The Next Fed Chair Inherits A Trump-Made Mess

Table of Contents

The Inflationary Legacy of Trump-Era Tax Cuts

The 2017 tax cuts, a cornerstone of the Trump administration's economic policy, significantly contributed to the current inflationary pressures. This section will explore the multifaceted impact of these cuts and the resulting economic challenges for the next Fed chair.

Fiscal Stimulus and its Impact

The 2017 tax cuts, while intended to stimulate economic growth, resulted in a dramatic increase in the national debt. This fiscal stimulus, coupled with already robust economic conditions, fueled inflationary pressures.

- Increased deficit spending: The tax cuts significantly reduced federal revenue, leading to a surge in the national debt.

- Reduced tax revenue: Lower tax rates across the board meant less money flowing into the federal treasury, exacerbating the deficit.

- Fueling inflationary pressures: Increased demand driven by the tax cuts, combined with already constrained supply chains, contributed to a sharp rise in inflation.

The long-term consequences of this fiscal expansion are significant and will require careful management by the next Fed chair, potentially impacting interest rates and future economic growth for years to come. The magnitude of this challenge is reflected in the persistently high inflation rates experienced in recent years.

Trade Wars and Supply Chain Disruptions

Trump's protectionist trade policies, including imposing tariffs on imported goods, further exacerbated inflationary pressures and disrupted global supply chains.

- Tariffs: These tariffs increased the cost of imported goods, directly impacting consumer prices.

- Trade disputes: Trade wars with key trading partners led to uncertainty and disruptions in global trade flows.

- Supply chain bottlenecks: The trade disputes and tariffs contributed to significant bottlenecks in global supply chains, leading to shortages and increased prices for numerous goods.

Industries such as agriculture and manufacturing felt the brunt of these policies. The ripple effects were felt globally, highlighting the interconnected nature of the modern economy and the complexities facing the next Fed chair.

The Fed's Response to Trump-Era Policies

The Federal Reserve's response to the economic conditions created by the Trump administration's policies presents another layer of complexity for the incoming chair.

Low Interest Rate Environment

During much of the Trump administration, the Fed maintained a low interest rate environment, partly in response to low unemployment figures. However, this strategy also presented challenges.

- Reasons for low interest rates: The Fed aimed to stimulate economic growth and maintain low unemployment.

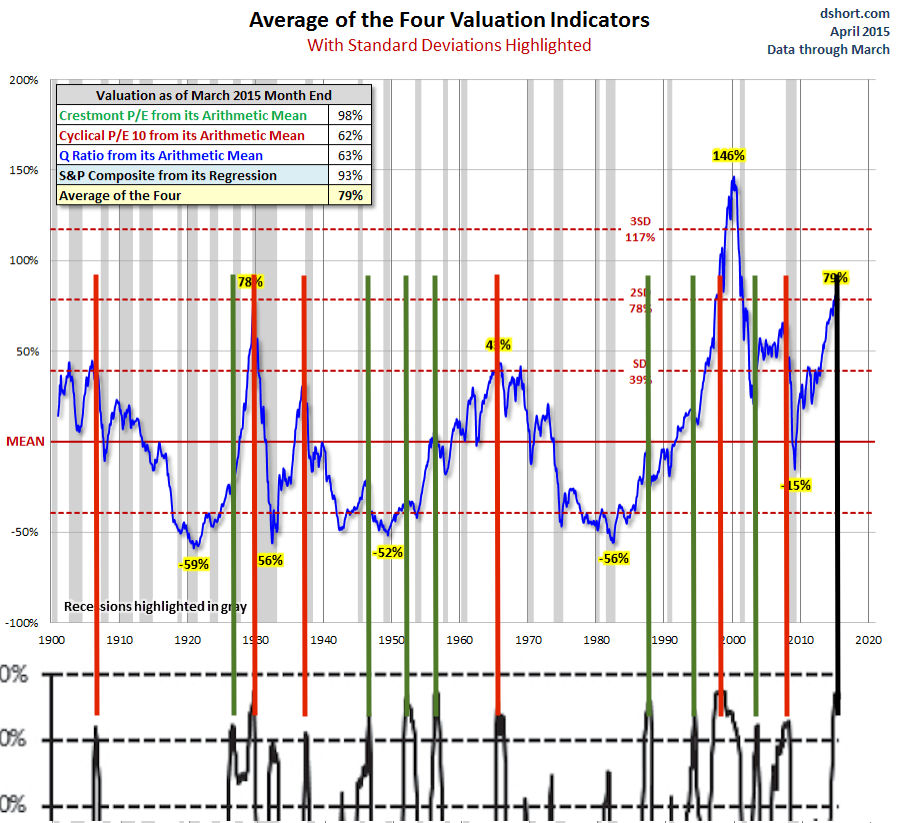

- Potential risks associated with prolonged low rates: Prolonged low interest rates can fuel asset bubbles and increase financial instability.

- The difficulty of adjusting to changing economic conditions: Shifting from a low interest rate environment to a more restrictive one requires careful calibration to avoid triggering a recession.

Challenges to Independent Monetary Policy

The Trump administration's frequent criticisms of the Fed's decisions raised concerns about the independence of the central bank – a crucial element of a healthy economy.

- Examples of public statements by Trump criticizing Fed decisions: These public criticisms created uncertainty and raised questions about the Fed's ability to act independently of political pressure.

- The importance of an independent central bank: An independent central bank is essential for maintaining price stability and long-term economic health.

- The implications for future policy: The perceived political pressure on the Fed during the Trump years could impact future policy decisions and the central bank's credibility.

The Economic Landscape Facing the Next Fed Chair

The next Fed chair will inherit a challenging economic landscape demanding careful navigation.

Navigating Inflationary Pressures

Combatting the elevated inflation inherited from the Trump era will be a primary focus for the next Fed chair.

- Potential monetary policy tools: The Fed may utilize tools such as interest rate hikes and quantitative tightening to curb inflation.

- The challenges of controlling inflation without triggering a recession: Finding the right balance between controlling inflation and avoiding a recession will be a delicate task.

- Managing expectations: Clearly communicating the Fed's plans and managing public expectations will be crucial to maintaining confidence in the economy.

Addressing Rising Debt Levels

The increased national debt resulting from the Trump-era tax cuts poses a significant long-term challenge.

- Fiscal policy options: Addressing the debt will likely require a combination of spending cuts and tax increases.

- The impact on future economic growth: High debt levels can hinder future economic growth by crowding out private investment and increasing interest rates.

- The potential for long-term economic instability: Uncontrolled debt levels can lead to significant economic instability and reduced long-term growth potential.

Conclusion

The next Federal Reserve Chair inherits a complex and challenging economic landscape, directly shaped by the policies of the Trump administration. The legacy of the Trump-era tax cuts, trade wars, and pressure on the Fed's independence has resulted in significant inflationary pressures, a ballooning national debt, and disrupted supply chains. Understanding the complex economic legacy of the Trump era is crucial for navigating the path ahead. The next Fed chair must carefully balance the need to curb inflation with the risk of triggering a recession, while also addressing the mounting national debt. Stay informed about the challenges facing the next Fed chair to better comprehend the future direction of the US economy. The Fed's next challenge requires a steady hand and a clear vision for navigating this "Trump-made mess."

Featured Posts

-

Discover 7 Exciting New Eateries In Orlando Beyond The Theme Parks 2025

Apr 26, 2025

Discover 7 Exciting New Eateries In Orlando Beyond The Theme Parks 2025

Apr 26, 2025 -

2025 3 17 140 20

Apr 26, 2025

2025 3 17 140 20

Apr 26, 2025 -

Where To Buy Chelsea Handlers I Ll Have What Shes Having Online

Apr 26, 2025

Where To Buy Chelsea Handlers I Ll Have What Shes Having Online

Apr 26, 2025 -

Understanding High Stock Market Valuations Bof As Take For Investors

Apr 26, 2025

Understanding High Stock Market Valuations Bof As Take For Investors

Apr 26, 2025 -

First Deployment Damen Csd 650 With Engineer Soltan Kazimov

Apr 26, 2025

First Deployment Damen Csd 650 With Engineer Soltan Kazimov

Apr 26, 2025