Navigate The Private Credit Boom: 5 Do's And Don'ts To Land Your Dream Job

Table of Contents

Do's – Maximize Your Chances in the Private Credit Job Market

1. Network Strategically

Building a strong network is paramount in the private credit industry. It's not just about who you know, but about the relationships you cultivate.

- Attend industry conferences and events: Conferences like the SuperReturn conferences, industry-specific events, and smaller, niche gatherings offer invaluable networking opportunities. These events provide a chance to meet key players, learn about new trends, and make connections that could lead to your next role.

- Leverage LinkedIn to connect with recruiters and potential employers: Optimize your LinkedIn profile to highlight your skills and experience relevant to private credit jobs. Actively engage with industry professionals, share insightful articles, and participate in relevant groups. Direct messaging recruiters can significantly increase your chances of getting noticed.

- Informational interviews are invaluable for gaining insights and making connections: Reaching out to professionals in private credit for informational interviews demonstrates your initiative and allows you to learn about their career paths and gain valuable advice. These conversations can often lead to unexpected job opportunities.

- Join relevant professional organizations focused on private credit and alternative investments: Membership in organizations like the Alternative Investment Management Association (AIMA) or local chapters of finance-focused groups can broaden your network and provide access to resources and events.

2. Highlight Relevant Skills and Experience

Your resume and cover letter are your first impression. Tailor them to the specific requirements of each private credit job application.

- Showcase experience in financial modeling, credit analysis, and portfolio management: Quantify your achievements whenever possible using metrics to demonstrate your impact (e.g., "Improved portfolio performance by 15%").

- Highlight your knowledge of various debt instruments: Mention your experience with senior secured loans, mezzanine debt, unitranche loans, and other relevant instruments. Show you understand the nuances of different debt structures.

- Emphasize experience with due diligence processes: Detail your experience in financial statement analysis, legal document review, and valuation methodologies used in private credit transactions.

- Use keywords strategically: Incorporate relevant keywords found in job descriptions (e.g., "private debt," "credit underwriting," "distressed debt investing") throughout your resume and cover letter.

3. Master the Art of the Private Credit Interview

Private credit interviews are rigorous. Preparation is key to success.

- Practice your responses to common interview questions: Prepare answers to behavioral questions ("Tell me about a time you failed"), technical questions ("Explain the concept of leverage"), and case study questions ("Analyze this company's financial statements").

- Research the firm and the interviewer thoroughly: Demonstrate your understanding of the firm's investment strategy, recent transactions, and the interviewer's background.

- Demonstrate your understanding of market trends and recent deals: Stay updated on current events and market dynamics within the private credit space.

- Prepare thoughtful questions to ask the interviewer: Asking insightful questions shows your genuine interest and engagement.

4. Develop Specialized Knowledge

Continuous learning is essential in the dynamic world of private credit.

- Pursue relevant certifications: Certifications like the Chartered Financial Analyst (CFA) or Chartered Alternative Investment Analyst (CAIA) demonstrate your commitment to professional development and enhance your credibility.

- Read industry publications and follow leading experts on social media: Stay informed about industry trends, regulations, and market dynamics by following reputable sources like Private Equity International, PEI Media, and leading professionals on platforms like LinkedIn and Twitter.

- Attend webinars and online courses: Expand your skill set through online learning platforms and industry-specific webinars.

- Network with experienced professionals: Learn from the experiences of senior professionals in the field through mentorship or informal discussions.

5. Showcase Your Passion for Private Credit

Genuine enthusiasm is contagious. Let your passion shine through.

- Express your interest in specific areas of private credit: Highlight your interest in direct lending, distressed debt, or other specialized areas within private credit.

- Highlight your understanding of the unique challenges and opportunities in the private credit market: Demonstrate your awareness of the regulatory environment, risk management considerations, and the competitive landscape.

- Show initiative and a proactive approach to learning and development: Showcase your willingness to learn and grow within the industry.

Don'ts – Avoid These Common Mistakes When Seeking Private Credit Jobs

1. Neglect Networking

Don't rely solely on online applications. Networking significantly increases your chances of finding private credit jobs.

- Avoid relying solely on online applications: Many private credit roles are filled through networking and referrals.

- Don't be afraid to reach out to people in your network: Leverage your existing connections to explore opportunities and gain valuable insights.

2. Submit Generic Applications

Tailoring your application to each job description is crucial.

- Don't send out generic resumes and cover letters: Each application should be customized to highlight the skills and experience most relevant to the specific role and company.

3. Underprepare for Interviews

Thorough preparation is essential for success in private credit interviews.

- Don't go into interviews unprepared: Practice your responses, research the firm, and prepare insightful questions.

4. Ignore Industry Trends

Staying informed is crucial in a constantly evolving industry.

- Don't fall behind on industry news and developments: Stay updated on market trends, regulatory changes, and competitor activities.

5. Lack Enthusiasm

Enthusiasm is highly valued in the private credit industry.

- Don't appear disinterested or unenthusiastic during the interview process: Show your passion and genuine interest in the role and the firm.

Conclusion

The private credit job market presents exciting opportunities for ambitious professionals. By following these do's and don'ts, you can significantly increase your chances of landing your dream job in this dynamic sector. Remember to network effectively, highlight relevant skills, master the interview process, stay updated on industry trends, and showcase your passion for private credit. Don't delay – start navigating the private credit boom and secure your ideal private credit job today!

Featured Posts

-

Us Dollar Rises Trumps Softer Tone On Fed Boosts Currency

Apr 24, 2025

Us Dollar Rises Trumps Softer Tone On Fed Boosts Currency

Apr 24, 2025 -

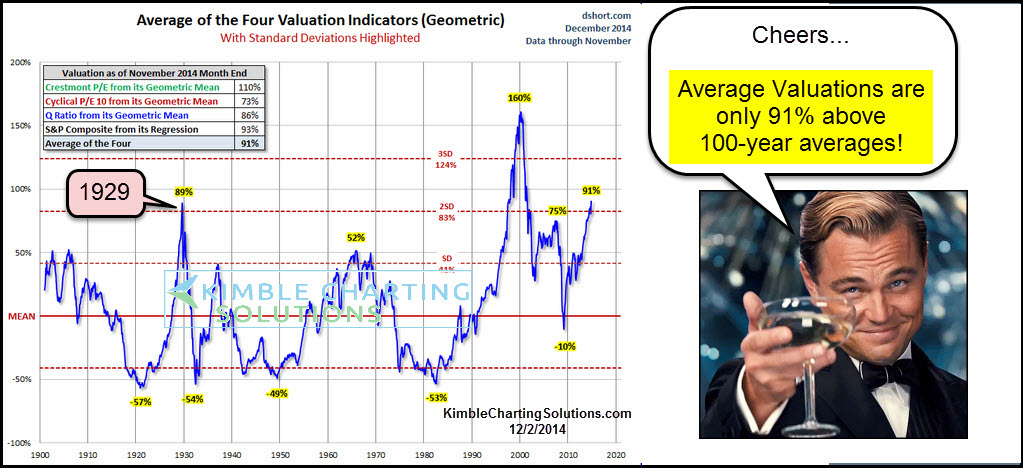

Why Investors Shouldnt Fear High Stock Market Valuations A Bof A Perspective

Apr 24, 2025

Why Investors Shouldnt Fear High Stock Market Valuations A Bof A Perspective

Apr 24, 2025 -

South Carolina Voters Confrontation With Rep Nancy Mace What Happened

Apr 24, 2025

South Carolina Voters Confrontation With Rep Nancy Mace What Happened

Apr 24, 2025 -

Chinas Rare Earth Export Curbs And The Future Of Teslas Optimus Robot

Apr 24, 2025

Chinas Rare Earth Export Curbs And The Future Of Teslas Optimus Robot

Apr 24, 2025 -

Gambling On Disaster The Rise Of Wildfire Betting In Los Angeles

Apr 24, 2025

Gambling On Disaster The Rise Of Wildfire Betting In Los Angeles

Apr 24, 2025