Analyzing The China Market: Why BMW And Porsche Are Facing Headwinds

Table of Contents

China's automotive market is a behemoth. In 2022, it accounted for nearly 30% of global car sales, making it the world's largest. This staggering figure highlights the immense opportunity – and the significant challenges – for international automakers. This article, "Analyzing the China Market: Why BMW and Porsche Are Facing Headwinds," explores the difficulties faced by these luxury giants in navigating the complexities of the Chinese automotive landscape. Despite the market's sheer size, several factors are creating significant headwinds for BMW and Porsche's continued success in China.

Intensifying Competition from Domestic Brands

The rise of Chinese automakers is perhaps the most significant challenge facing established luxury brands like BMW and Porsche. Domestic brands are rapidly gaining market share, fueled by technological innovation, competitive pricing, and substantial government support.

- Powerful Domestic Players: Companies like BYD, NIO, and Xpeng are leading this charge. BYD, with its Blade Battery technology and vertically integrated supply chain, has become a dominant force, while NIO and Xpeng are making significant inroads with their technologically advanced electric vehicles (EVs) and sophisticated battery-swapping infrastructure.

- Government Backing: The Chinese government actively promotes the growth of domestic automakers through subsidies, tax breaks, and favorable regulations. This support allows Chinese brands to invest heavily in research and development, further enhancing their competitiveness.

- EV Appeal: The increasing preference for electric vehicles among Chinese consumers plays directly into the hands of domestic brands. Many Chinese consumers perceive domestically produced EVs as technologically advanced and better suited to their needs than established foreign brands. This trend poses a serious threat to BMW and Porsche's traditional dominance in the luxury segment.

Shifting Consumer Preferences in the Chinese Luxury Market

The Chinese luxury car market is not static; it's rapidly evolving, driven by shifts in consumer preferences. Technological advancements and the growing demand for sophisticated features are reshaping the landscape.

- Tech-Savvy Consumers: Chinese luxury car buyers increasingly value smart features, advanced connectivity, and autonomous driving capabilities. They are digitally savvy and expect seamless integration of their vehicles with their digital lives.

- Brand Loyalty Evolving: While brand loyalty still exists, it's less entrenched than in other markets. Chinese consumers are more willing to explore new brands and technologies, making brand image and reputation less of a guarantee of success.

- Social Media Influence: Social media plays a crucial role in shaping consumer perceptions and preferences. Influencer marketing and online reviews significantly impact purchasing decisions, requiring luxury brands to adapt their marketing strategies accordingly. BMW and Porsche's relatively slower adaptation to these digital marketing trends is contributing to their challenges.

Economic Slowdown and Geopolitical Factors

Macroeconomic factors also pose significant headwinds. China's economic slowdown, coupled with geopolitical uncertainties, impacts consumer confidence and purchasing power.

- Economic Uncertainty: A slowing economy directly affects the luxury goods market. Consumers are more hesitant to make large purchases like luxury cars when economic prospects are uncertain.

- Geopolitical Risks: Trade tensions and geopolitical risks further complicate the situation. These factors can lead to supply chain disruptions, increased costs, and decreased consumer confidence.

- Impact on Luxury Sales: The combination of economic slowdown and geopolitical factors creates a perfect storm, significantly impacting sales of luxury vehicles like those from BMW and Porsche.

Challenges in Adapting to the Chinese Market

Successfully navigating the Chinese market requires understanding its unique cultural nuances and consumer behavior. This presents significant challenges for foreign automakers.

- Cultural Understanding: Understanding Chinese consumer behavior is paramount. This includes understanding preferences for specific features, brand perceptions, and the importance of social status and image.

- Localization Strategies: Simply translating marketing materials isn't enough. Successful localization requires tailoring products and marketing messages to resonate with the specific cultural context of the Chinese market.

- Building Relationships: Developing strong relationships with local dealers, suppliers, and government officials is crucial for navigating the complexities of the Chinese business environment. Strong partnerships are essential for long-term success. BMW and Porsche's strategies in this area have been less than optimally effective in countering the competition.

Conclusion

Analyzing the China market reveals significant headwinds for BMW and Porsche. Intense competition from rapidly growing domestic brands, evolving consumer preferences, macroeconomic factors, and the challenges of adapting to the unique cultural context all contribute to their difficulties. Key takeaways include the need to prioritize technological innovation, adapt to shifting consumer preferences, and develop robust localization strategies. Analyzing the China market for luxury brands requires a deep understanding of these complex dynamics. Further investigation into the strategies employed by both successful and struggling automakers in China is crucial for gaining a comprehensive understanding of this vital market. Understanding the dynamics of the Chinese market remains critical for the continued success of global automakers.

Featured Posts

-

Instagram Launches Video Editor To Rival Tik Tok

Apr 24, 2025

Instagram Launches Video Editor To Rival Tik Tok

Apr 24, 2025 -

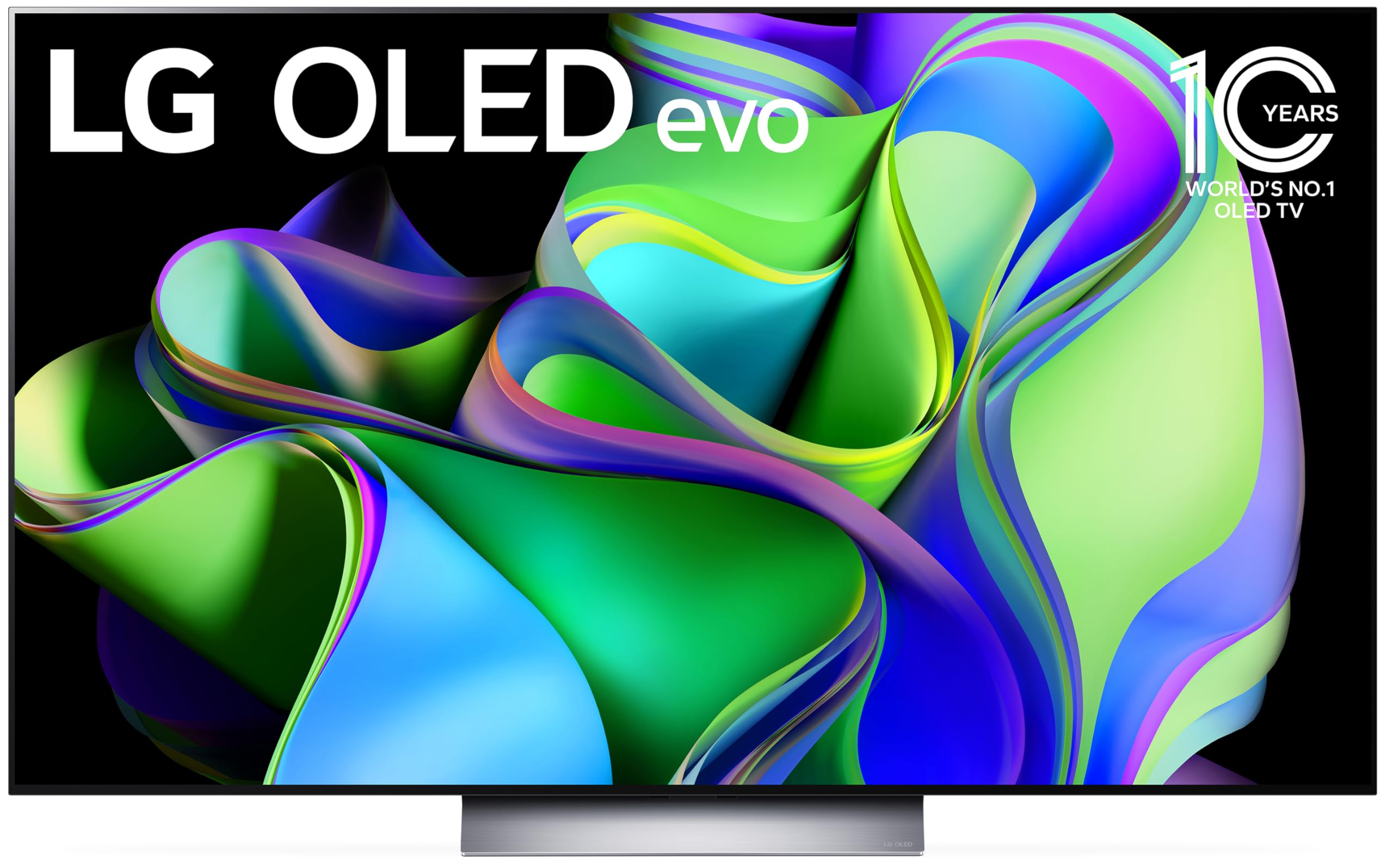

My 77 Inch Lg C3 Oled Tv A Detailed Review

Apr 24, 2025

My 77 Inch Lg C3 Oled Tv A Detailed Review

Apr 24, 2025 -

California Gas Prices Surge Governor Newsom Seeks Industry Partnership

Apr 24, 2025

California Gas Prices Surge Governor Newsom Seeks Industry Partnership

Apr 24, 2025 -

Shark Sightings Precede Swimmers Disappearance And Body Discovery On Israeli Beach

Apr 24, 2025

Shark Sightings Precede Swimmers Disappearance And Body Discovery On Israeli Beach

Apr 24, 2025 -

More Than Bmw And Porsche Western Automakers Face Headwinds In China

Apr 24, 2025

More Than Bmw And Porsche Western Automakers Face Headwinds In China

Apr 24, 2025