Strong Interest In 65 Hudson's Bay Company Leases

Table of Contents

Prime Locations and High-Traffic Areas

A primary driver of the demand for 65 Hudson's Bay Company leases is the strategic location of these properties. HBC has historically chosen high-traffic areas, ensuring maximum visibility and accessibility for businesses. These locations often boast exceptional foot traffic, placing tenants in the heart of bustling commercial centers and affluent residential neighborhoods.

- Specific Examples: Many HBC locations are situated near major transportation hubs, providing easy access for customers via public transit and private vehicles. For example, several stores are located within walking distance of major subway stations or bus terminals. Other locations are strategically placed within thriving shopping districts and entertainment centers.

- Demographic Profile: The areas surrounding these properties are often characterized by high population density, a strong concentration of desirable demographics, and high levels of disposable income. This makes them ideal locations for a wide range of businesses.

- Foot Traffic and Visibility: The high foot traffic and excellent visibility offered by HBC locations significantly increase the chances of attracting new customers and building brand awareness. This is a crucial element for businesses seeking to maximize their reach and revenue.

Brand Recognition and Prestige

Leasing space in a historic and renowned retail chain like HBC offers significant intangible benefits. The inherent value and prestige associated with the HBC brand significantly enhance the image and credibility of tenant businesses.

- Enhanced Image and Credibility: Associating your business with the HBC brand instantly elevates your profile, lending an air of sophistication and reliability. This can be particularly impactful for businesses seeking to attract a more discerning clientele.

- Attracting Higher-Quality Clientele: The HBC brand draws a specific demographic known for its purchasing power and appreciation for quality. This translates into a higher potential for sales and revenue for tenant businesses.

- Synergy with Other Tenants: The tenant mix within HBC locations often offers opportunities for synergy and collaboration. This co-location strategy can benefit businesses by increasing cross-promotion and mutually benefiting from shared customers.

Investment Opportunities and Return on Investment (ROI)

Investing in 65 Hudson's Bay Company leases presents a compelling opportunity for high returns on investment. The potential for profitability is amplified by several key factors.

- Factors Influencing ROI: Rental rates, location quality, and the overall tenant mix are crucial factors impacting the ROI of HBC leases. Strategic lease negotiations and a well-defined business strategy can significantly impact the return.

- Successful Business Examples: Numerous successful businesses operating within HBC locations demonstrate the potential for substantial growth and profitability. Case studies analyzing these successful ventures highlight the strong potential for return.

- Property Appreciation: Investing in HBC locations offers the potential for long-term appreciation. As prime commercial real estate continues to appreciate in value, HBC locations are expected to maintain their desirability and value.

Competition and Market Dynamics

The high demand for 65 HBC leases creates a competitive market. Understanding this competitive landscape is essential for securing a lease.

- Types of Competing Businesses: A wide range of businesses compete for these sought-after spaces, reflecting the desirability of these prime locations. This diverse competition underscores the value of a strong business plan and a compelling lease proposal.

- Lease Negotiations and Pricing: Negotiating lease terms in this competitive environment requires a strategic approach. Understanding market rates and presenting a strong business case are essential for securing favorable terms.

- Securing a Lease: To secure a lease in a highly competitive market, businesses should focus on highlighting their unique selling proposition and demonstrating their financial stability and growth potential.

Conclusion

The strong interest in 65 Hudson's Bay Company leases is driven by a compelling combination of prime locations, the prestige of the HBC brand, excellent investment potential, and dynamic market forces. Securing HBC retail space offers businesses a unique opportunity to thrive in a high-traffic, high-profile environment. Don't miss out on the opportunity to secure your place in a thriving retail market. Explore the available 65 Hudson's Bay Company leases today and unlock the potential for your business. Contact HBC directly to learn more about lease acquisition and available HBC retail space.

Featured Posts

-

Us Tariff Impact On Lpg China Turns To Middle East For Supply

Apr 24, 2025

Us Tariff Impact On Lpg China Turns To Middle East For Supply

Apr 24, 2025 -

My 77 Lg C3 Oled Tv Review A Big Screen Experience

Apr 24, 2025

My 77 Lg C3 Oled Tv Review A Big Screen Experience

Apr 24, 2025 -

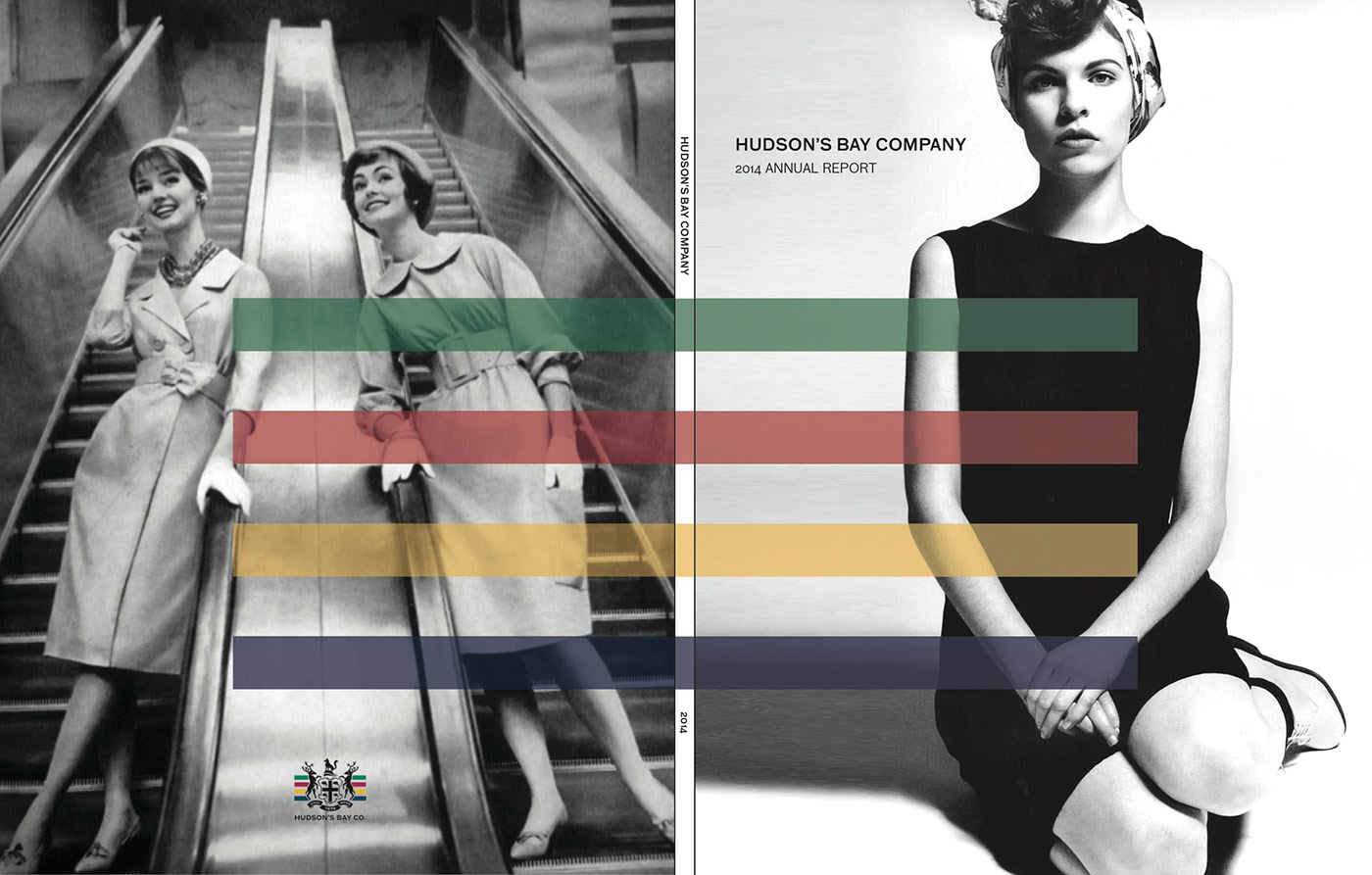

Analyzing Growth Mapping The Countrys Key Business Areas

Apr 24, 2025

Analyzing Growth Mapping The Countrys Key Business Areas

Apr 24, 2025 -

New John Travolta Action Movie Exclusive High Rollers Poster And Photo Preview

Apr 24, 2025

New John Travolta Action Movie Exclusive High Rollers Poster And Photo Preview

Apr 24, 2025 -

The Story Of Tina Knowles Early Detection And Breast Cancer Awareness

Apr 24, 2025

The Story Of Tina Knowles Early Detection And Breast Cancer Awareness

Apr 24, 2025