Understanding The Bank Of Canada's Pause: Insights From FP Video's Economists

Table of Contents

The Rationale Behind the Pause

The Bank of Canada's decision to pause interest rate increases wasn't arbitrary. It's a calculated move based on a complex assessment of current economic conditions and future projections. The Bank's reasoning hinges on several key factors influencing their monetary policy.

-

Inflation Rate Trajectory: While inflation remains above the Bank's target of 2%, recent data suggests a slowing trend. The Bank is closely monitoring this trajectory to determine if current measures are sufficient to bring inflation down sustainably. This careful observation is a crucial part of understanding the Bank of Canada's pause.

-

Impact of Previous Rate Increases: The cumulative effect of previous interest rate increases is now being felt across the Canadian economy. The Bank is assessing the lag effects of these hikes on consumer spending, business investment, and overall economic growth. The interest rate pause allows time to gauge the full impact of prior actions.

-

Economic Growth and Potential Risks: The Bank of Canada is walking a tightrope. While aiming to curb inflation, it also needs to avoid triggering a significant economic slowdown or recession. The pause reflects a cautious approach, allowing the Bank to assess the current growth rate and identify potential vulnerabilities.

-

Key Economic Indicators: The Bank's decision is underpinned by a thorough analysis of various economic indicators, including employment figures, consumer confidence indices, and housing market data. These data points provide crucial insights into the overall health of the Canadian economy and inform the Bank's monetary policy decisions. Understanding these indicators is key to grasping the nuances of the Bank of Canada's pause.

FP Video Economists' Perspectives on the Pause

FP Video's team of renowned economists offers insightful analysis of the Bank of Canada's pause, providing valuable perspectives and predictions. Their expertise in analyzing Canadian monetary policy offers a multifaceted view of this crucial decision.

-

Divergent Views, Shared Concerns: While the economists at FP Video generally agree on the rationale behind the pause, their predictions regarding future rate changes vary. Some anticipate further increases based on persistent inflationary pressures, while others foresee a prolonged pause or even potential rate cuts depending on upcoming economic data.

-

Key Arguments and Predictions: The FP Video analysis highlights concerns about lingering inflation, particularly in the service sector. Conversely, other key arguments emphasize the potential for a sharper-than-anticipated economic slowdown, requiring a more accommodative monetary policy stance.

-

Alternative Scenarios: FP Video's economists present various alternative scenarios, ranging from a continuation of the pause to further rate hikes or even rate cuts. These scenarios are presented with an explanation of their underlying assumptions, providing context for their respective predictions.

-

FP Video Analysis Quotes: (Insert relevant quotes from the FP Video analysis here, attributing them correctly to the specific economist.) This will add credibility and authority to your article.

Implications of the Bank of Canada's Pause for the Canadian Economy

The Bank of Canada's interest rate pause will undoubtedly have significant implications across various sectors of the Canadian economy. Understanding these potential effects is critical for businesses and individuals alike.

-

Consumer Spending and Borrowing: The pause might provide some relief to consumers facing high borrowing costs, potentially boosting consumer spending. However, this also depends on inflation's trajectory and consumer confidence levels.

-

Housing Market and Real Estate: The housing market remains sensitive to interest rate changes. While the pause could stabilize prices to some extent, the market's long-term outlook remains uncertain. Further analysis is needed to fully assess the effects of the Bank of Canada's decision on the housing market.

-

Employment and Job Growth: The impact on employment will depend on the interplay between reduced borrowing costs and the ongoing effects of previous rate increases. Continued monitoring of employment data is essential to gauge the long-term consequences of this pause.

-

Businesses and Investments: Businesses may adjust their investment plans in response to the pause, which could impact economic growth. Careful consideration of how this pause affects business confidence is crucial for understanding the overall impact on the Canadian economy.

Looking Ahead: What to Expect from the Bank of Canada

Predicting the Bank of Canada's future moves is challenging, but several factors will likely influence upcoming monetary policy decisions. The ongoing analysis provided by FP Video helps navigate these uncertainties.

-

Inflation Data and Economic Growth: Inflation figures and economic growth rates will be key determinants of future rate adjustments. Any deviation from the Bank's projections could trigger a change in monetary policy.

-

FP Video Economists' Forecasts: FP Video's economists offer valuable insights into potential future interest rate adjustments, providing a range of possibilities depending on evolving economic circumstances.

-

Global Economic Conditions: Global economic trends and geopolitical events will also play a role in shaping the Bank of Canada's future decisions. These external factors add complexity to forecasting the Bank's response.

-

Upcoming Economic Data Releases: Key economic data releases, such as GDP figures and employment reports, will provide vital information for informing the Bank’s next move. Monitoring these data releases is essential for staying abreast of the latest developments and anticipating potential future policy changes.

Conclusion

The Bank of Canada's pause is a complex decision with far-reaching implications for the Canadian economy. FP Video's economists provide crucial insights into the rationale behind this move and its potential consequences for various sectors. Understanding the Bank of Canada's pause is crucial for navigating the current economic climate and preparing for future market adjustments. To gain a more comprehensive understanding of the Bank of Canada's pause and its implications, learn more by watching the FP Video analysis. Understand the implications of the Bank of Canada's interest rate decision and stay informed about the future of Canadian monetary policy. Watch the FP Video for in-depth analysis of the Bank of Canada's pause.

Featured Posts

-

Joint Security Initiatives China And Indonesias Growing Partnership

Apr 22, 2025

Joint Security Initiatives China And Indonesias Growing Partnership

Apr 22, 2025 -

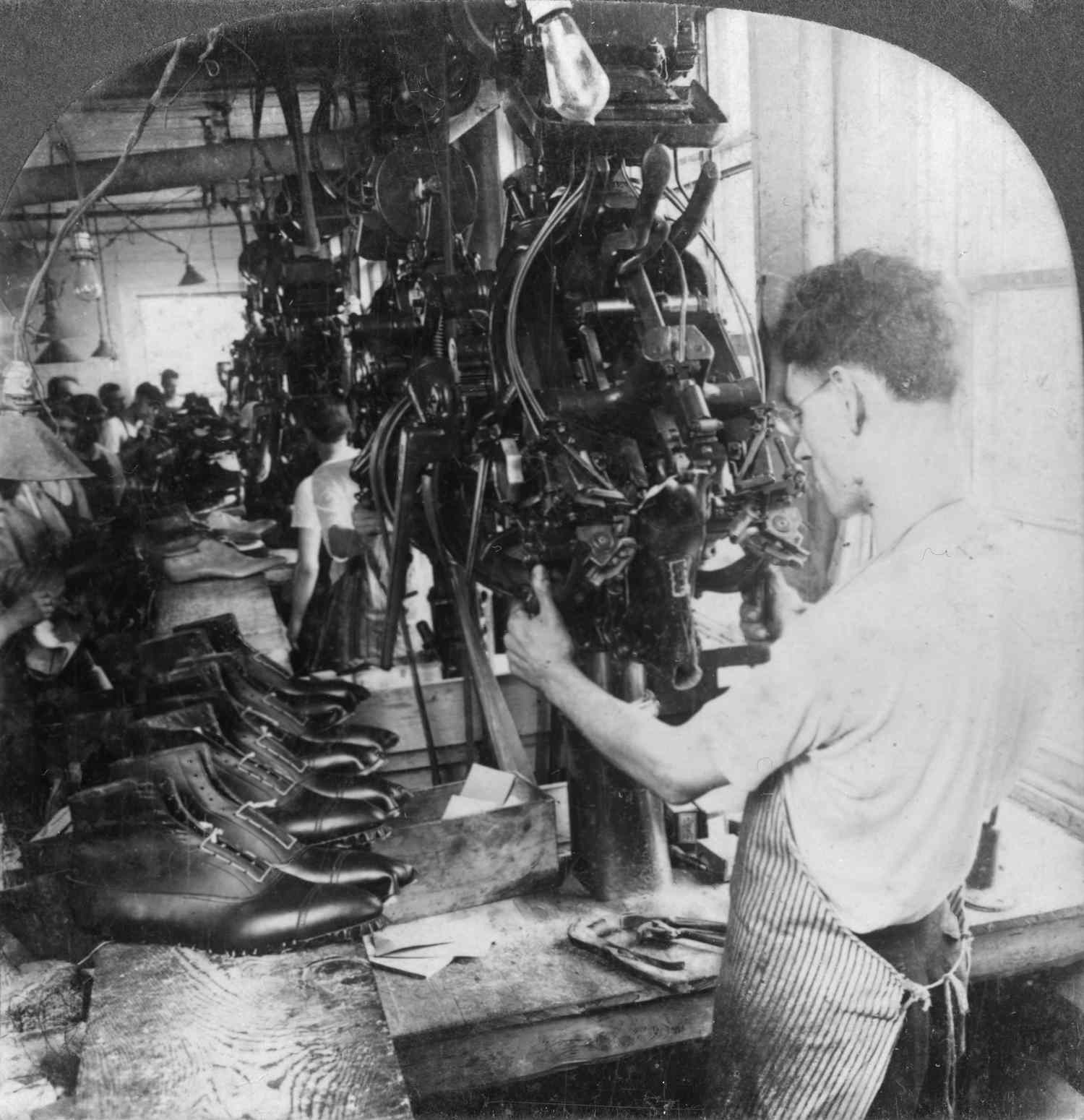

Robots Vs Sneakers The Complexities Of Automated Shoe Production

Apr 22, 2025

Robots Vs Sneakers The Complexities Of Automated Shoe Production

Apr 22, 2025 -

Investing In The Future Identifying The Countrys Prime Business Locations

Apr 22, 2025

Investing In The Future Identifying The Countrys Prime Business Locations

Apr 22, 2025 -

La Palisades Wildfires Which Celebrities Lost Their Homes

Apr 22, 2025

La Palisades Wildfires Which Celebrities Lost Their Homes

Apr 22, 2025 -

Post Roe America How Over The Counter Birth Control Reshapes Reproductive Healthcare

Apr 22, 2025

Post Roe America How Over The Counter Birth Control Reshapes Reproductive Healthcare

Apr 22, 2025