Navigate The Private Credit Boom: 5 Do's And Don'ts For Job Seekers

Table of Contents

Do's: Maximize Your Chances in the Private Credit Job Market

Do Your Research: Thoroughly understand the private credit landscape.

The private credit market encompasses diverse strategies and players. Before applying for private credit jobs, gain a comprehensive understanding of this multifaceted industry.

- Research different private credit strategies: Familiarize yourself with various investment strategies, including direct lending, mezzanine financing, distressed debt investing, and fund-of-funds. Understanding these strategies will allow you to tailor your resume and interview responses to specific roles.

- Identify key players and firms: Research prominent private credit firms, both large private equity firms with dedicated credit arms and smaller, boutique credit funds. Knowing the firms' investment philosophies and recent activities demonstrates genuine interest.

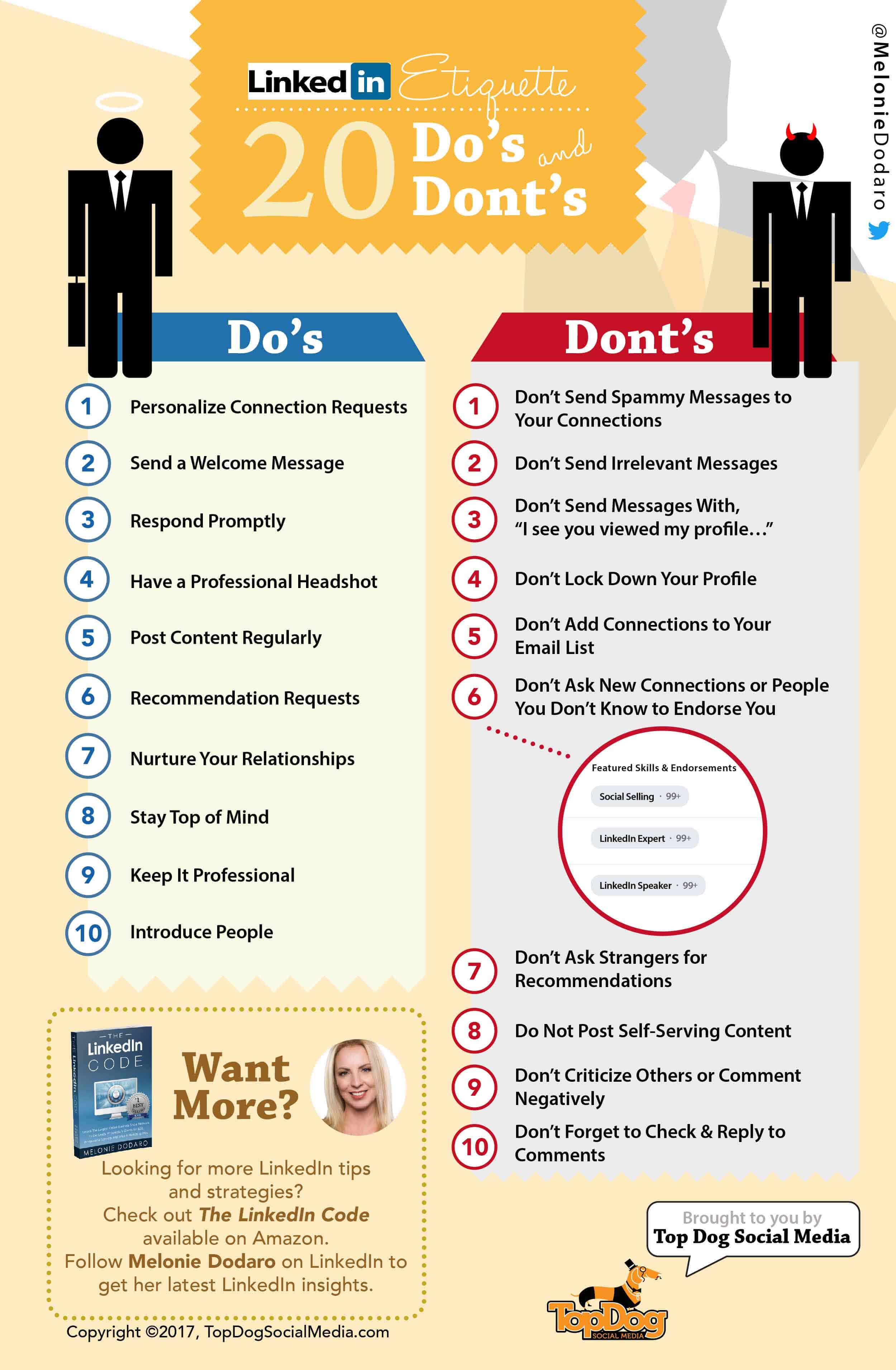

- Network with professionals: LinkedIn is a powerful tool. Actively connect with professionals in private credit, engage in relevant groups, and participate in industry discussions. Informational interviews are invaluable. Understanding the various roles within private credit (e.g., Analyst, Associate, Portfolio Manager, Principal) helps you target your job search effectively.

- Stay updated on industry trends: Follow reputable financial publications like Bloomberg, Reuters, and the Wall Street Journal to stay informed about market dynamics, regulatory changes, and emerging trends in the private credit sector.

Tailor Your Resume and Cover Letter: Highlight relevant skills and experience.

Your resume and cover letter are your first impression. Make them count by highlighting skills directly relevant to private credit jobs.

- Quantify your achievements: Instead of simply stating your responsibilities, quantify your accomplishments. For example, "Increased sales by 15%" is far more impactful than "Managed sales team."

- Use targeted keywords: Incorporate keywords commonly used in private credit job descriptions, including "credit analysis," "financial modeling," "due diligence," "portfolio management," "leverage," "covenant," and "underwriting."

- Customize your application: Don't send a generic resume and cover letter. Tailor each application to the specific requirements and responsibilities outlined in the job description. Show you understand the firm's investment strategy and the role's specific needs.

- Showcase relevant experience: Highlight experience in financial modeling, valuation, credit analysis, deal structuring, or any other relevant skill sets. Even seemingly unrelated experiences can be framed to showcase transferable skills.

Network Strategically: Leverage your connections and build new relationships.

Networking is crucial in the private credit industry. Actively cultivate relationships with professionals in the field.

- Attend industry events: Conferences and networking events provide unparalleled opportunities to meet recruiters and potential employers.

- Join professional organizations: Membership in organizations like the CFA Institute or the Association for Corporate Growth (ACG) can expand your network and provide access to valuable resources.

- Utilize LinkedIn effectively: Engage with industry leaders, participate in relevant discussions, and connect with people working in private credit.

- Practice your elevator pitch: Prepare a concise and compelling summary of your skills and career goals to effectively communicate your value proposition in networking situations.

Don'ts: Common Mistakes to Avoid When Seeking Private Credit Jobs

Don't Neglect Your Financial Modeling Skills: Mastering these skills is crucial.

Financial modeling is the backbone of private credit analysis. Proficiency in this area is non-negotiable for most private credit jobs.

- Practice building complex models: Develop your skills in Excel or dedicated financial modeling software. Focus on building discounted cash flow (DCF) models, leveraged buyout (LBO) models, and other relevant financial models.

- Obtain relevant certifications: Consider pursuing certifications like the Financial Modeling & Valuation Analyst (FMVA) to demonstrate your expertise.

- Familiarize yourself with valuation methodologies: Master various valuation methodologies, including DCF analysis, precedent transactions, and comparable company analysis.

Don't Underestimate the Importance of Networking: Networking is paramount in this industry.

The private credit industry is relationship-driven. Don't undervalue the power of networking.

- Proactively reach out: Don't hesitate to contact individuals in your network for informational interviews. These conversations provide valuable insights and can open doors to unadvertised opportunities.

- Follow up consistently: After networking events or informational interviews, send thank-you notes and maintain contact. Building genuine relationships takes time and effort.

- Build genuine connections: Focus on building meaningful relationships, not just collecting business cards. Authentic connections are more valuable than superficial ones.

Don't Settle for a Role That Doesn't Align with Your Goals: Be selective about your opportunities.

While securing a job is important, ensure it aligns with your long-term career aspirations.

- Research the firm's culture: Consider the firm's culture, investment philosophy, and team dynamics before accepting an offer. A good fit is crucial for job satisfaction and career growth.

- Evaluate growth potential: Assess the opportunities for professional development and advancement within the role and the firm.

- Stay true to your aspirations: Don't compromise your career goals just to secure any private credit job. The right opportunity will present itself in due time.

Conclusion

The private credit job market presents exciting opportunities, but success requires preparation and a strategic approach. By following these do's and don'ts, you can significantly improve your chances of landing your dream job in the dynamic world of private credit. Remember to thoroughly research the industry, tailor your application materials, and network strategically. Don't underestimate the importance of strong financial modeling skills and choosing a role that aligns with your long-term career goals. Start your journey to securing a rewarding career in private credit jobs today!

Featured Posts

-

Red Sox Lineup Changes Triston Casas Slide And Outfield Shuffle

Apr 28, 2025

Red Sox Lineup Changes Triston Casas Slide And Outfield Shuffle

Apr 28, 2025 -

Merd Fn Abwzby Tarykh Fealyat Wahm Almerwdat 19 Nwfmbr

Apr 28, 2025

Merd Fn Abwzby Tarykh Fealyat Wahm Almerwdat 19 Nwfmbr

Apr 28, 2025 -

Denny Hamlin Gets Michael Jordans Backing The Booing Makes Him Better Story

Apr 28, 2025

Denny Hamlin Gets Michael Jordans Backing The Booing Makes Him Better Story

Apr 28, 2025 -

Understanding The Recent Surge In Gpu Prices

Apr 28, 2025

Understanding The Recent Surge In Gpu Prices

Apr 28, 2025 -

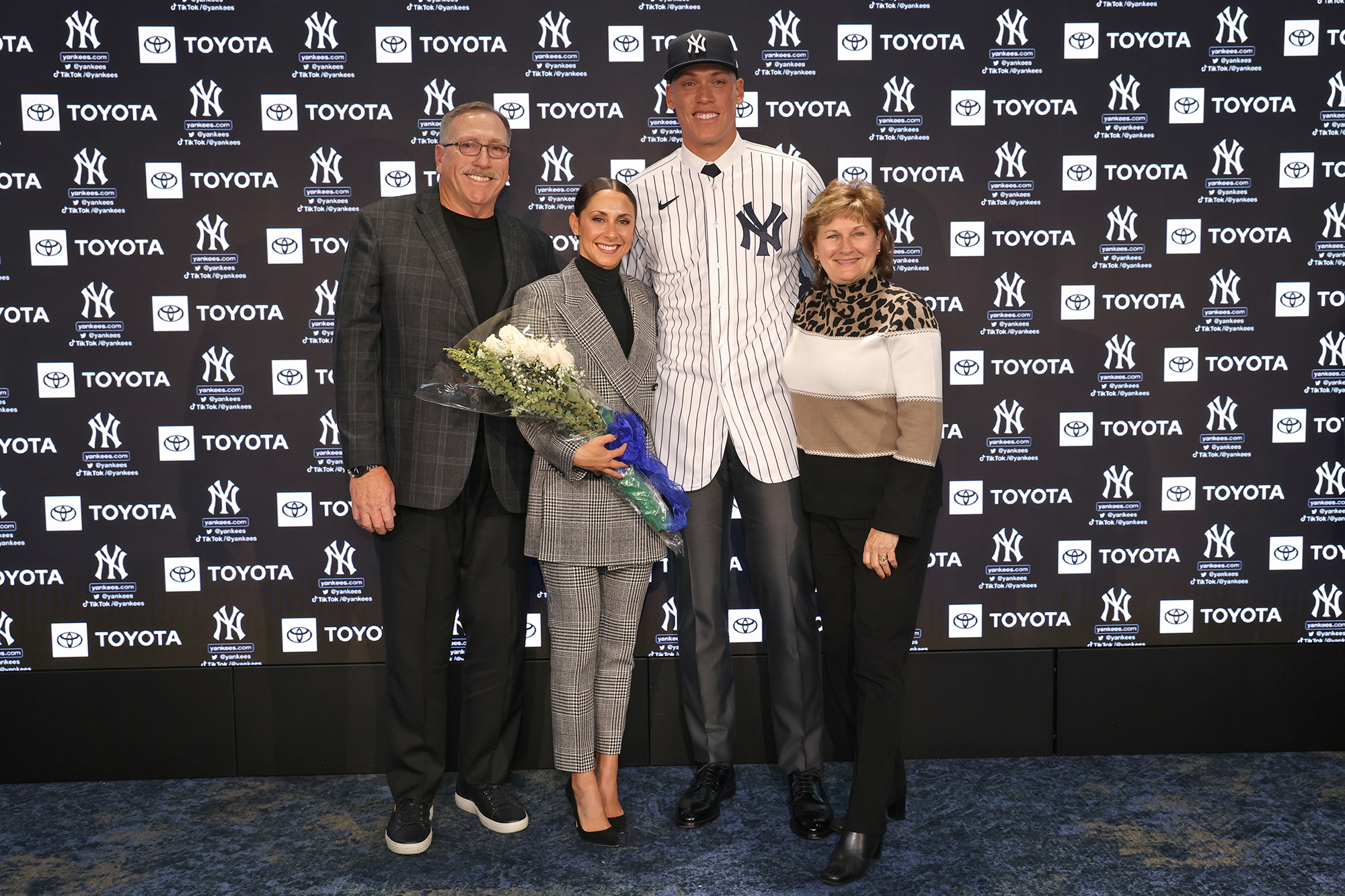

New York Yankees Aaron Judge Welcomes First Child With Wife Samantha

Apr 28, 2025

New York Yankees Aaron Judge Welcomes First Child With Wife Samantha

Apr 28, 2025