Private Credit Jobs: 5 Crucial Do's And Don'ts For Applicant Success

Table of Contents

DO'S for Private Credit Job Success

1. Tailor Your Resume and Cover Letter

Your resume and cover letter are your first impression. Make it count! To secure private credit jobs, focus on showcasing your relevant skills and experience in a compelling way.

- Quantify your achievements: Instead of simply stating your responsibilities, quantify your accomplishments. For example, instead of "Managed investments," use "Managed a $50M portfolio of distressed debt investments, resulting in a 12% annualized return." This demonstrates tangible impact.

- Incorporate relevant keywords: Sprinkle in keywords specific to private credit, such as:

- Leveraged buyouts

- Distressed debt

- Credit analysis

- Underwriting

- Portfolio management

- Due diligence

- Financial modeling

- Valuation

- Credit risk assessment

- Customize for each application: Generic applications won't cut it. Each resume and cover letter should be tailored to the specific job description and the firm's investment strategy. Research the firm thoroughly and demonstrate your understanding of their focus.

- Highlight financial expertise: Emphasize your proficiency in financial modeling using software like Excel and Bloomberg Terminal. Showcase your experience with valuation methodologies and credit risk assessment techniques.

2. Network Strategically

Networking is crucial in the private credit industry. Building relationships can significantly increase your visibility and open doors to unadvertised opportunities.

- Attend industry events: Private equity and alternative investment conferences are excellent networking opportunities. These events provide a chance to meet professionals and learn about new private credit jobs.

- Leverage LinkedIn: Optimize your LinkedIn profile to highlight your skills and experience in private credit. Connect with professionals in the industry and engage in relevant conversations.

- Conduct informational interviews: Reach out to professionals for informational interviews. This is a great way to learn about different firms, roles, and the private credit industry in general.

- Work with recruiters: Partner with recruiters specializing in private credit placements. They often have access to unadvertised roles and can provide valuable insights into the job market.

- Seek referrals: A strong referral can significantly boost your application. Leverage your existing network to see if anyone can connect you with hiring managers at firms where you are interested in private credit jobs.

3. Master the Technical Skills

Private credit firms demand a strong technical foundation. Demonstrating proficiency in key areas is essential for securing private credit jobs.

- Financial modeling proficiency: Develop exceptional skills in financial modeling using Excel and Bloomberg Terminal. This is a fundamental requirement for many roles.

- Credit analysis expertise: Master credit analysis techniques, including financial statement analysis, ratio analysis, and cash flow forecasting.

- Understanding of private credit investments: Familiarize yourself with various types of private credit investments, such as direct lending, mezzanine debt, and distressed debt.

- Market awareness: Stay updated on current market trends, regulatory changes, and economic factors impacting the private credit industry.

- Consider certifications: Pursuing relevant certifications, such as the CFA (Chartered Financial Analyst) or CAIA (Chartered Alternative Investment Analyst), can enhance your credentials.

DON'TS for Private Credit Job Applicants

1. Neglect Research

Thorough research is paramount. Failing to properly research firms and roles will significantly hurt your chances of landing private credit jobs.

- Don't apply blindly: Before applying for any private credit job, thoroughly research the firm's investment strategy, portfolio companies, and recent transactions. Demonstrate a genuine understanding of their business.

- Avoid generic applications: Generic cover letters and resumes are immediately noticeable and demonstrate a lack of effort. Tailor your application materials to each specific role and firm.

- Understand their investment thesis: A deep understanding of the firm’s investment focus is essential. Lack of knowledge will immediately highlight a lack of preparation.

- Know the team: Research the specific team or fund you’re applying to. This demonstrates your genuine interest and initiative.

2. Underestimate the Importance of Fit

While technical skills are essential, cultural fit is equally important. Private credit firms often prioritize candidates who align with their values and culture.

- Apply strategically: Only apply for roles that genuinely align with your career aspirations and interests. Don't apply for private credit jobs simply because they are available.

- Be authentic: Don’t try to be someone you’re not during the interview process. Authenticity is crucial and helps build a strong rapport.

- Showcase personality: Highlight your personality and how your work style complements the firm's culture. This demonstrates a genuine understanding of their environment.

- Show enthusiasm: Express genuine enthusiasm for the firm's culture, investment philosophy, and team. This helps showcase your genuine interest.

3. Ignore Follow-up

Following up after submitting your application and interviews is crucial. It demonstrates professionalism and continued interest.

- Send thank-you notes: Always send a personalized thank-you note after each interview, reiterating your interest and highlighting key discussion points.

- Follow up proactively: Follow up with recruiters and hiring managers at appropriate intervals to express your ongoing interest in the private credit job.

- Don't be pushy: Maintain a professional tone and avoid being overly persistent. Your goal is to reinforce your candidacy, not annoy the hiring manager.

- Tailor your follow-up: Customize your follow-up communications based on your previous conversations. Referencing specific aspects of your discussions demonstrates engagement.

Conclusion

Securing a position in the competitive field of private credit jobs requires a well-defined strategy that combines technical expertise with a proactive approach. By following these do's and don'ts – tailoring your application materials, networking effectively, mastering relevant skills, researching thoroughly, demonstrating cultural fit and maintaining consistent follow-up – you will significantly improve your chances of landing your dream private credit job. Don't delay your success – start implementing these strategies in your search for private credit jobs today!

Featured Posts

-

Red Sox Injury Updates For Crawford Bello Abreu And Rafaela

Apr 28, 2025

Red Sox Injury Updates For Crawford Bello Abreu And Rafaela

Apr 28, 2025 -

Eva Longoria And The Worlds Top Chef A Fishermans Stew Story

Apr 28, 2025

Eva Longoria And The Worlds Top Chef A Fishermans Stew Story

Apr 28, 2025 -

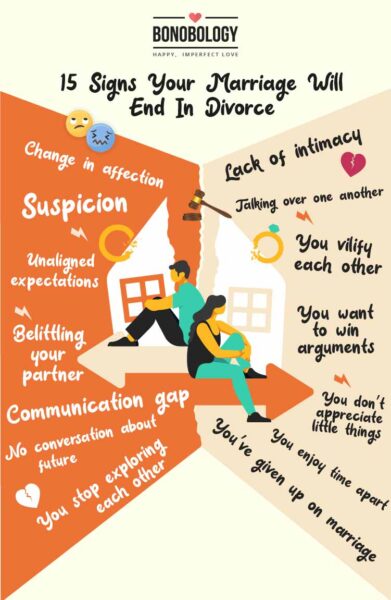

The Unseen Signs Of A Failing Marriage Recognizing A Silent Divorce

Apr 28, 2025

The Unseen Signs Of A Failing Marriage Recognizing A Silent Divorce

Apr 28, 2025 -

Global Leaders Gather To Mourn Pope Francis

Apr 28, 2025

Global Leaders Gather To Mourn Pope Francis

Apr 28, 2025 -

Exploring The Views Of Luigi Mangiones Supporters

Apr 28, 2025

Exploring The Views Of Luigi Mangiones Supporters

Apr 28, 2025