Trump's Tariffs: CEOs Express Concerns Over Economic Impact And Consumer Sentiment

Table of Contents

Keywords: Trump's tariffs, economic impact, consumer sentiment, CEO concerns, trade war, import tariffs, business impact, economic uncertainty, consumer spending, inflation.

The imposition of tariffs under the Trump administration sent shockwaves through the global economy, triggering widespread concern among business leaders. The significant economic implications and the market uncertainty created by these trade policies remain a pressing issue. This article delves into the anxieties expressed by CEOs regarding the negative economic impact of Trump's tariffs and their detrimental effect on consumer sentiment, exploring the cascading consequences for businesses and consumers alike.

Negative Economic Impact of Trump's Tariffs

Trump's tariffs, intended to protect domestic industries, inadvertently inflicted considerable harm on the broader economy. The increased costs, supply chain disruptions, and escalating trade wars significantly impacted businesses and their ability to operate effectively.

Increased Costs for Businesses

Tariffs directly translate into higher input costs for businesses. Importing raw materials, components, or finished goods suddenly became far more expensive, squeezing profit margins and threatening long-term viability.

- Rising prices of imported goods: The added tariff cost is passed on to businesses, increasing their overall expenses.

- Reduced competitiveness: Companies relying on imported materials face a competitive disadvantage against those sourcing domestically or from countries without tariffs.

- Increased production costs: Higher input costs inevitably lead to higher production costs, forcing businesses to either absorb the losses or raise prices.

- Potential for layoffs: To maintain profitability in the face of increased costs, businesses may resort to cost-cutting measures, including layoffs.

For example, the steel and aluminum tariffs significantly impacted manufacturers who rely on these materials, leading to price increases and reduced production in various sectors.

Supply Chain Disruptions

The complex global supply chains were severely disrupted by Trump's tariffs. Businesses faced difficulties sourcing materials, leading to delays, increased transportation costs, and even shortages.

- Difficulty sourcing materials: Tariffs made it more challenging and expensive to find reliable suppliers, forcing companies to explore alternative, often more costly, sources.

- Increased lead times: The complexities of navigating new supply chains resulted in extended lead times, impacting production schedules and potentially delaying product launches.

- Higher transportation costs: Businesses had to adapt their logistics, potentially opting for more expensive shipping routes to avoid tariffs, adding to their overall costs.

- Potential for shortages: Disruptions in the supply chain could lead to shortages of essential materials or finished goods, impacting production and potentially leading to price hikes.

A case study of a clothing manufacturer relying on imported textiles illustrates how tariffs led to significant delays and increased costs, impacting their ability to meet deadlines and maintain profitability.

Retaliatory Tariffs and Global Trade Wars

Trump's tariffs ignited a global trade war. Other countries retaliated with their own tariffs, creating a cycle of escalating trade tensions and harming global trade relationships.

- Reduced exports: American businesses faced reduced export opportunities as other countries imposed tariffs on their products.

- Market access restrictions: Tariffs created barriers to entry into foreign markets, limiting the ability of American companies to expand internationally.

- Damage to international relationships: The trade war strained relationships between the US and its trading partners, impacting future collaborations and trade agreements.

For instance, China retaliated with tariffs on a wide range of American goods, impacting agricultural exports and other key industries.

Weakened Consumer Sentiment and Reduced Spending

The economic uncertainty created by Trump's tariffs significantly impacted consumer sentiment and spending. Inflationary pressures, reduced investment, and uncertainty dampened consumer confidence.

Inflationary Pressures

Tariffs contributed to inflation, eroding consumer purchasing power and impacting overall consumer confidence.

- Rising prices of consumer goods: Tariffs on imported goods inevitably led to higher prices for consumers, reducing their disposable income.

- Decreased disposable income: Higher prices for essential goods left consumers with less money to spend on discretionary items.

- Impact on consumer confidence indices: Surveys consistently showed decreased consumer confidence as prices rose and economic uncertainty increased.

Data on inflation rates and consumer spending during the period of tariff implementation clearly demonstrates the negative correlation between the two.

Uncertainty and Reduced Investment

The economic uncertainty generated by Trump's tariffs discouraged both consumer and business investment.

- Delay in purchasing decisions: Consumers postponed major purchases like cars and homes due to the uncertainty surrounding future prices and economic conditions.

- Reduced business expansion plans: Businesses delayed expansion plans and investment in new projects due to the increased costs and market volatility.

- Negative impact on GDP growth: Reduced investment and consumer spending negatively impacted overall GDP growth.

Economic forecasts and analyses from the period vividly illustrate the dampening effect of uncertainty on investment and economic growth.

Impact on Specific Consumer Sectors

Specific consumer sectors, such as automobiles, electronics, and clothing, were disproportionately affected by tariffs.

- Price increases in specific sectors: Tariffs on imported parts and components led to significant price increases in these sectors.

- Change in consumer behavior: Consumers reacted by delaying purchases, opting for cheaper alternatives, or shifting their buying patterns.

- Shifts in purchasing patterns: Consumers looked for domestically produced goods or products from countries unaffected by the tariffs.

Sales figures for affected sectors during this period confirmed the significant negative impact of tariffs on consumer purchasing behavior.

Conclusion

The concerns expressed by CEOs regarding the negative economic impact of Trump's tariffs were well-founded. The increased costs faced by businesses directly translated into reduced consumer spending and weakened consumer sentiment. The interconnectedness between business costs and consumer confidence highlights the far-reaching implications of protectionist trade policies. The resulting inflationary pressures, supply chain disruptions, and global trade wars created considerable economic uncertainty. Stay informed on the evolving landscape of Trump's tariffs and their potential long-term impact on the economy.

Featured Posts

-

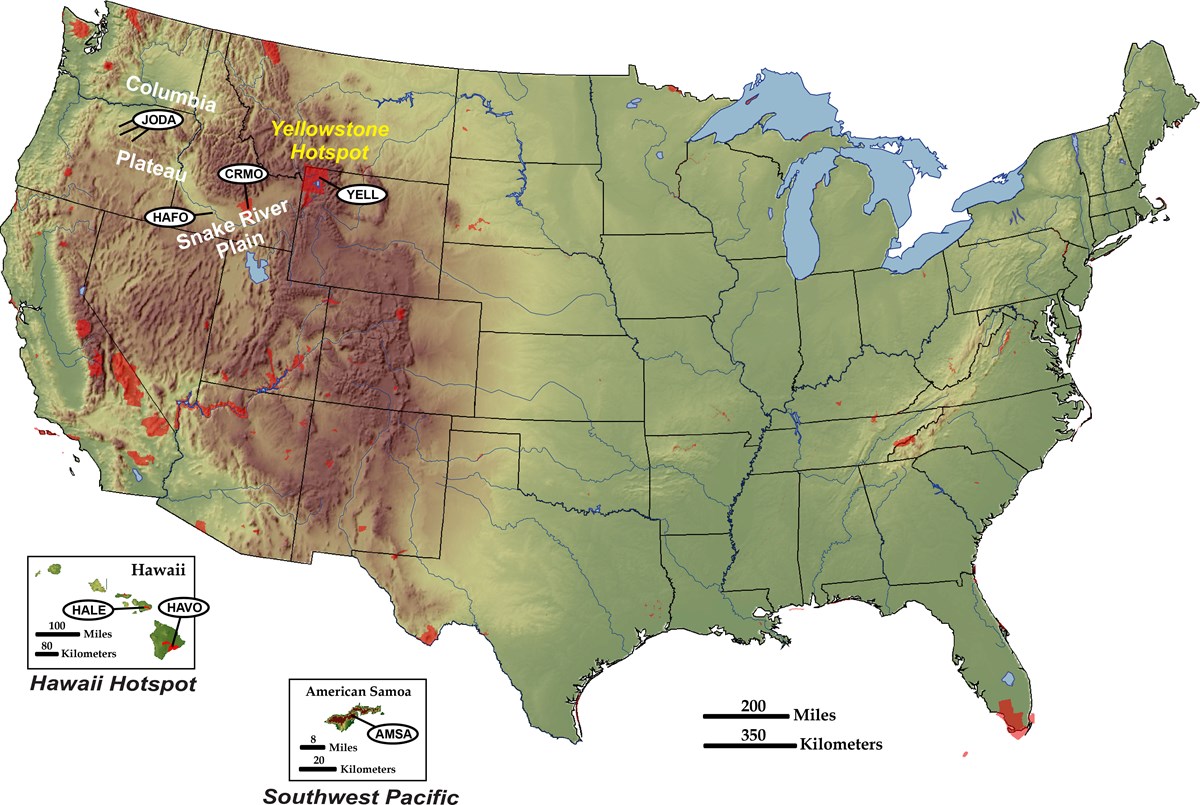

New Business Hotspots Across The Country An Interactive Map And Analysis

Apr 26, 2025

New Business Hotspots Across The Country An Interactive Map And Analysis

Apr 26, 2025 -

O Sucesso De Benson Boone Da Musica Popular Ao Lollapalooza

Apr 26, 2025

O Sucesso De Benson Boone Da Musica Popular Ao Lollapalooza

Apr 26, 2025 -

The Benson Boone And Harry Styles Sound Alike Debate Fact Or Fiction

Apr 26, 2025

The Benson Boone And Harry Styles Sound Alike Debate Fact Or Fiction

Apr 26, 2025 -

Stock Market Valuations Bof As Case For Investor Calm

Apr 26, 2025

Stock Market Valuations Bof As Case For Investor Calm

Apr 26, 2025 -

Lollapalooza Brasil 2024 Conheca Benson Boone O Cantor De Beautiful Thing

Apr 26, 2025

Lollapalooza Brasil 2024 Conheca Benson Boone O Cantor De Beautiful Thing

Apr 26, 2025