Tracking The Stock Market: Dow, S&P 500, And Nasdaq On April 23rd

Table of Contents

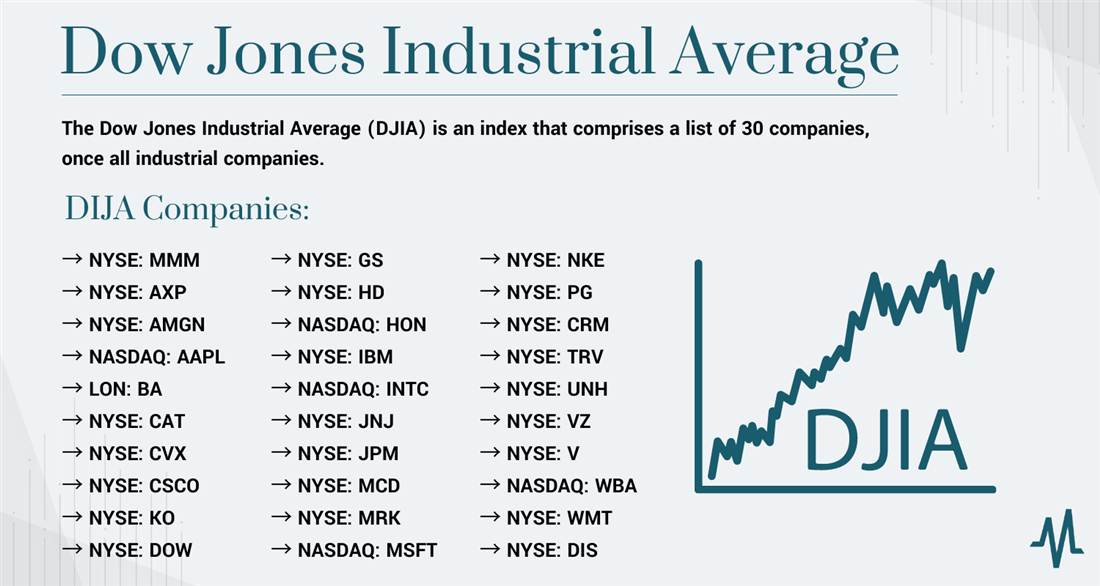

Dow Jones Industrial Average Performance on April 23rd

Opening, Closing, and Intraday Fluctuations

The Dow Jones Industrial Average (Dow) experienced a day of moderate fluctuation on April 23rd. Let's break down the specifics:

- Opening: [Insert Dow's opening value on April 23rd].

- Closing: [Insert Dow's closing value on April 23rd].

- High: [Insert Dow's intraday high on April 23rd].

- Low: [Insert Dow's intraday low on April 23rd].

- Percentage Change: [Insert percentage change from the previous day's closing value].

This [positive/negative] movement can be attributed to several factors. For example, [mention specific economic news or events that impacted the Dow on that day, e.g., a positive jobs report, a significant company announcement, or geopolitical events]. These events significantly influenced investor sentiment, leading to the observed daily performance of the Dow Jones. Tracking this daily performance is vital for understanding broader market trends.

Sector-Specific Performance within the Dow

Analyzing sector-specific performance provides a more granular understanding of the Dow's overall movement. On April 23rd, we observed:

- Top Performers: The [mention specific sectors, e.g., technology] sector showed strong performance, with companies like [mention specific companies and their performance, e.g., Company X gaining 3%].

- Bottom Performers: Conversely, the [mention specific sectors, e.g., energy] sector lagged behind, with [mention specific companies and their performance, e.g., Company Y losing 1.5%].

This sector-specific analysis of Dow components highlights the diverse influences shaping the Dow Industrial Average's daily performance and provides valuable context for stock market investment decisions.

S&P 500 Performance on April 23rd

Overall Performance and Key Movers

The S&P 500, a broader representation of the US stock market, also experienced [positive/negative] movement on April 23rd. Key metrics include:

- Opening: [Insert S&P 500 opening value on April 23rd].

- Closing: [Insert S&P 500 closing value on April 23rd].

- High: [Insert S&P 500 intraday high on April 23rd].

- Low: [Insert S&P 500 intraday low on April 23rd].

- Percentage Change: [Insert percentage change from the previous day's closing value].

Top-performing sectors within the S&P 500 included [mention sectors and examples], while underperforming sectors were [mention sectors and examples]. [Mention any significant market events influencing the S&P 500's performance].

Comparison to the Dow Jones on April 23rd

Comparing the Dow Jones and S&P 500 reveals [mention similarities or differences]. While both indices exhibited [positive/negative] movement, the S&P 500 showed a [slightly higher/lower] percentage change. This divergence could be attributed to [mention potential reasons, e.g., the differing composition of the indices, specific company performances influencing one index more than the other, or varying sector weights]. Tracking this relationship between the two major market indices is vital for understanding market correlation.

Nasdaq Composite Performance on April 23rd

Nasdaq's Daily Movement and Key Tech Stocks

The Nasdaq Composite, heavily weighted towards technology companies, reflected [positive/negative] sentiment on April 23rd. Key observations:

- Opening: [Insert Nasdaq opening value on April 23rd].

- Closing: [Insert Nasdaq closing value on April 23rd].

- High: [Insert Nasdaq intraday high on April 23rd].

- Low: [Insert Nasdaq intraday low on April 23rd].

- Percentage Change: [Insert percentage change from the previous day's closing value].

Major tech stocks such as Apple, Microsoft, and Google showed [positive/negative] performance, with [mention specific examples and percentage changes]. [Mention any significant news or events impacting these companies or the tech sector as a whole]. Analyzing the performance of these tech stocks provides crucial insights into the technology sector's overall health.

Relationship to Overall Market Sentiment

The Nasdaq's performance on April 23rd [aligned with/diverged from] the overall market sentiment reflected by the Dow and S&P 500. This suggests [mention conclusions about market correlation and leadership]. The correlation between these indices helps investors assess the strength and direction of the broader market trend.

Conclusion

In summary, April 23rd saw [summarize the overall market movement across the Dow, S&P 500, and Nasdaq]. Significant trends included [mention key observations]. Consistent tracking of these stock market indices – the Dow, S&P 500, and Nasdaq – is essential for staying informed about market movements and making sound investment decisions. To stay updated on stock market trends, regularly consult reputable financial news websites and investment platforms for the latest data and analysis. Continue tracking stock market indices to maintain a comprehensive understanding of market dynamics.

Featured Posts

-

Apr 24, 2025

Apr 24, 2025 -

Child Actress Sophie Nyweide Mammoth Noah Dead At 24

Apr 24, 2025

Child Actress Sophie Nyweide Mammoth Noah Dead At 24

Apr 24, 2025 -

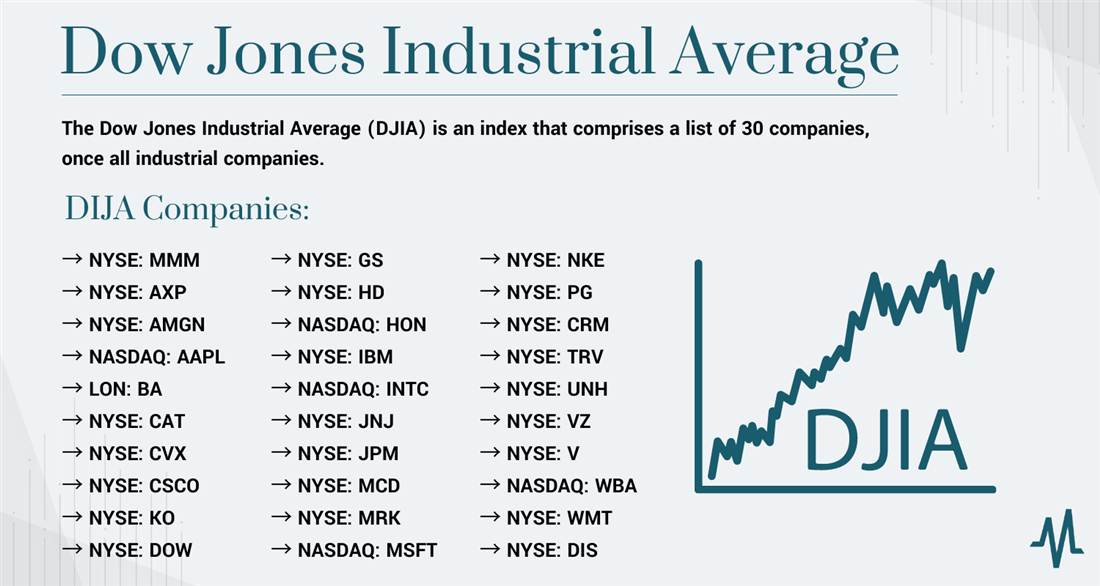

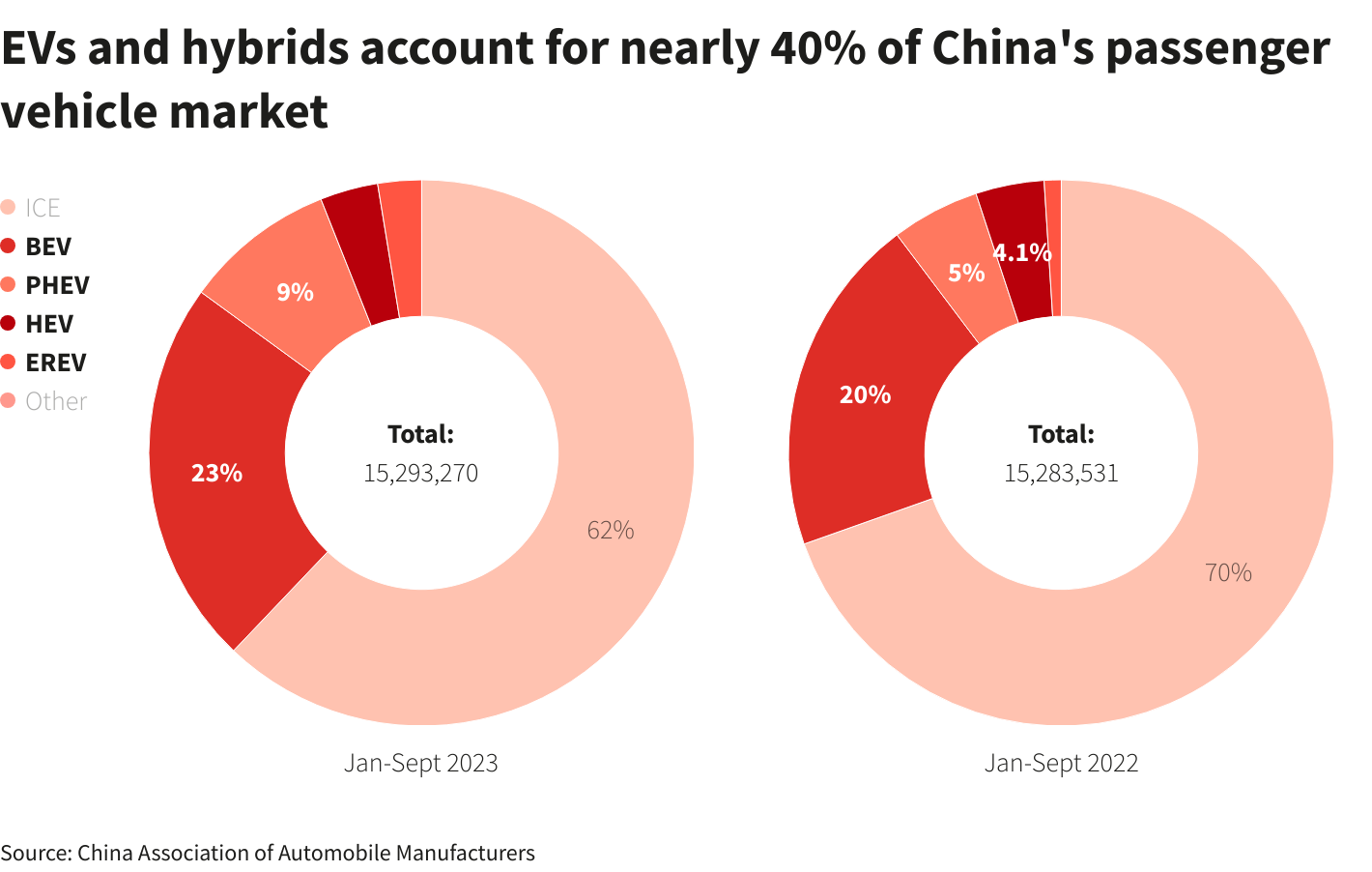

Beyond Bmw And Porsche Challenges For Foreign Automakers In China

Apr 24, 2025

Beyond Bmw And Porsche Challenges For Foreign Automakers In China

Apr 24, 2025 -

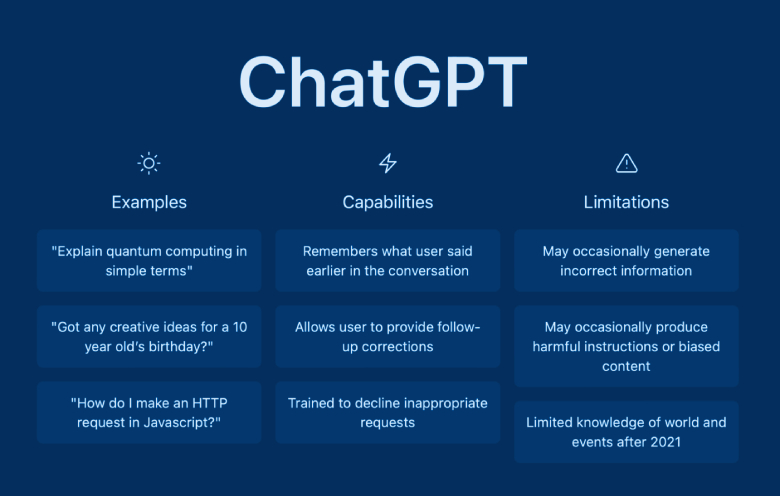

Open Ai And Google Chrome Speculation Following Chat Gpt Chiefs Remarks

Apr 24, 2025

Open Ai And Google Chrome Speculation Following Chat Gpt Chiefs Remarks

Apr 24, 2025 -

Section 230 And The Sale Of Banned Chemicals A Recent Court Ruling Impacts E Bay

Apr 24, 2025

Section 230 And The Sale Of Banned Chemicals A Recent Court Ruling Impacts E Bay

Apr 24, 2025