Why Investors Shouldn't Fear High Stock Market Valuations: A BofA Perspective

Table of Contents

BofA's View on Current Market Valuations

BofA Securities, a leading global financial services firm, generally maintains a cautiously optimistic outlook on the current market despite elevated valuations. Their analyses often emphasize the importance of considering several key factors beyond simple metrics like the Price-to-Earnings ratio (P/E ratio). Instead of solely focusing on headline P/E ratios, BofA's analysts delve deeper, incorporating a broader assessment of market valuation.

- Key Arguments: BofA's recent reports highlight the strength of corporate earnings, particularly in specific sectors, as a mitigating factor against high P/E ratios. They argue that robust future earnings potential can justify current valuations in many cases.

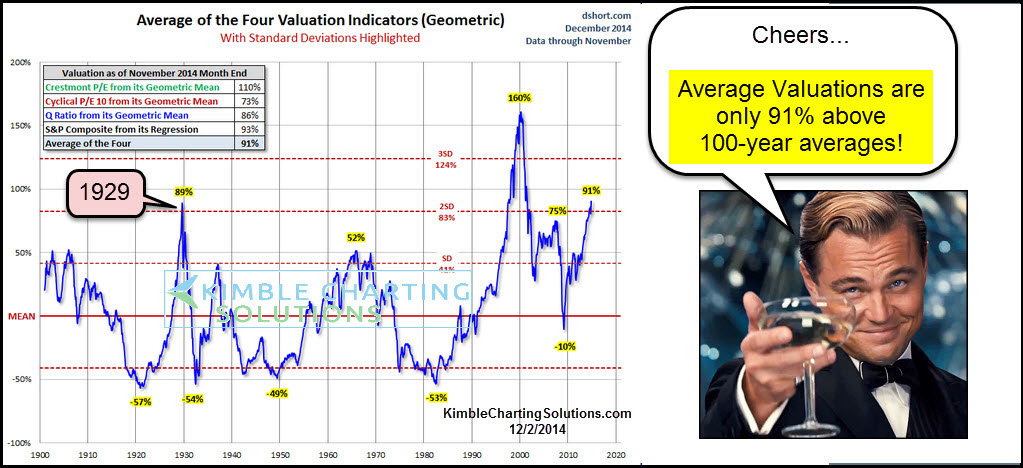

- Metrics Used: BofA utilizes a multifaceted approach incorporating various valuation metrics, including the cyclically adjusted price-to-earnings ratio (Shiller PE ratio), forward P/E ratios, and discounted cash flow models to paint a more comprehensive picture. They often stress that a single metric alone is insufficient for accurate assessment.

- Differentiating Factors: Unlike some analysts who advocate for immediate market correction based solely on high P/E ratios, BofA emphasizes the importance of long-term growth prospects and the influence of macroeconomic conditions, such as low interest rates, on market valuations. Their perspective leans toward a more nuanced interpretation of high valuations, considering the underlying drivers of growth.

Understanding the Drivers of High Valuations

Several key economic and market factors contribute to the current elevated stock market valuations. These factors need to be considered when evaluating the overall market health and the potential for future growth.

- Low Interest Rates: Persistently low interest rates globally encourage investment in riskier assets like stocks, driving up demand and consequently, prices. The low cost of borrowing also fuels corporate investment and expansion, further boosting earnings.

- Strong Corporate Earnings Growth: Many companies have experienced robust earnings growth, particularly those in technology and certain consumer sectors. This strong performance supports higher stock prices, even in the context of high valuations.

- Technological Innovation: Rapid technological advancements are constantly reshaping industries, creating new growth opportunities and attracting significant investment. This innovation, particularly in areas like artificial intelligence and renewable energy, is a key driver of future market potential.

- Increased Investor Confidence: Despite periods of uncertainty, investor confidence, particularly in the long-term outlook for the economy, remains relatively high. This confidence translates into sustained demand for equities, even at elevated price levels.

Long-Term Growth Potential Despite High Valuations

High stock market valuations don’t automatically preclude future growth. A long-term perspective is crucial when evaluating investment opportunities in such a market.

- Long-Term Investment Horizons: Investors should focus on long-term investment strategies (5-10 years or longer) to ride out market fluctuations and benefit from sustained growth. Short-term market timing is less effective than a well-diversified, long-term strategy.

- Future Earnings Potential: The key is assessing companies' future earnings potential. A company with robust future earnings growth may justify a higher current valuation. Investors should focus on identifying businesses with strong competitive advantages and sustainable growth trajectories.

- Historical Context: History demonstrates that periods of high valuations have been followed by periods of further growth. While corrections occur, a long-term perspective reveals that high valuations aren’t always followed by immediate market crashes.

- Strong Future Potential: Specific sectors, such as renewable energy, biotechnology, and certain technology sub-sectors, show immense growth potential, even with relatively high current valuations. Careful selection within these areas can offer significant long-term returns.

Risk Mitigation Strategies for High-Valuation Markets

Even with a positive long-term outlook, risk mitigation strategies are vital in a high-valuation environment.

- Diversification: Diversifying across asset classes (stocks, bonds, real estate, etc.) helps reduce overall portfolio risk and protect against significant losses in any single asset class.

- Quality Companies: Focus on investing in high-quality companies with strong fundamentals, consistent earnings growth, and a history of profitability. These companies are typically better positioned to withstand market downturns.

- Value Investing: Employ value investing strategies to identify undervalued opportunities within the market. This involves searching for companies whose stock prices are below their intrinsic value.

- Regular Rebalancing: Regularly rebalance your portfolio to maintain your desired asset allocation. This involves selling some of your higher-performing assets and buying more of your underperforming assets to ensure you remain aligned with your risk tolerance.

Conclusion

BofA's perspective on high stock market valuations highlights the importance of looking beyond simple metrics and considering the underlying drivers of growth. While high valuations are a valid concern, they don't necessarily signal an impending crash. By focusing on long-term growth potential, diversifying investments, and selecting quality companies, investors can mitigate risks and capitalize on opportunities. Don't let fear of high stock market valuations paralyze your investment decisions. Consult BofA's resources and develop a robust investment strategy to capitalize on long-term growth opportunities. [Link to BofA's investment resources].

Featured Posts

-

7

Apr 24, 2025

7

Apr 24, 2025 -

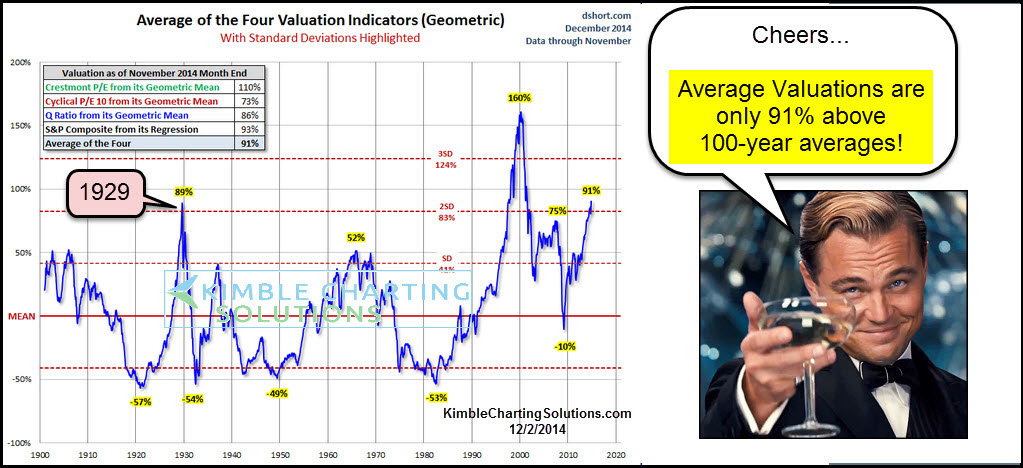

Millions Lost Executive Office365 Accounts Targeted In Major Data Breach

Apr 24, 2025

Millions Lost Executive Office365 Accounts Targeted In Major Data Breach

Apr 24, 2025 -

Two New Oil Refineries Planned Saudi Arabia India Collaboration

Apr 24, 2025

Two New Oil Refineries Planned Saudi Arabia India Collaboration

Apr 24, 2025 -

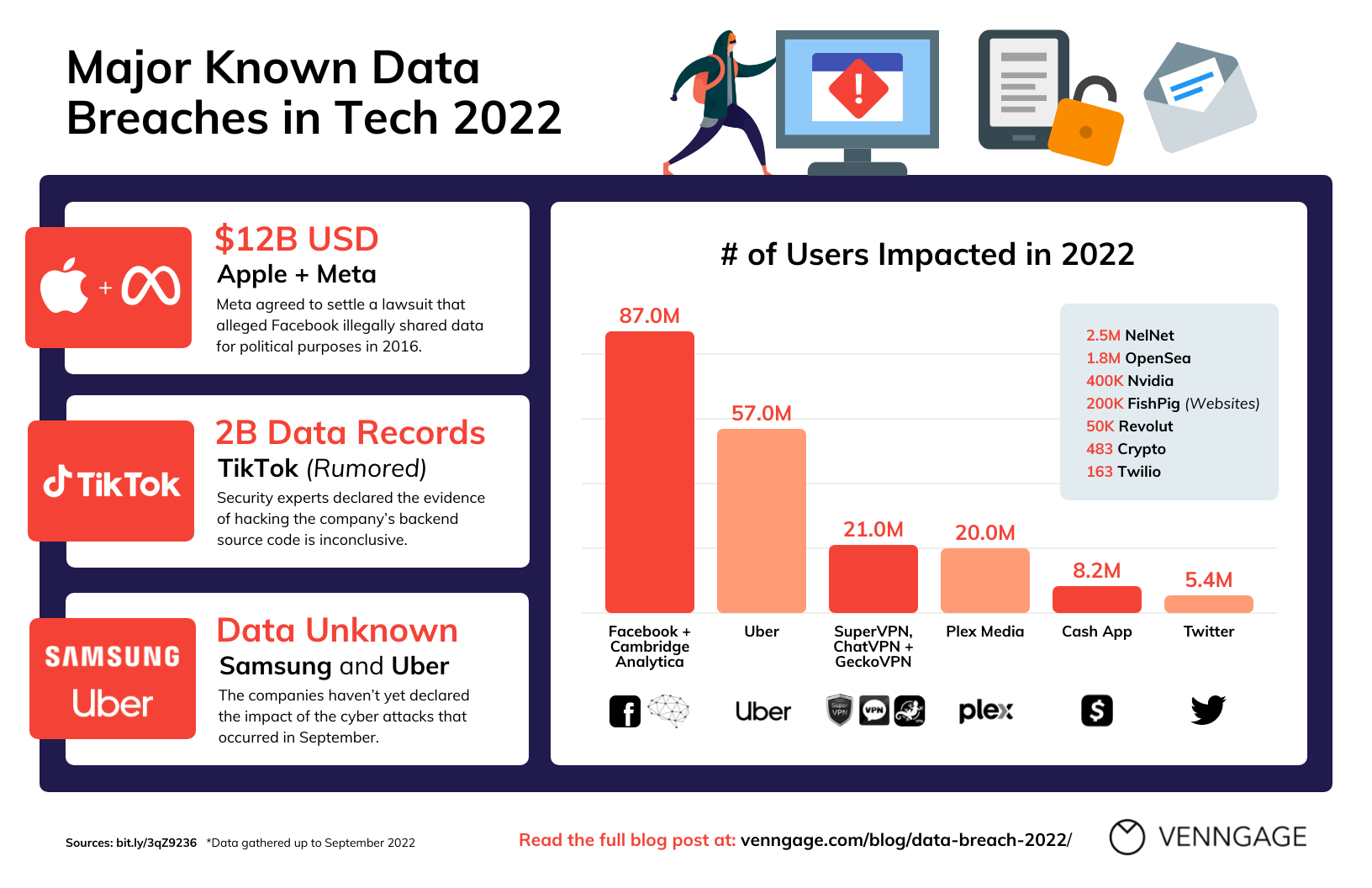

My 77 Inch Lg C3 Oled Tv A Detailed Review

Apr 24, 2025

My 77 Inch Lg C3 Oled Tv A Detailed Review

Apr 24, 2025 -

Trump Administration Immigration Crackdown Legal Challenges Mount

Apr 24, 2025

Trump Administration Immigration Crackdown Legal Challenges Mount

Apr 24, 2025