Analyzing The Economic Consequences Of Trump's Policies

Table of Contents

2.1. Tax Cuts and Jobs Act of 2017: A Boon or a Bane?

The Tax Cuts and Jobs Act (TCJA) of 2017, a cornerstone of Trump's economic agenda, significantly lowered both corporate and individual income tax rates. Proponents argued this would stimulate economic growth by encouraging increased investment and job creation. The corporate tax rate was slashed from 35% to 21%, a dramatic reduction intended to boost corporate profits and incentivize investment. Individual tax rates were also lowered, with the aim of increasing disposable income and consumer spending.

However, the effectiveness of the TCJA remains a subject of ongoing debate. While it did lead to a short-term surge in corporate profits and a rise in the stock market, the long-term effects are less clear. Critics point to the significant increase in the national debt as a major drawback. The increased deficit could ultimately hinder future economic growth and place a strain on government resources.

- Increased corporate profits: While corporate profits increased in the short term, the long-term impact on investment and job creation remains debated.

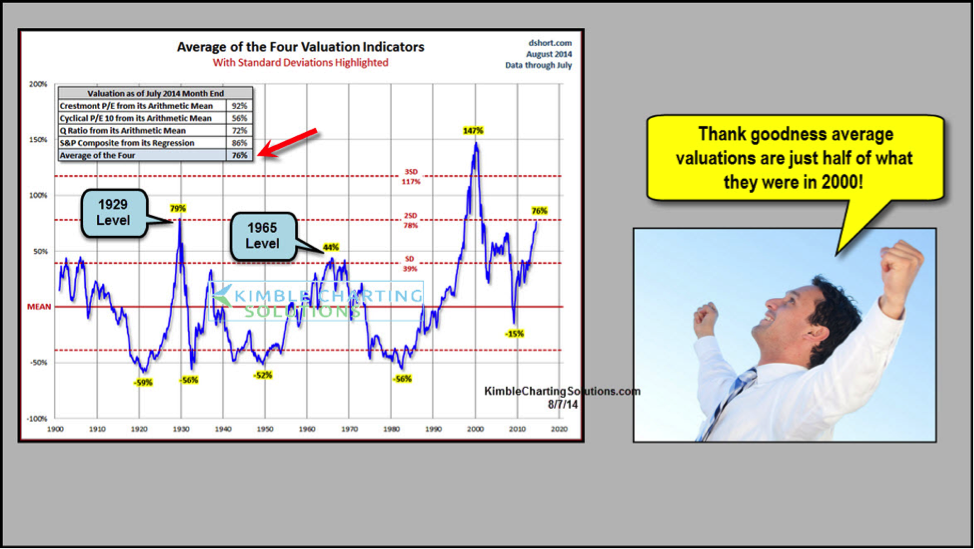

- Stock market surge (short-term vs. long-term): The stock market experienced a significant rise following the tax cuts, but this surge wasn't sustained and factors beyond the TCJA influenced market performance.

- Rising national debt: The TCJA significantly contributed to the growth of the national debt, raising concerns about long-term economic stability.

- Income inequality impacts: Critics argue the tax cuts disproportionately benefited high-income earners, exacerbating income inequality.

- Effect on small businesses: The impact on small businesses was mixed, with some benefiting from lower tax rates while others faced challenges related to increased competition and other economic factors.

2.2. Trade Wars and Protectionism: Winners and Losers

Trump's administration pursued a protectionist trade policy, initiating trade wars with several major economies, particularly China, Mexico, and the European Union. High tariffs were imposed on imported goods, aiming to protect American industries and reduce trade deficits. The economic consequences were complex and far-reaching.

While some domestic industries, like steel, saw temporary protection from foreign competition, the tariffs led to increased prices for consumers across various sectors. Furthermore, retaliatory tariffs from other countries negatively impacted American exporters, particularly in agriculture. The overall impact on American jobs is also debated, with some sectors experiencing job losses while others saw minimal changes.

- Increased prices for consumers: Tariffs increased the cost of imported goods, leading to higher prices for consumers.

- Trade deficits: Despite the protectionist measures, trade deficits persisted, indicating the complexity of altering global trade flows.

- Retaliatory tariffs from other countries: Other nations responded to the US tariffs with their own, creating a cycle of trade restrictions that hurt both American and foreign businesses.

- Impact on specific industries (e.g., farming, steel): The agricultural sector, for example, faced significant challenges due to retaliatory tariffs from China, while the steel industry saw temporary gains.

- Job creation/loss in different sectors: The net impact on job creation and loss is still being analyzed, with conflicting evidence across different industries.

2.3. Deregulation Efforts: Economic Stimulus or Environmental Risk?

The Trump administration pursued a significant deregulation agenda across various sectors, including environmental protection, finance, and healthcare. The stated goal was to reduce business costs and increase efficiency. However, this approach generated significant controversy, with critics raising concerns about potential environmental damage, increased financial risk, and long-term economic sustainability.

The rollback of environmental regulations, for example, sparked widespread concern about the impacts on climate change and public health. Similarly, deregulation in the financial sector raised questions about potential risks to financial stability. The long-term effects of these deregulation policies continue to be a focus of ongoing research and debate.

- Reduced environmental regulations and their consequences: The weakening of environmental regulations raised serious concerns about the long-term environmental and health consequences.

- Impact on financial stability: Deregulation in the financial sector raised concerns about potential risks to financial stability and increased vulnerability to economic shocks.

- Effects on specific industries (e.g., energy, finance): Specific industries experienced varied effects, with some benefiting from reduced regulatory burdens while others faced increased scrutiny or other challenges.

- Long-term economic sustainability: The long-term economic sustainability of a deregulatory approach remains a key question, with potential trade-offs between short-term gains and long-term risks.

2.4. The COVID-19 Pandemic and Economic Response

The COVID-19 pandemic significantly impacted the US economy during the Trump administration's final year. The administration's economic response included several stimulus packages, aimed at mitigating the economic fallout from the pandemic. These measures included direct payments to individuals, enhanced unemployment benefits, and loans to small businesses through the Paycheck Protection Program (PPP).

While these measures helped to prevent a deeper economic crisis, their effectiveness and long-term implications remain subject to debate. The pandemic's economic impact, coupled with the existing national debt, created significant long-term challenges for the US economy.

- Job losses and unemployment rates: The pandemic led to widespread job losses and a sharp increase in unemployment rates.

- Impact on small businesses and industries: Small businesses, particularly those in the hospitality and tourism sectors, were disproportionately affected by the pandemic-related lockdowns and restrictions.

- Effectiveness of stimulus packages: The effectiveness of the stimulus packages in preventing a deeper economic crisis is debated, with some arguing that more robust measures were needed.

- Long-term debt implications: The substantial increase in government spending to fund stimulus measures significantly increased the national debt.

Conclusion: Assessing the Long-Term Economic Effects of Trump's Policies

Analyzing the economic consequences of Trump's policies requires acknowledging the complex interplay of various factors. While some policies, such as the tax cuts, may have led to short-term gains in certain sectors, others, such as the trade wars and deregulation efforts, presented significant long-term challenges. The COVID-19 pandemic further complicated the economic landscape, highlighting the vulnerabilities of the US economy to unforeseen global events. Ongoing research and analysis are crucial to fully understand the lasting impact of these policies and to inform future economic decision-making. Further research and discussions on the lasting effects of Trump's economic policies and the economic consequences of such significant political shifts are needed. For more in-depth analysis, you can explore resources from the Congressional Budget Office, the Federal Reserve, and various academic institutions.

Featured Posts

-

Vehicle Subsystem Issue Causes Blue Origin Launch Cancellation

Apr 22, 2025

Vehicle Subsystem Issue Causes Blue Origin Launch Cancellation

Apr 22, 2025 -

Anchor Brewing Companys Closure What This Means For Craft Beer

Apr 22, 2025

Anchor Brewing Companys Closure What This Means For Craft Beer

Apr 22, 2025 -

T Mobile Hit With 16 Million Fine For Data Breaches Spanning Three Years

Apr 22, 2025

T Mobile Hit With 16 Million Fine For Data Breaches Spanning Three Years

Apr 22, 2025 -

Boosting Security Cooperation Recent Developments Between China And Indonesia

Apr 22, 2025

Boosting Security Cooperation Recent Developments Between China And Indonesia

Apr 22, 2025 -

Bof A On Stock Market Valuations Why Investors Shouldnt Panic

Apr 22, 2025

Bof A On Stock Market Valuations Why Investors Shouldnt Panic

Apr 22, 2025