Addressing High Stock Market Valuations: BofA's View For Investors

Table of Contents

BofA's Assessment of Current Market Conditions

BofA's stance on current high stock market valuations is generally one of cautious optimism. While acknowledging the elevated valuations compared to historical averages, they don't necessarily predict an imminent crash. Their arguments often center on the continued strength of corporate earnings, low interest rates (at least historically), and the ongoing influence of quantitative easing policies. However, they emphasize the increased risk associated with these elevated valuations.

- Key Economic Indicators and Forecasts: BofA typically incorporates data points such as GDP growth projections, inflation rates, unemployment figures, and consumer confidence indices into their assessment. Their forecasts will influence their overall view on market valuation.

- Overvalued and Undervalued Sectors: BofA frequently publishes sector-specific analyses. In periods of high valuations, some sectors (e.g., technology) may be deemed overvalued, while others (e.g., cyclical sectors sensitive to economic downturns) might be seen as undervalued. This analysis informs their investment recommendations.

- Geopolitical Factors: Global events like trade wars, political instability, and geopolitical risks significantly impact BofA's assessment of market valuations. These external factors can introduce uncertainty and volatility.

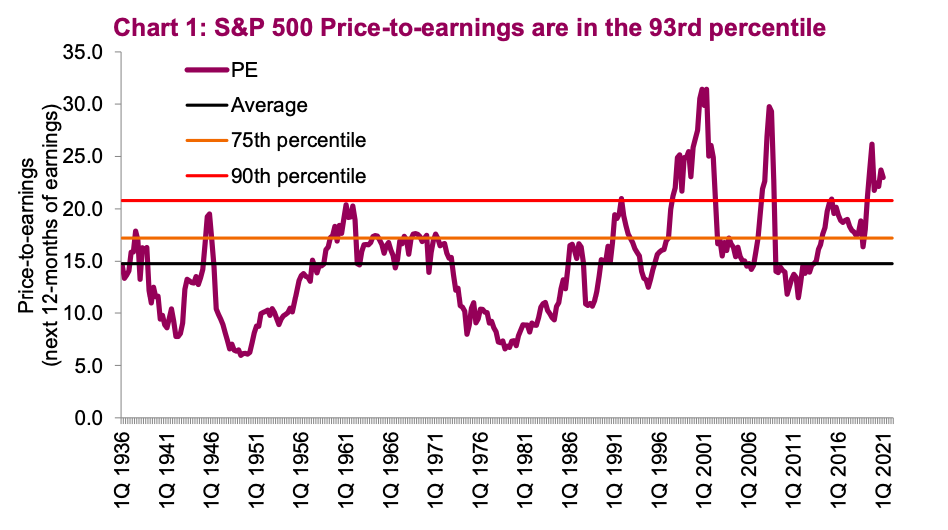

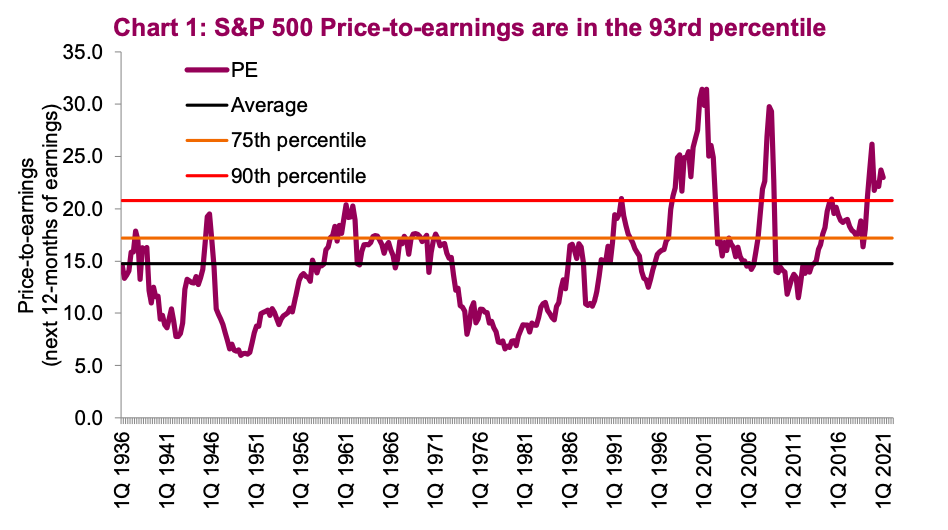

- Relevant Data and Statistics: BofA's reports often include specific data points, such as price-to-earnings ratios (P/E), price-to-sales ratios (P/S), and other valuation metrics, used to justify their assessment of whether current valuations are sustainable.

Identifying Potential Risks Associated with High Valuations

Investing in a market with high stock market valuations carries inherent risks. While potential for gains still exists, the probability of significant losses increases.

- Risk of Market Correction or Downturn: High valuations often precede market corrections or even downturns. A sharp decline in asset prices is a significant risk.

- Lower Returns: Historically, markets with high valuations tend to generate lower returns in the subsequent years compared to markets with lower valuations. Investors should manage expectations.

- Increased Volatility and Uncertainty: High-valuation markets are frequently characterized by increased volatility, making it challenging to predict market movements accurately. This heightened uncertainty can affect investment decisions.

- Sector-Specific Risks: BofA's analysis often highlights specific sectors particularly vulnerable to a market correction based on their current valuations and overall outlook. Understanding these sector-specific risks is crucial.

- Impact of Inflation: Inflation erodes the purchasing power of future returns, making high valuations even riskier when inflation is unexpectedly high. High inflation can cause central banks to increase interest rates, impacting valuations.

Strategies for Investors in a High-Valuation Environment

BofA generally recommends a cautious approach to investing in a high-valuation environment. Their strategies emphasize risk mitigation and diversification.

- Diversification Strategies: BofA advocates for diversifying across geographies, sectors, and asset classes to reduce overall portfolio risk. This reduces the impact of a downturn in any single area.

- Long-Term Investment Horizon: BofA stresses the importance of a long-term investment strategy to weather short-term market fluctuations. This mitigates the impact of short-term volatility.

- Value vs. Growth Investing: BofA might suggest a shift towards value investing (companies trading below their intrinsic value) as opposed to growth investing (companies with high growth potential but potentially inflated valuations) during periods of high valuations.

- Tactical Asset Allocation Adjustments: BofA might recommend tactical shifts in asset allocation based on their economic forecasts. This could involve increasing allocations to defensive assets or reducing exposure to riskier assets.

- Alternative Investments: Consideration of alternative investments, like real estate or commodities, can help diversify and mitigate the impact of a market downturn related to high stock market valuations.

The Role of Defensive Investing

Defensive investing plays a crucial role in mitigating risks associated with high stock market valuations. It focuses on preserving capital and generating stable returns, rather than maximizing growth.

- Examples of Defensive Investments: These include high-quality bonds, dividend-paying stocks with stable earnings, and other low-volatility assets.

- Benefits During Uncertainty: Defensive strategies help cushion against potential losses during periods of market uncertainty and volatility inherent in high valuation markets.

- Mitigating Potential Losses: By reducing exposure to riskier assets, defensive investing helps limit potential losses during market corrections.

BofA's Long-Term Outlook and Predictions

BofA's long-term outlook for the stock market varies depending on various economic indicators. While they may not predict a catastrophic crash, they often caution investors about the risks associated with current valuations.

- Projected Market Returns: BofA's projections for market returns over the next 1-5 years typically factor in their economic forecasts and valuation assessments. They're likely to show more moderate return expectations than in periods of lower valuations.

- Factors Driving the Outlook: These factors typically include projected economic growth, inflation rates, interest rate changes, and geopolitical risks, all influencing future market performance and valuation.

- Conditions that Could Alter the Forecast: Unexpected economic shocks, policy changes, or significant geopolitical events could significantly alter BofA's long-term outlook.

Conclusion:

Understanding and addressing high stock market valuations is crucial for successful investing. BofA's insights provide a valuable framework for investors to navigate this complex landscape, offering strategies to mitigate risks and capitalize on opportunities. By carefully considering BofA's assessment of current market conditions, potential risks, and suggested strategies, investors can make informed decisions and build a robust investment portfolio. Remember to conduct your own thorough research and consider seeking professional financial advice before making any investment decisions related to high stock market valuations and their potential impact on your portfolio.

Featured Posts

-

Debunking Myths And Misinformation About Gavin Newsom

Apr 26, 2025

Debunking Myths And Misinformation About Gavin Newsom

Apr 26, 2025 -

Krogkommissionens Recension Stockholm Stadshotell En Detaljerad Analys

Apr 26, 2025

Krogkommissionens Recension Stockholm Stadshotell En Detaljerad Analys

Apr 26, 2025 -

Trumps Tariffs Ceos Express Concerns Over Economic Impact And Consumer Sentiment

Apr 26, 2025

Trumps Tariffs Ceos Express Concerns Over Economic Impact And Consumer Sentiment

Apr 26, 2025 -

Political Fallout Newsoms Actions Rock The Democratic Party

Apr 26, 2025

Political Fallout Newsoms Actions Rock The Democratic Party

Apr 26, 2025 -

Guillaume Scheer Ouvre Son Restaurant A Strasbourg Le 13 Juin

Apr 26, 2025

Guillaume Scheer Ouvre Son Restaurant A Strasbourg Le 13 Juin

Apr 26, 2025