Stock Market Today: Dow Jumps 1000 Points, Nasdaq & S&P 500 Surge On Tariff Hopes

Table of Contents

Dow Jones Industrial Average Soars: A Detailed Look

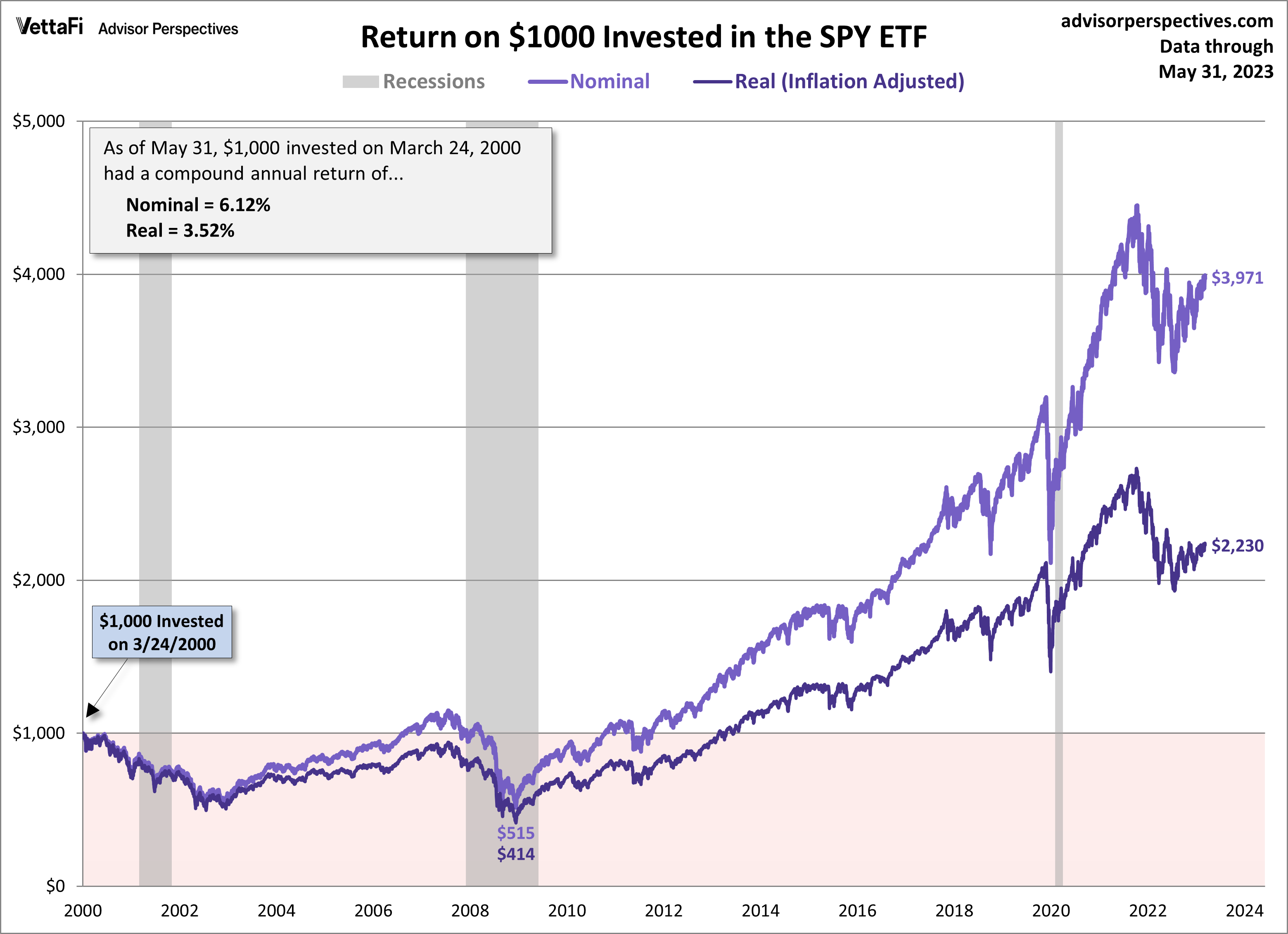

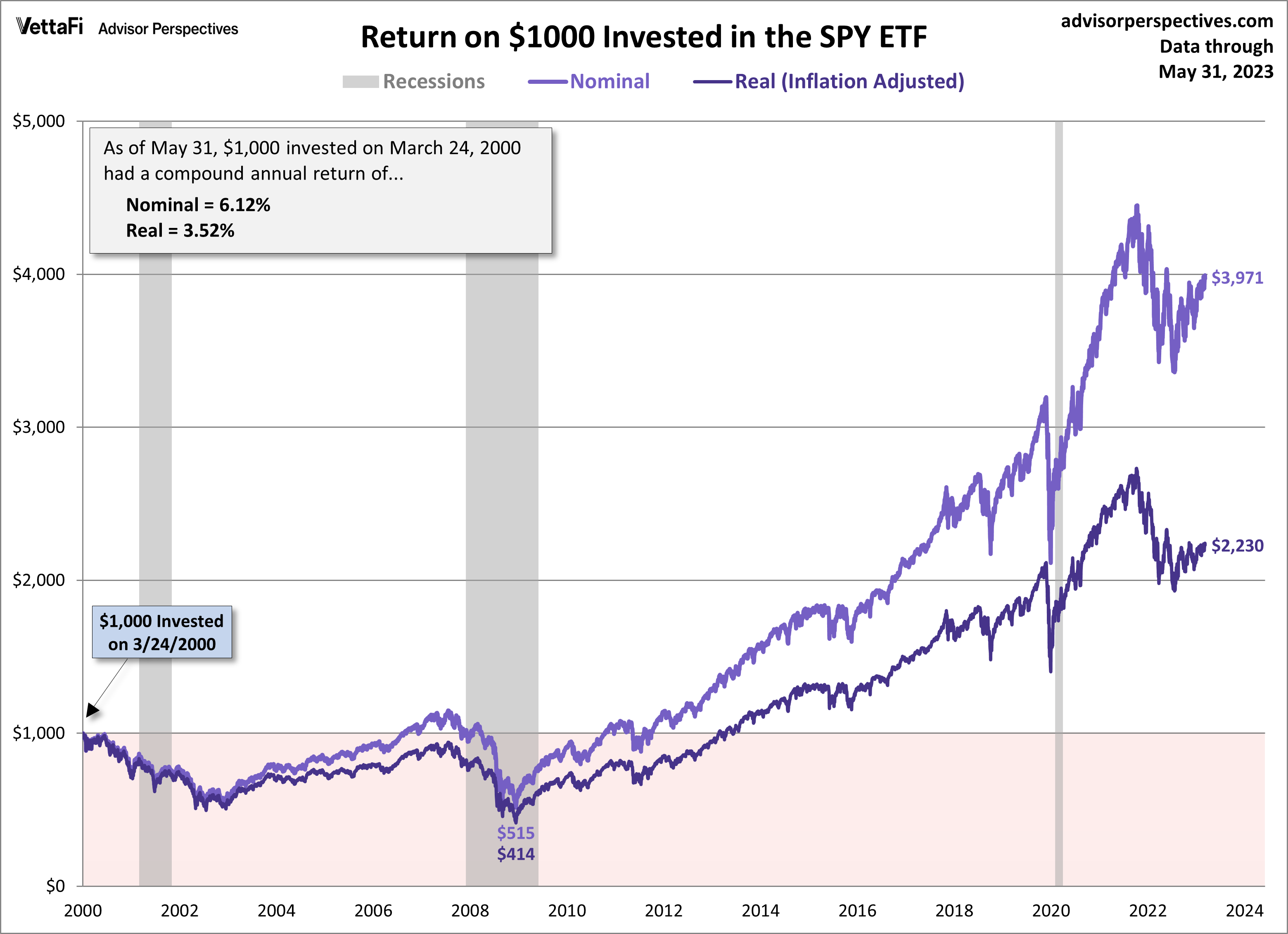

The Dow's 1000-point jump represents a remarkable percentage increase, closing significantly higher than yesterday's value. This represents a substantial gain compared to recent trading days, showcasing a dramatic shift in investor sentiment. Several key sectors contributed to this impressive performance. The technology sector, in particular, experienced robust growth, driving a significant portion of the Dow's overall increase. Financials also played a major role. This dramatic rise significantly boosted investor confidence, potentially signaling a strengthening bull market and reduced market volatility in the short term.

- Key Contributors: Companies like Apple, Microsoft, and JPMorgan Chase contributed significantly to the Dow's increase.

- Company-Specific News: Positive earnings reports and announcements from several major corporations likely fueled investor enthusiasm.

- Short-Term/Long-Term Effects: While this surge is positive, investors should consider potential short-term corrections and evaluate long-term implications based on sustained economic growth and further tariff developments.

Nasdaq and S&P 500 Follow Suit: Examining the Broader Market

The Nasdaq and S&P 500 mirrored the Dow's impressive gains, although the percentage increases may have varied slightly. Similar to the Dow, technology stocks played a pivotal role in driving the Nasdaq's surge. However, the S&P 500, representing a broader range of companies across various sectors, showcased the strength of the overall market. This positive performance across major indices demonstrates strong market breadth, indicating a widespread positive sentiment.

- Index Performance Comparison: While all three indices experienced significant growth, the percentage gains might differ, reflecting sector-specific performance.

- Technology Stocks: Mega-cap tech companies significantly influenced the Nasdaq's rise.

- Smaller-Cap Stocks: The participation of smaller-cap stocks in the rally suggests a positive outlook across the market capitalization spectrum.

Tariff Hopes Fuel Market Rally: Understanding the Driving Force

The market's enthusiastic response is directly linked to positive developments in ongoing trade tariff negotiations. News suggesting a potential easing of trade tensions or a breakthrough in negotiations ignited investor confidence. This positive sentiment significantly impacted investor expectations regarding future trade policy, lessening concerns about a protracted trade war and its potential negative economic consequences.

- Tariff News Summary: Reports suggesting a potential agreement or de-escalation of trade disputes fueled the market rally.

- Investor Sentiment Shift: The news spurred a significant shift in investor sentiment, moving from cautious pessimism to optimistic anticipation.

- Remaining Uncertainties: Despite the positive news, several uncertainties remain regarding the long-term trajectory of trade negotiations and their ultimate impact on global markets.

Expert Analysis and Future Outlook: What's Next for the Stock Market?

Market analysts offer a mixed outlook, with some expressing cautious optimism while others remain more reserved. While the current surge is encouraging, several factors could influence future market trends. Economic indicators, geopolitical events, and the continuing evolution of trade policy all play a significant role in shaping the market's future trajectory.

- Expert Opinions: Analysts generally agree that the tariff-related news is a significant positive catalyst, but caution against overreaction.

- Upcoming Economic Data: Upcoming economic data releases, such as inflation figures and employment reports, will influence market sentiment.

- Risks and Opportunities: While the current market conditions present opportunities, investors must remain aware of potential risks, such as unforeseen geopolitical events or unexpected shifts in economic indicators.

Conclusion: Stock Market Today – A Summary and Call to Action

Today's stock market witnessed a phenomenal surge, with the Dow Jones Industrial Average jumping over 1000 points, driven largely by renewed hopes regarding trade tariffs. The Nasdaq and S&P 500 followed suit, showcasing a broad-based market rally. While expert opinions are cautiously optimistic, investors should remain informed and monitor economic indicators and geopolitical developments. Stay updated on the latest stock market trends by subscribing to our newsletter or following us on social media. Understanding the "stock market today" is crucial for informed investment decisions.

Featured Posts

-

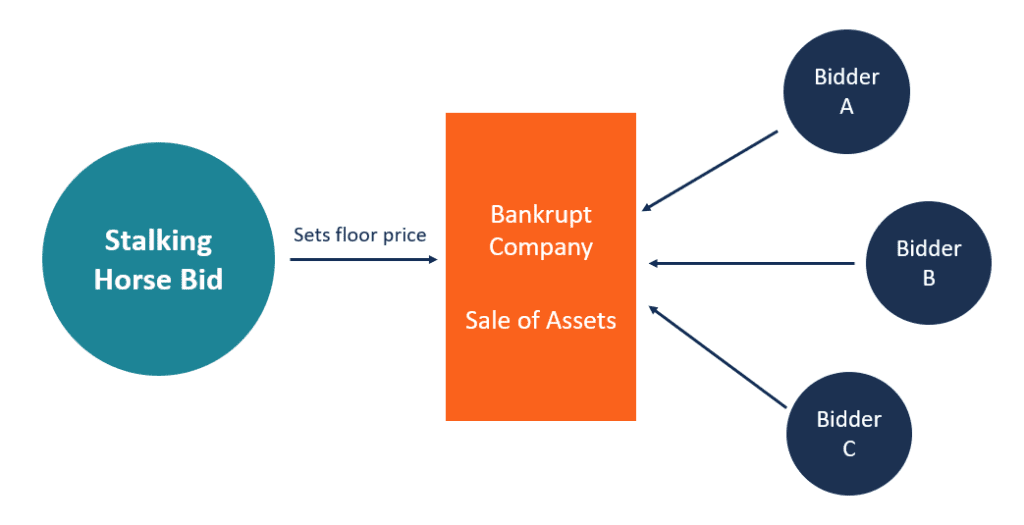

Village Roadshow Sale Finalized Alcon Secures 417 5 Million Stalking Horse Bid

Apr 24, 2025

Village Roadshow Sale Finalized Alcon Secures 417 5 Million Stalking Horse Bid

Apr 24, 2025 -

John Travoltas Rotten Tomatoes Record Is It Really That Bad

Apr 24, 2025

John Travoltas Rotten Tomatoes Record Is It Really That Bad

Apr 24, 2025 -

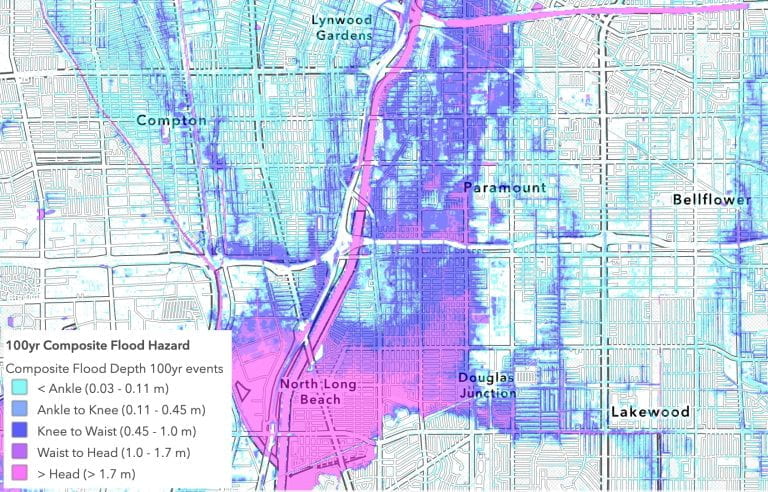

Tornado Season And Trumps Cuts Heightened Risk For Vulnerable Communities

Apr 24, 2025

Tornado Season And Trumps Cuts Heightened Risk For Vulnerable Communities

Apr 24, 2025 -

Chinese Stocks In Hong Kong See Gains On Improved Trade Outlook

Apr 24, 2025

Chinese Stocks In Hong Kong See Gains On Improved Trade Outlook

Apr 24, 2025 -

Decrease In Canada U S Border Encounters White House Statement

Apr 24, 2025

Decrease In Canada U S Border Encounters White House Statement

Apr 24, 2025