Thaksin Signals Thai Policy Shift: A Potential US Tariff Deal

Table of Contents

Thaksin's Past Economic Policies and Their Relevance

Thaksin Shinawatra's previous administrations were characterized by a strong emphasis on economic growth fueled by exports. Understanding his past policies is crucial to predicting potential shifts in Thailand's approach to trade negotiations with the US.

Focus on Export-Oriented Growth

Thaksin's previous focus on export-led growth involved several key strategies:

- Investment Incentives: Significant tax breaks and other incentives were offered to attract foreign direct investment (FDI), particularly in export-oriented industries.

- Infrastructure Development: Massive investments were made in infrastructure, including transportation networks (roads, railways, ports) and communication technologies, to improve the efficiency of exporting goods.

- Trade Liberalization Efforts: Thaksin's government actively pursued trade liberalization agreements, aiming to reduce barriers to Thai exports in global markets.

This history suggests that a return to power might involve a renewed push for export growth, making a US tariff deal significantly more attractive. His understanding of the need for efficient infrastructure and streamlined trade processes could expedite negotiations.

Relationship with the US During Previous Administrations

During Thaksin's previous time in office (2001-2006), US-Thai trade relations were generally positive, characterized by:

- Existing Trade Agreements: Thailand benefited from existing trade agreements with the US, facilitating the flow of goods.

- High Trade Volumes: Trade between the two countries was substantial, with both imports and exports reaching significant levels.

- Limited Major Tariff Disputes: While minor disagreements existed, there were no major tariff disputes or significant trade friction points during this period.

The relatively positive historical relationship provides a solid foundation for renewed negotiations and suggests that both sides possess experience in collaborative trade strategies. Understanding the details of past interactions can help pave the way for a successful future agreement.

Potential Impacts of a US Tariff Deal

A successful US tariff deal could have profound effects on the Thai economy.

Benefits for Thai Exporters

Reduced or eliminated tariffs on Thai goods in the US market would offer substantial benefits to several key sectors:

-

Agriculture: Thai agricultural products, such as rice, fruits, and seafood, could gain significantly increased access to the large US market.

-

Manufacturing: Thai manufacturers, particularly in textiles, electronics, and automotive parts, could see a boost in competitiveness and export volumes.

-

Increased Market Access: Lower tariffs would translate directly into enhanced market access, allowing Thai businesses to compete more effectively with other exporters.

-

Enhanced Competitiveness: Reduced tariffs would make Thai goods more price-competitive in the US market, leading to increased sales and profits.

-

Potential Job Creation: The increased export demand could lead to significant job creation in various sectors across Thailand. This could be especially beneficial for rural areas heavily reliant on agricultural exports.

Data from previous trade agreements can be used to model the potential economic gains – predicting increased GDP growth and export revenue for specific Thai industries.

Challenges and Concerns

Despite the potential benefits, a US tariff deal also presents challenges:

- Potential Trade Imbalances: A reduction in tariffs could lead to a widening trade imbalance if Thai imports from the US do not increase proportionally.

- Impact on Domestic Industries: Some domestic industries might face increased competition from US imports, necessitating adjustments and potential support measures.

- Compliance with US Regulations: Meeting US regulatory requirements for imported goods could pose challenges for some Thai businesses, requiring investment in upgrades and compliance processes.

These challenges highlight the need for a carefully negotiated deal that addresses both the opportunities and potential risks, ensuring a balanced outcome for the Thai economy.

Geopolitical Implications

A US-Thai tariff deal carries significant geopolitical implications.

Regional Competition

Thailand's position within Southeast Asia is complex, with strong economic ties to both the US and China. A US tariff deal could:

- Strengthen US-Thai relations: Such an agreement would signal a deepening of economic ties and potentially shift Thailand further towards the US sphere of influence.

- Impact relations with China: The deal might strain relations with China, particularly if it results in Thailand prioritizing US trade over Chinese trade.

- Potential benefits and drawbacks compared to alternative trade partnerships: A US deal offers benefits of access to the vast US consumer market but could come at the cost of reduced economic engagement with China, a major trading partner for Thailand.

The deal must be carefully considered in light of Thailand’s broader strategic relationships in the context of evolving US-China relations.

Conclusion

The return of Thaksin Shinawatra presents a pivotal moment for Thai-US relations. His potential influence on Thai policy, and particularly the possibility of a new US tariff deal, carries immense implications for the Thai economy. While such a deal could offer significant benefits for Thai exporters and contribute to overall economic growth, careful consideration of potential challenges, particularly concerning trade imbalances and the impact on domestic industries, is crucial. The broader geopolitical context, including Thailand's relations with other regional players, needs to be carefully analyzed. Further analysis of the potential US tariff deal and its ramifications is crucial to understanding the future trajectory of the Thai economy. Stay informed about developments regarding the Thaksin Shinawatra effect on Thai policy and its potential for a new US tariff deal. Keep checking back for updates on this evolving situation.

Featured Posts

-

Major Delays On Anzac Bridge Due To Vehicle Collision

Apr 26, 2025

Major Delays On Anzac Bridge Due To Vehicle Collision

Apr 26, 2025 -

Pentagon Leaks And Infighting Hegseths Polygraph Threat Response

Apr 26, 2025

Pentagon Leaks And Infighting Hegseths Polygraph Threat Response

Apr 26, 2025 -

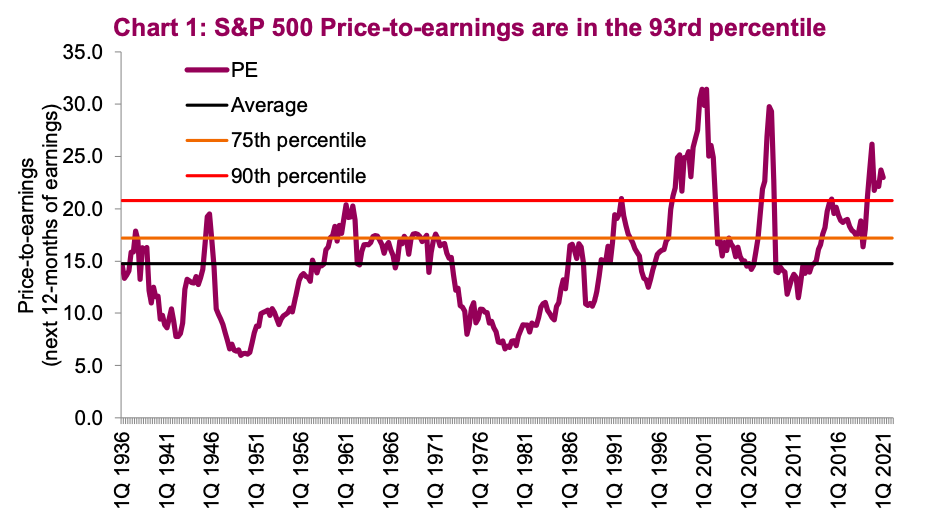

Addressing High Stock Market Valuations Bof As View For Investors

Apr 26, 2025

Addressing High Stock Market Valuations Bof As View For Investors

Apr 26, 2025 -

Benson Boone Vs Harry Styles A Look At The Similarities And Differences

Apr 26, 2025

Benson Boone Vs Harry Styles A Look At The Similarities And Differences

Apr 26, 2025 -

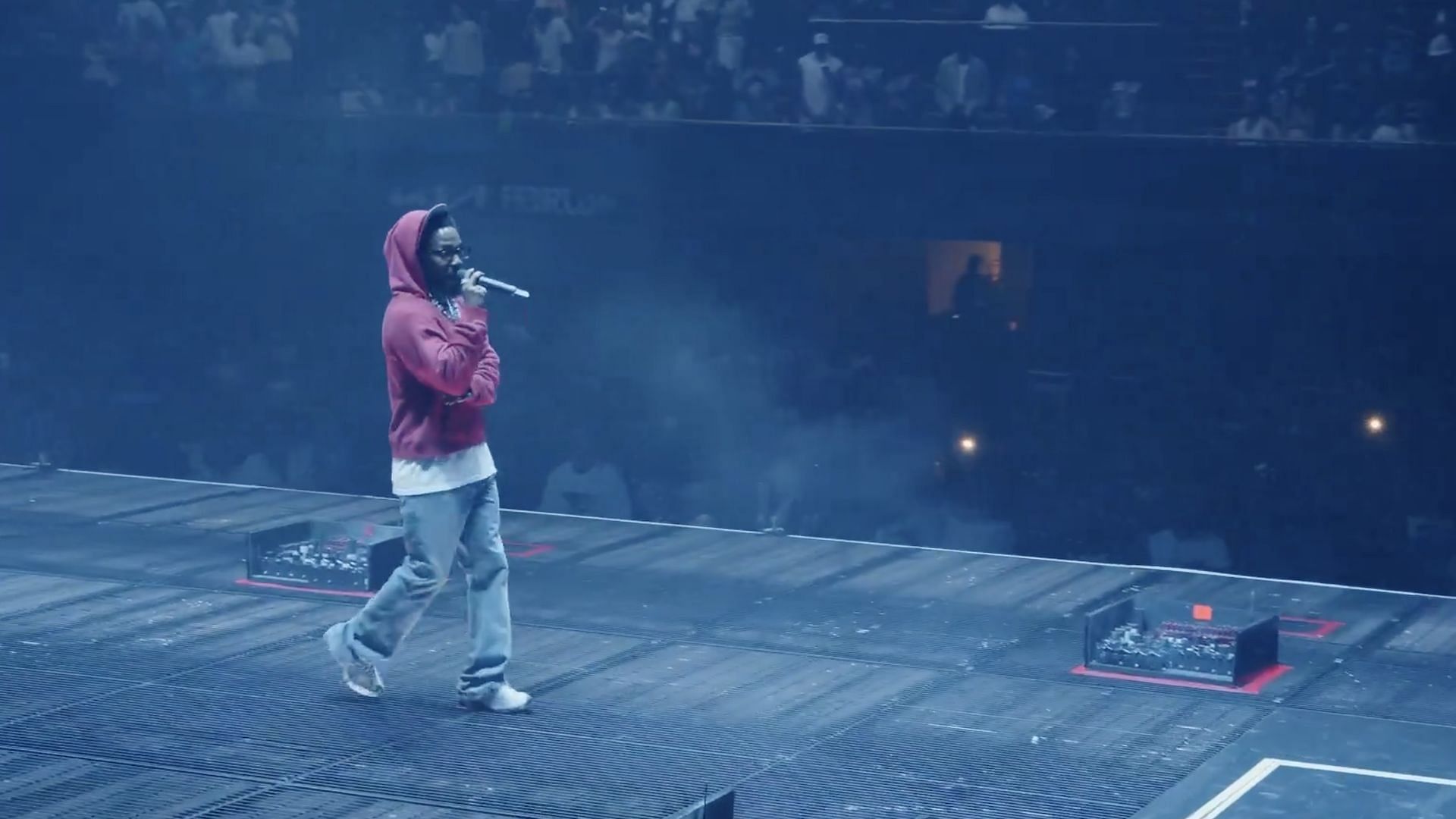

High Ticket Prices For Kendrick Lamars Hampden Show Leave Fans Furious

Apr 26, 2025

High Ticket Prices For Kendrick Lamars Hampden Show Leave Fans Furious

Apr 26, 2025

Latest Posts

-

Controversial Choice Vaccine Skeptic Appointed To Lead Immunization Autism Research

Apr 27, 2025

Controversial Choice Vaccine Skeptic Appointed To Lead Immunization Autism Research

Apr 27, 2025 -

Federal Study On Autism And Vaccines Headed By Vaccine Skeptic Concerns Raised

Apr 27, 2025

Federal Study On Autism And Vaccines Headed By Vaccine Skeptic Concerns Raised

Apr 27, 2025 -

Vaccine Skeptic Leads Federal Autism Immunization Study A Troubling Appointment

Apr 27, 2025

Vaccine Skeptic Leads Federal Autism Immunization Study A Troubling Appointment

Apr 27, 2025 -

Autism Study Controversy Feds Assign Anti Vaxxer To Lead Role

Apr 27, 2025

Autism Study Controversy Feds Assign Anti Vaxxer To Lead Role

Apr 27, 2025 -

Controversial Choice Anti Vaccination Advocate Heads Autism Research

Apr 27, 2025

Controversial Choice Anti Vaccination Advocate Heads Autism Research

Apr 27, 2025