Stock Market Valuation Concerns: Why BofA Remains Optimistic

Table of Contents

BofA's Bullish Stance: Understanding the Rationale

Despite widespread concerns about inflated stock market valuation, BofA remains bullish. This positive outlook isn't based on blind optimism but rather on a thorough analysis of several key factors. Recent BofA reports and analyst statements consistently highlight a belief in sustained market growth, even with current valuation levels. Their confidence stems from a confluence of positive indicators, suggesting that the market's current valuation is justified and may even be undervalued considering future potential.

-

Strong corporate earnings growth projections: BofA projects robust earnings growth for numerous sectors, indicating a healthy underlying economy capable of supporting current valuations and fueling future gains. This growth is expected to outpace inflation, mitigating concerns about the impact of rising interest rates on corporate profitability.

-

Positive economic indicators: Low unemployment rates and sustained consumer spending point to a resilient economy. These factors are vital for supporting corporate performance and justifying higher stock prices. The continued strength of the consumer, a key driver of economic growth, is a significant factor in BofA's positive outlook.

-

Belief in sustained consumer spending: Despite inflationary pressures, consumer spending remains robust, indicating continued economic confidence. This suggests a solid foundation for corporate profitability and further stock market growth.

-

Expected impact of technological advancements and innovation: BofA acknowledges the transformative power of technological advancements, particularly in sectors like artificial intelligence and renewable energy. These innovations are projected to drive significant future growth and potentially justify current valuations.

Addressing the High Valuation Concerns: A Deeper Dive

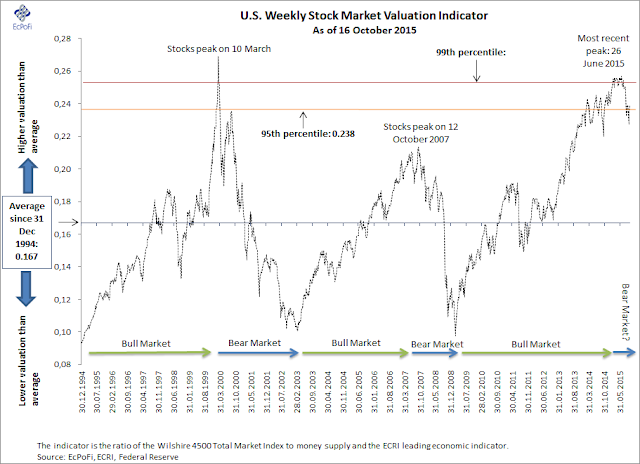

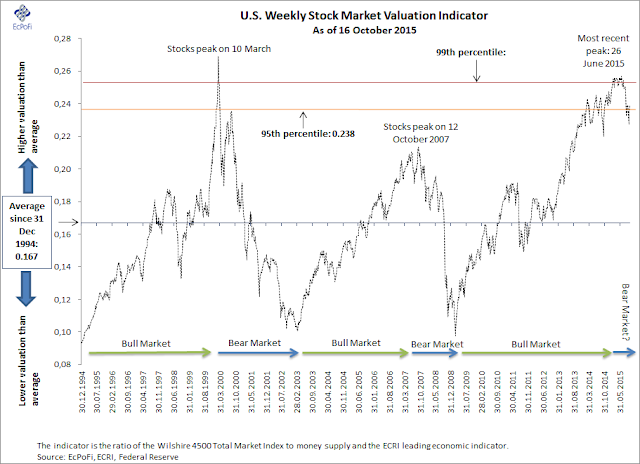

The prevailing concern surrounding current stock market valuations centers on high Price-to-Earnings (P/E) ratios and other valuation metrics. Many investors worry that these elevated valuations are unsustainable and may lead to a significant market correction. However, BofA counters these concerns by focusing on several key points.

-

Future earnings growth outweighing current valuations: BofA's analysts argue that projected future earnings growth will significantly outweigh current valuations, rendering the current P/E ratios less alarming in the long term. Their analysis suggests that the market is pricing in future growth, which is expected to materialize.

-

Specific sectors and companies undervalued: BofA identifies specific sectors and companies that they believe are currently undervalued. This targeted approach suggests that while some parts of the market may be overvalued, there remain pockets of opportunity for investors willing to conduct thorough due diligence.

-

Counterarguments to common valuation concerns: BofA directly addresses common concerns such as the impact of interest rate hikes. Their analysis indicates that while rising rates might temper growth slightly, the overall economic picture remains robust enough to support current valuations.

-

Potential market corrections and their limited impact: BofA acknowledges the possibility of market corrections but argues that any potential downturn would be relatively short-lived and have limited impact on long-term growth prospects. Their perspective emphasizes a long-term investment strategy.

Factors Contributing to BofA's Optimism: Beyond Earnings

BofA's optimism isn't solely based on earnings growth; other factors contribute significantly to their positive outlook.

-

Impact of government policies and infrastructure investments: Government initiatives like infrastructure spending can stimulate economic growth and positively impact various sectors, bolstering corporate earnings and stock valuations.

-

Analysis of global economic trends: BofA carefully analyzes global economic trends and their potential effect on the US market. While acknowledging global uncertainties, they believe that the overall global economic landscape is conducive to US market growth.

-

Technological disruption and market growth: The ongoing wave of technological disruption is seen as a catalyst for market growth, creating new opportunities and driving innovation across various sectors. This disruptive potential further supports their positive outlook.

-

Assessment of inflationary pressures: BofA acknowledges inflationary pressures but believes that their impact on stock valuations will be manageable and will be offset by strong earnings growth in several sectors.

The Role of Innovation in Redefining Stock Market Valuation

Technological innovation significantly impacts traditional stock market valuation metrics. The emergence of new business models and disruptive technologies challenges traditional valuation approaches. BofA recognizes this shift and adjusts its valuation analysis accordingly. They incorporate the potential for exponential growth from innovative companies and industries into their models, suggesting that traditional metrics alone may not fully capture the potential of some companies. This forward-looking approach is crucial to understanding their optimism.

Conclusion

BofA's optimistic outlook on stock market valuations is rooted in strong projected earnings growth, the positive impact of technological innovation, and a favorable macroeconomic environment. They address concerns about high valuations by highlighting future earnings growth potential, pointing out undervalued sectors, and acknowledging the possibility of short-term corrections without undermining the overall positive long-term outlook. While acknowledging inherent market risks, investors should consider BofA's analysis when formulating their stock market valuation strategies. Further research into BofA's reports and other reputable financial analyses is encouraged before making any investment decisions. Understanding the nuances of stock market valuation is crucial for informed investment choices.

Featured Posts

-

5 Key Dos And Don Ts To Succeed In The Private Credit Industry

Apr 22, 2025

5 Key Dos And Don Ts To Succeed In The Private Credit Industry

Apr 22, 2025 -

Lab Owner Pleads Guilty To Falsifying Covid Test Results

Apr 22, 2025

Lab Owner Pleads Guilty To Falsifying Covid Test Results

Apr 22, 2025 -

Why Automating Sneaker Production Is Harder Than You Think Focusing On Nike

Apr 22, 2025

Why Automating Sneaker Production Is Harder Than You Think Focusing On Nike

Apr 22, 2025 -

Swedens Tanks Finlands Troops A Look At The Pan Nordic Defense Force

Apr 22, 2025

Swedens Tanks Finlands Troops A Look At The Pan Nordic Defense Force

Apr 22, 2025 -

Trumps Supreme Court Defense Of Obamacare A Boost For Rfk Jr

Apr 22, 2025

Trumps Supreme Court Defense Of Obamacare A Boost For Rfk Jr

Apr 22, 2025