India Market Trends: Analyzing The Factors Behind Nifty's Growth

Table of Contents

Robust Economic Growth as a Foundation for Nifty's Rise

India's sustained economic expansion has been the bedrock of the Nifty 50's impressive growth. This robust growth fuels corporate earnings, directly translating into higher valuations for companies listed on the index.

Strong GDP Growth

India's consistently high GDP growth rate is a primary driver of Nifty's success.

- 2021-22: India's GDP grew by [Insert GDP growth percentage for 2021-22], exceeding expectations.

- 2022-23: Growth continued at [Insert GDP growth percentage for 2022-23], driven by strong performance in IT, manufacturing, and services sectors.

- Foreign Direct Investment (FDI): India received [Insert FDI inflow figures] in [Insert year], reflecting strong investor confidence.

This consistent growth signifies a healthy and expanding economy. The correlation between GDP growth and corporate profitability is clear: a thriving economy leads to increased corporate earnings, resulting in higher stock valuations and pushing the Nifty Index upward.

Rising Consumption and Domestic Demand

India's burgeoning middle class and increasing consumer spending power are crucial elements underpinning the Nifty's growth.

- Consumer Spending: Consumer spending has increased by [Insert percentage] in recent years, indicating a robust domestic market.

- Disposable Income: Growth in disposable income has fueled demand for a wide range of goods and services.

- Retail Sales: Retail sales figures showcase a consistently upward trend, demonstrating the strength of the consumer market.

- Government Initiatives: Government programs aimed at boosting rural consumption further contribute to this growth.

Increased domestic demand translates directly into higher sales and profits for companies listed in the Nifty 50, fostering a positive feedback loop that fuels further growth in the index.

Government Policies and Reforms Fueling Market Confidence

Government policies and reforms have played a significant role in bolstering investor confidence and attracting foreign investment, both vital factors driving Nifty's upward trajectory.

Structural Reforms

Several key initiatives have contributed to a more favorable business environment in India.

- Goods and Services Tax (GST): The implementation of GST streamlined the indirect tax system, improving ease of doing business.

- Demonetization: While initially disruptive, demonetization's long-term effects have been argued to include a reduction in the shadow economy and increased formalization of the economy.

- Ease of Doing Business: India's improved ranking in the World Bank's ease of doing business index reflects the government's commitment to reducing bureaucratic hurdles.

These reforms have created a more transparent and efficient business environment, attracting both domestic and foreign investment, ultimately contributing to higher Nifty valuations.

Infrastructure Development

Massive investments in infrastructure projects are crucial for sustained long-term economic growth, directly impacting the Nifty.

- Roads and Highways: Significant expansion of the national highway network is improving connectivity and boosting logistics efficiency.

- Railways: Modernization and expansion of the railway network are enhancing freight transportation and passenger services.

- Energy: Investments in renewable energy and power generation are ensuring reliable energy supplies for businesses and industries.

The multiplier effect of infrastructure spending is significant, creating jobs, stimulating demand in related sectors, and contributing to the overall positive sentiment reflected in Nifty's growth.

Technological Advancements and Digital Transformation

India's rapid technological advancement and digital transformation are significant catalysts for economic growth and Nifty's performance.

Digital India Initiatives

Government initiatives promoting digitalization have opened up vast opportunities for tech companies.

- Digital India Program: This initiative has accelerated digital inclusion and improved internet access across the country.

- Fintech Revolution: The rapid growth of the fintech sector has revolutionized financial services.

- E-commerce Boom: The e-commerce sector's expansion has created new avenues for businesses and consumers alike.

Increased digital adoption across various sectors improves efficiency, enhances productivity, and leads to greater profitability for Nifty 50 constituent companies.

Rise of Fintech and E-commerce

The remarkable growth of fintech and e-commerce is significantly impacting the Indian market.

- Fintech Growth: The fintech industry is witnessing exponential growth, with [Insert growth statistics] in recent years. Major players include [List some key players].

- E-commerce Expansion: E-commerce continues its rapid expansion, with [Insert growth statistics] and key players such as [List some key players].

These sectors' success translates into increased market capitalization and positive market sentiment, further contributing to Nifty's upward trend.

Global Factors and Geopolitical Influences

While India's domestic factors are primarily driving Nifty's growth, global factors and geopolitical events also play a role.

Foreign Institutional Investor (FII) Flows

Positive FII flows are a key indicator of confidence in the Indian market.

- FII Investments: [Insert data on FII investment trends] clearly indicates substantial investment in the Indian stock market.

FIIs are attracted to India's growth potential and the relatively stable macroeconomic environment. Their investments fuel Nifty's upward momentum.

Global Economic Conditions

The global economic climate has an impact, but India's relatively strong domestic economy acts as a buffer against global uncertainties.

- Global Economic Slowdowns: While global slowdowns can affect the Indian market, the strength of the domestic economy often mitigates the impact.

India's resilience and strong fundamentals provide a degree of insulation from some global economic shocks, further supporting Nifty's performance.

Conclusion

The remarkable growth of the Nifty 50 index is a testament to the confluence of several positive factors: robust economic growth, pro-growth government policies, technological advancements, and positive investor sentiment. Understanding these India market trends is crucial for investors seeking to navigate the Indian stock market effectively. By analyzing these underlying drivers, investors can make more informed decisions and capitalize on the opportunities presented by the ongoing expansion of the Nifty. Continue to monitor India market trends and the performance of the Nifty 50 and its constituent companies to develop optimal investment strategies. Stay informed on Indian Stock Market Growth and Economic Growth in India to make sound investment choices.

Featured Posts

-

Broadcoms Proposed V Mware Price Hike A 1 050 Increase For At And T

Apr 24, 2025

Broadcoms Proposed V Mware Price Hike A 1 050 Increase For At And T

Apr 24, 2025 -

Whats Next On The Bold And The Beautiful Hope Liam Steffy And Lunas Fate

Apr 24, 2025

Whats Next On The Bold And The Beautiful Hope Liam Steffy And Lunas Fate

Apr 24, 2025 -

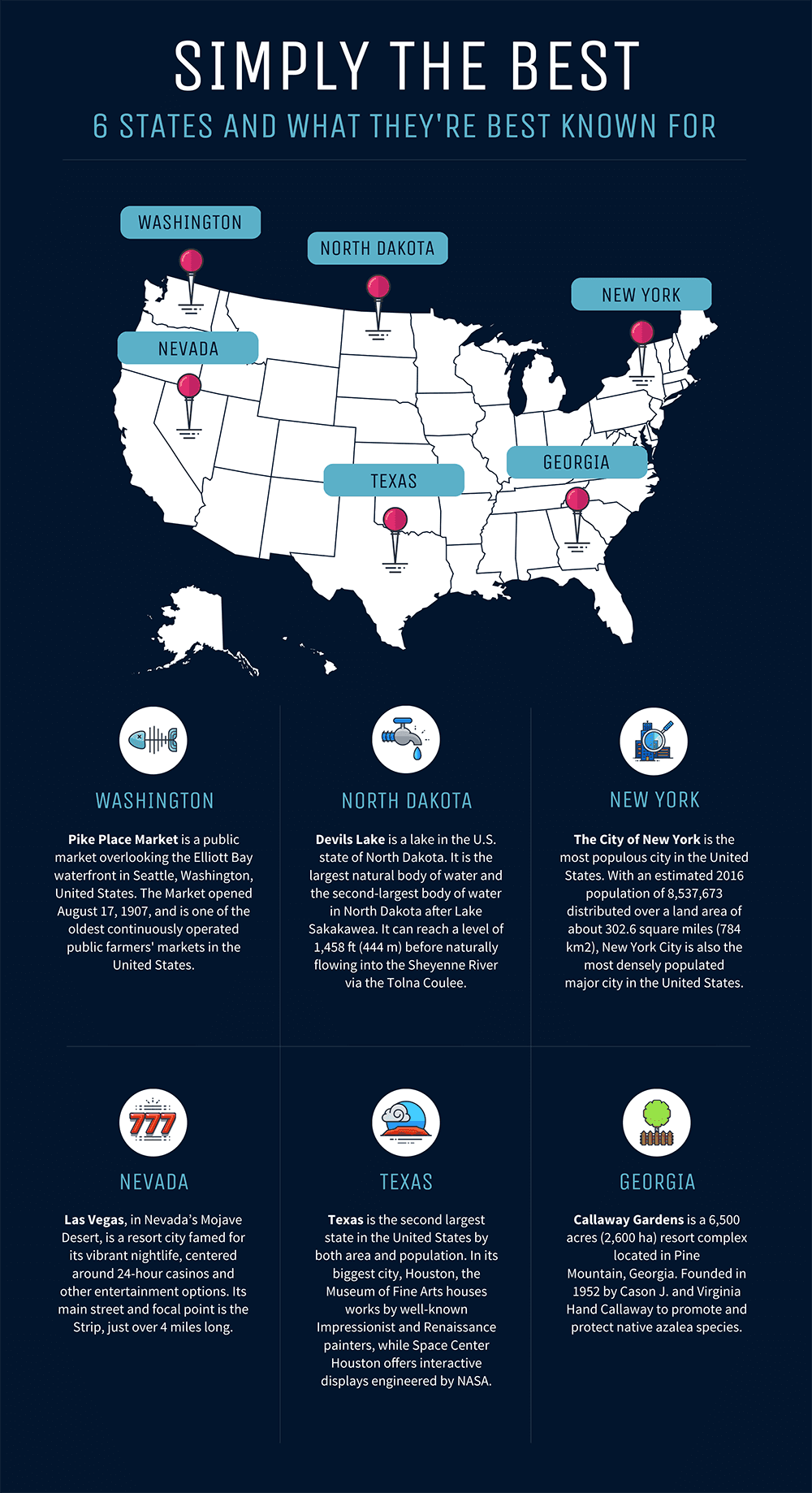

The Countrys Top New Business Locations A Geographic Analysis

Apr 24, 2025

The Countrys Top New Business Locations A Geographic Analysis

Apr 24, 2025 -

Understanding Stock Market Valuations Bof As View On Investor Concerns

Apr 24, 2025

Understanding Stock Market Valuations Bof As View On Investor Concerns

Apr 24, 2025 -

Usd Strengthens As Trump Softens Stance On Fed

Apr 24, 2025

Usd Strengthens As Trump Softens Stance On Fed

Apr 24, 2025