Stock Market Valuations: BofA's Reassuring Argument For Investors

Table of Contents

BofA's Core Argument: Why Current Valuations Aren't Overvalued

BofA's bullish stance on stock market valuations isn't based on blind optimism. Instead, their analysis rests on several key pillars, demonstrating that a thorough understanding of market valuation requires a nuanced approach.

Focus on Earnings Growth: A Key Driver of Market Valuation

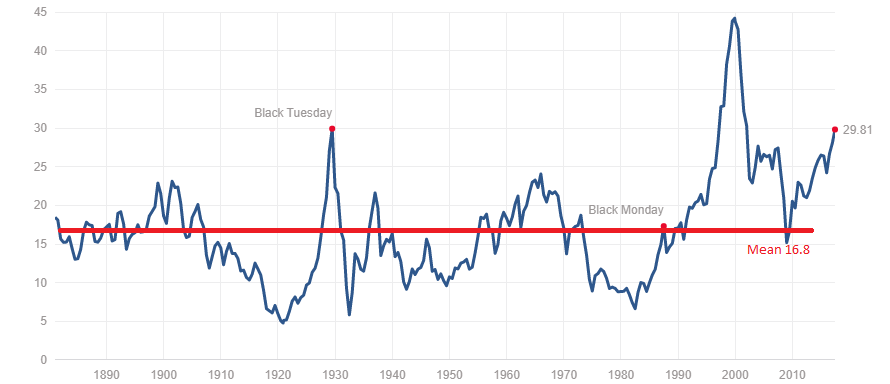

BofA highlights strong corporate earnings growth as a critical counterpoint to seemingly high price-to-earnings (P/E) ratios. Many investors focus solely on P/E ratios, a common metric in equity valuation, without considering the underlying earnings growth. However, robust earnings growth can easily justify higher valuations.

- Strong Earnings Growth Justifies Higher Valuations: When companies consistently demonstrate significant year-over-year earnings growth, higher stock prices become more justifiable. This growth signals future profitability and investor confidence.

- BofA's Sector-Specific Examples: (Note: This section would ideally include specific examples and data points from an actual BofA report. For this example, we'll use hypothetical data.) For instance, BofA might point to the technology sector, showing robust earnings growth driven by increased cloud adoption and artificial intelligence advancements. Similarly, they might highlight the resilience of the consumer staples sector despite inflationary pressures.

- Future Earnings Projections: BofA's analysis likely incorporates forward-looking projections, estimating future earnings growth to justify current valuation levels. These projections are crucial for determining whether current stock prices accurately reflect future profitability.

The Role of Interest Rates in Valuation: A Crucial Consideration

BofA's analysis undoubtedly considers the impact of interest rates on discounted cash flow valuations. Interest rates are a critical component in determining the present value of future earnings.

- Rising Rates and Stock Valuations: Rising interest rates generally lead to lower stock valuations because they increase the discount rate used in discounted cash flow (DCF) models. Higher discount rates reduce the present value of future earnings, making stocks appear less attractive.

- The Current Interest Rate Environment: BofA would likely assess the current interest rate environment and its potential impact on future earnings growth. Are rates likely to continue rising, plateau, or even fall? This directly impacts their valuation models.

- BofA's Interest Rate Predictions: (Again, this would ideally include specific data from a BofA report.) BofA might predict a moderate interest rate increase, incorporating this into their projections and concluding that the impact on valuations is manageable given the robust earnings growth in specific sectors.

Long-Term Growth Potential: A Bullish Perspective on the Future

BofA's bullish stance often rests on predictions of long-term economic growth. This long-term perspective is crucial for understanding their market valuation analysis.

- Long-Term Economic Expansion: BofA likely incorporates long-term forecasts for economic expansion, technological advancements, and demographic shifts. These factors collectively contribute to their overall market outlook.

- High-Growth Sectors: BofA might identify specific sectors poised for significant long-term growth, such as renewable energy, biotechnology, or e-commerce. These sectors could drive market performance in the coming years.

- Importance of Long-Term Investing: BofA's analysis emphasizes the importance of a long-term investment horizon. Short-term market fluctuations are less relevant when considering the potential for long-term growth.

Addressing Potential Counterarguments: Risks and Considerations

While BofA's arguments are compelling, it's crucial to acknowledge potential counterarguments and risks affecting stock market valuations.

Inflationary Pressures: A Significant Headwind

Persistent inflation poses a significant threat to corporate earnings and valuations.

- Impact on Consumer Spending and Profitability: High inflation erodes consumer purchasing power, potentially reducing demand and impacting corporate profitability.

- BofA's Inflationary Concerns: BofA's analysis would likely address these concerns, perhaps by focusing on companies with pricing power or those in sectors less susceptible to inflation's impact.

- Mitigating Inflationary Risks: Strategies to mitigate inflation's negative effects could include investing in companies with strong pricing power or those that benefit from inflationary environments (e.g., commodity producers).

Geopolitical Uncertainty: A Source of Volatility

Geopolitical events can significantly influence market sentiment and valuations.

- Key Geopolitical Risks: These might include escalating trade wars, geopolitical instability in key regions, or unforeseen global crises.

- BofA's Geopolitical Risk Assessment: BofA's analysis likely incorporates an assessment of these risks and their potential impact on market valuations.

- Mitigating Geopolitical Risks: Strategies to mitigate these risks could include diversification across different geographical regions and asset classes.

Potential for a Market Correction: Acknowledging the Reality of Market Cycles

Even with a generally positive outlook, the possibility of a market correction remains.

- Triggers for a Market Correction: These could include rising interest rates, unexpected economic slowdowns, or a significant negative geopolitical event.

- BofA's Perspective on Corrections: BofA might acknowledge the potential for a correction but view it as a temporary setback within a longer-term upward trend.

- Navigating a Market Downturn: Strategies for navigating a downturn could include holding a diversified portfolio, having a sufficient cash reserve, and sticking to a long-term investment plan.

Conclusion: Navigating Stock Market Valuations

BofA's analysis presents a compelling case for maintaining a bullish outlook on stock market valuations, emphasizing strong earnings growth, interest rate considerations, and long-term growth potential. However, the analysis acknowledges potential headwinds, including inflationary pressures, geopolitical uncertainty, and the possibility of a market correction. A balanced perspective is crucial. Understanding stock market valuations is paramount for informed investment decisions. While BofA's assessment offers reassurance for long-term investors, conducting thorough research and considering professional financial advice before making investment choices based on this or any market analysis is essential. Remember, carefully assessing stock market valuations is key to successful investing.

Featured Posts

-

1 Billion In Funding Trump Administrations Action Against Harvard Exclusive

Apr 22, 2025

1 Billion In Funding Trump Administrations Action Against Harvard Exclusive

Apr 22, 2025 -

Top Chinese Indonesian Officials Strengthen Security Cooperation

Apr 22, 2025

Top Chinese Indonesian Officials Strengthen Security Cooperation

Apr 22, 2025 -

Ukraine Under Fire Russia Launches Deadly Air Strikes As Us Seeks Peace

Apr 22, 2025

Ukraine Under Fire Russia Launches Deadly Air Strikes As Us Seeks Peace

Apr 22, 2025 -

Open Ais Chat Gpt The Ftc Investigation And Future Of Ai Development

Apr 22, 2025

Open Ais Chat Gpt The Ftc Investigation And Future Of Ai Development

Apr 22, 2025 -

Understanding High Stock Market Valuations Insights From Bof A

Apr 22, 2025

Understanding High Stock Market Valuations Insights From Bof A

Apr 22, 2025