Nifty's Bullish Charge: A Deep Dive Into India's Market Dynamics

Table of Contents

The Booming Indian Economy: A Foundation for Growth

The robust growth of the Indian economy forms the bedrock of the Nifty's bullish trend. Strong Indian GDP growth, fueled by key economic reforms, provides fertile ground for stock market expansion. Several factors contribute to this positive trajectory:

-

Increased foreign direct investment (FDI) inflows: India's attractive investment climate has led to a significant surge in FDI, injecting capital into various sectors and boosting economic activity. This influx of foreign capital directly contributes to the positive sentiment reflected in the Nifty 50.

-

Government initiatives focusing on infrastructure development: Massive investments in infrastructure—roads, railways, ports, and digital connectivity—are enhancing efficiency, productivity, and overall economic competitiveness. This translates into lucrative opportunities for companies involved in infrastructure development and related sectors, positively impacting the Nifty.

-

The positive impact of a young and growing demographic: India's burgeoning young population represents a massive consumer market and a large pool of skilled labor. This demographic dividend fuels consumption-driven growth and supports the expansion of various sectors represented in the Nifty 50.

-

Government's focus on the "Make in India" initiative boosting domestic manufacturing: This initiative aims to boost domestic manufacturing and reduce reliance on imports. Success in this area strengthens the Indian economy and creates opportunities for Indian companies, positively affecting the Nifty's performance.

Key Sectors Fueling the Nifty's Ascent

The Nifty's ascent isn't driven by a single sector; rather, a confluence of strong performers contributes to its overall bullish trajectory. Analyzing the performance of key sectors reveals the multifaceted nature of this growth:

-

Strong growth in the IT sector due to global demand: India's IT sector continues to be a significant driver of economic growth, benefiting from global demand for software services and technological solutions. This sector's consistent performance significantly impacts the Nifty 50's upward trend.

-

Expansion of the pharmaceutical industry, driven by domestic and export markets: The Indian pharmaceutical industry is experiencing significant expansion, fueled by both domestic demand and strong exports. This growth contributes substantially to the overall market performance and the Nifty's upward movement.

-

Resilience of the FMCG sector despite economic fluctuations: The fast-moving consumer goods (FMCG) sector demonstrates resilience even amidst economic fluctuations, reflecting the consistent demand for essential goods and services. This steady performance provides stability to the Nifty.

-

Positive outlook for the banking sector with increased lending and financial inclusion: Increased lending activity and financial inclusion initiatives are bolstering the Indian banking sector, leading to a positive outlook and contributing to the overall strength of the Nifty. Analyzing Nifty sectoral performance reveals the synergistic effect of these key sectors.

Global Factors Influencing the Indian Market

While domestic factors are paramount, global economic conditions and geopolitical events significantly influence the Indian market and the Nifty's performance:

-

Impact of global inflation on Indian markets: Global inflationary pressures can impact investor sentiment and influence monetary policy decisions in India, affecting the Nifty's trajectory.

-

Influence of geopolitical instability on investor sentiment: Geopolitical events and uncertainties can impact investor confidence and lead to volatility in the Indian stock market, affecting the Nifty's performance.

-

Role of foreign portfolio investment (FPI) flows in Nifty's performance: FPI flows play a crucial role in influencing the Nifty 50's performance. Positive FPI flows contribute to upward momentum, while outflows can lead to corrections.

-

Effect of global interest rate hikes on Indian monetary policy: Global interest rate hikes can influence India's monetary policy decisions, affecting borrowing costs and impacting market sentiment, thus affecting the Nifty.

Investment Strategies in a Bullish Nifty

Navigating a bullish market like the Nifty requires a well-defined investment strategy that emphasizes risk management and diversification:

-

Strategies for long-term investment in the Indian market: A long-term investment horizon allows investors to ride out market fluctuations and benefit from the potential for sustained growth.

-

Importance of portfolio diversification across sectors: Diversifying investments across different sectors mitigates risk and capitalizes on the growth potential of various market segments.

-

Utilizing mutual funds for broader market exposure: Mutual funds offer diversified exposure to the Indian stock market, providing a convenient way to participate in the Nifty's growth.

-

The role of risk management in a dynamic market: Effective risk management strategies, including setting stop-loss orders and diversifying investments, are crucial in mitigating potential losses.

Conclusion

The Nifty's bullish charge is a result of a powerful combination of strong domestic economic fundamentals, robust sectoral performance, and, despite some global headwinds, a relatively resilient response to global economic uncertainties. Understanding these interconnected dynamics is essential for successful investing in the Indian stock market. Understanding the dynamics behind the "Nifty's Bullish Charge" is crucial for effectively navigating the Indian stock market. Learn more about investment opportunities within the Nifty 50 and harness the potential of this thriving market. Begin your journey into the exciting world of Nifty 50 investing today!

Featured Posts

-

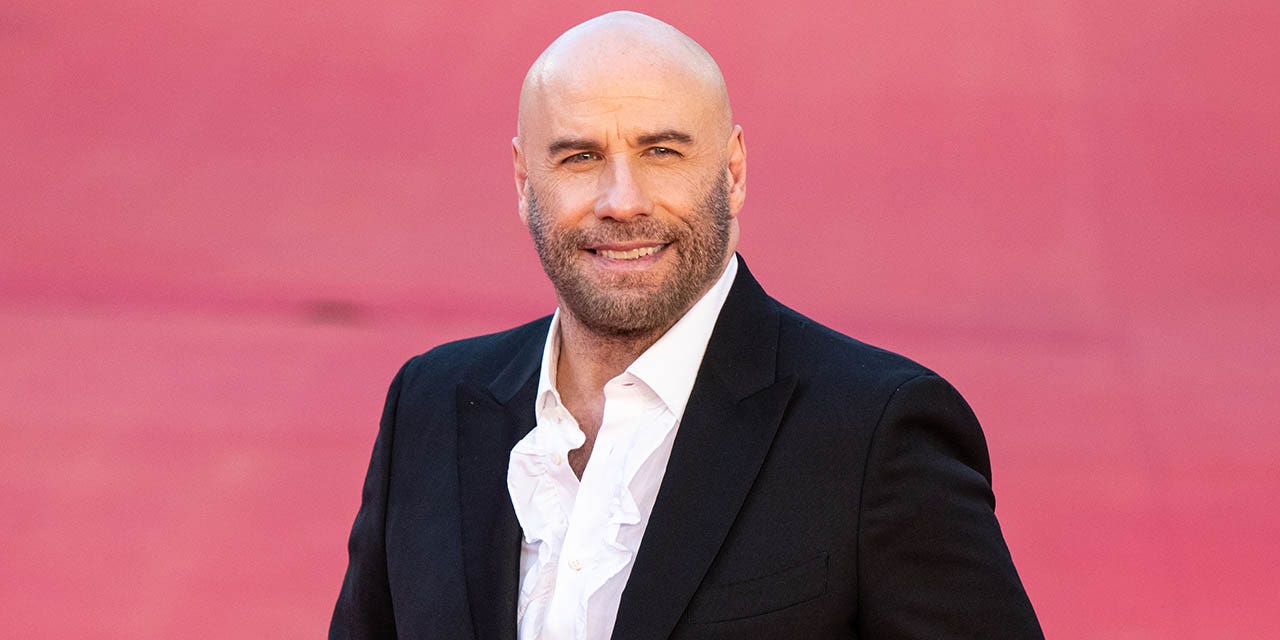

Remembering Jett Travolta John Travolta Shares Emotional Photo On What Would Have Been His Sons 33rd Birthday

Apr 24, 2025

Remembering Jett Travolta John Travolta Shares Emotional Photo On What Would Have Been His Sons 33rd Birthday

Apr 24, 2025 -

Oblivion Remastered Now Available From Bethesda

Apr 24, 2025

Oblivion Remastered Now Available From Bethesda

Apr 24, 2025 -

Is Betting On Natural Disasters Like The La Wildfires The Future Of Gambling

Apr 24, 2025

Is Betting On Natural Disasters Like The La Wildfires The Future Of Gambling

Apr 24, 2025 -

Herros Hot Shooting 3 Point Contest Victory And Cavs Skills Challenge Win

Apr 24, 2025

Herros Hot Shooting 3 Point Contest Victory And Cavs Skills Challenge Win

Apr 24, 2025 -

The Bold And The Beautiful April 3 Liams Health Scare And Hopes Move

Apr 24, 2025

The Bold And The Beautiful April 3 Liams Health Scare And Hopes Move

Apr 24, 2025