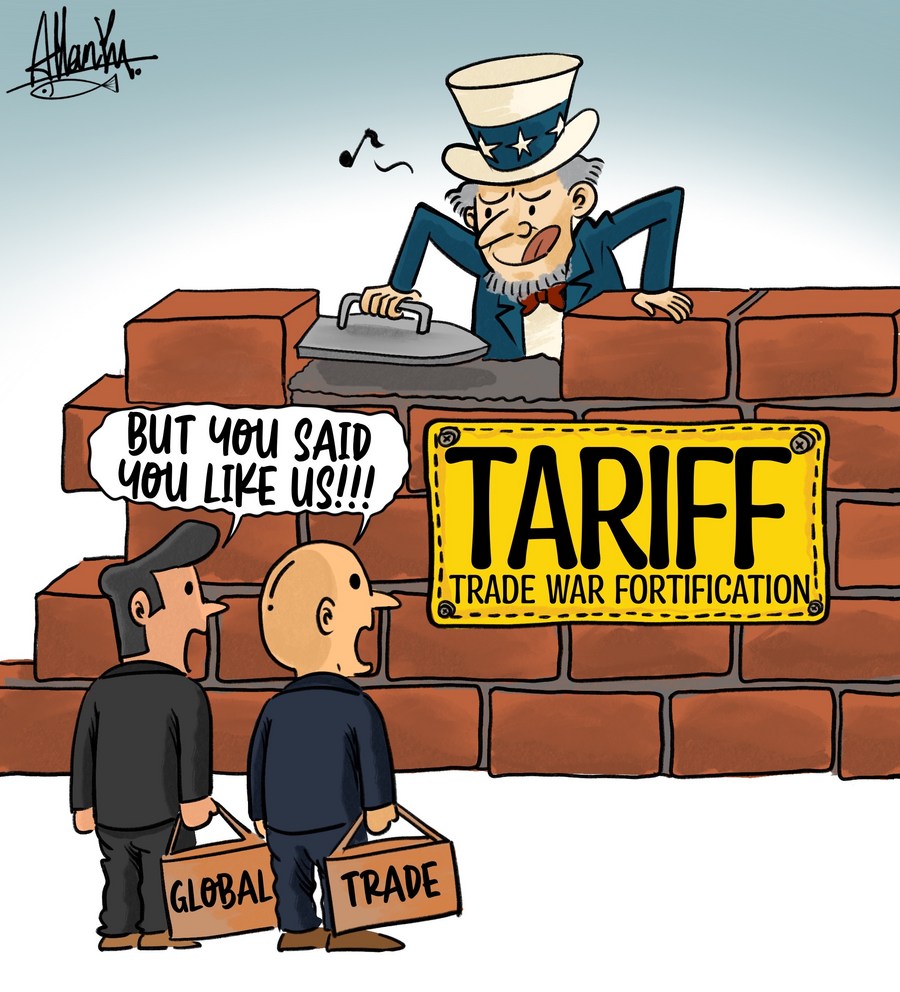

US Tariff Impact On LPG: China Turns To Middle East For Supply

Table of Contents

The US Tariff Impact on Chinese LPG Imports

The imposition of US tariffs on LPG imports to China significantly altered the landscape of this energy market. While the exact timing and specifics of these tariffs varied, their impact was undeniable. Before the tariffs, China relied considerably on US LPG supplies, viewing them as a reliable and relatively cost-effective source. The tariffs, however, dramatically increased the price of US LPG in China, making it less competitive against alternative suppliers. This led to:

- Increased price of US LPG in China: The tariffs added a substantial cost to each shipment, directly impacting the final price for Chinese consumers and industries.

- Reduced competitiveness of US LPG against other sources: Middle Eastern and other international suppliers became far more attractive due to lower costs.

- Disruption to established trade relationships: Existing contracts and partnerships between US and Chinese LPG companies were significantly affected, resulting in renegotiations or complete termination.

The quantitative impact of these tariffs is difficult to precisely measure without access to confidential trade data. However, it is widely acknowledged that import volumes from the US plummeted after the tariff implementation, forcing China to seek alternative sources to meet its growing energy demands.

China's Diversification of LPG Supply Sources

Facing reduced access to US LPG and escalating costs, China strategically shifted its focus to Middle Eastern suppliers. Countries like Saudi Arabia and Qatar, with their vast LPG reserves and production capabilities, emerged as key alternatives. This shift wasn't merely a reactive measure; it was a calculated strategic move driven by several factors:

- Price competitiveness: Middle Eastern LPG often offered lower prices compared to US LPG, even after factoring in transportation costs.

- Geopolitical factors: Strengthening ties with Middle Eastern nations offered China greater geopolitical influence and diversified its energy partnerships, reducing reliance on any single supplier.

- Reliability of supply: Middle Eastern producers could offer long-term contracts and consistent supply, providing greater predictability for China's energy planning.

This pivot involved significant investment:

- Increased investment in infrastructure: China invested heavily in building new import terminals and pipelines to accommodate the increased flow of LPG from the Middle East.

- Strengthening of diplomatic and trade relationships: China strengthened diplomatic ties and trade agreements with key Middle Eastern nations to secure favorable terms for LPG imports.

- Long-term contracts secured with Middle Eastern producers: China negotiated long-term contracts to guarantee a stable supply of LPG at competitive prices.

Geopolitical Implications of the Shift

This strategic shift in LPG supply chains carries significant geopolitical implications. The reduced reliance on US LPG impacts US-China relations, potentially adding another layer of complexity to their already strained trade relationship. The consequences extend beyond bilateral ties, influencing the global LPG market and energy security:

- Increased influence of Middle Eastern nations in the global LPG market: The Middle East's role as a major LPG supplier is enhanced, potentially impacting global pricing and market dynamics.

- Potential for price volatility as supply chains adjust: The transition to new supply chains can lead to short-term price fluctuations as markets adapt to the change.

- Shifting global power dynamics in energy trade: The shift alters the global energy landscape, potentially reshaping alliances and power dynamics among energy-producing and consuming nations.

Future Outlook for LPG Trade and the US-China Relationship

Forecasting future LPG trade patterns requires careful consideration of various factors. The continued growth of China's energy demands, combined with the established partnerships with Middle Eastern producers, suggests a sustained reliance on this supply route. However, future US-China trade negotiations could potentially influence LPG trade dynamics. Any easing of US tariffs or the establishment of new trade agreements could lead to a partial return of US LPG to the Chinese market.

The long-term implications are significant:

- Potential for increased competition among LPG suppliers: The shift could spark greater competition among LPG producers globally, potentially benefiting consumers through lower prices.

- Need for greater transparency and stability in global LPG markets: A more transparent and stable LPG market is crucial to ensure reliable energy supplies and mitigate price volatility.

- Opportunities for new partnerships and investment in the energy sector: This transition presents opportunities for new partnerships and investments in LPG infrastructure and related technologies.

Conclusion: Understanding the Shifting Sands of LPG Trade and the US-China Dynamic

The imposition of US tariffs on LPG imports has profoundly impacted China's energy strategy, leading to a significant shift towards Middle Eastern suppliers. This shift carries broad geopolitical implications, altering the global LPG market, influencing US-China relations, and reshaping global energy dynamics. Understanding the interplay between US tariffs, LPG supply chains, and evolving China-Middle East relations is crucial for navigating the complexities of the global energy market. Stay updated on the latest developments in US tariff impacts on LPG and explore further research on the global LPG market to fully grasp the implications of this dynamic shift. Understanding this evolving landscape is key for investors, policymakers, and anyone interested in global energy security.

Featured Posts

-

Chinas Rare Earth Export Curbs And The Future Of Teslas Optimus Robot

Apr 24, 2025

Chinas Rare Earth Export Curbs And The Future Of Teslas Optimus Robot

Apr 24, 2025 -

Nba All Star Game Draymond Green Moses Moody And Buddy Hield Participate

Apr 24, 2025

Nba All Star Game Draymond Green Moses Moody And Buddy Hield Participate

Apr 24, 2025 -

A Responsible Fiscal Plan For Canada An Alternative To Liberal Spending

Apr 24, 2025

A Responsible Fiscal Plan For Canada An Alternative To Liberal Spending

Apr 24, 2025 -

Teslas Q1 2024 Financial Results Significant Net Income Decrease

Apr 24, 2025

Teslas Q1 2024 Financial Results Significant Net Income Decrease

Apr 24, 2025 -

Missed Mammogram Leads To Tina Knowles Breast Cancer Diagnosis Prevention Strategies

Apr 24, 2025

Missed Mammogram Leads To Tina Knowles Breast Cancer Diagnosis Prevention Strategies

Apr 24, 2025