BofA On Stock Market Valuations: Why Investors Shouldn't Panic

Table of Contents

BofA's Assessment of Current Stock Market Valuations

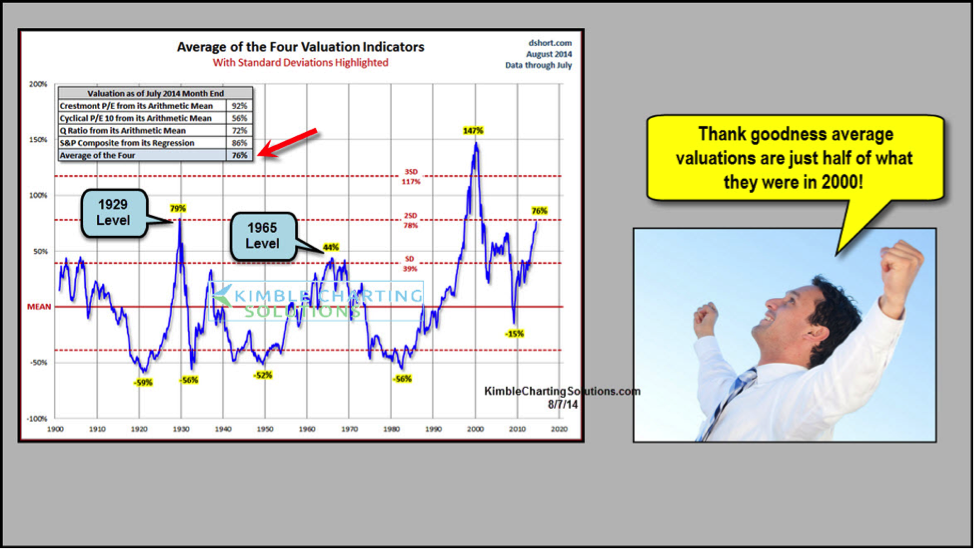

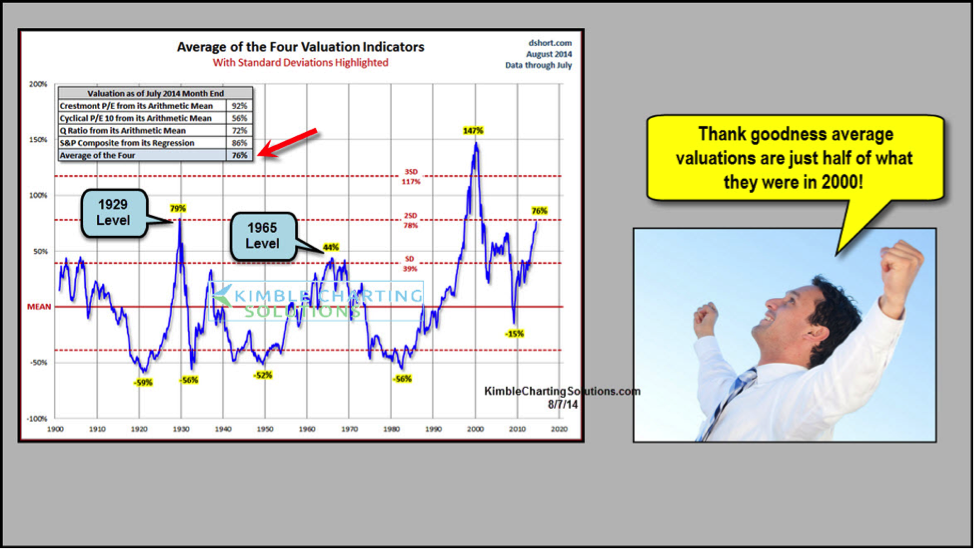

BofA's analysis of current stock market valuations provides a crucial counterpoint to the prevailing anxiety. Their reports offer a detailed look at various market indicators, aiming to separate short-term noise from long-term trends. BofA's assessment typically incorporates a range of valuation metrics, focusing not only on price-to-earnings ratios (P/E) but also considering factors like earnings growth forecasts, dividend yields, and macroeconomic conditions.

-

BofA's view on current P/E ratios compared to historical averages: While current P/E ratios might appear high compared to some historical averages, BofA often contextualizes this by highlighting periods of similar economic conditions and technological advancements. They acknowledge the higher valuations but tend to emphasize the underlying growth potential driving these figures.

-

BofA's predictions for future earnings growth: BofA's analysts typically incorporate detailed forecasts for future earnings growth in their valuation models. These projections influence their overall assessment of whether current valuations are justified by anticipated future performance.

-

Any specific sectors or stocks BofA highlights as particularly undervalued or overvalued: BofA's reports often pinpoint specific sectors or individual stocks that they believe are either undervalued by the market, offering attractive investment opportunities, or overvalued, requiring cautious consideration. These sector-specific analyses help investors refine their portfolio strategies.

-

Mention any caveats or limitations in BofA’s analysis: It is vital to acknowledge that no financial analysis is perfect. BofA's reports often include disclaimers and acknowledge the inherent uncertainties in predicting future market performance. Understanding these limitations is crucial for informed decision-making.

Factors Supporting a Cautious, Yet Optimistic, Outlook

Despite market volatility, BofA's relatively positive outlook is underpinned by several key factors. While acknowledging risks, their analysis suggests that a measured approach, rather than panic selling, is the more prudent strategy.

-

Explanation of how BofA factors in economic growth projections: BofA's analysis considers projected economic growth rates, both domestically and globally. Strong economic fundamentals often support higher valuations, offsetting some concerns about market highs.

-

Analysis of the impact of inflation and interest rate changes on valuations: The impact of inflation and interest rate adjustments on stock valuations is thoroughly examined. BofA's analysts assess how these factors influence corporate earnings and investor sentiment.

-

Assessment of the influence of geopolitical events on market sentiment: Geopolitical instability invariably influences market sentiment. BofA's reports integrate assessments of potential risks arising from geopolitical events, but often temper these concerns by emphasizing historical resilience of the market.

-

Discussion of BofA's perspective on long-term growth potential: A crucial component of BofA's analysis is their assessment of long-term economic growth potential. This focus on the long-term horizon informs their recommendation against hasty reactions to short-term market fluctuations.

Why Panic Selling is Often Counterproductive

Panic selling, driven by fear and emotional reactions, is often counterproductive. Market timing is notoriously difficult, and attempting to predict short-term market movements is rarely successful.

-

Statistics on the poor returns of market timing: Numerous studies show that investors attempting to time the market typically underperform those who maintain a consistent long-term investment strategy.

-

The importance of a well-diversified portfolio to mitigate risk: Diversification across various asset classes is a key risk-management strategy. A diversified portfolio can reduce the impact of losses in any single investment.

-

The benefits of maintaining investment discipline during periods of volatility: Sticking to a well-defined investment plan, even during market downturns, is crucial for long-term success. Disciplined investing mitigates emotional decision-making.

-

Tips for managing emotions during market downturns: Managing emotions during market volatility is essential. Techniques such as regularly reviewing your long-term goals, focusing on the big picture, and seeking professional advice can help.

Alternative Investment Strategies During Market Uncertainty

Investors seeking to adjust their approach without resorting to panic selling can explore alternative strategies.

-

Brief description of value investing and its potential benefits during market corrections: Value investing focuses on identifying undervalued assets. During market corrections, undervalued opportunities may present themselves.

-

Advantages of dividend investing as a source of income and stability: Dividend investing provides a stream of income, potentially mitigating some of the uncertainty associated with market fluctuations.

-

Explanation of dollar-cost averaging as a risk-management technique: Dollar-cost averaging involves investing a fixed amount at regular intervals, regardless of market fluctuations. This strategy reduces the impact of market timing.

-

The role of portfolio rebalancing in maintaining a desired asset allocation: Portfolio rebalancing helps maintain your desired asset allocation by buying and selling assets to return to your target percentages.

Conclusion

BofA's analysis of stock market valuations paints a picture of a market facing challenges but still possessing substantial long-term growth potential. Their insights suggest that panicking and selling off assets in response to short-term volatility is often a detrimental strategy. The importance of maintaining a long-term perspective and a well-defined investment strategy cannot be overstated. A well-diversified portfolio, coupled with disciplined investing, provides a robust approach to navigating market uncertainty. Don't let fear dictate your investment decisions. Understand BofA's insights on stock market valuations and develop a robust, long-term investment plan. Learn more about BofA's analysis and refine your approach to stock market valuations today.

Featured Posts

-

Anti Trump Protests A Cnn Politics Report

Apr 22, 2025

Anti Trump Protests A Cnn Politics Report

Apr 22, 2025 -

The End Of Ryujinx Nintendo Contact Leads To Development Halt

Apr 22, 2025

The End Of Ryujinx Nintendo Contact Leads To Development Halt

Apr 22, 2025 -

Understanding The Anti Trump Protests Sweeping The Us

Apr 22, 2025

Understanding The Anti Trump Protests Sweeping The Us

Apr 22, 2025 -

Ftc Appeals Microsoft Activision Merger Ruling

Apr 22, 2025

Ftc Appeals Microsoft Activision Merger Ruling

Apr 22, 2025 -

Analyzing The Economic Consequences Of Trumps Policies

Apr 22, 2025

Analyzing The Economic Consequences Of Trumps Policies

Apr 22, 2025