US Dollar Rises: Trump's Softer Tone On Fed Boosts Currency

Table of Contents

Trump's Changed Stance on the Federal Reserve

For years, the Trump administration's relationship with the Federal Reserve was marked by considerable tension. President Trump frequently criticized the Fed's monetary policy, particularly its interest rate decisions, viewing them as detrimental to economic growth. Keywords like "Federal Reserve," "interest rates," and "monetary policy" were frequently used in his pronouncements, often accompanied by accusations of hindering his economic agenda.

This outspoken criticism, however, has recently given way to a more conciliatory tone. While direct, overt praise remains less frequent, the sharp attacks have subsided. This shift is evident in his more recent public statements and tweets, though concrete evidence is sparse and specific examples require careful consideration. (Source links to reliable news sources would be included here, for example, links to official White House transcripts or reputable news articles detailing Trump's statements).

Several potential reasons explain this change: political expediency ahead of elections, changing economic indicators suggesting less need for aggressive interest rate cuts, or perhaps a shift in his economic advisory team's recommendations.

- Example 1: Previous criticism: A tweet from 2019 where Trump directly criticized the Fed for raising interest rates.

- Example 2: Recent softer tone: A more recent statement where Trump acknowledges the Fed's efforts to support the economy, lacking previous harsh criticism.

- Example 3: Possible reasons: A shift towards a more moderate approach due to upcoming elections and a need to appeal to a broader electorate.

Impact on Interest Rates and Investor Confidence

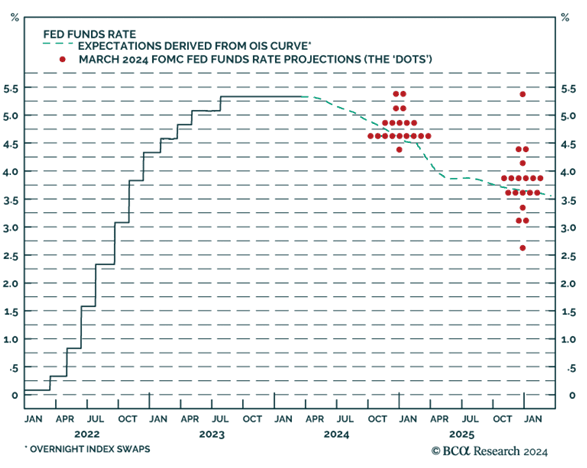

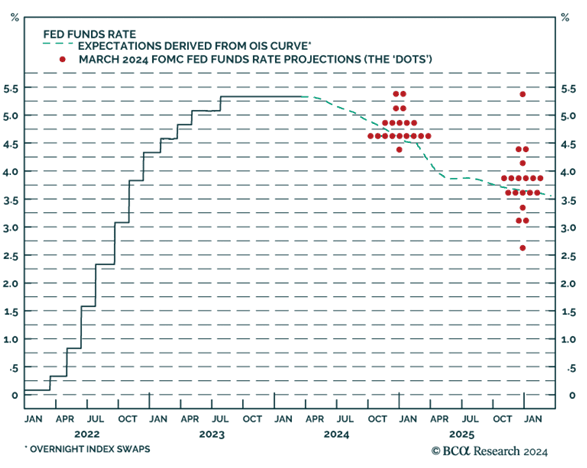

Trump's more tempered approach towards the Fed has significantly influenced market expectations regarding interest rates. A less antagonistic relationship between the President and the central bank reduces uncertainty, leading to increased stability and predictability in monetary policy. This, in turn, directly affects bond yields and investor sentiment. Lower market volatility and a decreased risk of unpredictable policy changes are attractive to investors.

This increased investor confidence is a major driver behind the stronger dollar. Investors, feeling more secure about the economic outlook, are more likely to invest in US assets, increasing demand for the dollar and driving up its value. The flow of capital into US markets strengthens the US Dollar.

- Explanation: Lower interest rates generally weaken a currency, and vice versa. The decreased uncertainty surrounding the Fed's policy under Trump's softer stance leads to a more positive outlook and subsequently, a stronger dollar.

- Impact on US Treasury yields: Increased demand for US Treasury bonds pushes yields lower, further contributing to the stronger dollar.

- Effect on foreign exchange markets: The increased demand for the dollar leads to appreciation against other major currencies.

Global Implications of a Stronger US Dollar

A stronger US dollar has significant implications for global trade. For the US, increased dollar strength makes imports cheaper but exports more expensive, potentially impacting the trade balance. A decrease in US exports could also lead to decreased domestic job growth and a widening trade deficit.

Emerging market economies are particularly vulnerable to a strengthening dollar. Their debts, often denominated in dollars, become more expensive to service, potentially creating financial instability. Countries with significant dollar-denominated debt could face challenges, impacting growth and stability.

- Impact on US competitiveness: Increased export prices could reduce US market share in the global arena.

- Impact on emerging market economies: Increased debt servicing costs can lead to economic hardship and currency devaluations in emerging markets.

- Potential for increased inflation or deflation: A stronger dollar can lead to deflation in the US through lower import costs, while countries with weaker currencies may experience inflation.

Conclusion: Summarizing the Rise of the US Dollar

The recent rise of the US dollar is a multifaceted phenomenon. This article has highlighted the significant contribution of President Trump's shifted rhetoric towards the Federal Reserve. His less antagonistic stance has led to increased investor confidence, reduced market volatility, and ultimately, a stronger US dollar. Understanding the intricate interplay between political rhetoric, monetary policy, and currency valuation is crucial for navigating the complexities of the global economy.

The potential long-term implications of this strengthened US dollar are vast and far-reaching, potentially affecting global trade, international finance, and economic stability worldwide. Stay informed about the fluctuating US dollar and its impact on the global market by following reliable financial news sources and using tools that track currency exchange rates, monitoring the US dollar strength and its fluctuations to make informed decisions. Understanding US dollar strength and its movements is vital in today's global landscape.

Featured Posts

-

The La Wildfires And The Ethics Of Disaster Betting

Apr 24, 2025

The La Wildfires And The Ethics Of Disaster Betting

Apr 24, 2025 -

The Bold And The Beautiful Spoilers Wednesday April 23 Finns Vow To Liam

Apr 24, 2025

The Bold And The Beautiful Spoilers Wednesday April 23 Finns Vow To Liam

Apr 24, 2025 -

Reduced Consumer Spending A Challenge For Credit Card Companies

Apr 24, 2025

Reduced Consumer Spending A Challenge For Credit Card Companies

Apr 24, 2025 -

Trumps Transgender Sports Ban Faces Legal Challenge From Minnesota

Apr 24, 2025

Trumps Transgender Sports Ban Faces Legal Challenge From Minnesota

Apr 24, 2025 -

India Market Update Tailwinds Power Niftys Strong Performance

Apr 24, 2025

India Market Update Tailwinds Power Niftys Strong Performance

Apr 24, 2025