China's Shift To Middle Eastern LPG: Replacing US Imports Amid Tariffs

Table of Contents

Rising Tariffs on US LPG Imports

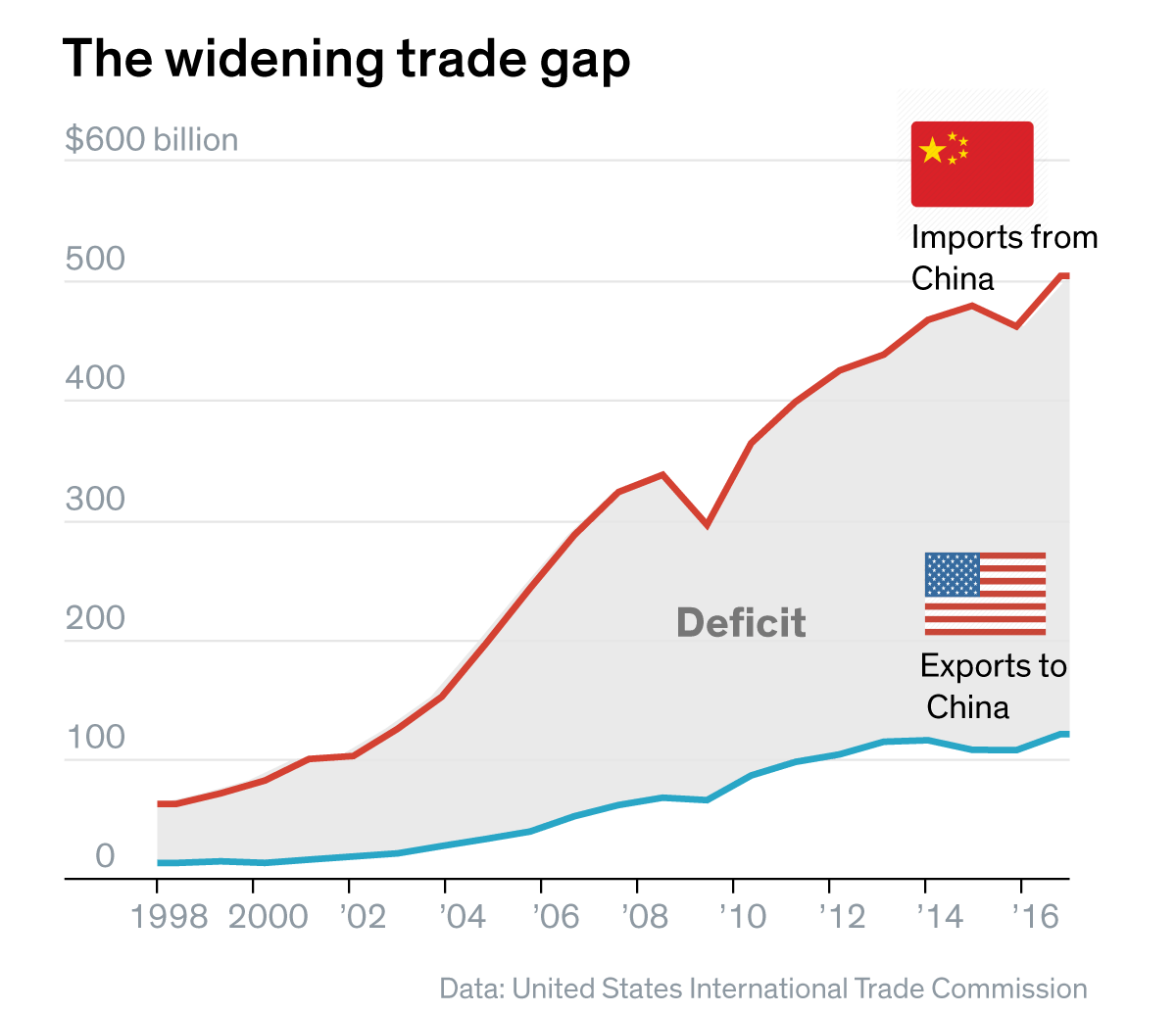

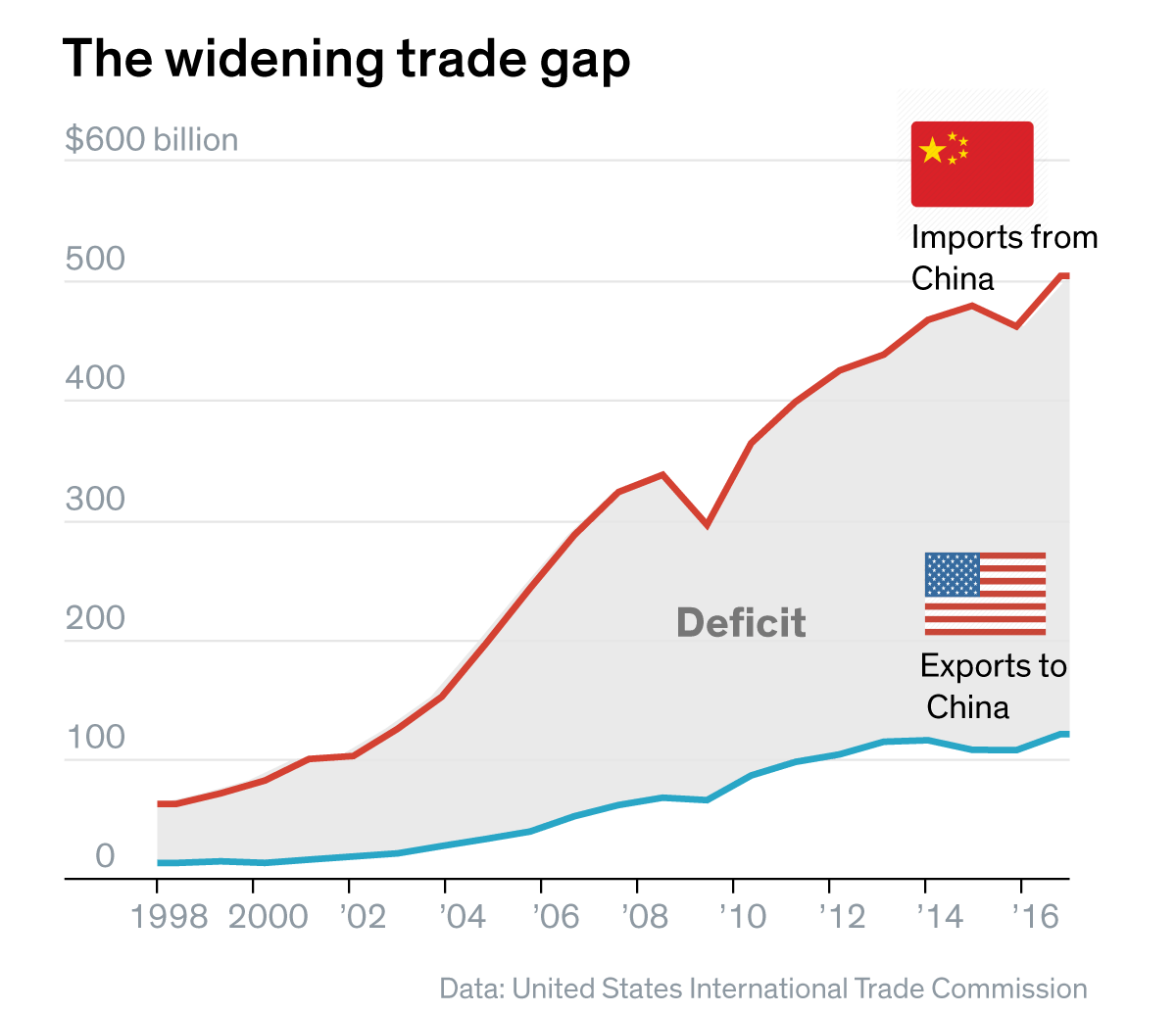

The imposition of US tariffs on Chinese goods, including those indirectly related to LPG import infrastructure, significantly impacted the cost-effectiveness of sourcing LPG from the United States. These tariffs increased the price of US LPG imports to China, making them less competitive compared to alternatives. This price increase directly affected Chinese businesses and consumers reliant on LPG for various applications, from heating to industrial processes.

- Specific tariff amounts and dates of implementation: While specific tariff amounts varied and changed over time, the overall impact was a substantial increase in the cost of US LPG imports to China, starting in [Insert specific date and relevant tariff codes if available]. The fluctuating nature of these tariffs created uncertainty in the market.

- Data showcasing the volume decrease in US LPG imports to China: Data from [Source – e.g., reputable trade statistics website] reveals a sharp decline in the volume of US LPG imports to China following the tariff implementation. [Insert specific data if available, for example: "Imports decreased by X% from Y tons in Z year to A tons in B year"].

- Analysis of the economic impact on Chinese businesses and consumers: The increased cost of LPG translated to higher prices for consumers and reduced profit margins for businesses utilizing LPG in their operations. This led to some businesses seeking alternative fuels or adjusting their operational models to mitigate the impact.

- Mention alternative sources explored before the Middle East: Before the significant shift to Middle Eastern sources, China explored alternative LPG suppliers, including those in [mention other potential suppliers and briefly explain why they were less viable]. However, none could match the combination of price and reliability offered by Middle Eastern nations.

The Allure of Middle Eastern LPG Suppliers

The Middle East, particularly countries like Saudi Arabia, Qatar, and the UAE, emerged as a highly attractive alternative source of LPG for China. This shift is driven by several factors:

- Competitive pricing strategies of Middle Eastern suppliers: Middle Eastern LPG suppliers offered significantly more competitive prices than their US counterparts, largely due to lower production costs and regional geopolitical advantages.

- Reliable supply chains and established trade relationships: The Middle East boasts established LPG production and export infrastructure, along with well-developed trade relationships with China, ensuring a reliable and consistent supply.

- Geopolitical factors influencing the shift (e.g., strengthened diplomatic ties): Strengthened diplomatic and economic ties between China and various Middle Eastern nations contributed to facilitating these trade agreements. These relationships provide a level of political stability crucial for long-term energy partnerships.

- Mention specific agreements or contracts between China and Middle Eastern countries: [Insert details of any publicly available agreements or contracts, if possible. Otherwise, state that specific details may not be publicly available].

Implications for Global LPG Markets

China's shift to Middle Eastern LPG has significant ramifications for the global LPG market:

- Changes in LPG prices globally: The increased demand from China put upward pressure on global LPG prices, benefiting Middle Eastern producers while potentially affecting other suppliers and consumers.

- The impact on US LPG producers and exporters: US LPG producers experienced a reduction in demand and faced increased competition from Middle Eastern suppliers, impacting their market share and profitability.

- Increased competition among LPG suppliers worldwide: The shift intensified competition within the global LPG market, forcing suppliers to optimize their pricing, logistics, and supply chain management strategies.

- Potential environmental implications of this shift in trade routes: The change in LPG trade routes may lead to changes in the overall carbon footprint of LPG transportation, depending on shipping distances and fuel efficiency. Further analysis is needed to fully assess the environmental impacts.

China's Domestic LPG Production and Consumption

Understanding China's domestic LPG production and consumption is crucial to contextualizing this shift in imports.

- Data on China's domestic LPG production: China's domestic LPG production [Insert data on production levels and trends, citing sources]. While domestic production contributes significantly, it hasn't met the growing demand, necessitating imports.

- Analysis of China's LPG consumption across sectors (residential, industrial, etc.): LPG is used extensively across various sectors in China, including residential heating, industrial processes, and transportation. [Insert breakdown of consumption by sector, with data if available].

- Future projections for China's LPG demand: China's LPG demand is expected to [Insert projections for future demand, citing sources], highlighting the continuing importance of both domestic production and imports.

Conclusion

China's shift from US to Middle Eastern LPG imports is primarily driven by rising US tariffs, coupled with the competitive pricing and reliable supply chains offered by Middle Eastern suppliers. This transformation has profound implications for the global LPG market, leading to price fluctuations, increased competition, and potential environmental impacts. To fully grasp the complexities and future trends of China's energy strategy and its impact on the global market, ongoing analysis of LPG imports is critical. For further insights into the evolving dynamics of the China LPG market and the implications of its shift towards Middle Eastern suppliers, continue exploring reliable sources of energy market analysis. Stay informed about the latest developments in China's LPG imports to make strategic decisions in this dynamic sector.

Featured Posts

-

Stock Market Today Dow Jumps 1000 Points Nasdaq And S And P 500 Surge On Tariff Hopes

Apr 24, 2025

Stock Market Today Dow Jumps 1000 Points Nasdaq And S And P 500 Surge On Tariff Hopes

Apr 24, 2025 -

Bold And The Beautiful Recap April 16 Hopes Anxiety Over Liam And Bridgets Unexpected Discovery

Apr 24, 2025

Bold And The Beautiful Recap April 16 Hopes Anxiety Over Liam And Bridgets Unexpected Discovery

Apr 24, 2025 -

The Zuckerberg Trump Dynamic Implications For The Tech Industry

Apr 24, 2025

The Zuckerberg Trump Dynamic Implications For The Tech Industry

Apr 24, 2025 -

William Watson Understanding The Liberal Platform Before You Vote

Apr 24, 2025

William Watson Understanding The Liberal Platform Before You Vote

Apr 24, 2025 -

Niftys Bullish Charge A Deep Dive Into Indias Market Dynamics

Apr 24, 2025

Niftys Bullish Charge A Deep Dive Into Indias Market Dynamics

Apr 24, 2025