Understanding High Stock Market Valuations: Insights From BofA

Table of Contents

BofA's Perspective on Current Market Valuations

BofA's recent reports generally indicate a cautious outlook on current market valuations, classifying them as "elevated" or "rich," rather than outright "high" or "overvalued." While acknowledging the robust performance and strong corporate earnings, they emphasize the inherent risks associated with these high levels. Their analysis often incorporates various metrics to support their assessment.

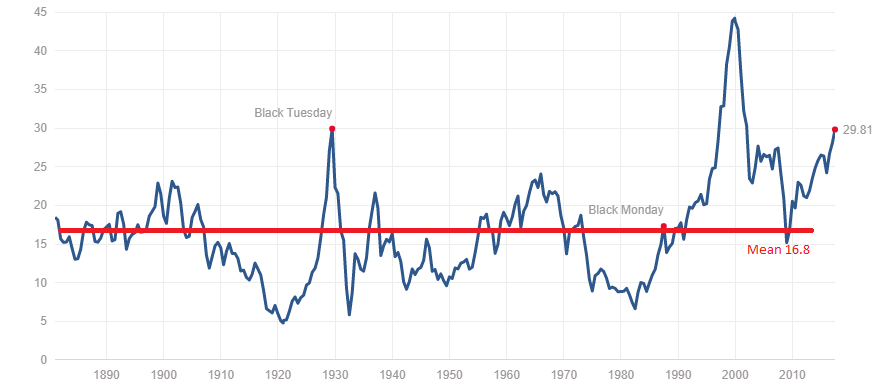

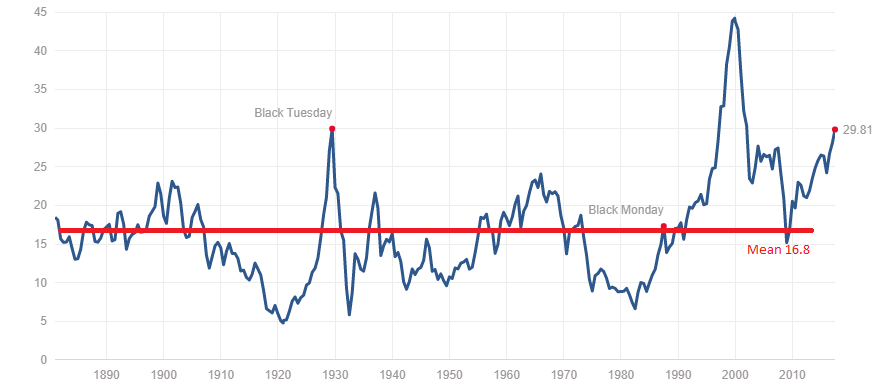

- Key Arguments: BofA's analysts often point to stretched valuation multiples, particularly the Shiller PE ratio (CAPE ratio), and the relatively low bond yields as key factors contributing to their cautious stance. They highlight the potential for a market correction should these factors shift.

- Key Metrics: BofA utilizes a range of metrics including the Price-to-Earnings ratio (P/E), Price-to-Sales ratio (P/S), and the aforementioned Shiller PE ratio (CAPE), incorporating them into broader macroeconomic models to assess overall market valuation.

- Divergences: While BofA shares some common ground with other analysts concerning elevated valuations, their specific assessments and recommended strategies might differ in nuance, emphasizing the importance of conducting independent research and comparing multiple perspectives before making investment decisions. Some analysts might be more optimistic, while others might express stronger concerns regarding the potential for a significant market downturn given these high stock market valuations.

Factors Contributing to High Stock Market Valuations

Several macroeconomic factors have contributed to the current high stock market valuations. Understanding these underlying forces is crucial to understanding the current market environment and the potential risks associated with high stock market valuations.

- Low Interest Rates: Exceptionally low interest rates have fueled investor appetite for riskier assets like stocks. This has pushed up demand and, consequently, valuations. The reduced cost of borrowing also encourages companies to take on more debt, potentially contributing to earnings growth.

- Quantitative Easing (QE): Central banks' quantitative easing programs injected significant liquidity into the financial system, further bolstering asset prices, including stocks. This increased liquidity provided a substantial boost to market valuations, increasing the overall level of capital available for investment.

- Strong Corporate Earnings Growth: While not uniformly across all sectors, many companies have experienced solid earnings growth, supporting higher stock prices. This growth has been particularly evident in the tech sector, creating a ripple effect across the market.

- Technological Innovation: Technological advancements continually drive market growth and create new opportunities for investment, further boosting valuations. This constant innovation creates new areas for investment, drawing more capital into the market and thus supporting higher valuations.

- Geopolitical Factors: While often unpredictable, geopolitical events can impact investor sentiment and market valuations. Currently, certain geopolitical factors are contributing to a flight to safety, but overall, the impact on valuations remains complex and dynamic.

Potential Risks Associated with High Valuations

Investing in a highly valued market carries inherent risks. Understanding these risks is critical for making informed investment decisions, especially concerning high stock market valuations.

- Market Corrections: High valuations inherently increase the market's vulnerability to corrections or even crashes. A sudden shift in investor sentiment or unexpected economic news could trigger a significant downturn.

- Lower Future Returns: Investing in a market at peak valuations often results in lower future returns compared to investing at lower valuations. This is a fundamental principle of investing. High stock market valuations suggest that the potential for future growth is already largely priced in.

- Inflationary Pressures: Rising inflation can erode the real value of stock prices, potentially leading to market corrections. High inflation can impact corporate profits and consumer spending, which ultimately affects stock prices.

- Rising Interest Rates: Increases in interest rates typically lead to lower stock valuations as investors shift towards higher-yielding bonds. Rising interest rates increase the cost of borrowing for businesses, potentially affecting profits and slowing the growth rate.

- Geopolitical Instability: Unforeseen geopolitical events can significantly impact market sentiment and valuations, causing volatility and potential losses. Geopolitical risks are inherently unpredictable, and therefore, it is crucial to account for them in any market assessment.

Investment Strategies in a High-Valuation Market

Navigating a market with high stock market valuations requires a carefully considered strategy. While BofA doesn't offer prescriptive advice, general best practices suggest the following approaches:

- Diversification: Diversifying across asset classes (stocks, bonds, real estate, etc.) helps to mitigate risk and reduce potential losses. Diversification remains a critical element of any effective long-term investment strategy.

- Value Investing: Focusing on undervalued companies with strong fundamentals can provide opportunities for growth even in a high-valuation market. Value investing strategies remain a timeless and effective technique.

- Defensive Sectors: Considering investments in defensive sectors (e.g., consumer staples, utilities) which are less susceptible to economic downturns. Defensive sectors are crucial in times of market uncertainty.

- Long-Term Perspective: Maintaining a long-term investment horizon allows for weathering market fluctuations and benefiting from long-term growth. Long-term investing reduces the impact of short-term volatility.

- Portfolio Rebalancing: Regularly rebalancing your portfolio ensures that you maintain your desired asset allocation and manage risk effectively. Portfolio rebalancing ensures your investment strategy remains aligned with your goals.

Conclusion

This article examined BofA's perspective on current high stock market valuations, exploring the contributing factors and associated risks. We also discussed potential investment strategies for navigating this market environment. Understanding these dynamics is crucial for making informed investment decisions. Remember, high stock market valuations present both opportunities and challenges. While the potential for high returns might be reduced, careful analysis and a strategic approach can still lead to successful outcomes.

Call to Action: Stay informed about market trends and consult with a financial advisor to develop a personalized investment strategy for managing your exposure to high stock market valuations. Continue researching current market analyses, including BofA's reports and those of other reputable firms, to better understand the ever-changing landscape of high stock market valuations and adjust your strategy accordingly.

Featured Posts

-

Los Angeles Wildfires A Reflection Of Societal Attitudes Towards Disaster Betting

Apr 22, 2025

Los Angeles Wildfires A Reflection Of Societal Attitudes Towards Disaster Betting

Apr 22, 2025 -

Karen Read Murder Case Timeline Of Key Events And Legal Decisions

Apr 22, 2025

Karen Read Murder Case Timeline Of Key Events And Legal Decisions

Apr 22, 2025 -

1 Billion In Funding Trump Administrations Action Against Harvard Exclusive

Apr 22, 2025

1 Billion In Funding Trump Administrations Action Against Harvard Exclusive

Apr 22, 2025 -

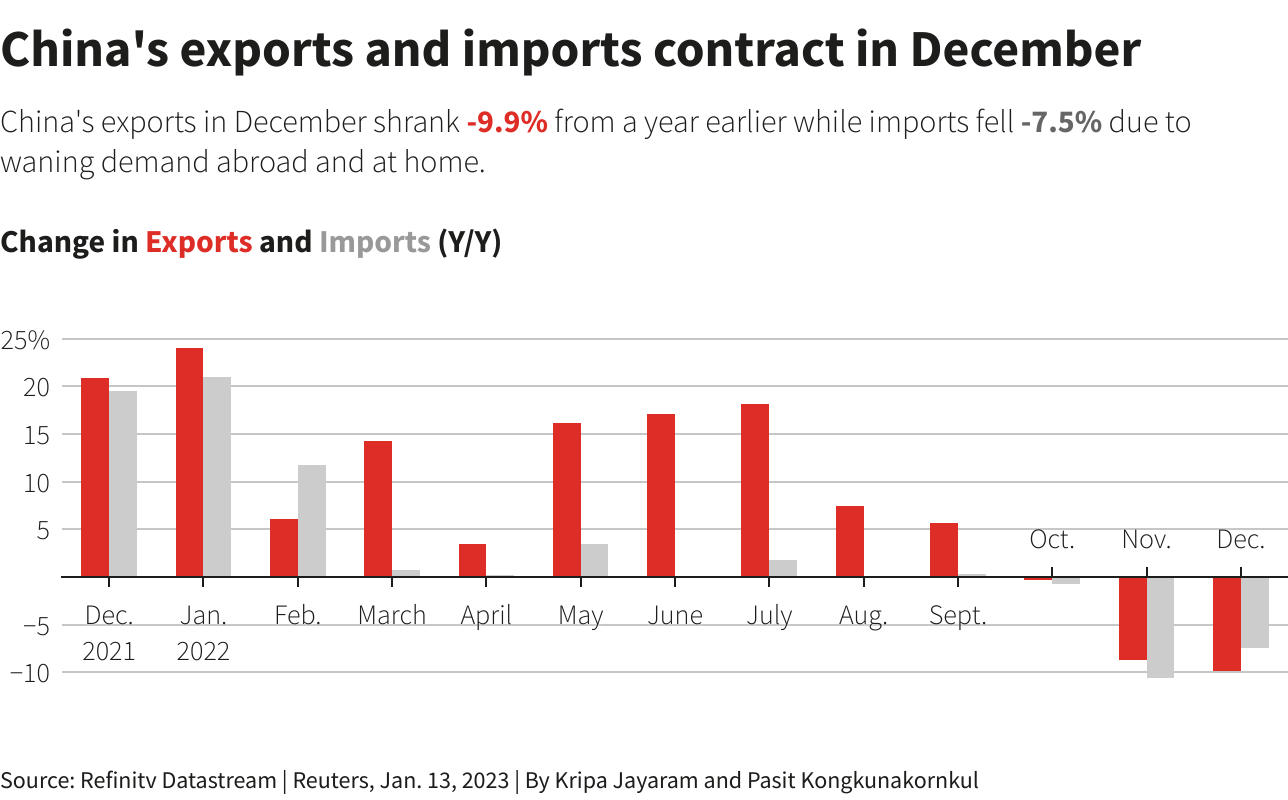

Chinas Export Dependence Vulnerability To Tariff Hikes

Apr 22, 2025

Chinas Export Dependence Vulnerability To Tariff Hikes

Apr 22, 2025 -

Full List Famous Faces Affected By The La Palisades Fires

Apr 22, 2025

Full List Famous Faces Affected By The La Palisades Fires

Apr 22, 2025