Trade War Weighs On Economy: ECB's Simkus Signals Potential For Additional Rate Cuts

Table of Contents

The Impact of Trade Wars on the European Economy

Trade wars, characterized by escalating tariffs and trade restrictions, inflict significant damage on the European economy. Increased tariffs directly impact European businesses, raising the cost of imported goods and making European exports less competitive in global markets. This translates into reduced export volumes and revenue for many companies. Furthermore, trade wars disrupt established supply chains, forcing businesses to scramble for alternative suppliers and increasing production costs.

The automotive and agricultural sectors, for example, are particularly vulnerable. Tariffs on automotive parts and agricultural products have severely impacted production, leading to job losses and reduced investment in these crucial sectors. The resulting uncertainty undermines investor confidence, leading to a decrease in business investment and hindering economic growth.

- Reduced consumer spending: Higher prices for imported goods directly impact consumer purchasing power, leading to reduced spending and dampening economic activity.

- Increased uncertainty and decreased market predictability: The unpredictable nature of trade wars makes it difficult for businesses to plan for the future, impacting investment decisions and hindering long-term growth.

- Slowdown in economic growth: The combined effects of reduced exports, decreased investment, and weakened consumer confidence result in a significant slowdown in overall economic growth.

ECB's Response: Assessing the Current Monetary Policy

The ECB's current monetary policy aims to stimulate economic activity and counter the negative effects of the trade war. This involves utilizing tools like interest rate adjustments and quantitative easing (QE). Previous measures, including lowering interest rates and implementing QE programs, have had some success in supporting lending and investment. However, the effectiveness of these measures in fully offsetting the impact of a structural economic issue like a trade war is debatable. Monetary policy has limitations in addressing deep-seated problems stemming from geopolitical tensions.

- Current interest rate levels: The ECB has already implemented several interest rate cuts, bringing rates to historically low levels.

- Quantitative easing programs: Previous QE programs have injected liquidity into the market, but their effectiveness in boosting investment and growth is being continuously monitored.

- Effectiveness of previous rate adjustments: While previous rate adjustments have provided some support, the ongoing impact of the trade war suggests the need for further consideration of policy options.

Šimkus's Statement and the Implications of Potential Rate Cuts

ECB board member Gediminas Šimkus's recent comments hinted at a potential for further rate cuts to stimulate economic activity and combat the negative effects of the trade war. This signals a growing concern within the ECB regarding the severity of the situation. Additional rate reductions could potentially boost lending and investment by making borrowing cheaper. However, such a move also carries risks.

- Potential positive effects on lending and investment: Lower interest rates could incentivize businesses to take out loans for investment and expansion, fostering economic growth.

- Risks of further weakening the Euro: Rate cuts could potentially weaken the Euro, impacting import costs and potentially fueling inflation.

- Impact on inflation and price stability: The ECB must carefully balance the need to stimulate growth with the risk of igniting inflationary pressures.

Alternative Measures to Combat Trade War Impacts

While monetary policy plays a crucial role, addressing the negative impacts of trade wars requires a multifaceted approach. Governments can implement fiscal policy measures to support economic activity. Structural reforms aimed at boosting productivity and competitiveness are also crucial for long-term economic resilience. Finally, international cooperation and negotiation are essential to resolve trade disputes and foster a more stable global trading environment.

- Government spending on infrastructure projects: Investments in infrastructure can create jobs and stimulate economic activity.

- Tax cuts to stimulate business investment: Reducing tax burdens can encourage companies to invest and expand, creating jobs and boosting economic growth.

- Trade negotiations and agreements: International cooperation and diplomatic solutions are critical to resolving trade disputes and fostering a stable global trade environment.

Trade War Weighs on Economy: The Need for Proactive Measures

The ongoing trade war is having a significant negative impact on the European economy, affecting various sectors and hindering growth. The ECB's role in navigating this challenging landscape is paramount. While monetary policy tools like rate cuts can provide some relief, a comprehensive strategy involving fiscal policy, structural reforms, and international cooperation is crucial. The potential implications of additional rate cuts, while potentially beneficial, require careful consideration of the potential risks.

Stay informed about the evolving situation. Monitor developments in the trade war and the ECB's monetary policy closely, paying attention to how the "Trade War Weighs on Economy" dynamic could affect your personal finances and investments. Further research into reports from the ECB, IMF, and other relevant economic organizations is recommended to stay abreast of the situation and its potential consequences. Understanding these complexities is essential for making informed decisions in today's volatile economic climate.

Featured Posts

-

Accor Reports Canadas Rising Popularity Among Tourists

Apr 27, 2025

Accor Reports Canadas Rising Popularity Among Tourists

Apr 27, 2025 -

Kanopys Hidden Gems Free Movies And Shows You Shouldnt Miss

Apr 27, 2025

Kanopys Hidden Gems Free Movies And Shows You Shouldnt Miss

Apr 27, 2025 -

Broadcoms Proposed V Mware Price Hike At And T Reports A 1050 Increase In Costs

Apr 27, 2025

Broadcoms Proposed V Mware Price Hike At And T Reports A 1050 Increase In Costs

Apr 27, 2025 -

How Bundestag Elections Shape The Dax Index

Apr 27, 2025

How Bundestag Elections Shape The Dax Index

Apr 27, 2025 -

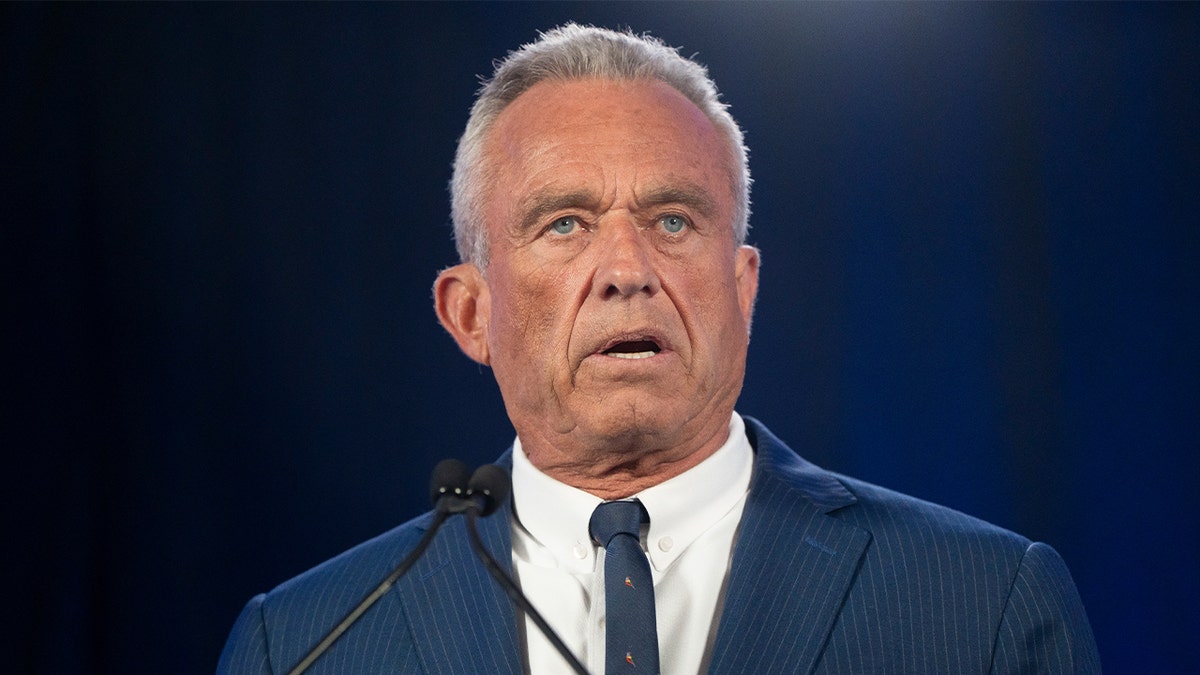

Analysis Of Vaccine Studies Hhss Choice Of David Geier Sparks Debate

Apr 27, 2025

Analysis Of Vaccine Studies Hhss Choice Of David Geier Sparks Debate

Apr 27, 2025