FTC Appeals Microsoft-Activision Merger Ruling

Table of Contents

The FTC's Core Arguments Against the Merger

The FTC's appeal rests on two primary pillars: concerns about anti-competitive practices and the creation of a gaming monopoly.

Concerns about Anti-Competitive Practices

The FTC argues that the merger would grant Microsoft an unfair competitive advantage, ultimately harming consumers. This alleged anti-competitive behavior centers on several key concerns:

- Call of Duty Exclusivity: A central concern is Microsoft's potential to make Call of Duty exclusive to Xbox consoles and its gaming subscription service, Xbox Game Pass. This would severely disadvantage PlayStation and other competitors, potentially driving players towards the Xbox ecosystem. This strategic move could stifle innovation and competition within the gaming industry.

- Reduced Innovation: With less competition, the incentive for Microsoft to innovate and improve its gaming offerings might decrease. This could lead to stagnation and a decline in the quality of games available to consumers.

- Price Increases and Reduced Quality: The FTC argues that reduced competition could result in higher prices for games and a decline in overall game quality. A lack of competitive pressure allows companies to prioritize profit over innovation.

- Loss of Market Diversity: The merger could lead to a less diverse gaming market, limiting consumer choice and potentially stifling the emergence of new and innovative gaming companies.

Market Dominance and Monopoly Power

The FTC emphasizes that the merger would significantly increase Microsoft's market power, enabling it to dictate terms to developers, publishers, and consumers.

- Existing Market Share: Microsoft already holds a substantial market share in gaming consoles and the rapidly growing cloud gaming market.

- Activision Blizzard's Portfolio: Activision Blizzard boasts a vast portfolio of iconic franchises, including Call of Duty, World of Warcraft, Candy Crush, and many more. The acquisition would significantly expand Microsoft's market reach and influence.

- Bundling and Cross-Promotion: The combined entity could leverage bundling and cross-promotion strategies to lock out competitors and solidify its dominance in the gaming market. This could create significant barriers to entry for new players.

- Impact on the Ecosystem: The merger’s potential impact on the wider gaming ecosystem is a major concern, impacting everything from game development to the distribution of games.

Microsoft's Defense and Counterarguments

Microsoft has vigorously defended the merger, arguing that it will ultimately benefit gamers and the gaming industry.

Commitment to Maintain Call of Duty Availability

Microsoft has repeatedly pledged to maintain Call of Duty's availability on PlayStation and other platforms, aiming to alleviate the FTC's primary concern.

- Long-Term Agreements: Microsoft has proposed long-term agreements with Sony and other competitors to ensure continued access to Call of Duty.

- Broad Reach Importance: Microsoft emphasizes that maintaining Call of Duty's broad reach is vital to its own success, suggesting that restricting access would be financially detrimental.

- Addressing Market Dominance Concerns: Microsoft counters the FTC's claims of market dominance, arguing that the gaming market is dynamic and competitive.

Benefits of the Merger for Game Development and Innovation

Microsoft claims the merger will stimulate game development and innovation, bringing improved gaming experiences to consumers.

- Increased Development Resources: The merger would significantly increase the resources available for Activision Blizzard game development, potentially leading to more ambitious and innovative projects.

- Cross-Platform Advancements: Microsoft envisions cross-platform advancements and technological improvements resulting from the combined expertise and resources.

- Enhanced Developer Benefits: Microsoft claims the merger would benefit game developers and creators, providing them with more opportunities and resources.

Potential Outcomes and Implications of the Appeal

The FTC's appeal holds significant ramifications for the gaming industry and beyond.

Impact on the Gaming Industry

The outcome of this appeal will undoubtedly reshape the gaming industry, influencing competition, pricing, and the availability of major game titles.

- Uncertainty for Developers and Publishers: The appeal creates uncertainty for developers and publishers regarding future acquisitions and the regulatory landscape.

- Impact on Console Sales: The merger's outcome could significantly impact console sales and market share, potentially favoring one console over others.

- Cloud Gaming Consequences: The appeal has important implications for the future of cloud gaming and its competitive dynamics.

Legal Precedents and Future Regulatory Scrutiny

This case could establish a significant legal precedent for future mergers and acquisitions in the tech industry, leading to increased regulatory scrutiny of large corporate deals.

- Antitrust Enforcement Implications: The outcome will influence how antitrust laws are applied to future mergers in the tech sector.

- Changes to Merger Review Processes: The case might lead to changes in merger review processes and a stricter evaluation of potential anti-competitive effects.

- Growing Focus on Digital Market Competition: The appeal underscores the growing focus on competition within the digital marketplace and the need for robust regulatory oversight.

Conclusion

The FTC Appeals Microsoft-Activision Merger is a pivotal case with far-reaching implications for the gaming industry and beyond. The outcome will shape the competitive landscape, influencing pricing, innovation, and the availability of popular game titles. Understanding the nuances of this case – from the FTC's concerns about anti-competitive practices to Microsoft's defense of its proposed acquisition – is crucial. Stay informed about the developments in this landmark case as it unfolds, shaping the future of gaming. Keep an eye on the FTC Appeals Microsoft-Activision Merger for further updates and analysis.

Featured Posts

-

How Tariffs Threaten Chinas Export Led Growth Model

Apr 22, 2025

How Tariffs Threaten Chinas Export Led Growth Model

Apr 22, 2025 -

Cassidy Hutchinsons Fall Memoir Insights From A Key Jan 6 Witness

Apr 22, 2025

Cassidy Hutchinsons Fall Memoir Insights From A Key Jan 6 Witness

Apr 22, 2025 -

Saudi Aramco Invests In Chinas Byd For Ev Technology Exploration

Apr 22, 2025

Saudi Aramco Invests In Chinas Byd For Ev Technology Exploration

Apr 22, 2025 -

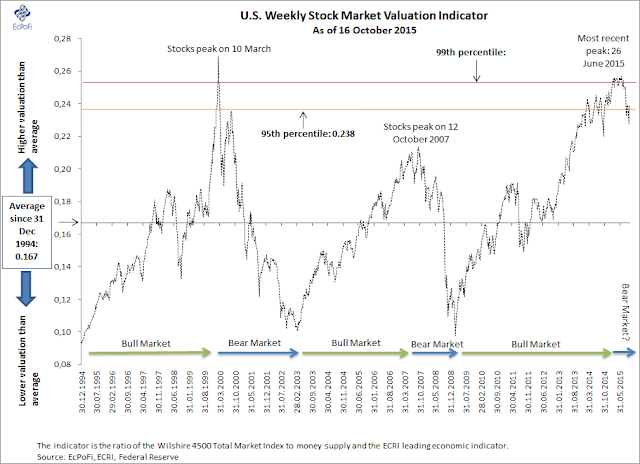

Stock Market Valuation Concerns Why Bof A Remains Optimistic

Apr 22, 2025

Stock Market Valuation Concerns Why Bof A Remains Optimistic

Apr 22, 2025 -

Exclusive Trump Administration To Sever 1 Billion In Harvard Funding

Apr 22, 2025

Exclusive Trump Administration To Sever 1 Billion In Harvard Funding

Apr 22, 2025