Canadian Conservatives' Fiscal Plan: Tax Cuts And Deficit Control

Table of Contents

Proposed Tax Cuts

The Conservative plan proposes significant reductions across various tax categories, aiming to stimulate economic activity and boost disposable income.

Individual Income Tax Reductions

The Conservatives propose lowering individual income tax rates across multiple brackets. This aims to benefit a broad spectrum of Canadian taxpayers.

- Proposed Reductions: A potential reduction of 10% in the lowest tax bracket, 8% in the middle bracket, and 5% in the highest bracket (These figures are hypothetical examples and should be replaced with the actual proposed percentages from the official Conservative plan).

- Canadians to Benefit: Estimates suggest millions of Canadians across various income levels will see a reduction in their tax burden. Detailed demographic breakdowns should be added based on the official plan.

- Economic Stimulus: The increased disposable income resulting from these cuts is expected to stimulate consumer spending and drive economic growth. This could potentially lead to job creation and increased business activity.

Corporate Tax Rate Cuts

A reduction in the corporate tax rate is another key element. This measure aims to enhance business investment and competitiveness.

- Proposed Rate: A decrease from the current rate (insert current rate) to (insert proposed rate) is being proposed.

- Impact on Investment and GDP: The Conservatives anticipate that this reduction will encourage businesses to invest more, leading to higher GDP growth and job creation.

- Foreign Investment: Lower corporate taxes could make Canada a more attractive destination for foreign investment, further boosting economic activity.

Other Tax Measures

Beyond individual and corporate income taxes, the Conservative plan may include adjustments to other tax areas. (This section requires information on any other proposed tax changes from the official Conservative plan. Examples include adjustments to capital gains taxes, GST/HST, etc.)

- Capital Gains Tax: (Details of any proposed changes. For example: A potential reduction in the inclusion rate for capital gains.)

- GST/HST: (Details of any proposed changes. For example: Potential adjustments to GST/HST rates or exemptions.)

- Other Levies: (Details on any other tax changes.)

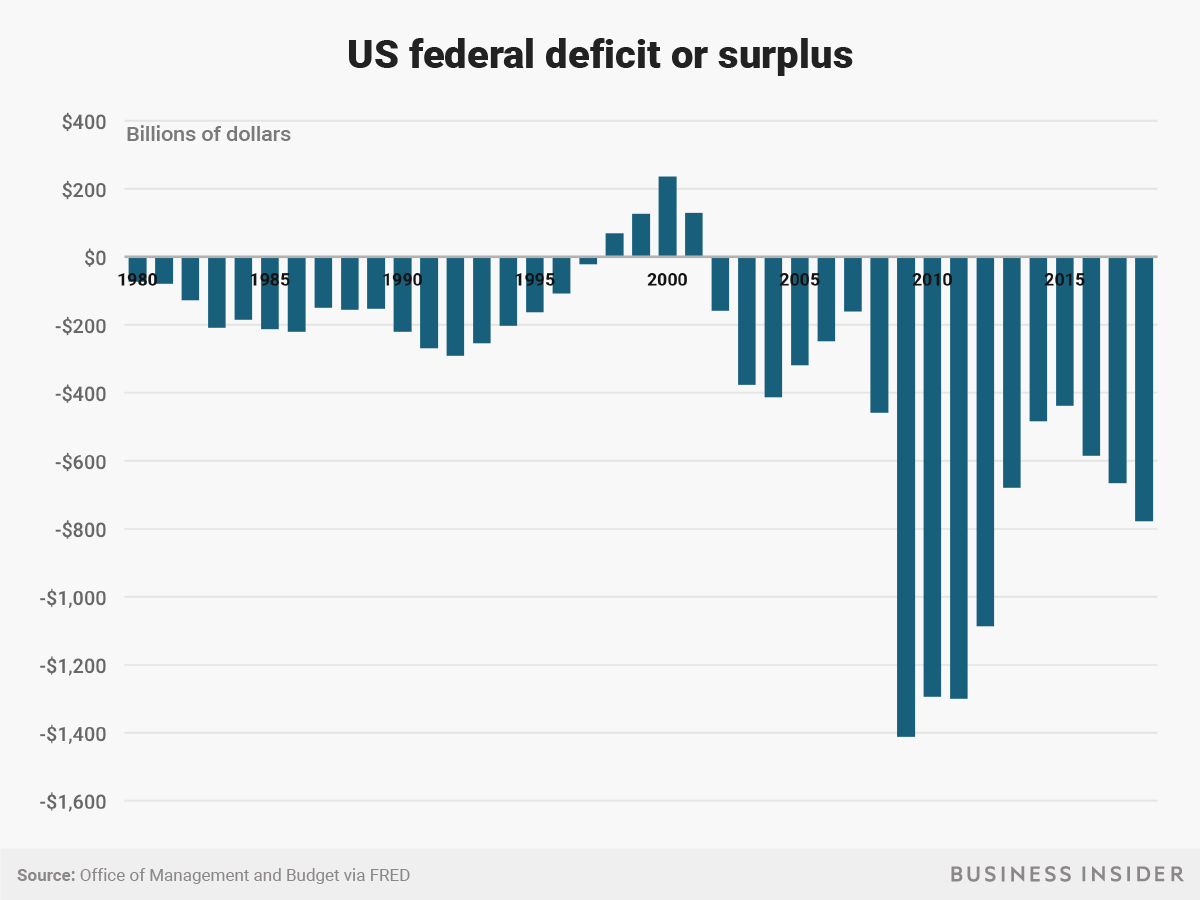

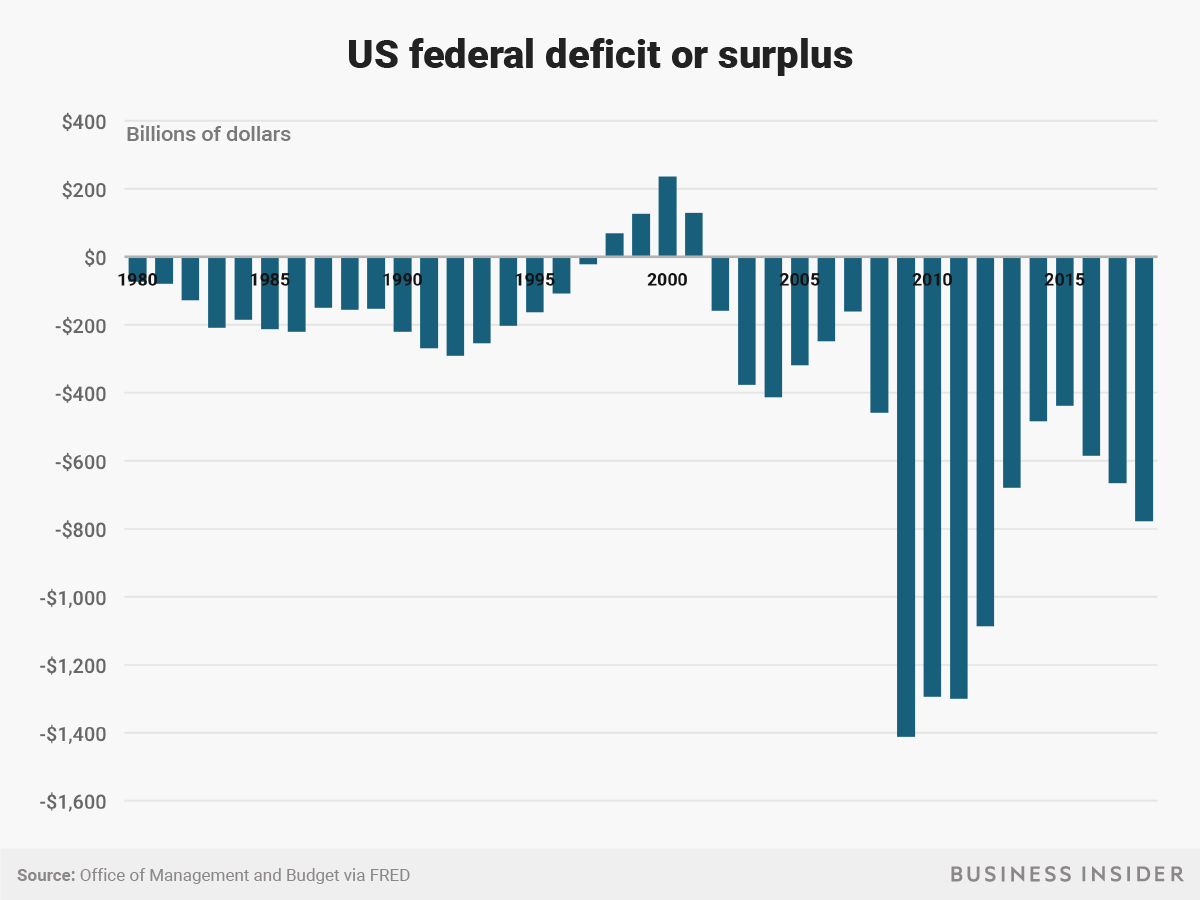

Deficit Reduction Strategies

To offset the revenue losses from tax cuts, the Conservatives outline several strategies to control the deficit.

Spending Cuts

The plan proposes targeted cuts across various government programs and departments. (Specific details from the Conservative plan need to be included here. The following are examples.)

- Program X: Proposed cut of (amount) with an estimated saving of (amount).

- Department Y: Proposed restructuring leading to a reduction of (amount) in operating costs.

- Consequences: Potential consequences of these cuts, both positive and negative, need to be explored. This could include potential job losses in certain sectors.

Increased Efficiency

The Conservatives also highlight efforts to improve government efficiency and reduce administrative costs.

- Streamlining processes: Implementing technology to automate tasks and reduce bureaucratic delays.

- Reducing duplication: Identifying and eliminating overlapping programs and services.

- Challenges: Achieving significant efficiency gains in the public sector can be challenging and requires careful planning and execution.

Economic Growth Strategies

The plan depends on boosting economic growth to generate higher tax revenue.

- Investment incentives: Tax breaks or subsidies to encourage private sector investment.

- Regulatory reform: Easing regulations to make it easier for businesses to operate and expand.

- Projected Growth: The Conservatives would need to present projected growth rates based on this plan, along with the assumptions supporting those projections.

Economic Impact and Analysis

Several independent economic analyses have been conducted on the proposed plan, offering varying perspectives.

Independent Economic Forecasts

- Report A: Highlights positive projections for job growth and GDP growth.

- Report B: Expresses concern about the potential impact on social programs and the long-term sustainability of the plan.

- Risks and Uncertainties: All economic forecasts contain inherent uncertainties. Factors such as global economic conditions and the effectiveness of government policies will significantly influence the actual outcome.

Comparison to Other Fiscal Plans

(This section requires details from the fiscal plans of other Canadian political parties. Comparisons should highlight key similarities and differences in approaches, focusing on tax cuts, spending plans, and projected economic outcomes.)

Conclusion

The Canadian Conservatives' fiscal plan represents a significant policy proposal for Canada. Its success relies heavily on effectively managing the balance between tax cuts and deficit reduction. While the tax cuts could stimulate economic growth, the proposed spending cuts and efficiency improvements are crucial for achieving fiscal responsibility. Independent economic analyses offer a range of opinions, showcasing both the potential benefits and risks. Careful consideration of the Canadian Conservatives' fiscal plan is vital for voters to make informed decisions. We encourage further investigation into the specifics of this plan and its potential impacts on the Canadian economy and its citizens. Thoroughly understanding the Canadian Conservatives' fiscal plan is crucial for navigating the complexities of Canadian politics and economics.

Featured Posts

-

Strategic Partnership Saudi Arabia And India To Establish Two Oil Refineries

Apr 24, 2025

Strategic Partnership Saudi Arabia And India To Establish Two Oil Refineries

Apr 24, 2025 -

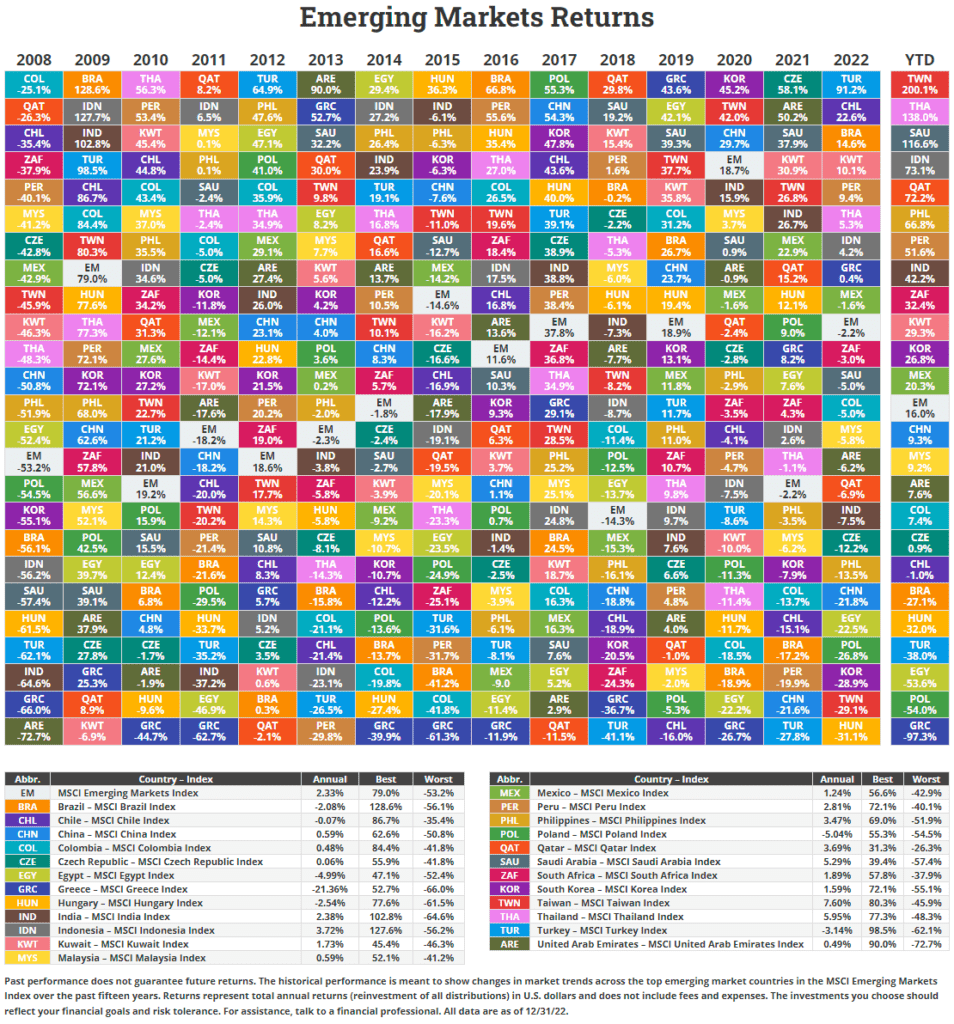

Us Market Slump Emerging Markets Post Positive Returns

Apr 24, 2025

Us Market Slump Emerging Markets Post Positive Returns

Apr 24, 2025 -

Emerging Market Stocks Resilience A Contrast To The Us Market

Apr 24, 2025

Emerging Market Stocks Resilience A Contrast To The Us Market

Apr 24, 2025 -

60 Minutes Executive Producers Resignation Loss Of Independence Cited

Apr 24, 2025

60 Minutes Executive Producers Resignation Loss Of Independence Cited

Apr 24, 2025 -

Celebrities Who Lost Homes In The La Palisades Fires A Complete List

Apr 24, 2025

Celebrities Who Lost Homes In The La Palisades Fires A Complete List

Apr 24, 2025