Why Is The Canadian Dollar Falling Against Major Currencies?

Table of Contents

Impact of Commodity Prices on the Canadian Dollar

The Canadian economy is heavily reliant on commodity exports, creating a strong correlation between commodity prices and the CAD's value. Fluctuations in these prices directly impact the Canadian dollar falling against other currencies.

Fluctuations in Oil Prices

Canada is a major oil producer, and oil prices significantly influence the CAD exchange rate. Decreased oil prices translate to lower export revenues, weakening the Canadian dollar.

- Recent Example: The recent dip in global oil prices due to [insert recent specific event impacting oil prices, e.g., OPEC+ production cuts, global recession fears] directly contributed to the Canadian dollar falling.

- Global Demand and Supply: Shifts in global oil demand and supply, influenced by factors like geopolitical events and the transition to renewable energy sources, heavily impact oil prices and, consequently, the CAD.

- Alternative Energy Sources: The increasing adoption of alternative energy sources poses a long-term risk to Canada's oil-dependent economy, potentially further weakening the CAD in the future.

Other Commodity Prices

Beyond oil, other commodities play a crucial role in the Canadian economy and the CAD's value. Changes in global demand for lumber, potash, and various metals significantly influence export revenues and the currency's strength.

- Lumber: Fluctuations in global housing markets directly impact lumber prices and, subsequently, the CAD.

- Potash: Global demand for fertilizers influences potash prices, impacting Canadian exports and the currency.

- Metals: Prices of metals like nickel, aluminum, and zinc, vital to Canada's mining sector, also contribute to the Canadian dollar's volatility.

- Commodity Price Risk: Over-reliance on a few key commodities exposes the Canadian economy to significant price volatility, making the CAD susceptible to fluctuations.

Influence of Interest Rate Differentials

Interest rate differentials between Canada and other major economies significantly impact the CAD's attractiveness to investors. The Bank of Canada's monetary policy plays a crucial role in this dynamic.

Bank of Canada Monetary Policy

The Bank of Canada's interest rate decisions influence the CAD's exchange rate. Higher interest rates generally attract foreign investment, strengthening the currency; conversely, lower interest rates can weaken it.

- Interest Rate Differentials: When Canadian interest rates are higher than those in other countries, investors are drawn to Canadian assets, increasing demand for the CAD and pushing its value up. The opposite is true when interest rates are lower.

- Recent Bank of Canada Decisions: [Mention recent Bank of Canada rate decisions and their perceived impact on the CAD. E.g., "The recent interest rate hike by the Bank of Canada aimed to combat inflation, but its impact on the CAD has been muted due to [explain reason]."]

Global Interest Rate Environment

Interest rate changes in other major economies, particularly the US, also influence the CAD. The US Federal Reserve's monetary policy decisions often impact the USD/CAD exchange rate.

- US Interest Rate Impact: When the US Federal Reserve raises interest rates, the US dollar strengthens, often leading to a weakening of the Canadian dollar.

Geopolitical Factors and Global Uncertainty

Geopolitical events and global uncertainty play a considerable role in influencing the CAD's value.

Global Economic Slowdown

A global economic slowdown reduces demand for Canadian exports, negatively impacting the CAD.

- Trade Wars and Political Instability: Trade wars and political instability in major economies can disrupt global trade and reduce demand for Canadian goods, weakening the CAD.

- Global Pandemics: Major global events like pandemics can severely disrupt supply chains and global demand, impacting the Canadian economy and the CAD.

US-Canada Relations

The strong economic relationship between the US and Canada significantly impacts the CAD. Changes in this relationship can influence the exchange rate.

- Trade Agreements: Modifications or renegotiations of trade agreements between the US and Canada can affect trade flows and the CAD's value.

- Political Tensions: Political tensions between the two countries can negatively impact economic cooperation and potentially weaken the CAD.

Canadian Economic Performance and Investor Sentiment

Canada's domestic economic performance and investor sentiment significantly influence the CAD.

Economic Growth and Employment

Strong economic growth and healthy employment figures boost investor confidence, strengthening the CAD. Conversely, weak economic data can weaken the currency.

- Economic Indicators: Key economic indicators like GDP growth, unemployment rates, and inflation figures significantly impact investor sentiment and the CAD.

Government Debt and Fiscal Policy

High government debt levels and unsustainable fiscal policies can erode investor confidence and weaken the CAD.

- Government Spending and Borrowing: Excessive government spending and borrowing can raise concerns about Canada's long-term economic stability, negatively impacting the CAD.

Conclusion

The Canadian dollar falling is a complex issue influenced by a multitude of factors. The interplay of commodity price fluctuations, interest rate differentials, geopolitical events, and domestic economic performance all contribute to the CAD's volatility. Understanding these dynamics is crucial for navigating the complexities of the global currency market. The weakening of the Canadian dollar necessitates careful monitoring of these factors and proactive adjustments in investment and business strategies. Staying informed about the latest economic news and consulting a financial advisor for personalized guidance on navigating the fluctuating Canadian dollar exchange rate is essential. Understanding why the Canadian dollar is falling is crucial for making informed decisions.

Featured Posts

-

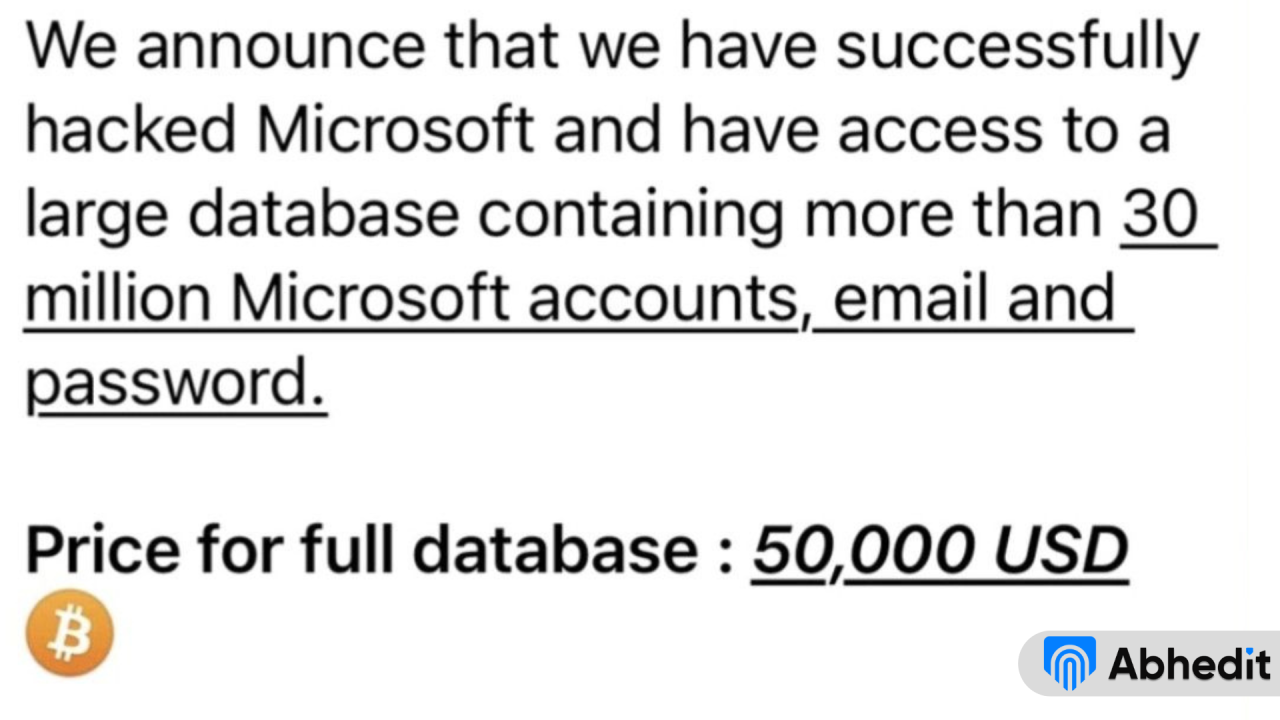

Federal Investigation Into Multi Million Dollar Office365 Data Breach

Apr 24, 2025

Federal Investigation Into Multi Million Dollar Office365 Data Breach

Apr 24, 2025 -

The Epa Vs Tesla And Space X Elon Musks Crypto Countermove

Apr 24, 2025

The Epa Vs Tesla And Space X Elon Musks Crypto Countermove

Apr 24, 2025 -

All Star Weekend Draymond Green Moses Moody And Buddy Hield In Attendance

Apr 24, 2025

All Star Weekend Draymond Green Moses Moody And Buddy Hield In Attendance

Apr 24, 2025 -

John Travolta Shares Personal Photo Calms Fan Anxiety

Apr 24, 2025

John Travolta Shares Personal Photo Calms Fan Anxiety

Apr 24, 2025 -

The Alarming Truth About John Travoltas Rotten Tomatoes Rating

Apr 24, 2025

The Alarming Truth About John Travoltas Rotten Tomatoes Rating

Apr 24, 2025