A Responsible Fiscal Plan For Canada: An Alternative To Liberal Spending

Table of Contents

Addressing Canada's Debt Burden

Canada's growing national debt poses significant long-term risks. The continued accumulation of debt leads to reduced credit ratings, increased interest payments, and ultimately, restricts government spending in crucial areas like healthcare and education. This unsustainable trajectory necessitates immediate action.

- Examples of potential wasteful spending:

- [Specific example 1 – Source: Government report or news article]

- [Specific example 2 – Source: Government report or news article]

- [Specific example 3 – Source: Government report or news article]

To alleviate this burden, we propose several concrete measures:

- Freezing or reducing non-essential government spending: A thorough review of government programs and spending is needed to identify areas ripe for cuts or consolidation. This includes eliminating redundant programs and streamlining bureaucratic processes.

- Implementing more efficient and effective government programs: Investing in technology and data-driven decision-making can improve program efficiency and reduce waste.

- Cutting wasteful bureaucracy: Reducing the number of government employees in non-essential roles and restructuring departments can lead to significant cost savings.

Prioritizing Essential Government Services

While fiscal responsibility demands spending cuts, it's crucial to protect investments in essential services. Healthcare, education, and infrastructure are fundamental to a thriving society and a strong economy. Cutting these services would have devastating long-term consequences. Instead, we propose strategic investments that maximize impact and promote long-term growth.

- Strategic Investments:

- Infrastructure: Investing in renewable energy projects, public transportation, and modernizing our aging infrastructure creates jobs, boosts economic activity, and reduces our environmental footprint.

- Human Capital: Investing in skills training and education reform enhances the workforce's productivity and competitiveness, making Canada more attractive for businesses and attracting high-skilled workers.

These investments contribute to a sustainable future by:

- Improving the quality of life for Canadians.

- Enhancing Canada's global competitiveness.

- Fostering long-term economic growth.

Promoting Economic Growth through Tax Reform

A well-designed tax system is essential for economic growth. The current system, in some aspects, may stifle private sector investment and job creation. Therefore, strategic tax reforms are needed to stimulate economic activity.

- Tax Reform Proposals:

- Reducing corporate tax rates: This incentivizes businesses to invest, expand, and create jobs, leading to increased economic activity and higher tax revenues in the long run.

- Simplifying the tax code: Reducing complexity makes it easier for businesses to comply, encourages investment, and frees up resources that can be used for growth.

These reforms, supported by economic modeling and projections (where available), will lead to:

- Increased private sector investment.

- Higher rates of job creation.

- Increased tax revenues in the long term.

Enhanced Transparency and Accountability

Restoring public trust in government requires a commitment to transparency and accountability in financial matters. Open and accessible financial data empowers citizens to hold their elected officials accountable for their spending decisions.

- Measures to Enhance Transparency and Accountability:

- Stricter auditing processes: Independent audits of government programs and spending ensure that funds are used effectively and efficiently.

- Publicly accessible budget data: Making budget information readily available to the public increases transparency and enables better scrutiny of government spending.

- Independent reviews of government programs: Regular, independent evaluations of government programs ensure that they are achieving their intended outcomes and are cost-effective.

A Path Towards Fiscal Responsibility in Canada

This proposed responsible fiscal plan focuses on a multi-pronged approach: reducing Canada’s debt burden through targeted spending cuts and increased efficiency; prioritizing crucial government services while ensuring they are delivered effectively; stimulating economic growth through tax reforms; and enhancing transparency and accountability in all aspects of government finance. Adopting such a plan is not merely a matter of sound financial management; it's an investment in a stronger, more prosperous future for all Canadians. A fiscally responsible government is better equipped to handle future challenges and ensure a higher quality of life for generations to come.

Demand a responsible fiscal plan for Canada – contact your elected officials today and let them know you support fiscal responsibility and a more sustainable future for our nation.

Featured Posts

-

Car Dealerships Step Up Resistance To Mandatory Ev Sales

Apr 24, 2025

Car Dealerships Step Up Resistance To Mandatory Ev Sales

Apr 24, 2025 -

The Bold And The Beautiful Recap April 3 Liams Health Crisis Following A Major Fallout With Bill

Apr 24, 2025

The Bold And The Beautiful Recap April 3 Liams Health Crisis Following A Major Fallout With Bill

Apr 24, 2025 -

Us Tariff Impact On Lpg China Turns To Middle East For Supply

Apr 24, 2025

Us Tariff Impact On Lpg China Turns To Middle East For Supply

Apr 24, 2025 -

Is The 77 Inch Lg C3 Oled Tv Worth It My Experience

Apr 24, 2025

Is The 77 Inch Lg C3 Oled Tv Worth It My Experience

Apr 24, 2025 -

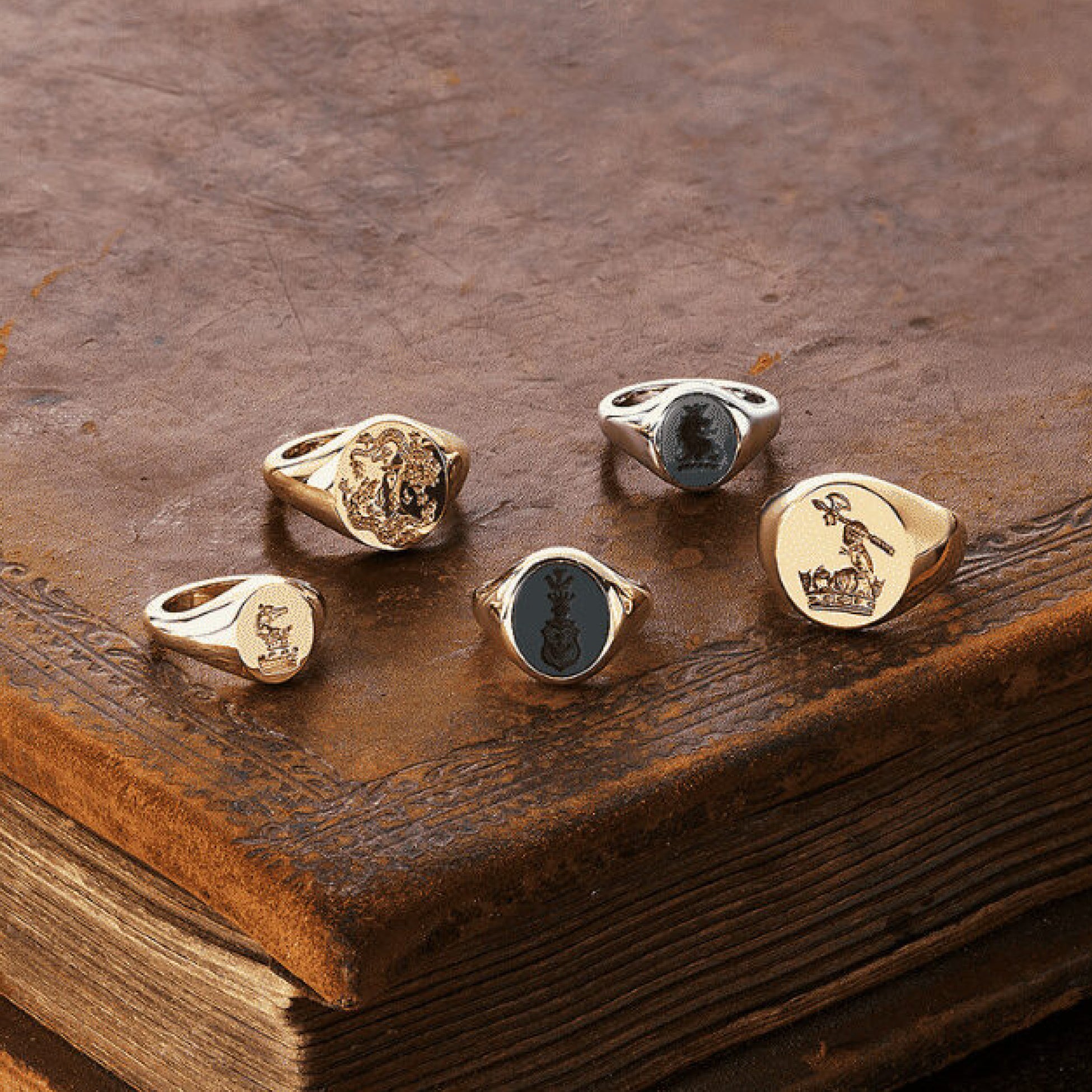

Pope Francis Signet Ring Its Fate After His Death And The Significance Of The Papal Seal

Apr 24, 2025

Pope Francis Signet Ring Its Fate After His Death And The Significance Of The Papal Seal

Apr 24, 2025