Emerging Market Stocks' Resilience: A Contrast To The US Market

Table of Contents

Diversification Benefits: Why Emerging Markets Matter

Diversifying your portfolio beyond the US market is crucial for mitigating risk and capturing growth opportunities. Emerging market stocks, often exhibiting lower correlation with developed markets, offer significant diversification benefits.

Reduced Portfolio Volatility

Adding emerging market stocks to a portfolio can significantly reduce overall volatility. The correlation between major emerging market indices and the US S&P 500 is often lower than the correlation between different sectors within the US market itself.

- The MSCI Emerging Markets Index often shows a lower correlation with the S&P 500 than the correlation between the S&P 500 and the Nasdaq Composite.

- This lower correlation means that when the US market experiences downturns, emerging markets may not fall as sharply, providing a buffer to your overall portfolio performance.

This reduced volatility translates to better risk-adjusted returns. By diversifying internationally, investors can potentially achieve higher returns for a given level of risk, improving the overall efficiency of their portfolio.

Accessing Untapped Growth Potential

Emerging economies boast significant growth potential driven by factors like rapid urbanization, technological advancements, and a burgeoning middle class. This presents opportunities for investors seeking exposure to high-growth sectors.

- Technology: Many emerging markets are experiencing rapid adoption of digital technologies, creating opportunities in fintech, e-commerce, and software. India and Southeast Asia are prime examples.

- Infrastructure: Massive infrastructure development projects in countries like China, India, and Brazil offer significant investment potential.

- Consumer Goods: The expanding middle class in numerous emerging markets fuels strong demand for consumer goods, from automobiles to packaged foods.

These factors contribute to the potential for substantial long-term growth, outpacing the growth rates observed in many developed economies. Countries like Vietnam and Indonesia, for example, are showcasing particularly robust economic expansions.

Resilience in the Face of Global Uncertainty

Emerging markets have historically demonstrated remarkable adaptability to global economic shocks. Their inherent characteristics contribute to this resilience.

Emerging Markets' Adaptability

Emerging markets have repeatedly shown the ability to weather global crises.

- During the 2008 financial crisis, while developed markets experienced sharp declines, some emerging markets recovered more quickly.

- This resilience is often attributed to factors like younger, more adaptable populations and a less developed financial sector, reducing vulnerability to certain types of systemic risk.

This adaptability is a key feature that separates emerging markets from more established economies.

Differing Economic Cycles

Emerging market economies often operate on different cycles than the US. This presents counter-cyclical investment opportunities.

- During periods of US economic slowdown or recession, some emerging markets might experience growth, offering diversification benefits.

- Similarly, during periods of high inflation in the US, certain emerging markets might offer inflation hedges or opportunities for alpha generation through strategic sector selection.

Understanding these differing economic cycles is key to exploiting the potential for counter-cyclical returns in emerging market investments.

Navigating the Risks of Emerging Market Investments

While offering significant potential, investing in emerging markets also entails risks. It is crucial to acknowledge and manage these risks effectively.

Geopolitical Risks

Geopolitical risks are inherent in emerging markets. Political instability, currency fluctuations, and regulatory changes can significantly impact investment returns.

- Political instability in a particular country can disrupt business operations and lead to capital flight.

- Currency fluctuations can erode returns, particularly if investments are not hedged against currency risk.

- Changes in regulations can impact the profitability of certain industries.

Effective risk mitigation strategies include diversifying investments across multiple countries and utilizing currency hedging techniques.

Liquidity Concerns

Liquidity in some emerging markets can be lower compared to the US markets.

- Trading volumes in some emerging market exchanges might be lower, making it challenging to buy or sell assets quickly at desired prices.

- This is especially true for smaller, less-established companies.

To mitigate liquidity risk, investors should focus on larger, more liquid companies listed on major emerging market exchanges. Careful selection of assets is paramount.

The Allure of Emerging Market Stocks

In conclusion, emerging market stocks offer compelling diversification benefits and resilience in the face of global uncertainty. Their lower correlation with the US market, coupled with the significant growth potential in many emerging economies, presents attractive opportunities for investors seeking superior risk-adjusted returns. While geopolitical risks and liquidity concerns need to be considered and managed effectively, a well-diversified portfolio that includes emerging market assets can enhance overall portfolio performance. Don't overlook the resilience of emerging market stocks. Learn more about diversifying your portfolio today!

Featured Posts

-

Tornado Season And Trumps Cuts Heightened Risk For Vulnerable Communities

Apr 24, 2025

Tornado Season And Trumps Cuts Heightened Risk For Vulnerable Communities

Apr 24, 2025 -

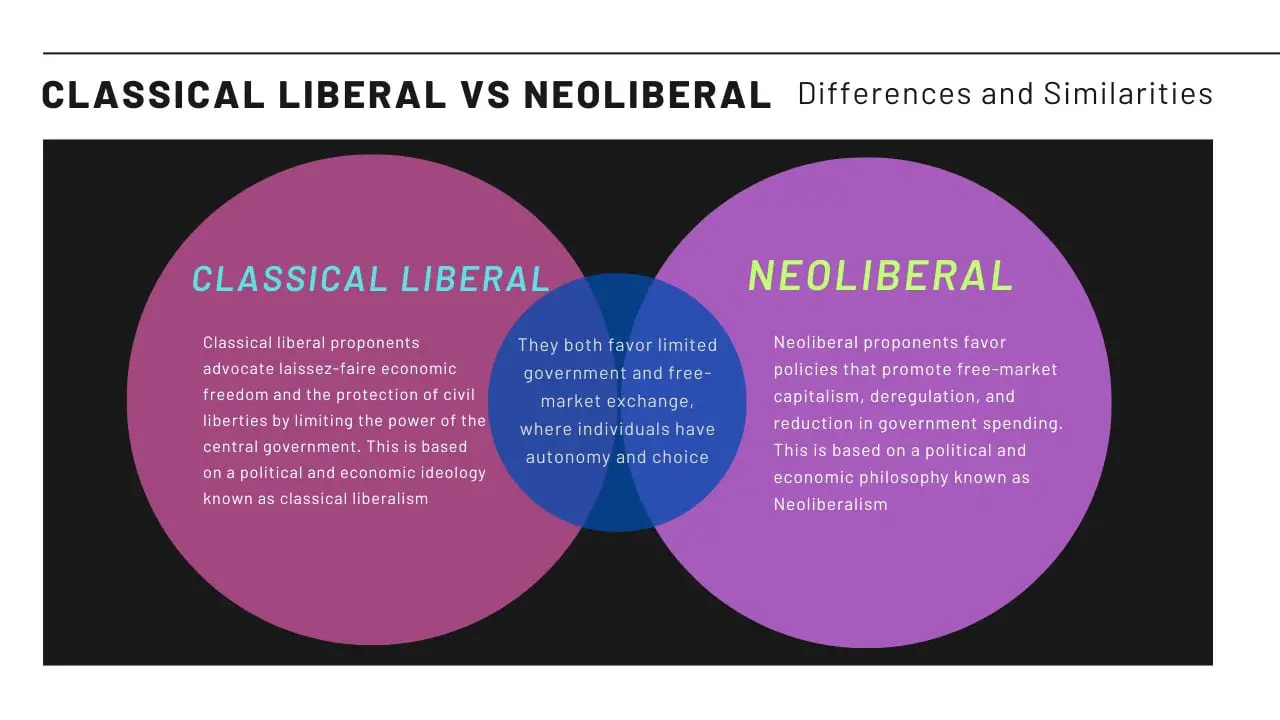

Liberal Fiscal Policies A Critical Analysis

Apr 24, 2025

Liberal Fiscal Policies A Critical Analysis

Apr 24, 2025 -

Ohio Train Disaster Prolonged Presence Of Toxic Chemicals In Buildings

Apr 24, 2025

Ohio Train Disaster Prolonged Presence Of Toxic Chemicals In Buildings

Apr 24, 2025 -

The Future Of Luxury Cars In China Lessons From Bmw And Porsche

Apr 24, 2025

The Future Of Luxury Cars In China Lessons From Bmw And Porsche

Apr 24, 2025 -

La Palisades Fire A List Of Celebrities Affected By Home Losses

Apr 24, 2025

La Palisades Fire A List Of Celebrities Affected By Home Losses

Apr 24, 2025