USD Strengthens As Trump Softens Stance On Fed

Table of Contents

Trump's Shift in Fed Policy Approach

President Trump's previous outspoken criticisms of the Fed's monetary policy decisions, particularly regarding interest rate hikes, created considerable market uncertainty. His frequent public pronouncements often pressured the central bank, undermining its perceived independence and injecting volatility into the USD exchange rate. This unpredictable environment made it challenging for investors to gauge the future direction of the US economy and consequently, the value of the dollar.

However, a noticeable shift in Trump's rhetoric has emerged. His recent statements have displayed a more conciliatory tone towards the Fed, acknowledging its autonomy and the complexities of monetary policy. This change in approach signals a potential lessening of political interference in the central bank's operations.

- Examples of Trump's past criticisms: Public statements criticizing interest rate increases as hindering economic growth, tweets directly targeting Fed Chair Jerome Powell. These actions often led to immediate market reactions, with the USD sometimes weakening following negative comments.

- Recent conciliatory statements: More measured comments about the Fed's role, avoiding direct attacks on its policies, a shift towards a more respectful public discourse.

- Reasons for the change: This shift might be attributed to several factors, including a potential recognition of the Fed's independence, approaching elections, and a growing understanding of the negative consequences of open political pressure on the central bank.

Impact on USD Exchange Rates

The consequences of Trump's softened stance on the Fed have been clearly reflected in the USD exchange rate. The decreased uncertainty surrounding US monetary policy has fostered a more favorable environment for the dollar. This has led to a noticeable appreciation of the USD against other major currencies.

- Charts illustrating USD's rise: The EUR/USD pair, for instance, has seen a decline, indicating a strengthening dollar. Similarly, the GBP/USD and USD/JPY pairs have exhibited trends consistent with USD appreciation. (Note: Ideally, this section would include actual charts or links to charts showing these currency movements).

- Beyond Trump's statements: While Trump's changed rhetoric has played a significant role, other factors have also contributed to the USD's strength. Strong US economic data, particularly robust employment figures and relatively healthy GDP growth, have further boosted investor confidence in the US economy. Global economic uncertainty, making the USD a safe-haven asset, has also played a part.

- Short-term and long-term projections: The short-term outlook for the USD remains positive, based on current market trends. However, long-term projections are subject to various economic and geopolitical factors. Sustained economic growth and a stable political climate will likely support further USD appreciation, while global economic downturns could trigger a reversal.

Implications for Global Markets and Investors

The strengthening USD has significant implications for global markets and investors. A stronger dollar makes US exports more expensive and imports cheaper, impacting international trade balances.

- Impact on US exporters and importers: US exporters might face reduced competitiveness in global markets, while importers benefit from lower import costs.

- Effects on emerging markets: Emerging markets with significant USD-denominated debt face increased repayment burdens as the value of their local currencies falls against the dollar. This can exacerbate existing economic challenges in these regions.

- Investment strategies: Investors need to adjust their portfolio diversification strategies to account for the changing currency landscape. Hedging strategies might be necessary to mitigate the risks associated with USD fluctuations. Investors may also consider opportunities presented by a stronger dollar, such as investing in US assets or companies that benefit from a strong dollar.

Conclusion

President Trump's recent softening of his stance towards the Federal Reserve has had a noticeable impact on the strength of the USD. This shift, coupled with other economic factors, has led to USD appreciation against major currencies, creating both opportunities and challenges for global markets and investors. Understanding these dynamics is critical for making informed decisions.

Stay informed about the ever-changing dynamics of the USD and its impact on the global economy. Learn more about USD trading and investment strategies by [link to relevant resource, e.g., a reputable financial news website or trading platform].

Featured Posts

-

Investigation Reveals Lingering Toxic Chemicals In Buildings After Ohio Derailment

Apr 24, 2025

Investigation Reveals Lingering Toxic Chemicals In Buildings After Ohio Derailment

Apr 24, 2025 -

From Scatological Data To Engaging Podcast Ais Role In Content Creation

Apr 24, 2025

From Scatological Data To Engaging Podcast Ais Role In Content Creation

Apr 24, 2025 -

The Countrys Top New Business Locations A Geographic Analysis

Apr 24, 2025

The Countrys Top New Business Locations A Geographic Analysis

Apr 24, 2025 -

Impact Players Hield And Paytons Bench Performance Secures Warriors Win Over Blazers

Apr 24, 2025

Impact Players Hield And Paytons Bench Performance Secures Warriors Win Over Blazers

Apr 24, 2025 -

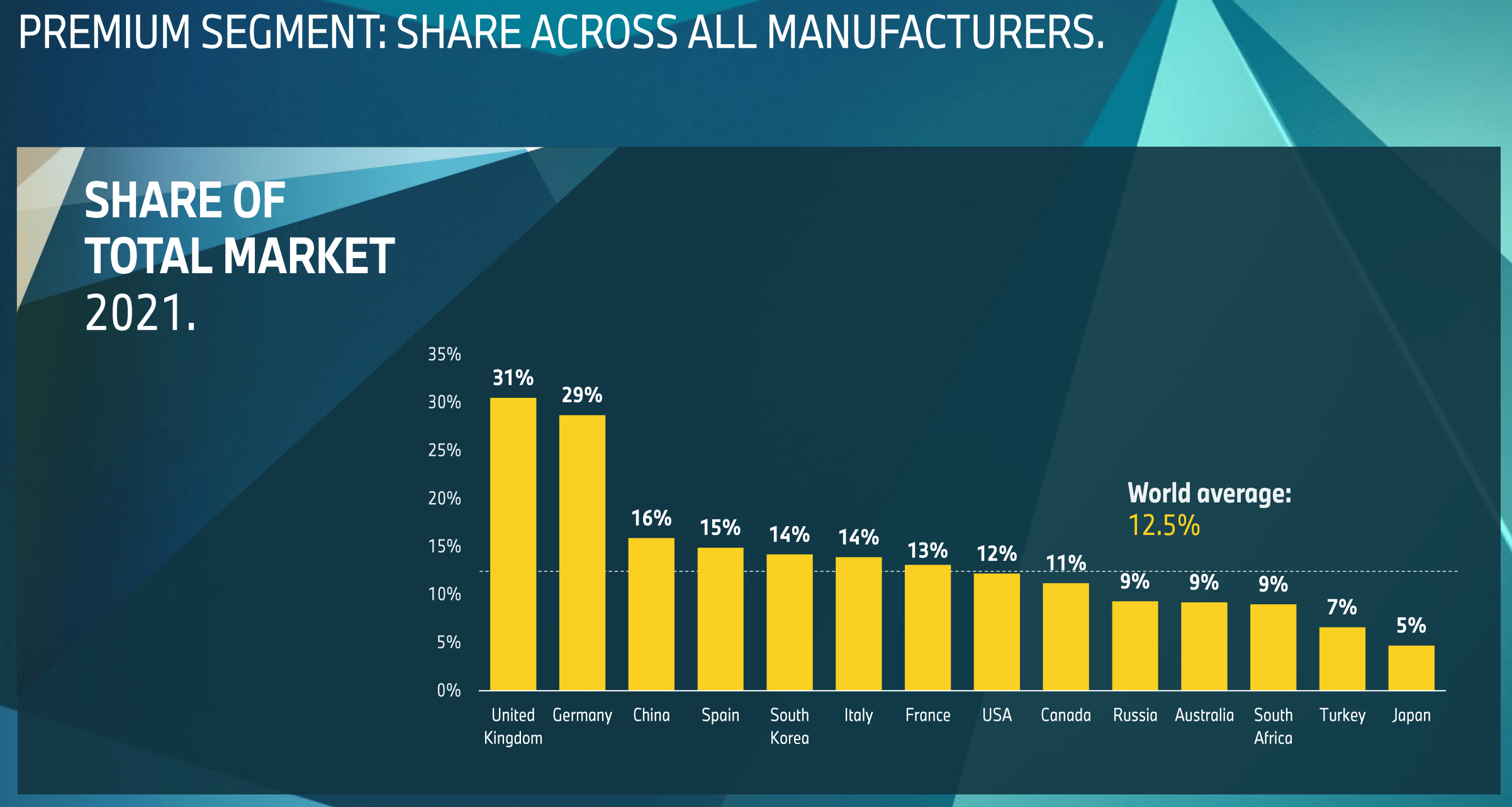

Analyzing The China Market Why Bmw And Porsche Are Facing Headwinds

Apr 24, 2025

Analyzing The China Market Why Bmw And Porsche Are Facing Headwinds

Apr 24, 2025