Tesla Q1 2024 Results: Profit Plunge And Political Controversy

Table of Contents

Significant Drop in Tesla's Q1 2024 Profit: A Detailed Analysis

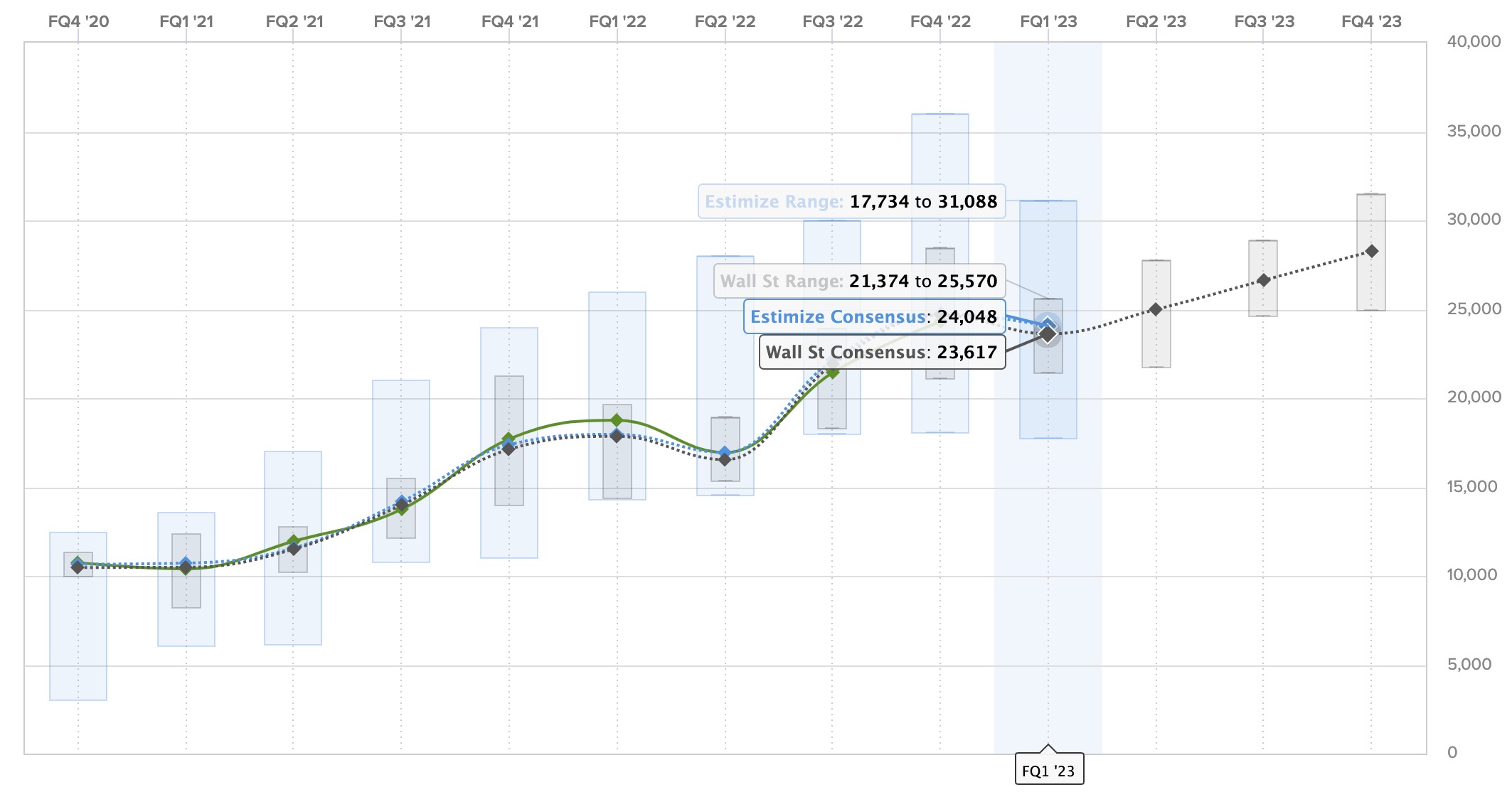

Tesla's Q1 2024 profit significantly underperformed expectations, raising concerns about the company's future trajectory. Several interconnected factors contributed to this decline.

Lower-Than-Expected Sales Figures

Tesla's Q1 2024 sales figures fell short of analysts' predictions and even lagged behind Q4 2023 performance. While precise numbers will vary depending on the final report, initial indications suggest a considerable drop compared to the same period last year (Q1 2023).

- Regional Variations: While some regions showed relatively strong performance, others, notably key markets like China, experienced significant weakening in demand for Tesla vehicles. This disparity highlights the challenges of navigating diverse global economic conditions.

- Model Underperformance: Specific Tesla models may have experienced greater sales declines than others. Factors such as increased competition, shifting consumer preferences, and production bottlenecks might have contributed to this.

- Statistics and Charts: (This section would ideally include a chart visually representing the sales figures for Q1 2024 compared to previous quarters. The chart should be properly labeled and sourced.) For example, a bar graph displaying quarterly Tesla vehicle deliveries across different regions would effectively illustrate sales variations. This visual representation significantly enhances reader understanding and engagement.

Increased Production Costs and Supply Chain Issues

Rising production costs played a substantial role in Tesla's reduced profitability. Several factors exacerbated this issue:

- Raw Material Costs: The cost of crucial raw materials like lithium, nickel, and cobalt, essential for battery production, surged significantly throughout 2023 and into 2024. This directly impacts the overall cost of manufacturing Tesla vehicles.

- Supply Chain Disruptions: Ongoing supply chain challenges, ranging from logistical bottlenecks to shortages of specific components, further increased production costs and hampered production efficiency. Geopolitical instability also contributed to these disruptions.

- Inflationary Pressures: Persistent inflation added to the overall cost of manufacturing, impacting labor, energy, and transportation expenses. This inflationary environment puts pressure on profit margins across the automotive industry, not just Tesla.

Pricing Strategies and Their Impact on Profitability

Tesla's pricing strategies, including recent price cuts aimed at boosting sales volume, also impacted profitability. While these cuts temporarily stimulated demand, they also significantly reduced profit margins per vehicle.

- Price Cuts and Sales Volume: While price reductions increased sales volume in the short term, the resulting lower profit margins per unit significantly impacted the overall profitability.

- Competitive Landscape: Intense competition from other electric vehicle manufacturers is forcing Tesla to engage in price wars, further compressing profit margins. Maintaining competitive pricing while managing costs is a significant challenge.

Navigating Political Headwinds: Global Regulatory Challenges and Geopolitical Risks

Beyond the financial challenges, Tesla faces considerable political headwinds impacting its global operations.

Political Controversy and its Impact on Tesla's Reputation

Elon Musk's high-profile activities and public statements, particularly on social media, continue to generate controversies. These controversies, in turn, impact Tesla's brand image and consumer perception.

- Public Relations Challenges: Negative media coverage and public backlash related to these controversies pose substantial public relations challenges for Tesla and may impact consumer confidence and sales.

- Regional Impacts: Controversies in specific regions can result in regulatory scrutiny, consumer boycotts, and negative media attention, significantly impacting sales within those regions.

Regulatory Challenges and Their Impact on Operations

Tesla faces diverse regulatory hurdles across its global operations, potentially hindering production, sales, and expansion.

- Regulatory Compliance: Meeting increasingly stringent environmental regulations and safety standards in various markets places considerable pressure on Tesla's operations and increases compliance costs.

- Trade Wars and Restrictions: Trade wars and import/export restrictions can significantly impact Tesla's ability to efficiently manufacture and distribute vehicles internationally. The complexities of navigating global trade policies add to the overall operational challenge.

Geopolitical Uncertainty and its Influence on Tesla's Global Strategy

Geopolitical instability further complicates Tesla's global strategy and supply chain.

- Supply Chain Vulnerability: Geopolitical risks, including conflicts and political tensions, can disrupt Tesla's global supply chain, increasing the cost and unpredictability of sourcing critical components.

- Investment Decisions: Geopolitical uncertainty can influence Tesla's investment decisions, affecting where the company chooses to build new factories and expand its operations.

Conclusion

Tesla's Q1 2024 results paint a complex picture of declining profitability impacted by lower-than-expected sales, increased production costs, and significant political challenges. The company's ability to navigate these headwinds, manage its pricing strategies effectively, and mitigate the impact of geopolitical uncertainties will be crucial for its future success.

Call to Action: Stay informed about Tesla's evolving performance and future strategies by following our regular updates on Tesla Q1 2024 and beyond. Understanding the dynamic interplay of these factors impacting Tesla's performance is vital for investors and industry observers. Continue reading our in-depth analyses of Tesla's Q1 2024 results for further insights into the company's prospects and the broader electric vehicle market.

Featured Posts

-

Ella Bleu Travolta Nevjerojatna Transformacija Kceri Johna Travolte

Apr 24, 2025

Ella Bleu Travolta Nevjerojatna Transformacija Kceri Johna Travolte

Apr 24, 2025 -

Trumps Influence On Bitcoin Btc Trade And Interest Rates Drive Price Increase

Apr 24, 2025

Trumps Influence On Bitcoin Btc Trade And Interest Rates Drive Price Increase

Apr 24, 2025 -

Whats Next On The Bold And The Beautiful Hope Liam Steffy And Lunas Fate

Apr 24, 2025

Whats Next On The Bold And The Beautiful Hope Liam Steffy And Lunas Fate

Apr 24, 2025 -

Tesla Q1 Earnings Net Income Plunges 71 Amidst Political Headwinds

Apr 24, 2025

Tesla Q1 Earnings Net Income Plunges 71 Amidst Political Headwinds

Apr 24, 2025 -

Remembering Sophie Nyweide Child Star Of Mammoth And Noah Dies At 24

Apr 24, 2025

Remembering Sophie Nyweide Child Star Of Mammoth And Noah Dies At 24

Apr 24, 2025