US Stock Futures Surge After Trump Comments On Powell

Table of Contents

Trump's Comments and Their Market Impact

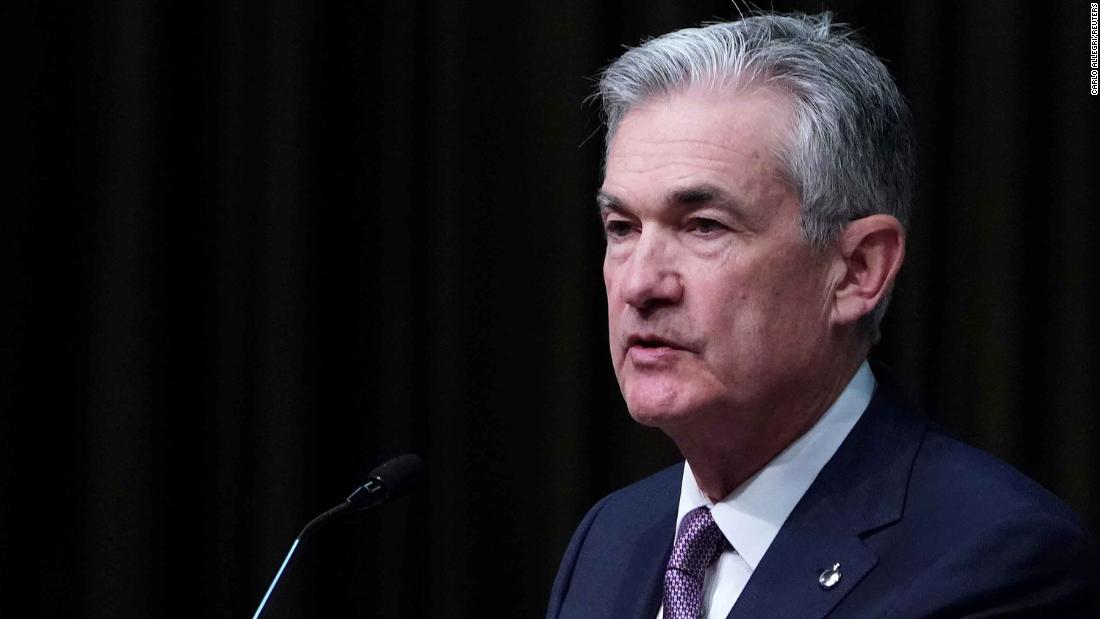

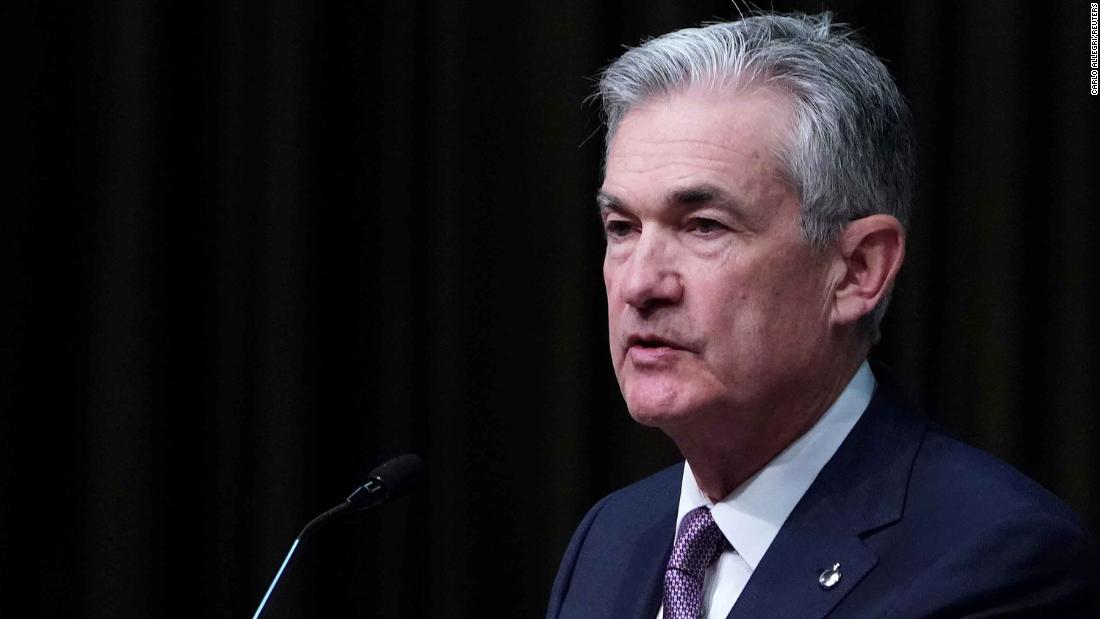

Former President Trump's recent remarks on Federal Reserve Chairman Powell and the current monetary policy sparked a considerable ripple effect in the financial markets. While the exact nature of his comments varied, they generally expressed a critical view of the Fed's actions, particularly concerning interest rate hikes.

- Specific quotes from Trump (if available): [Insert specific quotes if available, attributing the source. If not available, replace with a general description, e.g., "Trump criticized the Fed's 'slow' response to inflation and suggested that higher interest rates were harming the economy."]

- Type of comments: The comments were largely critical, suggesting that Powell's monetary policy was too restrictive and was negatively impacting economic growth. He implied that the Fed was not acting swiftly enough to curb inflation, and potentially damaging the economy in the process.

- Immediate market response: Following Trump's comments, US stock futures experienced a noticeable increase. The Dow Jones Industrial Average futures and S&P 500 futures both saw a significant upward trend, indicating a positive market response to the perceived shift in political pressure on the Fed.

Analyzing the Volatility

The market's reaction to Trump's comments can be attributed to several factors. Investor sentiment, heavily influenced by the perceived change in political pressure on the Fed, played a key role. The market seemed to interpret Trump's criticism as a potential signal for future policy adjustments, potentially leading to looser monetary policy. Speculation about the Fed's future actions also fueled volatility.

- Impact on different sectors: While the overall market reacted positively, the impact varied across sectors. Technology stocks, which are typically sensitive to interest rate changes, may have shown particularly strong gains.

- Short-term vs. long-term implications: The short-term impact was a surge in futures, indicating a positive short-term outlook. However, the long-term implications remain uncertain and will depend on the Fed's response and overall economic conditions.

- Role of media coverage: Extensive media coverage of Trump's comments amplified their impact, contributing to the market's heightened volatility. News reports, analyses, and expert opinions all shaped investor perceptions and trading decisions.

The Role of the Federal Reserve (Powell's Response)

The Federal Reserve's current monetary policy, aimed at controlling inflation, is likely to remain a central focus, regardless of political pressure. While the Fed strives for independence from political influence, Trump's comments highlight the ongoing tension between the executive branch and the central bank.

- Powell's recent statements on interest rates and inflation: [Include recent statements by Chairman Powell on interest rates and inflation targets. Cite the source.]

- Federal Reserve's independence and its relationship with the executive branch: The Fed's independence is constitutionally protected, aiming to prevent political interference in monetary policy decisions. However, such high-profile statements can impact investor confidence and create uncertainty in the markets.

- Potential consequences for the Fed's future decisions: While the Fed is unlikely to change its course solely based on political pressure, the ongoing debate about inflation and economic growth could influence its future strategies regarding interest rate adjustments.

Inflation and Economic Outlook

Trump's comments, and the subsequent market reaction, reflect the ongoing concerns about inflation and the broader economic outlook. The current inflationary environment has forced the Fed to adopt a more restrictive monetary policy, leading to concerns about potential economic slowdown.

- Current inflation rate and projections: [Insert current inflation data and projections from reliable sources.]

- Impact on consumer spending and business investment: High inflation and interest rates can dampen consumer spending and business investment, creating a complex economic landscape.

- Potential for future interest rate adjustments: The Fed's future decisions on interest rates will depend on a variety of factors, including inflation data, economic growth, and labor market conditions.

Investor Sentiment and Trading Strategies

The surge in US stock futures following Trump's comments reflects a shift in investor sentiment. Increased volatility naturally leads to changes in investment strategies.

- Increased trading volume in US stock futures: The news triggered a significant rise in trading volume as investors reacted to the uncertainty and potential opportunities.

- Changes in investment portfolios: Investors may have adjusted their portfolios based on their risk tolerance and assessment of the situation. Some may have chosen to increase their holdings, while others may have opted for more conservative strategies.

- Strategies for managing risk (hedging, diversification): Hedging strategies, such as options trading, and diversification across different asset classes become crucial for managing risk in times of heightened volatility.

- Opportunities and challenges for different investor types: Short-term traders might look to capitalize on the increased volatility, while long-term investors might see this as an opportunity to acquire undervalued assets or adjust their long-term strategies.

Conclusion

In summary, former President Trump's comments on Chairman Powell and the Federal Reserve's monetary policy significantly impacted US stock futures, highlighting the profound influence of political statements on market dynamics. The subsequent surge reflects investor sentiment and speculation about potential changes in future monetary policy. The Fed's response, the ongoing inflationary concerns, and the subsequent investor reactions create a complex interplay influencing the economic landscape.

To make informed decisions, it's crucial to monitor US stock futures closely, stay updated on Federal Reserve policy, and understand the impact of political commentary on market trends. Carefully analyze your investment strategy in light of these events. For further insights, consider consulting reputable financial news sources and seeking advice from a qualified financial advisor to navigate the volatility of US stock futures and other related market fluctuations.

Featured Posts

-

California Gas Prices Surge Governor Newsom Seeks Industry Partnership

Apr 24, 2025

California Gas Prices Surge Governor Newsom Seeks Industry Partnership

Apr 24, 2025 -

Latest Oil Prices Market News And Analysis For April 23

Apr 24, 2025

Latest Oil Prices Market News And Analysis For April 23

Apr 24, 2025 -

Chinas Rare Earth Export Curbs And The Future Of Teslas Optimus Robot

Apr 24, 2025

Chinas Rare Earth Export Curbs And The Future Of Teslas Optimus Robot

Apr 24, 2025 -

Is Betting On Natural Disasters Like The La Wildfires The Future Of Gambling

Apr 24, 2025

Is Betting On Natural Disasters Like The La Wildfires The Future Of Gambling

Apr 24, 2025 -

Understanding Stock Market Valuations Bof As View On Investor Concerns

Apr 24, 2025

Understanding Stock Market Valuations Bof As View On Investor Concerns

Apr 24, 2025