Deloitte Sees Substantial Slowdown In US Economic Growth

Table of Contents

Key Factors Contributing to the Slowdown

Several interconnected factors are converging to create this perfect storm of economic headwinds. Understanding these contributing elements is crucial for navigating the challenges ahead.

Inflation's Persistent Impact

High inflation continues to erode purchasing power, dampening consumer spending and hindering business investment. This persistent inflationary pressure is a major driver of the predicted slowdown.

- CPI Remains Elevated: The Consumer Price Index (CPI) remains stubbornly high, indicating that the cost of goods and services continues to outpace wage growth.

- Reduced Consumer Confidence: High inflation erodes consumer confidence, leading to decreased discretionary spending and a shift towards essential purchases only.

- Federal Reserve Response: The Federal Reserve's aggressive interest rate hikes, while intended to curb inflation, are also contributing to the economic slowdown by increasing borrowing costs for businesses and consumers.

Rising Interest Rates and Their Effects

The Federal Reserve's interest rate hikes, while aimed at taming inflation, are simultaneously acting as a brake on economic growth. Increased borrowing costs stifle investment and reduce consumer spending on big-ticket items.

- Mortgage Rates Surge: Higher interest rates have led to a significant increase in mortgage rates, cooling down the already slowing housing market.

- Business Investment Curtailed: Businesses are less likely to invest in expansion or new projects when borrowing costs are high, leading to reduced job creation and economic activity.

- Increased Consumer Debt Burden: Higher interest rates increase the cost of existing debt, impacting consumer budgets and reducing disposable income.

Weakening Consumer Spending

The lifeblood of the US economy, consumer spending, is showing signs of weakening. Decreased consumer confidence and reduced purchasing power are contributing significantly to the projected slowdown.

- Retail Sales Slowdown: Recent data shows a slowdown in retail sales, indicating a decline in consumer demand for goods and services.

- Job Market Uncertainty: Concerns about potential job losses, even amidst a still-relatively-low unemployment rate, are contributing to cautious consumer behavior.

- Savings Depletion: Consumers are increasingly relying on savings to offset rising prices, which is unsustainable in the long term and will eventually contribute to further declines in spending.

Deloitte's Forecast and Projected Impact

Deloitte's detailed analysis paints a concerning picture. The firm projects a substantial decrease in GDP growth for the coming quarters.

Deloitte's Specific Growth Projections

Deloitte's report projects a GDP growth rate of [Insert Deloitte's Projected GDP Growth Rate Here]% for [Insert Time Period, e.g., the next two quarters], significantly lower than previous forecasts. [Insert link to Deloitte report or visual representation of the projection here]. This represents a considerable slowdown compared to [mention previous growth rates for comparison].

Potential Consequences of the Slowdown

The projected slowdown carries significant implications for the US economy and its citizens.

- Increased Unemployment: A slower economy typically leads to job losses across various sectors.

- Reduced Investment: Businesses may postpone or cancel investment plans, further hindering economic growth.

- Global Market Ripple Effects: The slowdown in the US economy could have significant ripple effects on global markets, impacting international trade and investment.

Mitigation Strategies and Outlook

While the outlook is challenging, there are strategies that can be implemented to mitigate the impact of the economic slowdown.

Government Policies and Their Effectiveness

Government intervention through fiscal and monetary policies may play a crucial role in moderating the severity of the slowdown. However, the effectiveness of these policies depends on various factors and can be subject to considerable debate.

- Fiscal Stimulus: Government spending on infrastructure projects or other stimulus measures could boost economic activity.

- Monetary Policy Adjustments: The Federal Reserve may need to adjust its monetary policy based on evolving economic conditions.

- Challenges and Limitations: Political gridlock, bureaucratic inefficiencies, and unpredictable economic factors can hamper the effectiveness of government interventions.

Business Strategies for Navigating the Slowdown

Businesses need to adapt and implement strategies to navigate the challenging economic landscape.

- Cost Management: Implementing efficient cost-cutting measures is crucial for maintaining profitability.

- Diversification: Expanding into new markets or product lines can help reduce reliance on single revenue streams.

- Strategic Planning: Developing a robust business plan that accounts for potential economic downturns is vital for long-term sustainability.

Conclusion: Understanding Deloitte's US Economic Slowdown Prediction and Taking Action

Deloitte's prediction of a substantial slowdown in US economic growth highlights the need for proactive planning and adaptation. The key factors driving this slowdown—high inflation, rising interest rates, and weakening consumer spending—demand careful consideration. The potential consequences, including increased unemployment and reduced investment, underscore the severity of the situation. To stay informed about the US economic slowdown and to prepare for the predicted slowdown, delve deeper into Deloitte's report for a comprehensive understanding of the US economic outlook. Develop informed strategies to navigate the anticipated slowdown by visiting [link to Deloitte report]. Understanding Deloitte's analysis of the US economic slowdown is critical for both individuals and businesses to make informed decisions and mitigate potential risks.

Featured Posts

-

Concerns Raised Over Hhss Appointment Of Anti Vaccine Activist To Examine Debunked Claims

Apr 27, 2025

Concerns Raised Over Hhss Appointment Of Anti Vaccine Activist To Examine Debunked Claims

Apr 27, 2025 -

The Anti Trump Feeling In Canada An Alberta Perspective

Apr 27, 2025

The Anti Trump Feeling In Canada An Alberta Perspective

Apr 27, 2025 -

Trade War Weighs On Economy Ecbs Simkus Signals Potential For Additional Rate Cuts

Apr 27, 2025

Trade War Weighs On Economy Ecbs Simkus Signals Potential For Additional Rate Cuts

Apr 27, 2025 -

Justin Herbert And The La Chargers A Brazilian Beginning In 2025

Apr 27, 2025

Justin Herbert And The La Chargers A Brazilian Beginning In 2025

Apr 27, 2025 -

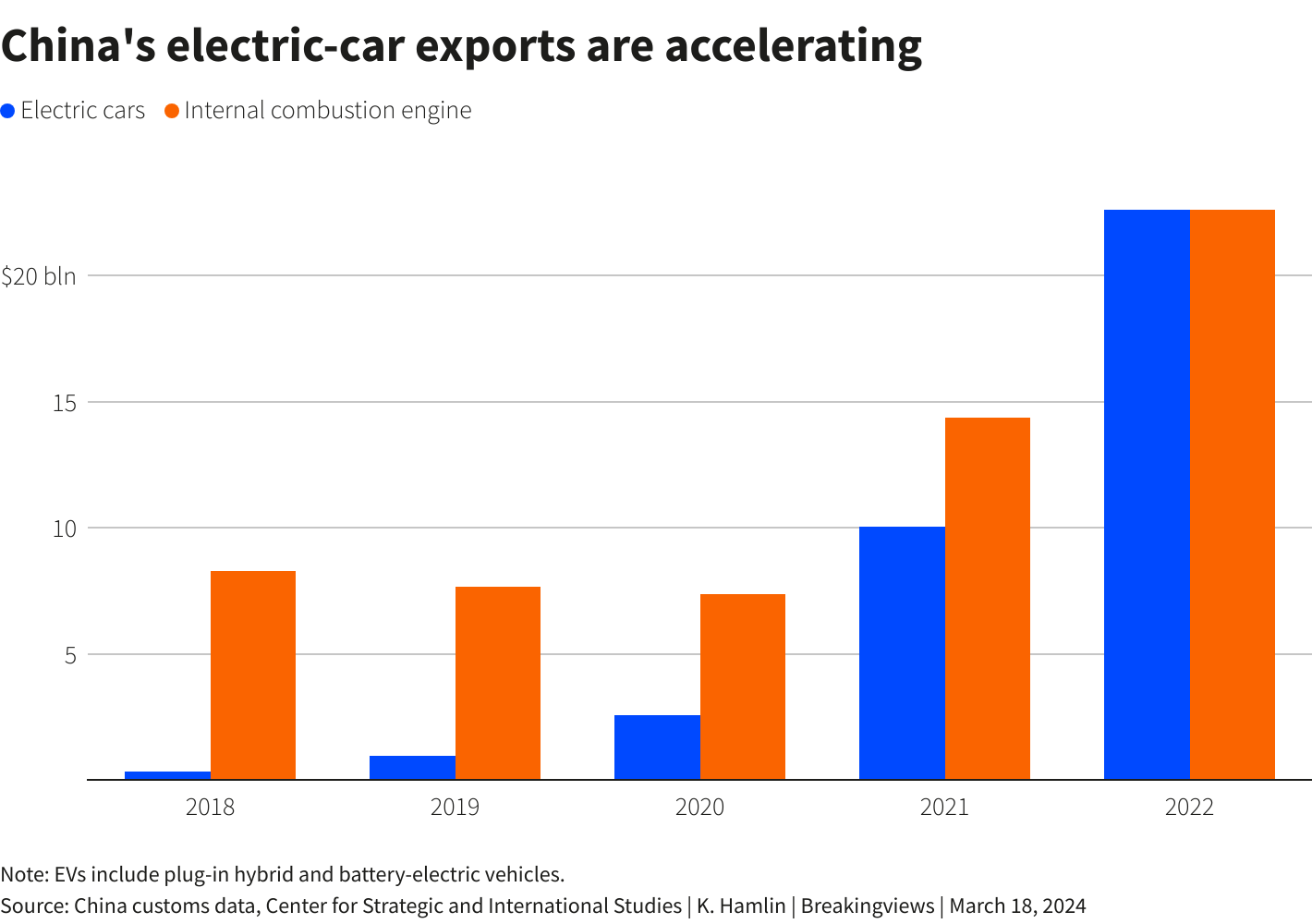

The Challenges And Opportunities For Premium Automakers In Chinas Market

Apr 27, 2025

The Challenges And Opportunities For Premium Automakers In Chinas Market

Apr 27, 2025

Private Credit Jobs 5 Crucial Dos And Don Ts For Applicant Success

Private Credit Jobs 5 Crucial Dos And Don Ts For Applicant Success

Land Your Dream Private Credit Job 5 Key Dos And Don Ts To Follow

Land Your Dream Private Credit Job 5 Key Dos And Don Ts To Follow

Navigate The Private Credit Boom 5 Dos And Don Ts For Job Seekers

Navigate The Private Credit Boom 5 Dos And Don Ts For Job Seekers