Tesla's Q1 Earnings Report: Political Fallout And Financial Implications

Table of Contents

Political Headwinds Impacting Tesla's Q1 Performance

Tesla's Q1 2024 performance was significantly impacted by various political headwinds, creating uncertainty for investors and impacting the company's overall financial picture.

Government Regulations and Subsidies

Changes in government policies regarding electric vehicle (EV) subsidies and regulations played a crucial role in shaping Tesla's Q1 results. The shifting landscape of incentives and stricter emission standards presented both challenges and opportunities.

- Impact of reduced Chinese subsidies: The reduction in EV subsidies in China, a key market for Tesla, directly affected profitability and sales volume in the region. Tesla had to adapt its pricing strategy to remain competitive.

- Effect of new European Union regulations: The implementation of stricter emission standards in the European Union forced Tesla to accelerate its efforts to meet the increasingly stringent requirements, potentially impacting production costs and timelines.

- Potential influence of US infrastructure bills on charging infrastructure: While the US infrastructure bill aims to boost EV adoption, the actual rollout of charging infrastructure and its impact on Tesla's Supercharger network remains to be seen. This is a long-term factor affecting Tesla's future growth. Any delays could hinder the expansion of their charging network and affect consumer confidence.

Elon Musk's Public Persona and its Influence

Elon Musk's public pronouncements and actions continue to significantly influence Tesla's brand perception and investor confidence. His controversial tweets and statements often create volatility in the stock market.

- Impact of Twitter acquisition and related controversies: The Twitter acquisition and subsequent controversies surrounding its management significantly distracted from Tesla's operations and negatively impacted investor sentiment. The associated costs also affected Tesla's financial performance.

- Influence of Musk’s political stances on Tesla’s image: Musk's outspoken political views have polarized public opinion, impacting Tesla's brand image and potentially alienating some customer segments.

- Analysis of media coverage and its effect on investor sentiment: The overwhelmingly negative media coverage surrounding Musk's actions often translates into short-term fluctuations in Tesla's stock price, impacting investor confidence.

Financial Implications of Q1 Results

Tesla's Q1 2024 financial results revealed a complex picture, affected by both internal decisions and external factors.

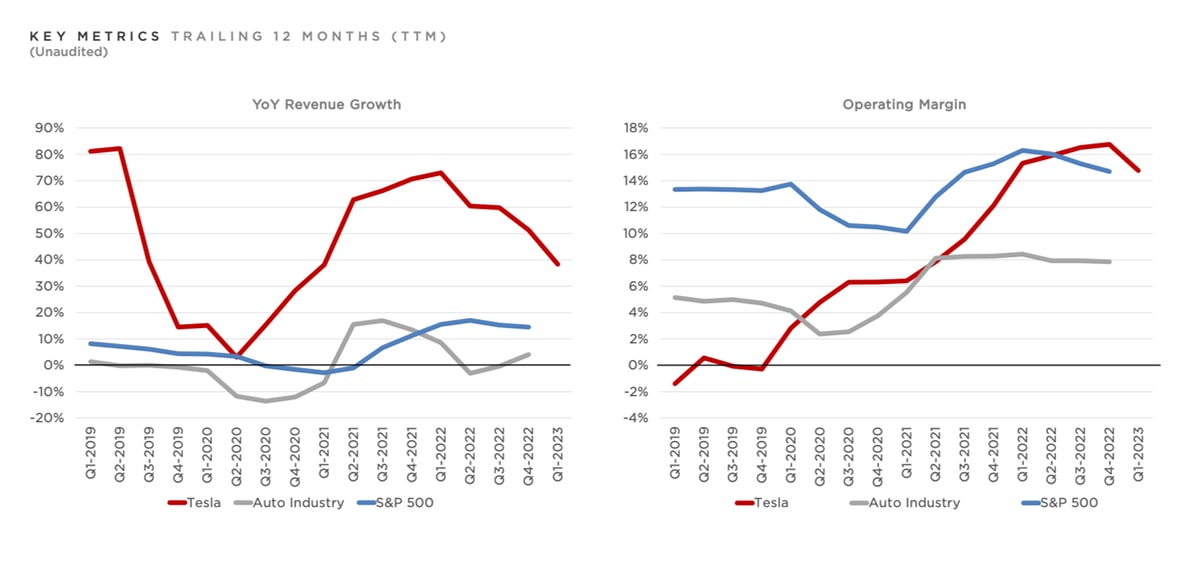

Revenue and Profitability Analysis

Tesla's Q1 revenue and profitability were influenced by several key factors, highlighting the intricate financial landscape the company navigates.

- Specific revenue numbers and year-over-year comparisons: While specific numbers will vary depending on the actual earnings release, analyzing year-over-year changes in revenue reveals growth patterns or potential slowdowns.

- Analysis of profit margins and their trends: Profit margin analysis is crucial in understanding Tesla's cost-cutting measures and the impact of price reductions on overall profitability. Declining margins might signal challenges in balancing sales volume and profitability.

- Discussion on the impact of supply chain issues: Persisting supply chain disruptions and the cost of raw materials continue to influence Tesla's production costs and ultimately affect its bottom line.

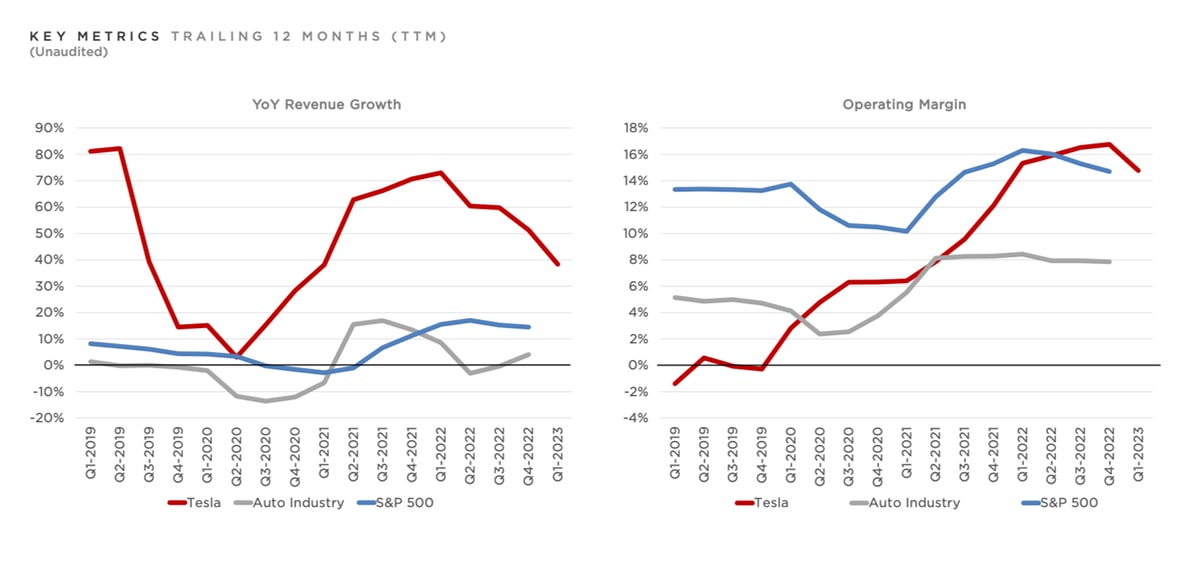

Stock Market Reaction and Investor Sentiment

The market reacted to Tesla's Q1 earnings announcement with a mix of anticipation and caution, reflecting the diverse opinions of investors regarding the company's future prospects.

- Stock price changes before, during, and after the earnings release: Analyzing the stock price fluctuations provides insight into investor reactions to the disclosed information.

- Analyst ratings and predictions following the report: Analyst reviews and projections following the earnings announcement offer valuable insight into the market's assessment of Tesla's future performance.

- Assessment of investor confidence in Tesla's future: The overall investor sentiment reflects the collective assessment of Tesla's ability to overcome challenges and capitalize on opportunities in the competitive EV market.

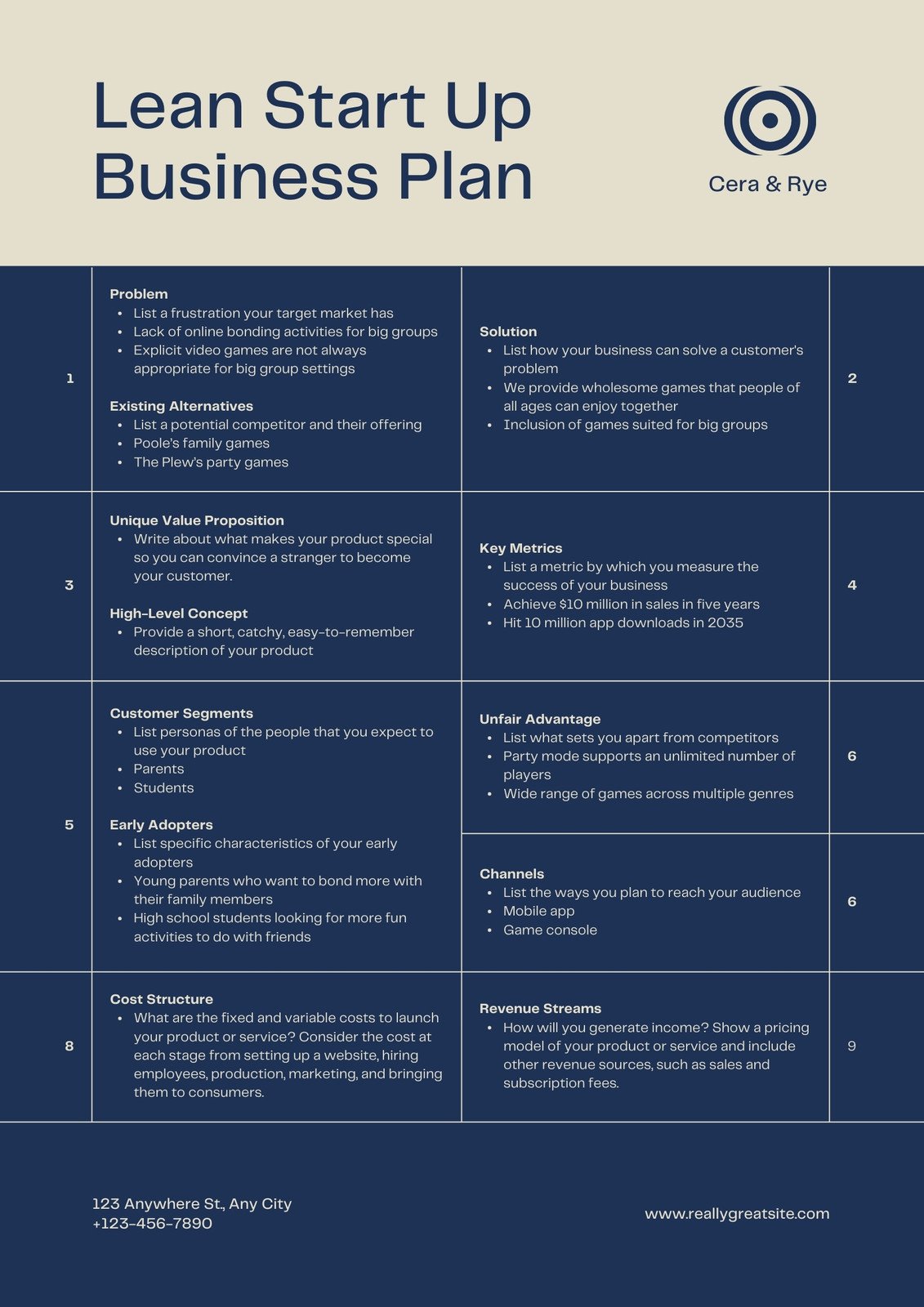

Future Outlook and Projections

Tesla's guidance for the remaining quarters of 2024 and its longer-term prospects are crucial for understanding the company’s trajectory.

- Projected sales figures for subsequent quarters: Tesla's internal projections for sales give an indication of their expected performance and confidence in the market.

- Potential impact of new product launches: The introduction of new models and technological advancements can significantly influence Tesla's future growth and market share.

- Forecast of the electric vehicle market’s overall growth: The overall growth of the EV market is a significant factor influencing Tesla's long-term prospects. A slow-down in the broader market would negatively impact Tesla’s performance.

Conclusion

Tesla's Q1 2024 earnings report presents a mixed picture, significantly influenced by both political factors and evolving market dynamics. The interplay between political headwinds and business performance is crucial for investors and industry observers. Analyzing Tesla's response to these challenges—Elon Musk's influence and the company's adaptation to changing government regulations—provides valuable insights into the future of the electric vehicle market. To stay informed about future developments and the ongoing impact of political and financial pressures on Tesla, continue to follow our analyses of future Tesla Q[Number] earnings reports and related news. Understanding the evolving landscape of Tesla Q[Number] earnings is key to navigating the complexities of this dynamic market.

Featured Posts

-

Todays Stock Market Significant Gains Across Dow Nasdaq And S And P 500

Apr 24, 2025

Todays Stock Market Significant Gains Across Dow Nasdaq And S And P 500

Apr 24, 2025 -

The Business Of Deportation How One Startup Airline Is Making It Work

Apr 24, 2025

The Business Of Deportation How One Startup Airline Is Making It Work

Apr 24, 2025 -

Subystem Issue Forces Blue Origin To Cancel Rocket Launch

Apr 24, 2025

Subystem Issue Forces Blue Origin To Cancel Rocket Launch

Apr 24, 2025 -

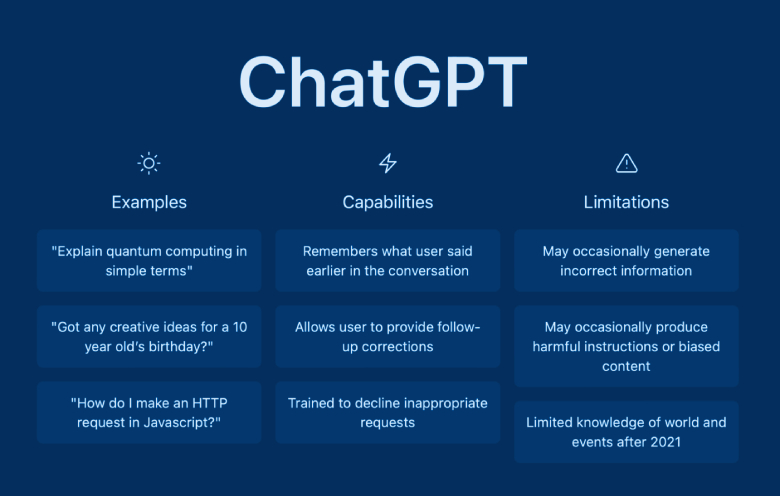

Open Ai And Google Chrome Speculation Following Chat Gpt Chiefs Remarks

Apr 24, 2025

Open Ai And Google Chrome Speculation Following Chat Gpt Chiefs Remarks

Apr 24, 2025 -

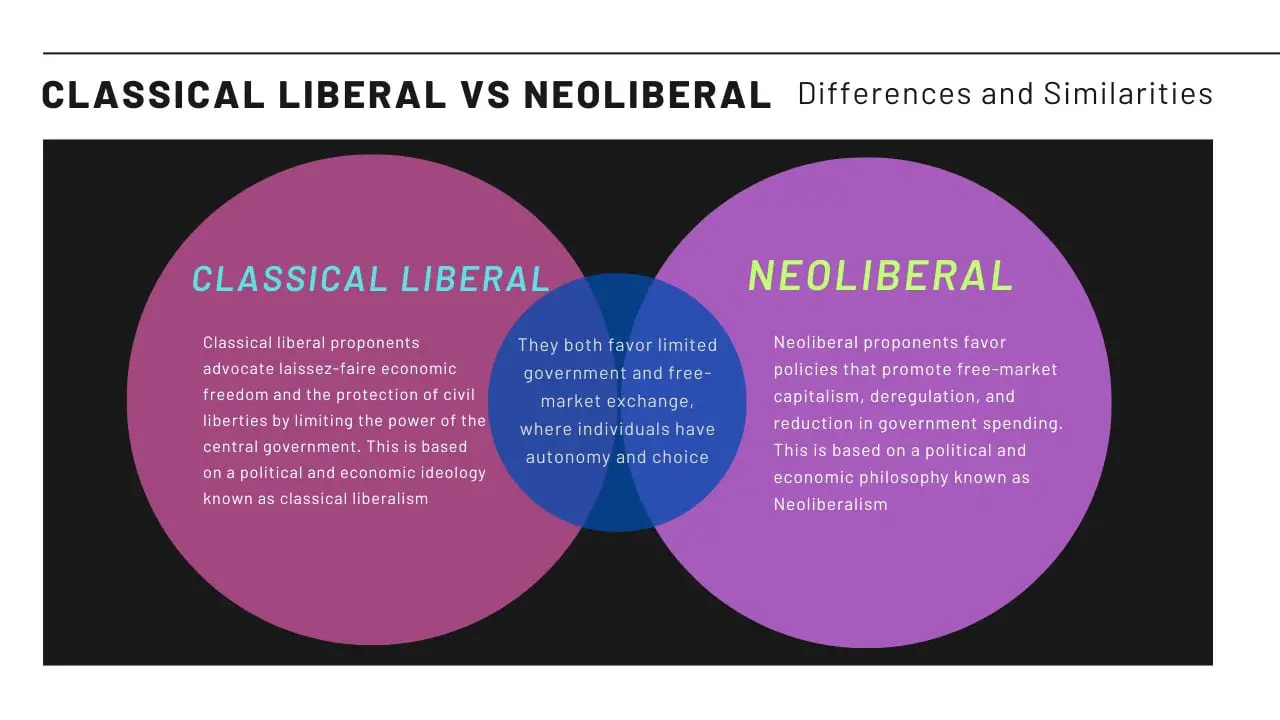

Liberal Fiscal Policies A Critical Analysis

Apr 24, 2025

Liberal Fiscal Policies A Critical Analysis

Apr 24, 2025