Understanding High Stock Market Valuations: BofA's Take For Investors

Table of Contents

BofA's Current Assessment of Stock Market Valuations

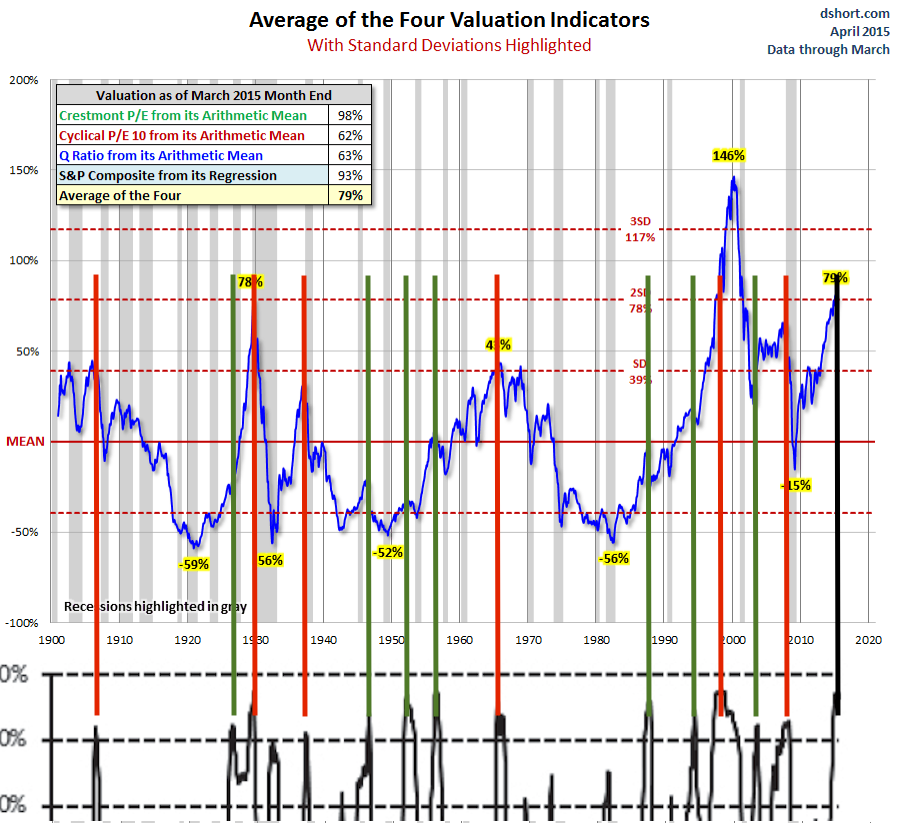

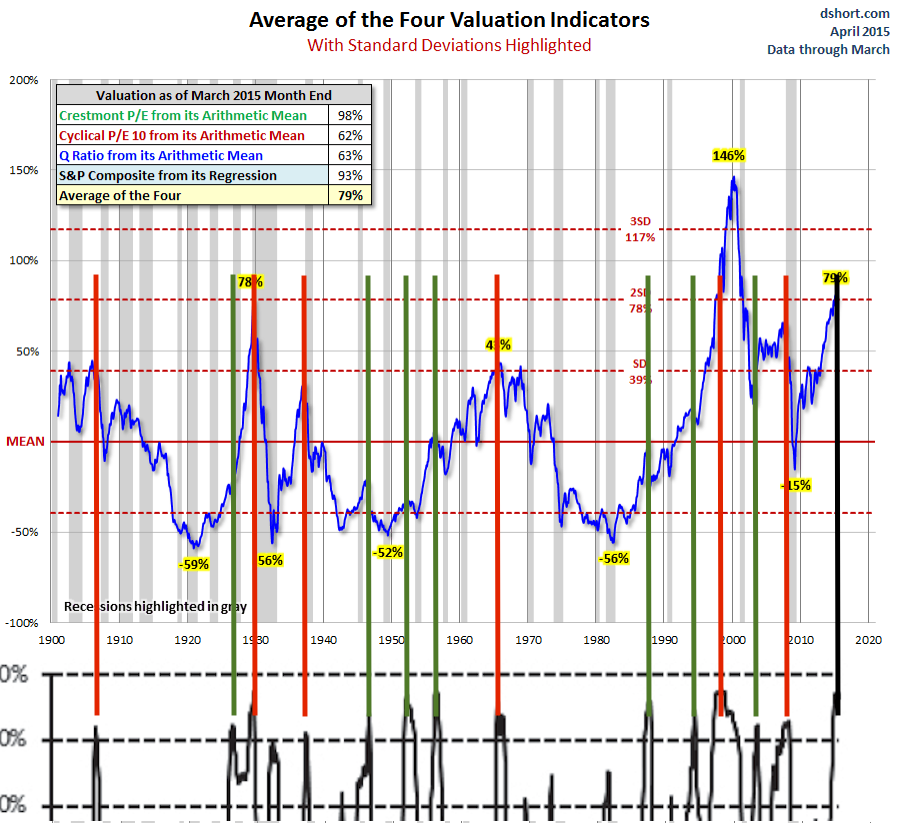

BofA's analysis of stock market valuations incorporates a multifaceted approach, drawing upon various economic indicators and financial models. Their assessment frequently utilizes metrics such as the Price-to-Earnings (P/E) ratio and the cyclically adjusted price-to-earnings ratio (Shiller PE ratio) to gauge market valuations relative to historical norms and future earnings expectations. BofA's equity valuation models consider a wide range of factors to arrive at their conclusions.

- BofA's current valuation range for the market: (Note: This requires referencing BofA's most recent reports. Replace with actual data from BofA's publications). For example, BofA might suggest a range indicating the market is slightly overvalued or fairly valued, depending on their latest findings.

- Key factors driving BofA's assessment: BofA’s analysis likely incorporates the current interest rate environment, projected economic growth rates, inflation trends, and geopolitical risks. These factors significantly influence their overall valuation assessment.

- Comparison to historical valuations: BofA's reports often include comparisons to past market valuations to provide context. This helps investors understand whether the current levels are unusually high, average, or low compared to historical trends. This historical context is critical for judging the sustainability of current valuations.

- BofA's forecast for future valuation changes: BofA's analysts typically provide forecasts outlining their expectations for future market valuation changes, incorporating their assessment of the various economic factors influencing the market. These forecasts, while not guarantees, provide valuable insights into potential market movements.

Factors Contributing to High Stock Market Valuations

Several interconnected macroeconomic and microeconomic factors contribute to the elevated stock market valuations we are currently witnessing. Understanding these factors is crucial for developing a robust investment strategy.

- Low interest rates: Low interest rates make borrowing cheaper for businesses and consumers, stimulating economic activity and boosting corporate profits. Lower interest rates also decrease the attractiveness of bonds relative to stocks, driving investors towards equities.

- Strong corporate earnings (or expectations thereof): Strong corporate earnings, or the anticipation of future strong earnings, support higher stock prices. This reflects the market's confidence in the companies' ability to generate future returns.

- Increased liquidity in the market: Abundant liquidity, often fueled by central bank policies, provides ample capital for investment, pushing up asset prices, including stocks.

- Investor sentiment and risk appetite: Optimistic investor sentiment and a high risk appetite can inflate stock valuations. Market psychology plays a significant role in driving price movements.

- The influence of technological advancements: The rapid pace of technological advancements creates opportunities for significant growth in certain sectors, leading to higher valuations for companies in those sectors.

Investment Strategies in a High-Valuation Environment

Investing in a high-valuation market requires a cautious and strategic approach. BofA's recommendations might emphasize risk management and diversification strategies.

- Strategies for mitigating risk: Diversification across different asset classes (stocks, bonds, real estate) and sectors is crucial to mitigate portfolio risk in a potentially overvalued market. Consider allocating a portion of your portfolio to defensive stocks, which tend to perform relatively well even during economic downturns.

- Sector-specific investment opportunities: BofA's analysis might highlight specific sectors poised for growth despite the overall high valuations. Focusing on these sectors could offer better risk-adjusted returns.

- Importance of long-term investing strategies: A long-term investment horizon can help weather short-term market fluctuations. Focusing on the long-term potential of companies and sectors can mitigate the impact of short-term valuation concerns.

- The role of value investing versus growth investing: In a high-valuation market, value investing (focusing on undervalued companies) may become increasingly attractive as a counterpoint to growth investing, which focuses on companies with high growth potential.

- Potential risks associated with staying fully invested: Staying fully invested in the market during periods of high valuations carries increased risk. Consider adjusting your portfolio allocation to incorporate lower-risk investments to protect against potential market corrections.

Alternative Investment Options to Consider

Investors concerned about high stock market valuations may find alternative investments appealing. Diversifying into these asset classes can help balance your portfolio's risk profile.

- High-yield bonds: High-yield bonds, while carrying higher risk than investment-grade bonds, often offer higher yields, potentially providing a better return in a low-interest-rate environment.

- Real estate investment trusts (REITs): REITs offer exposure to the real estate market without the direct ownership responsibilities. They can be a valuable addition to a diversified portfolio.

- Other alternative assets: Other options, such as commodities or private equity, can offer diversification benefits, but typically come with higher levels of risk and require specialized knowledge.

- Benefits and drawbacks of each alternative option: Each alternative investment option carries its own unique set of benefits and drawbacks. Thorough research is crucial before making any investment decisions.

Conclusion

BofA's analysis of high stock market valuations highlights the need for careful consideration and a strategic approach to investing. Understanding the factors influencing these valuations and employing appropriate risk management techniques is paramount. The suggested strategies, including diversification, focusing on specific sectors, and considering alternative investment options, can help navigate this complex market environment effectively. Remember to conduct thorough research, consider seeking professional financial advice, and develop a well-diversified investment strategy to effectively manage the complexities of high stock market valuations. Consult BofA's research for more detailed analysis on High Stock Market Valuations and to stay informed about the evolving market dynamics.

Featured Posts

-

Introducing Dong Duong Hotel Hues Newest Fusion Hotel

Apr 26, 2025

Introducing Dong Duong Hotel Hues Newest Fusion Hotel

Apr 26, 2025 -

53

Apr 26, 2025

53

Apr 26, 2025 -

California Governor Newsom Challenges His Partys Status Quo

Apr 26, 2025

California Governor Newsom Challenges His Partys Status Quo

Apr 26, 2025 -

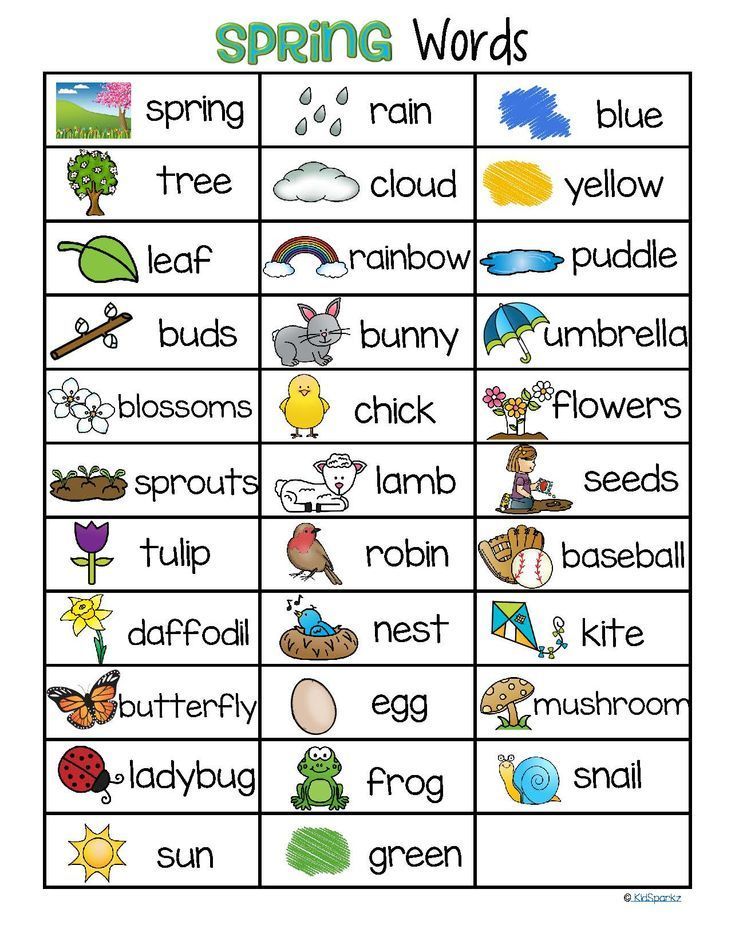

Spring Into Lente A Comprehensive Vocabulary Lesson

Apr 26, 2025

Spring Into Lente A Comprehensive Vocabulary Lesson

Apr 26, 2025 -

Are European Stocks Still A Good Investment Strategists Weigh In On Trumps Trade War

Apr 26, 2025

Are European Stocks Still A Good Investment Strategists Weigh In On Trumps Trade War

Apr 26, 2025