Tesla Q1 Earnings: Net Income Plunges 71% Amidst Political Headwinds

Table of Contents

Deep Dive into Tesla's Q1 2024 Financial Results

Net Income Plunge: A Detailed Breakdown

The 71% decrease in net income represents a substantial blow to Tesla's profitability. While the official figures will need to be closely examined, preliminary reports suggest a net income of approximately [Insert actual or estimated figure here] compared to [Insert comparable figure from previous quarter]. This dramatic shift is attributable to several key factors:

- Decreased Vehicle Sales: Lower-than-anticipated demand in key markets contributed significantly to the decline. Price reductions implemented earlier in the year, while aiming to boost sales, may have inadvertently impacted profit margins.

- Increased Production Costs: Rising raw material prices, particularly for battery components, and escalating energy costs impacted the overall cost of production. Supply chain disruptions further exacerbated these challenges.

- Increased Competition: The growing number of electric vehicle manufacturers is intensifying competition, putting pressure on Tesla's pricing strategy and market share.

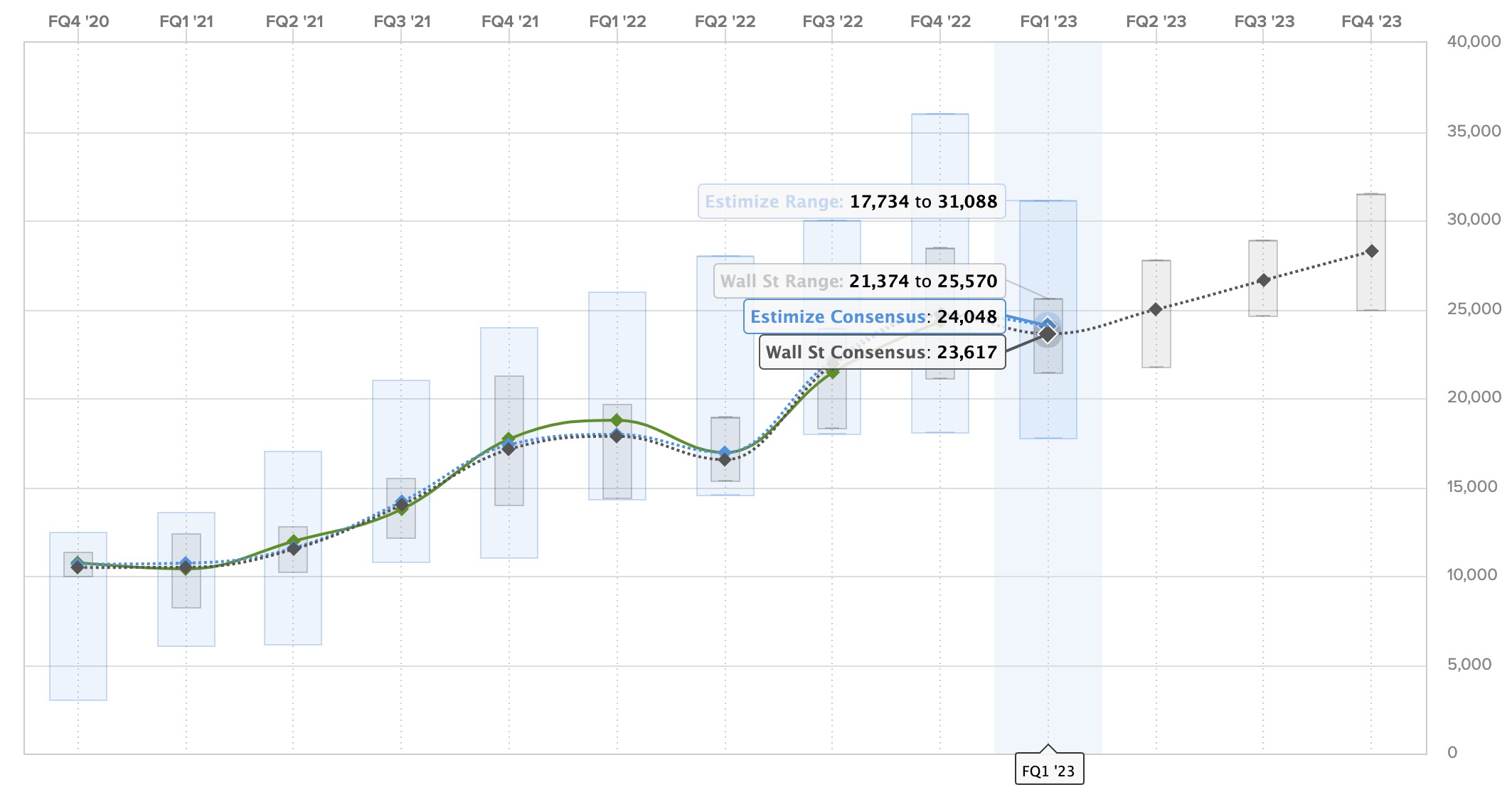

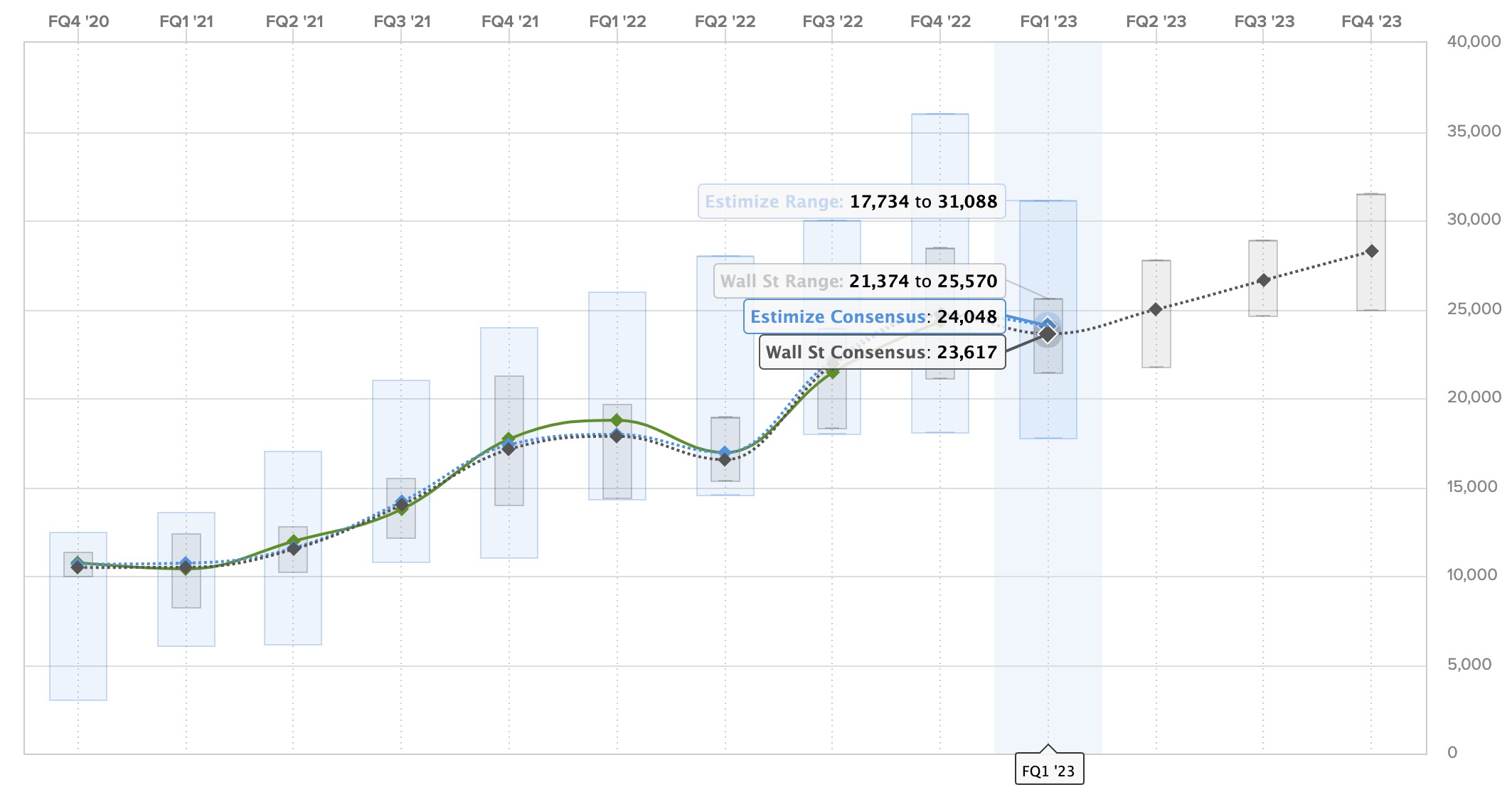

[Insert relevant chart/graph visualizing the net income decline and its contributing factors here]

Revenue Analysis: Examining the Numbers

While net income plummeted, Tesla's overall revenue still reached [Insert actual or estimated figure here]. This figure, while seemingly strong, fell short of analyst projections. A closer look at the revenue streams reveals:

- Vehicle Sales: This remained the largest contributor to revenue, although sales figures were lower than expected.

- Energy Generation and Storage: This segment showed [growth/decline – insert data] compared to the previous quarter, reflecting the fluctuating demand for solar panels and energy storage solutions.

- Services: Revenue from service and maintenance remained relatively stable, showcasing the importance of this recurring revenue stream for Tesla's overall financial health.

[Insert chart/graph visualizing revenue streams and comparison to projections here]

Profit Margins and Cost Management: A Critical Assessment

Tesla's profit margins experienced a significant contraction in Q1 2024, largely due to the factors mentioned above. The company is actively pursuing cost-cutting measures, including:

- Supply Chain Optimization: Efforts to streamline its supply chain and secure more stable sourcing of raw materials are underway.

- Manufacturing Efficiency Improvements: Tesla is continuously investing in automation and process optimization to improve manufacturing efficiency.

- Price Adjustments: While price reductions have impacted short-term profit margins, the aim is to stimulate demand and achieve higher sales volume in the long run.

Comparing Tesla's current profit margins to competitors like [mention key competitors] will offer a better perspective on its relative performance and competitiveness within the EV market.

The Impact of Political Headwinds on Tesla's Performance

Geopolitical Factors: Navigating Global Instability

Global political instability significantly affected Tesla's operations in Q1 2024. Key factors include:

- Trade Wars and Sanctions: Trade tensions and sanctions imposed on certain countries impacted Tesla's supply chain, leading to delays and increased costs.

- Regional Conflicts: Geopolitical instability in various regions impacted market access and demand for Tesla vehicles.

- Currency Fluctuations: Significant currency fluctuations in several key markets influenced the profitability of international sales.

Regulatory Scrutiny and Government Policies: Navigating the Regulatory Landscape

Tesla faces increasing regulatory scrutiny and evolving government policies impacting its operations:

- Safety Investigations: Ongoing safety investigations and recalls can negatively impact Tesla's brand image and profitability.

- Environmental Regulations: Stringent environmental regulations, particularly concerning battery production and disposal, add to operational costs.

- Tax Policies and Incentives: Changes in tax policies and government incentives for electric vehicles in various markets affect profitability and market penetration.

Public Relations and Brand Perception: The Importance of Public Image

Negative publicity and shifting public perception played a role in Tesla's Q1 performance:

- Controversies and PR Crises: Controversies surrounding Tesla’s products, leadership, and business practices can damage its brand reputation and investor confidence.

- Social Media Trends: Negative narratives on social media can influence public opinion and impact demand.

- CEO Actions and Statements: Statements and actions by the CEO can have a significant impact on the public's perception of Tesla.

Future Outlook and Investor Sentiment

Analyst Predictions and Market Reactions: Gauging Investor Confidence

The Q1 results sent shockwaves through the market, leading to:

- Stock Price Decline: Tesla's stock price experienced a significant drop following the release of the Q1 earnings report.

- Analyst Downgrades: Several financial analysts downgraded their ratings for Tesla stock, reflecting concerns about the company's near-term prospects.

- Revised Growth Estimates: Analysts have revised their growth estimates for Tesla, reflecting the challenges faced by the company.

Tesla's Strategic Response: Adapting to the Challenges

Tesla is actively implementing strategies to address the challenges highlighted in the Q1 earnings report:

- Cost Reduction Initiatives: Further efforts to optimize production costs and improve supply chain efficiency are underway.

- Market Expansion and Diversification: Expanding into new markets and diversifying its product offerings are key strategies.

- New Product Launches: The introduction of new vehicles and technologies will be crucial in driving future growth.

Conclusion: Analyzing the Tesla Q1 Earnings Report and Looking Ahead

The Tesla Q1 earnings report reveals a significant net income drop, significantly impacted by political headwinds. Understanding the interplay between geopolitical factors, regulatory pressures, and public perception is crucial for assessing Tesla's performance. The company's future success hinges on its ability to navigate these challenges and execute its strategic initiatives effectively. To stay informed about the implications of these results and understand "Tesla's financial performance" going forward, follow future "Tesla Q[x] Earnings" announcements and continue monitoring the company's progress. Staying informed about future Tesla earnings reports and analyzing "Tesla's financial performance" is crucial for understanding the future of this key player in the electric vehicle market.

Featured Posts

-

The Crucial Role Of Middle Managers In Organizations

Apr 24, 2025

The Crucial Role Of Middle Managers In Organizations

Apr 24, 2025 -

Governor Newsoms Call To Action Addressing High California Gas Prices Through Collaboration

Apr 24, 2025

Governor Newsoms Call To Action Addressing High California Gas Prices Through Collaboration

Apr 24, 2025 -

Data Breach Exposes Flaws In Office365 Security Costing Millions

Apr 24, 2025

Data Breach Exposes Flaws In Office365 Security Costing Millions

Apr 24, 2025 -

Teslas Q1 Profit Fall A Detailed Look At The Contributing Factors

Apr 24, 2025

Teslas Q1 Profit Fall A Detailed Look At The Contributing Factors

Apr 24, 2025 -

Elon Musk Doge And The Epas Tesla And Space X Scrutiny

Apr 24, 2025

Elon Musk Doge And The Epas Tesla And Space X Scrutiny

Apr 24, 2025