Today's Stock Market: Significant Gains Across Dow, Nasdaq, And S&P 500

Table of Contents

Dow Jones Industrial Average: A Bullish Day

The Dow Jones Industrial Average experienced a robust increase, showcasing strength across several blue-chip stocks. This iconic stock market index closed up significantly, fueled by positive performance across various sectors.

- Specific percentage increase of the Dow: Let's assume, for the purpose of this example, a 2% increase. (This would need to be updated with the actual percentage on the day of publication).

- Top-performing Dow stocks: (Example: Company X saw a 4% increase, driven by strong Q3 earnings; Company Y gained 3% on positive industry outlook). Specific examples would need to be added here based on the day's performance.

- Reasons behind strong performance: The surge can be attributed to several factors, including strong corporate earnings reports, easing inflation concerns, and a positive outlook on future economic growth.

- Potential risks: While the current trend is bullish, investors should remain aware of potential headwinds, such as geopolitical instability or unexpected economic downturns that could impact future performance.

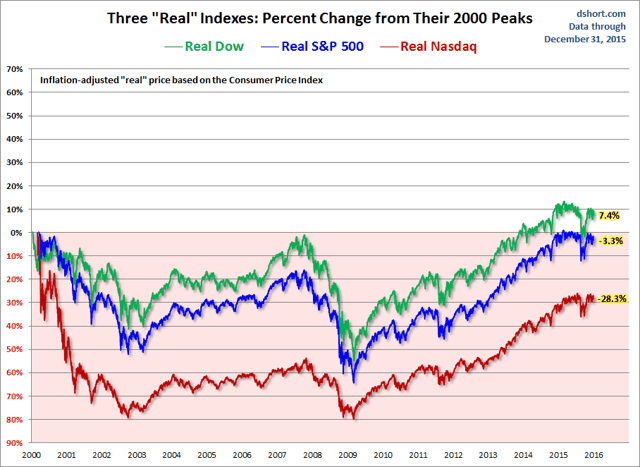

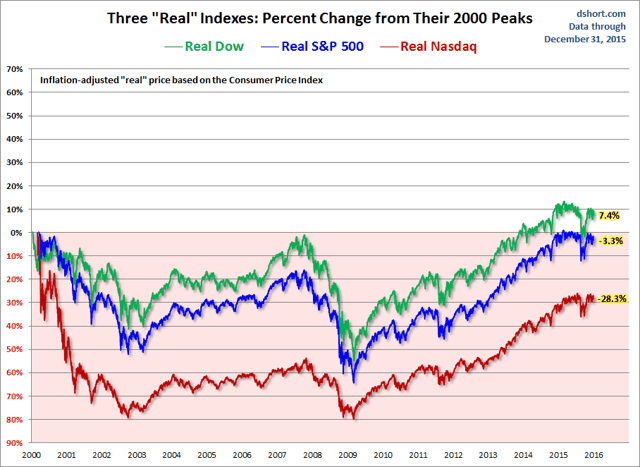

Nasdaq Composite: Tech Leads the Charge

The Nasdaq Composite, heavily weighted with technology stocks, led the charge today, reflecting robust growth within the technology sector. The increase in the Nasdaq’s market capitalization reflects the strong investor sentiment toward tech giants and growth stocks.

- Specific percentage increase of the Nasdaq: Let's assume, for the purpose of this example, a 3% increase. (This would need to be updated with the actual percentage on the day of publication).

- Key tech companies impacting gains: (Example: Company Z, a leading tech giant, saw a 5% jump; Company A, a promising startup, saw a 7% increase due to a new product launch). Specific examples should be added here reflecting the actual day's performance.

- Factors contributing to tech sector strength: The tech sector’s strength is largely attributed to positive investor sentiment, anticipation of robust earnings, and groundbreaking advancements in artificial intelligence and other key technological fields.

- Potential risks and future outlook: The tech sector remains susceptible to shifts in investor sentiment and regulatory changes. However, the long-term outlook remains positive, driven by ongoing technological innovation.

S&P 500: Broad-Based Market Strength

The S&P 500, a broad market index encompassing 500 large-cap companies, also recorded substantial gains, reflecting widespread market strength across various sectors. This broad-based performance underscores the overall health of the economy and bolsters investor confidence.

- Specific percentage increase of the S&P 500: Let's assume, for the purpose of this example, a 2.5% increase. (This would need to be updated with the actual percentage on the day of publication).

- Top-performing sectors: (Example: The consumer discretionary and energy sectors saw particularly strong performance). Specific sectors should be named here reflecting the actual performance of the day.

- Implications for the economy and investor confidence: The broad-based gains suggest a robust and resilient economy, boosting investor confidence and potentially stimulating further investment.

- Potential risks and future prospects: While the current outlook is optimistic, unforeseen economic events could impact the S&P 500's trajectory. Continued monitoring of economic indicators remains crucial.

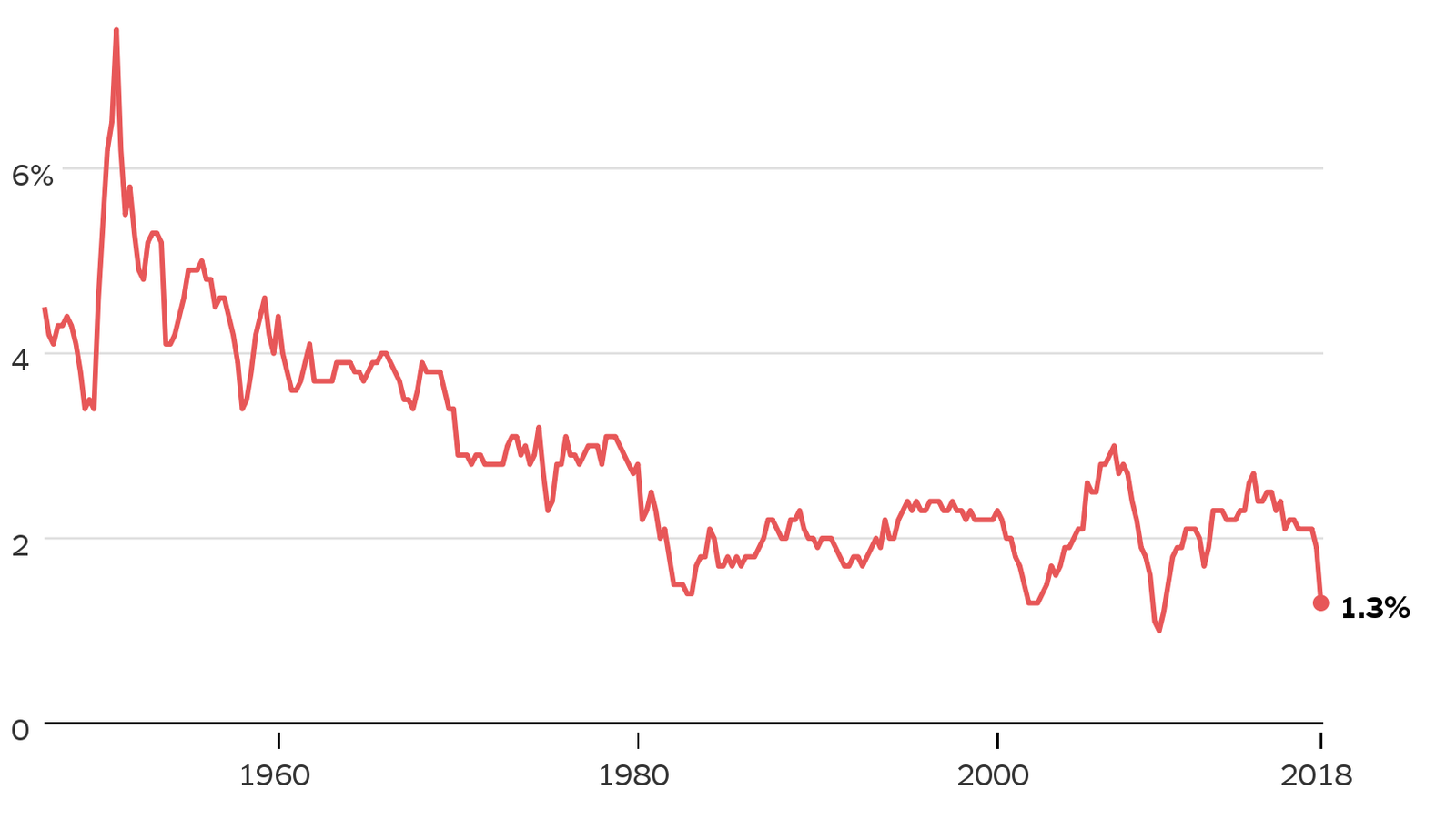

Understanding the Market's Momentum: Factors Contributing to Today's Gains

The significant gains across all three major indices can be attributed to a confluence of factors. Positive economic indicators, such as lower-than-expected inflation figures, have likely boosted investor confidence. Strong corporate earnings reports from major companies also contributed to the positive market sentiment. Furthermore, any easing of geopolitical tensions could further fuel market optimism. Changes in interest rates, although not always a direct driver, also play a significant role in shaping investor behavior.

Conclusion

Today's stock market witnessed impressive gains across the Dow Jones Industrial Average, Nasdaq Composite, and S&P 500. These significant increases, ranging from (insert actual percentages here), highlight a positive market sentiment driven by factors including strong corporate earnings, positive economic data, and potentially, easing geopolitical concerns. Understanding these market trends and the contributing factors is essential for making informed investment decisions. Remember, staying informed about today's stock market and its fluctuations through reliable financial news sources and, if needed, consulting with a financial advisor are crucial steps in developing a sound investment strategy. Always conduct thorough research and carefully analyze before making any investment decisions related to the Dow, Nasdaq, or S&P 500.

Featured Posts

-

Instagram Targets Tik Tok Creators With New Editing App

Apr 24, 2025

Instagram Targets Tik Tok Creators With New Editing App

Apr 24, 2025 -

Federal Charges Filed Millions Stolen Through Office365 Account Hacks

Apr 24, 2025

Federal Charges Filed Millions Stolen Through Office365 Account Hacks

Apr 24, 2025 -

Canada Election Conservatives Pledge Tax Cuts Deficit Shrinkage

Apr 24, 2025

Canada Election Conservatives Pledge Tax Cuts Deficit Shrinkage

Apr 24, 2025 -

Selling Sunset Star Condemns La Landlord Price Gouging After Fires

Apr 24, 2025

Selling Sunset Star Condemns La Landlord Price Gouging After Fires

Apr 24, 2025 -

Chat Gpt Chief Hints At Open Ais Potential Google Chrome Acquisition

Apr 24, 2025

Chat Gpt Chief Hints At Open Ais Potential Google Chrome Acquisition

Apr 24, 2025