Canada's Economic Outlook: The Importance Of Fiscal Responsibility

Table of Contents

Current State of Canada's Economy and Fiscal Situation

Canada's economy currently presents a mixed picture. While GDP growth remains positive, albeit at a slower pace than previous years, several factors warrant close attention. Inflation remains stubbornly high, impacting consumer spending and eroding purchasing power. Unemployment, while relatively low, shows regional variations and potential vulnerabilities. Furthermore, the level of government debt and the ongoing deficit represent significant challenges to Canada's fiscal health and long-term economic stability. Understanding the interplay of these factors is key to formulating effective economic policy.

- Current GDP growth rate and projections: While precise figures fluctuate, recent projections suggest moderate GDP growth, susceptible to both domestic and global economic headwinds.

- Inflation rate and its impact on consumer spending: High inflation significantly reduces consumer purchasing power, impacting demand and potentially slowing economic growth. The Bank of Canada's efforts to control inflation are crucial in this context.

- Unemployment rate and its potential effects: While the overall unemployment rate might be low, regional disparities and potential job losses in specific sectors necessitate monitoring and proactive measures.

- Level of government debt and deficit: Canada's national debt and ongoing deficit present considerable financial risks and require careful management to prevent long-term economic instability. The Canadian economy's ability to service this debt is crucial.

Global economic uncertainties, including supply chain disruptions and geopolitical instability, further complicate Canada's economic landscape, highlighting the importance of proactive and responsible fiscal policy.

The Role of Government Spending and Revenue

The Canadian government plays a vital role in shaping the nation's economic trajectory through its management of spending and revenue. Government spending, encompassing investments in social programs, infrastructure development, and other key areas, directly influences economic activity and employment. Revenue generation, primarily through taxes, tariffs, and resource revenues, fuels this spending. The effectiveness of current tax policies in balancing revenue needs with economic incentives is crucial.

- Analysis of government spending on social programs, infrastructure, and other key areas: A careful balance is needed to ensure efficient allocation of resources across various sectors while promoting economic growth and social equity.

- Examination of various revenue streams, including taxes, tariffs, and resource revenues: Diversification of revenue streams reduces reliance on any single source and improves resilience to economic fluctuations.

- Discussion of the effectiveness of current tax policies: Reviewing tax policies for efficiency, fairness, and their impact on economic activity is paramount. A balanced approach ensures revenue collection while encouraging investment and growth.

Effective government budget management and fiscal policy are essential for maintaining a healthy Canadian economy and ensuring responsible public spending.

Risks Associated with Irresponsible Fiscal Policies

Excessive government debt and persistent deficits pose significant risks to Canada's long-term economic prosperity. Irresponsible fiscal policies can lead to a cascade of negative consequences.

- Increased interest payments, crowding out private investment: Higher debt servicing costs divert funds away from crucial investments in infrastructure, education, and research and development.

- Higher inflation and reduced purchasing power: Increased government borrowing can fuel inflation, eroding the value of savings and reducing consumer spending.

- Increased risk of sovereign debt crisis: Uncontrolled debt accumulation can lead to a loss of investor confidence and potentially a sovereign debt crisis.

- Negative impact on long-term economic growth: High debt levels constrain future economic growth potential by limiting government's ability to invest in productive sectors and respond to economic shocks.

Understanding these risks and prioritizing fiscal health are crucial for ensuring Canada's financial stability.

Strategies for Fiscal Responsibility and Sustainable Economic Growth

Achieving sustainable economic growth requires a commitment to fiscal responsibility and proactive policy adjustments. Several key strategies can contribute to improved fiscal health.

- Implementing targeted spending cuts: Identifying areas of government spending that can be streamlined or made more efficient without compromising essential services is crucial.

- Reforming tax policies to increase revenue: Evaluating and optimizing tax policies to maximize revenue collection while encouraging investment and economic activity is essential.

- Investing in infrastructure and human capital: Strategic investments in infrastructure and human capital development are crucial for long-term economic growth and increased productivity.

- Promoting economic diversification: Reducing reliance on single sectors and fostering growth in diverse industries strengthens Canada's economy against shocks.

These strategies contribute to sustainable finance and fiscal sustainability, crucial for Canada's long-term economic well-being.

Conclusion: The Path to a Strong Canadian Economy Through Fiscal Responsibility

In conclusion, Canada's economic outlook is significantly shaped by the nation's commitment to fiscal responsibility. The current economic climate, while presenting challenges, also highlights the urgent need for proactive and responsible financial management. Ignoring the risks associated with excessive debt and deficits could severely hamper Canada's long-term growth and prosperity. By implementing strategies that prioritize sustainable finance, investing in crucial sectors, and reforming tax policies, Canada can secure a stronger economic future. We must all engage in informed discussions about Canada's fiscal policy and advocate for responsible government spending and revenue management. Let's work together to ensure responsible fiscal management is a priority, safeguarding Canada's economic future and building a stronger, more prosperous nation. The time for action in achieving fiscal responsibility in Canada is now.

Featured Posts

-

Canadian Auto Industry Responds To Us Trade War With Five Point Proposal

Apr 24, 2025

Canadian Auto Industry Responds To Us Trade War With Five Point Proposal

Apr 24, 2025 -

From Whataburger Viral Video To Uil State The Story Of A Hisd Mariachi Group

Apr 24, 2025

From Whataburger Viral Video To Uil State The Story Of A Hisd Mariachi Group

Apr 24, 2025 -

A More Global More Divided Church Pope Francis Papacy

Apr 24, 2025

A More Global More Divided Church Pope Francis Papacy

Apr 24, 2025 -

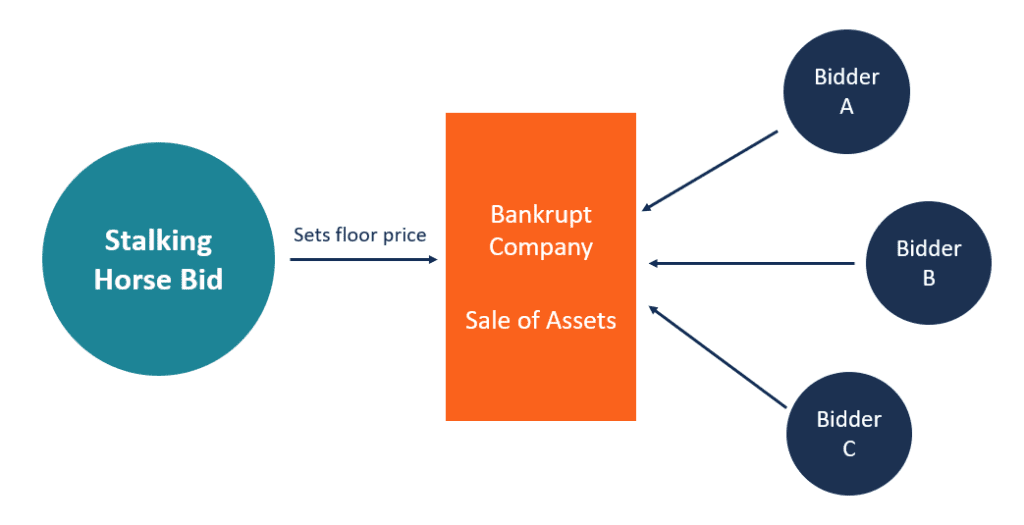

Village Roadshow Sale Finalized Alcon Secures 417 5 Million Stalking Horse Bid

Apr 24, 2025

Village Roadshow Sale Finalized Alcon Secures 417 5 Million Stalking Horse Bid

Apr 24, 2025 -

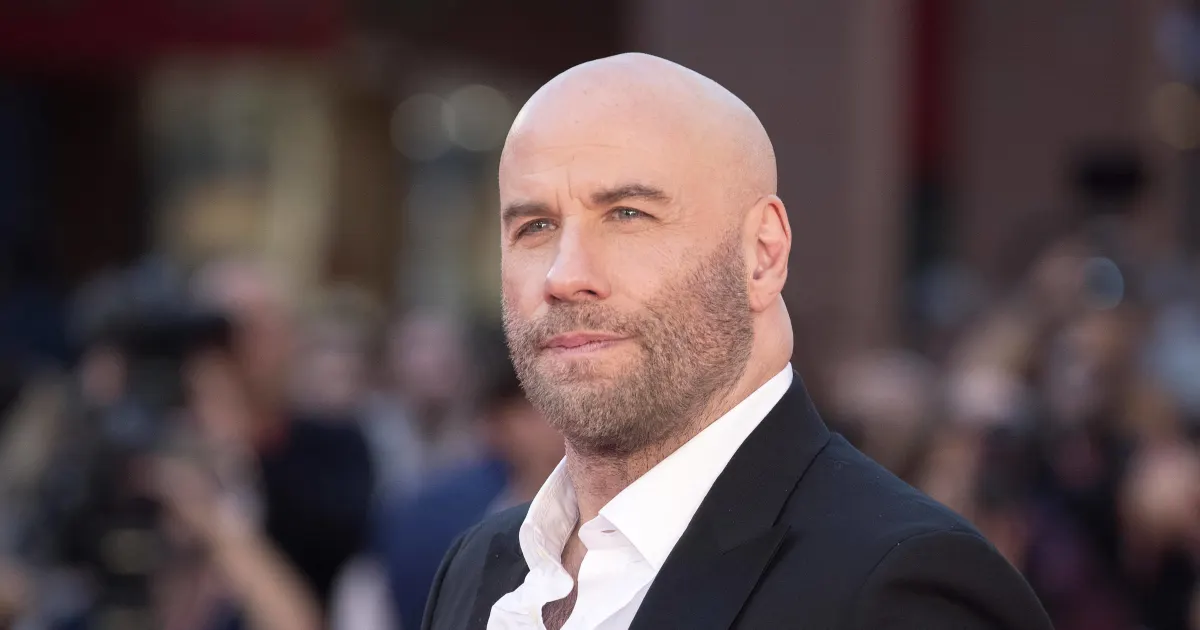

John Travoltas Heartfelt Tribute Photo Marks Late Son Jetts Birthday

Apr 24, 2025

John Travoltas Heartfelt Tribute Photo Marks Late Son Jetts Birthday

Apr 24, 2025