Middle East LPG: China's Response To US Tariff Hikes On LPG Imports

Table of Contents

The Impact of US Tariffs on China's LPG Market

The imposition of US tariffs on LPG imports to China significantly disrupted the country's energy market. These tariffs, implemented as part of broader trade tensions, resulted in a substantial increase in the price of LPG for Chinese businesses and consumers. This wasn't simply an inconvenience; it created a tangible threat to energy security.

- Quantifiable Price Increases: The tariffs led to an estimated increase of 15-20% in the price of imported LPG, depending on the specific grade and origin.

- Industries Affected: The petrochemical industry, a major consumer of LPG for feedstock, was severely impacted. Residential heating in northern China, which relies heavily on LPG during winter months, also experienced price hikes, impacting household budgets.

- Energy Insecurity Concerns: The reliance on a single major supplier (the US) left China vulnerable to price volatility and supply chain disruptions. This highlighted the critical need for diversification of LPG sources.

Middle East LPG as an Alternative Source

The Middle East, with its vast reserves of natural gas and established LPG production infrastructure, presents a geographically advantageous and abundant alternative source for China. The region's proximity significantly reduces shipping times and costs compared to transpacific shipments from the US. Increased trade between the Middle East and China offers a viable solution to mitigate the negative impacts of US tariffs on LPG imports.

- Key Middle Eastern Producers: Saudi Arabia, Qatar, and the UAE are major LPG producers with the capacity to significantly increase exports to China.

- Trade Agreements: Existing and potential bilateral trade agreements between China and Middle Eastern nations facilitate increased LPG trade, potentially creating mutually beneficial partnerships.

- Logistical Considerations: While increased shipping and potential pipeline infrastructure development present logistical challenges, investments in enhanced port facilities and shipping capacity are already underway to address these hurdles.

China's Strategic Shift in LPG Procurement

China's response to US tariffs demonstrates a clear strategic shift towards diversifying its LPG import sources. This diversification isn't simply a reaction to tariffs; it's a proactive measure to enhance energy security and reduce reliance on any single supplier.

- Investment in Infrastructure: China has significantly increased investments in its LPG storage and distribution infrastructure to accommodate the increased volumes expected from Middle Eastern suppliers.

- Broader Geopolitical Implications: While the Middle East is a key focus, China is also exploring potential partnerships with other LPG-producing nations to further reduce its reliance on the US. This includes exploring options from countries such as Russia and Australia.

- Geopolitical Repercussions: This shift diminishes the US's influence on China's energy sector and potentially alters the balance of power within the global energy market.

Economic and Geopolitical Implications

The shift towards Middle East LPG has significant economic and geopolitical consequences. For China, it secures a more stable and reliable LPG supply, reducing vulnerability to trade disputes. Middle Eastern economies, in turn, benefit from increased export revenue and strengthened trade relationships with a major global consumer.

- Economic Benefits for the Middle East: Increased LPG exports provide substantial economic benefits to Middle Eastern countries, boosting their GDP and creating new employment opportunities.

- Weakening US Influence: China's diversification weakens the leverage the US previously held over China's energy sector.

- Increased Competition: This shift introduces increased competition among LPG suppliers globally, potentially leading to more competitive pricing and greater efficiency in the market.

Conclusion: Navigating the Future of Middle East LPG and China

The US tariffs on LPG imports to China have served as a catalyst, accelerating a strategic shift towards Middle East LPG as a primary source. This diversification not only mitigates the negative impacts of US trade policies but also enhances China's energy security and reduces reliance on any single supplier. The importance of Middle East LPG for China's energy security is undeniable. The implications for the global LPG supply chain are profound, with increased competition and shifting geopolitical dynamics creating a more complex landscape. To understand the complete picture, further research into China's evolving energy policy and the ongoing complexities of US-China trade relations is essential. Learn more about the evolving dynamics of the global LPG market and the increasing importance of Middle East LPG by exploring relevant resources on these topics. Understanding the intricacies of Middle East LPG and its global impact is crucial in navigating the future of energy security.

Featured Posts

-

Blue Origin Cancels Launch Vehicle Subsystem Malfunction

Apr 24, 2025

Blue Origin Cancels Launch Vehicle Subsystem Malfunction

Apr 24, 2025 -

Canadas Economic Outlook The Importance Of Fiscal Responsibility

Apr 24, 2025

Canadas Economic Outlook The Importance Of Fiscal Responsibility

Apr 24, 2025 -

Chinas Automotive Market A Case Study Of Bmw Porsche And Other International Players

Apr 24, 2025

Chinas Automotive Market A Case Study Of Bmw Porsche And Other International Players

Apr 24, 2025 -

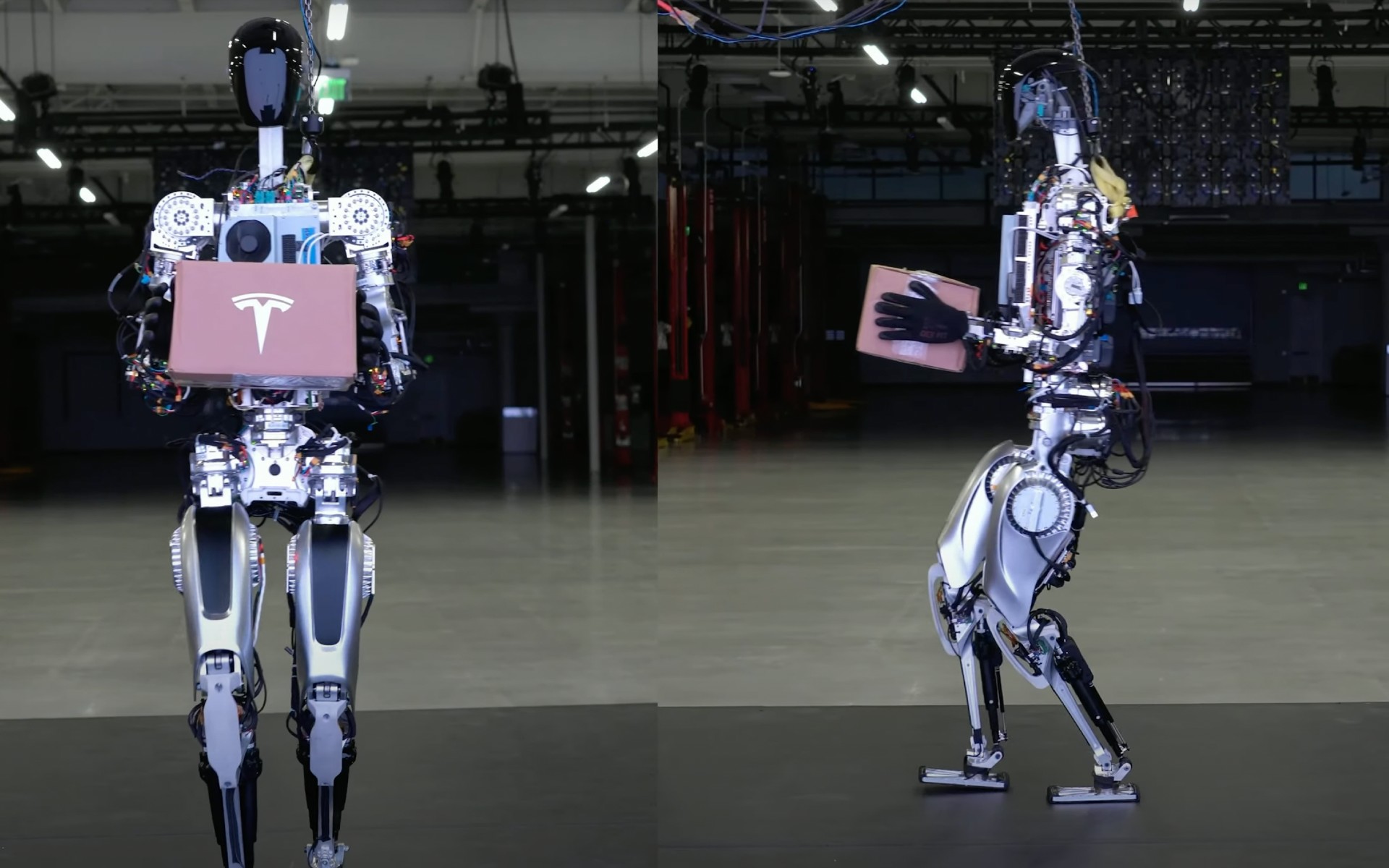

Rare Earth Dependence How Chinas Policies Impact Teslas Optimus Robot Development

Apr 24, 2025

Rare Earth Dependence How Chinas Policies Impact Teslas Optimus Robot Development

Apr 24, 2025 -

Middle East Lpg Chinas Response To Us Tariff Hikes On Lpg Imports

Apr 24, 2025

Middle East Lpg Chinas Response To Us Tariff Hikes On Lpg Imports

Apr 24, 2025