology, battery technology advancements, and other future innovations.

- Capital expenditure on new factories and infrastructure: The construction of new Gigafactories and expansion of existing facilities requires significant capital investment, further impacting current profitability.

- Long-term strategic implications of these investments: These investments are vital for Tesla's future competitiveness and long-term growth, despite their short-term impact on the bottom line.

External Factors Influencing Tesla's Performance

Macroeconomic headwinds, geopolitical uncertainties, and fluctuating consumer sentiment also played a role in Tesla's Q1 performance.

- Key macroeconomic factors affecting Tesla: Inflationary pressures, rising interest rates, and global economic uncertainty have affected consumer spending and investment decisions.

- Geopolitical risks and their impact: Geopolitical instability and trade tensions can disrupt supply chains and impact Tesla's operations globally.

- Consumer demand trends and their influence: Fluctuations in consumer confidence and demand for electric vehicles can significantly influence Tesla's sales figures.

Conclusion: Understanding Tesla's Q1 Profit Fall and Looking Ahead

Tesla's Q1 profit decline resulted from a complex interplay of factors: aggressive price cuts impacting margins, heightened competition in the EV market, rising production costs and supply chain constraints, substantial investments in R&D and expansion, and external macroeconomic pressures. While these challenges are real, Tesla's long-term prospects remain strong given its technological leadership and brand recognition. However, understanding these contributing factors is critical for investors and industry stakeholders alike. Stay informed about future Tesla financial reports and continue following our analysis of Tesla's performance and the evolving electric vehicle market. Learn more about the intricacies of Tesla's financial strategies and the factors influencing their profitability, by subscribing to our newsletter and getting regular updates on Tesla's Q2 earnings and the ongoing analysis of Tesla's Q1 profit fall.

Featured Posts

-

Bitcoin Btc Climbs Amidst Trumps Trade Initiatives And Fed Concerns

Apr 24, 2025

Bitcoin Btc Climbs Amidst Trumps Trade Initiatives And Fed Concerns

Apr 24, 2025 -

Gambling On Natural Disasters The Troubling Trend Of Betting On The Los Angeles Wildfires

Apr 24, 2025

Gambling On Natural Disasters The Troubling Trend Of Betting On The Los Angeles Wildfires

Apr 24, 2025 -

California Gas Prices Newsoms Plea For Oil Industry Cooperation

Apr 24, 2025

California Gas Prices Newsoms Plea For Oil Industry Cooperation

Apr 24, 2025 -

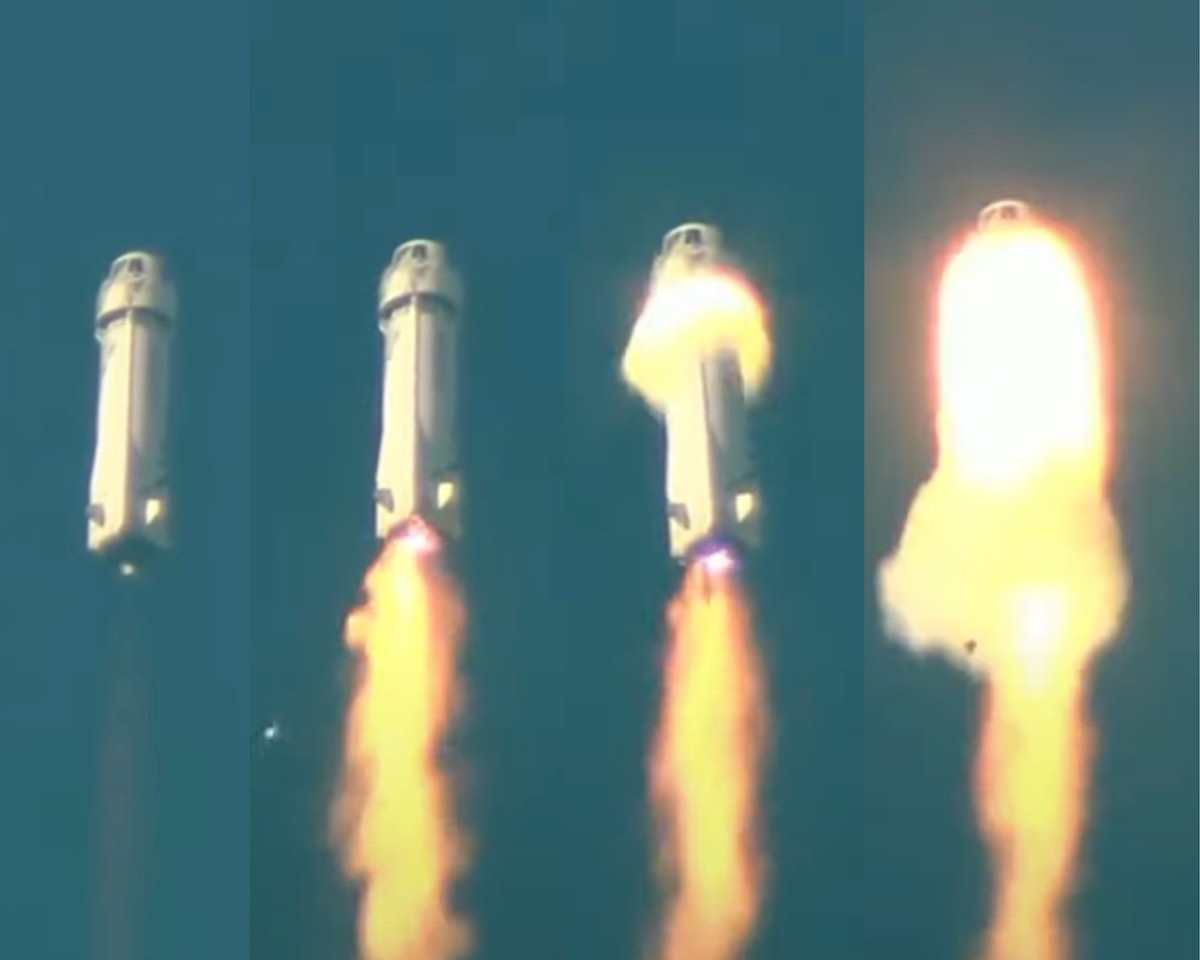

Blue Origin Rocket Launch Abruptly Halted Subsystem Malfunction

Apr 24, 2025

Blue Origin Rocket Launch Abruptly Halted Subsystem Malfunction

Apr 24, 2025 -

Remembering Jett Travolta A Photo Shared By His Father On His Birthday

Apr 24, 2025

Remembering Jett Travolta A Photo Shared By His Father On His Birthday

Apr 24, 2025