Stock Market Analysis: Dow Futures And Weekly Market Predictions

Table of Contents

Understanding Dow Futures Contracts

What are Dow Futures?

Dow Futures contracts are financial instruments that track the performance of the Dow Jones Industrial Average (DJIA). They represent an agreement to buy or sell a specific number of DJIA shares at a predetermined price on a future date. These contracts are traded on various exchanges globally, offering a dynamic and liquid market.

- How they work: Investors buy or sell Dow Futures contracts based on their expectations of the DJIA's future price movements. If they believe the DJIA will rise, they buy contracts (long position), hoping to sell them at a higher price later. Conversely, if they anticipate a decline, they sell contracts (short position), intending to buy them back at a lower price.

- Trading Mechanics: Dow Futures trade electronically, allowing for rapid execution and high liquidity. Trading occurs throughout the day, offering investors ample opportunities to manage their positions.

- Leading Indicator Role: Dow Futures are often considered a leading indicator of the broader stock market. Their price movements can sometimes foreshadow shifts in the DJIA and the overall market sentiment. This makes them valuable tools for short-term market predictions.

- Keywords: Dow Jones Industrial Average, DJIA, Futures Contracts, Index Futures

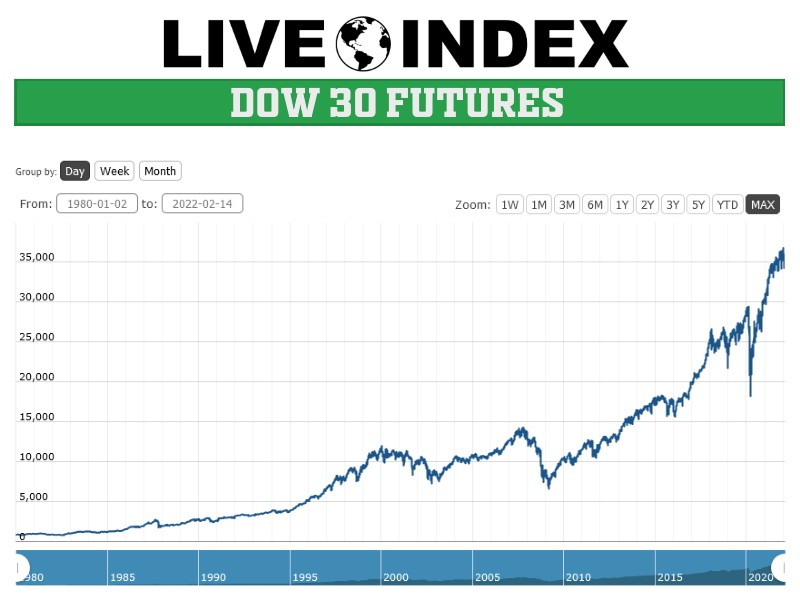

Interpreting Dow Futures Charts

Technical analysis plays a crucial role in interpreting Dow Futures charts and predicting price movements. Traders utilize various tools and techniques to identify trends and potential turning points.

- Moving Averages: Moving averages (e.g., 50-day, 200-day) smooth out price fluctuations and help identify the overall trend. Crossovers of different moving averages can generate buy or sell signals.

- Support and Resistance Levels: These are price levels where the market has historically shown difficulty breaking through. Support levels represent potential buying opportunities, while resistance levels suggest potential selling pressure.

- Candlestick Patterns: Candlestick charts visually represent price movements over a specific period, with various patterns indicating potential reversals or continuations of trends. Identifying these patterns can enhance predictive accuracy.

- Keywords: Technical Analysis, Chart Patterns, Moving Averages, Support and Resistance

Factors Influencing Weekly Market Predictions

Economic Indicators

Macroeconomic data releases significantly influence Dow Futures and the broader market. These indicators offer valuable insights into the health of the economy and investor confidence.

- GDP (Gross Domestic Product): A strong GDP growth rate generally boosts market sentiment, leading to higher Dow Futures prices. Conversely, weak GDP growth can trigger declines.

- Inflation: Inflation rates affect interest rates and corporate profits. High inflation can lead to market uncertainty and lower Dow Futures prices, while controlled inflation can support market growth.

- Unemployment Rate: Low unemployment indicates a strong economy, positively impacting Dow Futures. High unemployment often signals economic weakness, potentially causing declines.

- Keywords: GDP, Inflation, Unemployment Rate, Economic Data, Macroeconomic Factors

Geopolitical Events

Global events and political uncertainty can create significant market volatility, impacting Dow Futures. Unexpected geopolitical developments can trigger sharp price movements.

- International Conflicts: Major geopolitical events, such as wars or escalating tensions, can create uncertainty and lead to declines in Dow Futures.

- Political Instability: Political shifts and instability in major economies can negatively affect market confidence, influencing Dow Futures prices.

- Trade Wars and Sanctions: Trade disputes and sanctions between countries can disrupt global trade and negatively impact Dow Futures.

- Keywords: Geopolitical Risk, International Relations, Political Uncertainty, Market Volatility

Sentiment Analysis

Investor sentiment – whether bullish (optimistic) or bearish (pessimistic) – is a key factor shaping Dow Futures prices. Gauging market sentiment can provide valuable insights.

- Social Media Analysis: Monitoring social media sentiment related to specific stocks or the overall market can provide clues about investor confidence.

- News Sentiment: Analyzing news articles and financial reports can reveal the prevailing market sentiment and its potential impact on Dow Futures.

- Surveys and Polls: Investor surveys and polls can offer direct insight into market sentiment and expectations.

- Keywords: Investor Sentiment, Market Sentiment, Bullish, Bearish, Sentiment Indicators

Developing Your Weekly Market Prediction Strategy

Combining Indicators

A successful weekly market prediction strategy requires a holistic approach, combining multiple indicators for a more comprehensive perspective.

- Fundamental Analysis: Analyze the financial health of companies within the DJIA, considering factors such as earnings, revenue, and debt levels.

- Technical Analysis: Utilize technical indicators, chart patterns, and other tools to identify trends and potential turning points in Dow Futures prices.

- Integrated Analysis: Combine fundamental and technical analysis to gain a more nuanced understanding of market dynamics.

- Predictive Modeling: Consider employing predictive modeling techniques, which utilize statistical methods and historical data to forecast future price movements.

- Keywords: Fundamental Analysis, Integrated Analysis, Predictive Modeling

Risk Management

Effective risk management is crucial when trading based on market predictions. Protecting your capital is paramount.

- Stop-Loss Orders: Set stop-loss orders to limit potential losses if the market moves against your predictions.

- Diversification: Diversify your investments across various assets to reduce the impact of losses in any single investment.

- Position Sizing: Carefully manage your position size to avoid excessive risk. Don't invest more than you can afford to lose.

- Keywords: Risk Management, Stop-Loss Orders, Diversification, Portfolio Management

Conclusion

Analyzing Dow Futures effectively requires a multifaceted approach incorporating technical analysis of charts, understanding economic indicators, assessing geopolitical risks, and gauging investor sentiment. Combining these elements with robust risk management techniques allows for a more informed and successful investment strategy. By incorporating Dow Futures analysis into your weekly market predictions, you can enhance your investment decision-making. Stay tuned for our next analysis on Dow Futures and weekly market predictions!

Featured Posts

-

Shedeur Sanders Will He Be A Top 3 Nfl Draft Pick Giants Rumors Fuel Speculation

Apr 26, 2025

Shedeur Sanders Will He Be A Top 3 Nfl Draft Pick Giants Rumors Fuel Speculation

Apr 26, 2025 -

Steun Voor Koninklijk Huis Stijgt Naar 59 Eerste Toename In Jaren

Apr 26, 2025

Steun Voor Koninklijk Huis Stijgt Naar 59 Eerste Toename In Jaren

Apr 26, 2025 -

Facing Implosion George Santos Last Stand

Apr 26, 2025

Facing Implosion George Santos Last Stand

Apr 26, 2025 -

Chelsea Handlers The Feeling Netflix Premiere Date And What To Expect

Apr 26, 2025

Chelsea Handlers The Feeling Netflix Premiere Date And What To Expect

Apr 26, 2025 -

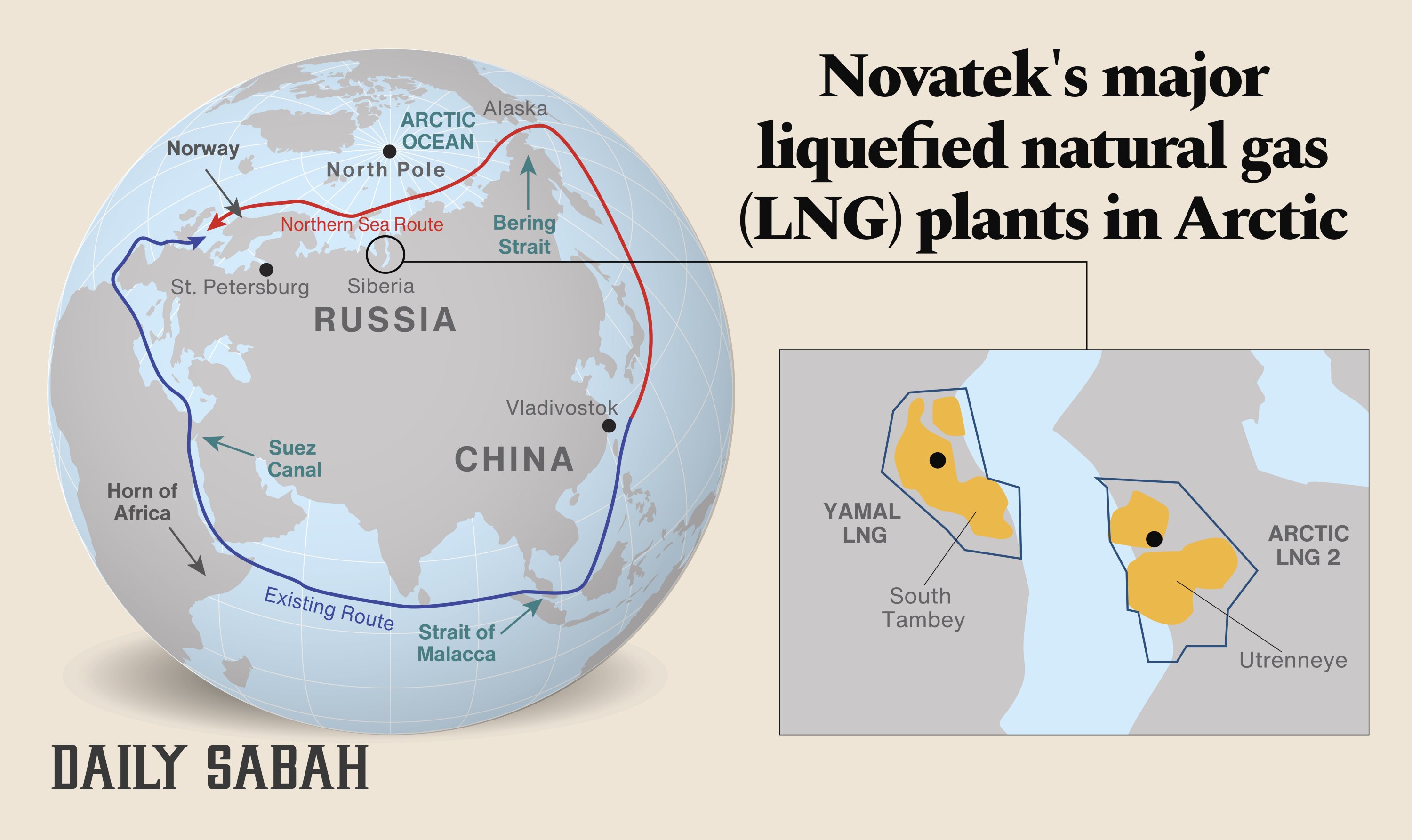

The Continued Support Of European Shipyards In Russias Arctic Gas Ambitions

Apr 26, 2025

The Continued Support Of European Shipyards In Russias Arctic Gas Ambitions

Apr 26, 2025