US Market Slump: Emerging Markets Post Positive Returns

Table of Contents

The US Market Slump: Understanding the Causes

The current US market downturn is a complex issue with several contributing factors.

Inflation and Interest Rate Hikes

Rising inflation and the Federal Reserve's aggressive interest rate hikes are significantly impacting US equities and bonds.

- Correlation: High inflation erodes purchasing power, forcing the Fed to raise interest rates to cool the economy. Higher interest rates increase borrowing costs for businesses, slowing investment and reducing corporate profits. This, in turn, negatively impacts stock valuations. For example, the tech sector, heavily reliant on future earnings, has been particularly hard hit by rising interest rates.

- Statistics: The Consumer Price Index (CPI) recently reached X%, while the Federal Funds Rate has increased by Y% since the beginning of the year. These figures demonstrate the aggressive monetary policy response to inflation.

Geopolitical Uncertainty

Geopolitical factors add to market volatility.

- Impact: The war in Ukraine, tensions between the US and China, and other global conflicts create uncertainty and negatively affect investor sentiment. Supply chain disruptions, increased energy prices, and sanctions further exacerbate the situation. For instance, the war in Ukraine has driven up energy prices globally, impacting various sectors.

- Examples: The conflict in Ukraine has led to significant market fluctuations, particularly in the energy and agricultural sectors. Increased US-China trade tensions have also impacted specific industries reliant on trade between the two countries.

Recessionary Fears

Growing concerns about a potential US recession are dampening investor confidence.

- Decreased Investment: Recessionary fears lead to decreased investment as businesses and individuals become more cautious about spending. Economic indicators such as declining consumer confidence, weakening manufacturing activity, and an inverted yield curve, all point towards a potential economic slowdown.

- Economic Indicators: A decline in GDP growth, rising unemployment claims, and a shrinking manufacturing PMI are all key indicators that economists are monitoring closely.

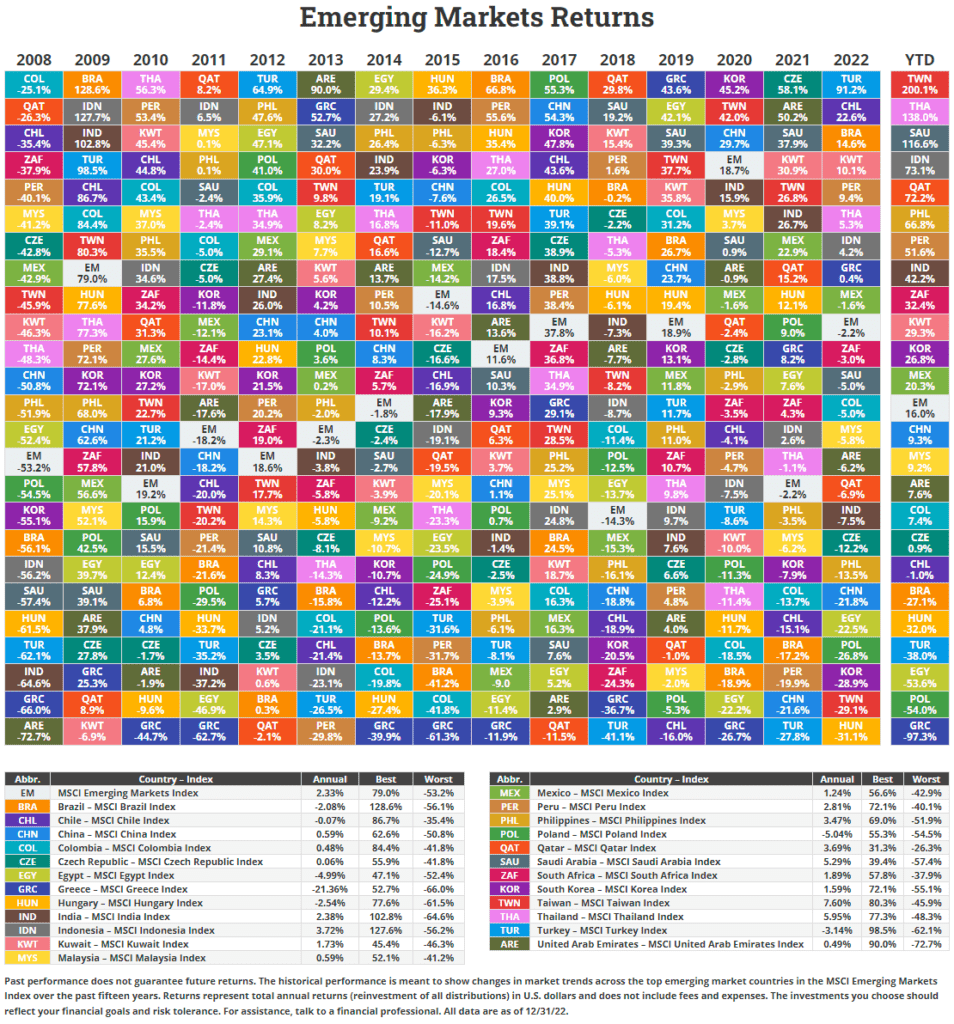

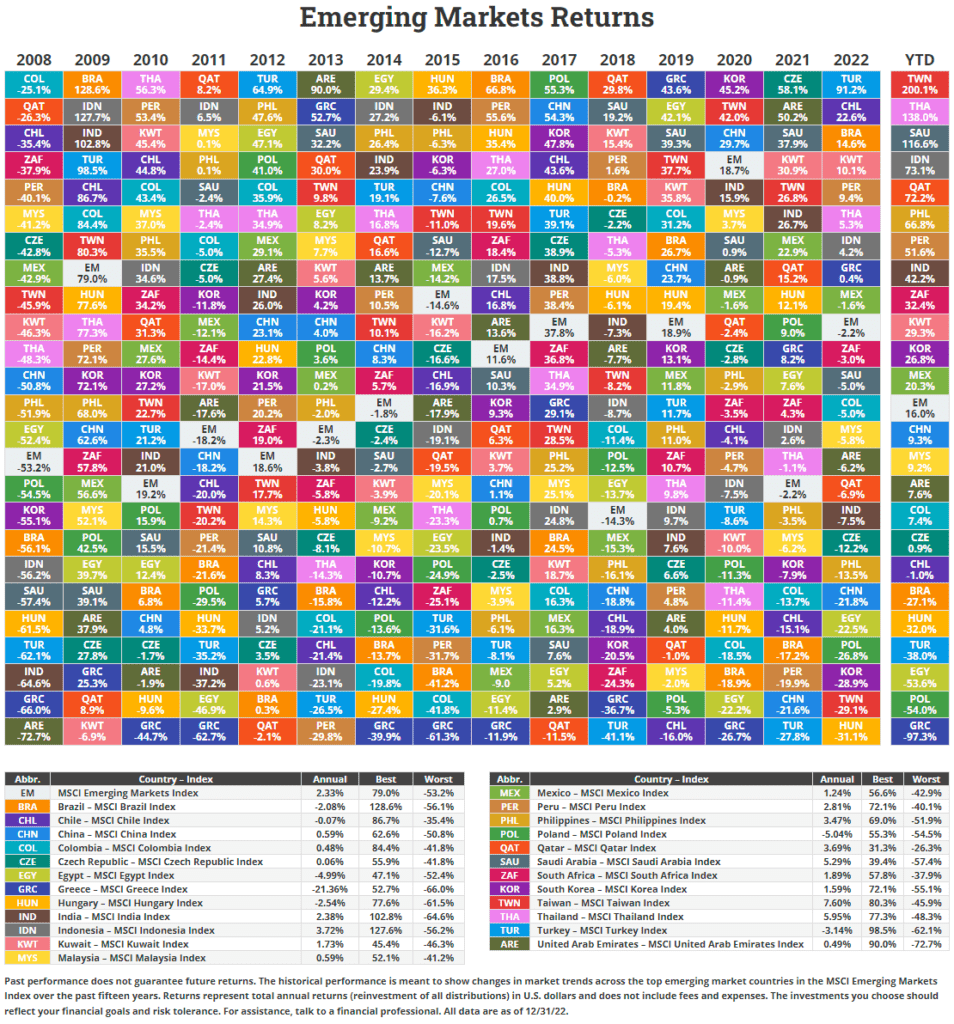

Emerging Markets: A Beacon of Opportunity

While the US market struggles, several emerging markets are exhibiting robust growth.

Strong Economic Growth in Select Emerging Markets

Certain emerging markets are demonstrating impressive economic expansion.

- Growth Rates: Countries like India, Indonesia, and Vietnam are experiencing significant GDP growth rates, driven by factors such as young and growing populations, increasing consumer spending, and government investments in infrastructure. India, for example, is projected to achieve X% GDP growth this year.

- Driving Factors: These economies benefit from a large working-age population fueling consumer demand and driving economic activity. Government initiatives focused on infrastructure development and digital transformation further stimulate growth.

Diversification Benefits

Emerging markets play a crucial role in portfolio diversification.

- Reduced Volatility: Emerging markets often exhibit lower correlation with developed markets like the US, meaning they don't always move in the same direction. This characteristic helps reduce the overall volatility of a diversified portfolio.

- Asset Allocation: Strategic asset allocation, incorporating emerging markets investments, can significantly improve risk-adjusted returns. By spreading investments across different asset classes and geographies, investors can mitigate potential losses in any single market.

Attractive Investment Valuations

Emerging markets may offer higher potential returns due to relatively lower valuations.

- Undervalued Assets: Compared to developed markets, some sectors and companies within emerging markets may be undervalued, presenting opportunities for value investors. This provides the potential for significant capital appreciation as these markets mature.

- Value Investing: Value investing strategies can be particularly effective in emerging markets, identifying companies with strong fundamentals trading at prices below their intrinsic value.

Navigating the Emerging Markets Landscape: Key Considerations

Investing in emerging markets requires careful consideration.

Risk Management

Thorough due diligence and risk management are paramount.

- Political Risks: Political instability, regulatory changes, and geopolitical events can significantly impact emerging markets. Investors need to carefully assess the political landscape of each country before investing.

- Currency Fluctuations: Currency fluctuations can impact returns. Investors should consider hedging strategies to mitigate currency risk.

- Regulatory Uncertainty: Regulatory changes and enforcement in emerging markets can be unpredictable.

Choosing the Right Investment Vehicles

Several investment vehicles provide access to emerging markets.

- ETFs: Exchange-Traded Funds (ETFs) offer broad diversification at a low cost.

- Mutual Funds: Mutual funds provide professional management but may have higher fees.

- Individual Stocks: Investing in individual stocks allows for targeted exposure but requires more research and carries higher risk. The choice of investment vehicle should align with individual risk tolerance and investment goals.

Conclusion

While the US market faces headwinds, emerging markets investment offers a compelling opportunity for diversification and growth. The robust economic growth, diversification benefits, and attractive valuations in select emerging markets offer the potential for significant returns. However, it's crucial to approach emerging markets investment with a well-defined strategy, focusing on risk management and selecting appropriate investment vehicles. Don't miss out on the potential of emerging markets investment; start exploring opportunities today by conducting thorough research and seeking professional financial advice tailored to your investment goals.

Featured Posts

-

John Travolta Enjoys A Pulp Fiction Themed Steak Dinner In Miami

Apr 24, 2025

John Travolta Enjoys A Pulp Fiction Themed Steak Dinner In Miami

Apr 24, 2025 -

The Bold And The Beautiful Spoilers Steffy Comforts Liam Poppy Warns Finn February 20

Apr 24, 2025

The Bold And The Beautiful Spoilers Steffy Comforts Liam Poppy Warns Finn February 20

Apr 24, 2025 -

The Bold And The Beautiful Spoilers Thursday February 20 Steffy Liam And Finns Fate

Apr 24, 2025

The Bold And The Beautiful Spoilers Thursday February 20 Steffy Liam And Finns Fate

Apr 24, 2025 -

Pandemic Fraud Lab Owner Pleads Guilty To Fake Covid Test Results

Apr 24, 2025

Pandemic Fraud Lab Owner Pleads Guilty To Fake Covid Test Results

Apr 24, 2025 -

The Bold And The Beautiful Wednesday April 16th Liam Hope And Bridgets Pivotal Day

Apr 24, 2025

The Bold And The Beautiful Wednesday April 16th Liam Hope And Bridgets Pivotal Day

Apr 24, 2025